Closing of illimity SGR’s First Fund, the “illimity Credit & Corporate Turnaround Fund,” Sells UTP Credit Positions of ...

April 01 2021 - 7:58AM

Closing of illimity SGR’s First Fund, the “illimity Credit &

Corporate Turnaround Fund,” Sells UTP Credit Positions of Over 200M

Euro

via InvestorWire -- illimity SGR, the illimity Group’s asset

management company created to set up and manage alternative

investment funds, has completed the first closing of “illimity

Credit & Corporate Turnaround” (the “

Fund” or

“

iCCT”)—a contribution fund dedicated to

investments in unlikely to pay (“UTP”) loans to SMEs with revival

and relaunch prospects.

The initial portfolio consists of loans for a

gross total of over 200 million euro made to 33 companies operating

in highly diversified sectors. These loans have been sold by seven

banks and banking groups (Banca Popolare di Sondrio, Banca Sella,

Banco Desio, Bnl Gruppo Bnp Paribas, BPER Gruppo, Gruppo Bancario

Cooperativo Iccrea, Gruppo La Cassa di Ravenna), which have then

become unit holders in the Fund.

The initial cash facilities – subscribed by

institutional investors, including illimity Bank – amount to 25

million euro. These funds will be used to service the acquired

loans and support the turnaround of the companies in which the Fund

has invested.

More specifically, the illimity Credit &

Corporate Turnaround Fund presents a number of highly innovative

features (including the possibility of acquiring and managing fully

operational short-term credit lines as well as, through a

securitisation structure, receivables and leasing agreements in

continuity). These features enable banks to fully transfer their

financial exposure, regardless of the technical forms used, and to

benefit from the restructuring process of the corporates.

The Fund will support a financial restructuring

of businesses designed not only to overcome a crisis but also to

make the most of their potential and pursue a concrete prospect of

recovery.

“The Management Team of our first turnaround

fund effectively combines financial and industrial skills that

allow us to look beyond the reports to capture the potential of the

companies in which the Fund invests,” said illimity SGR’s UTP &

Funds unit head Paola Tondelli. “This first turnaround fund, which

has very innovative technical features, will soon be followed by

other initiatives, always aimed at relaunching the entrepreneurial

soul of the country, which will find in illimity SGR a new type of

support, not only financial, but also advisory for a strategic

vision.”

"The closing of our iCCT fund represents the

first, very important step in the SGR's multi-product strategy

aimed at bringing innovative funds to the attention of our

institutional clients,” added illimity SGR Chairman Massimo Di

Carlo. “The new funds will focus both on SMEs and on those sectors

where we will be able to operate by leveraging the distinctive

skills of the group.”

The illimity Group was assisted by BE Partner

for the structuring of the SGR and the Fund, as well as on

negotiations regarding the purchase of the loans, by Giovanardi

Studio Legale on the legal and regulatory aspects and by Studio

Ludovici (which has become Gatti Pavesi Bianchi Ludovici) on fiscal

matters.

In addition, PwC assisted illimity SGR on the

fairness of the loan valuations and relative valuation models.

The banks were assisted by Studio Gatti Pavesi

Bianchi Ludovici for the legal aspects.

The securitisation of loans and leasing

contracts was structured by Banca Finint.

For further information:

Investor RelationsSilvia Benzi:

+39.349.7846537 - +44.7741.464948 - silvia.benzi@illimity.com

|

Press & Communication illimity |

|

|

Isabella Falautano, Francesca D’Amico |

Sara Balzarotti, Ad Hoc Communication Advisors |

|

+39.340.1989762 press@illimity.com |

+39.335.1415584 sara.balzarotti@ahca.it |

Wire Service Contact:InvestorWire

(IW) Los Angeles, Californiawww.InvestorWire.com212.418.1217

OfficeEditor@InvestorWire.com

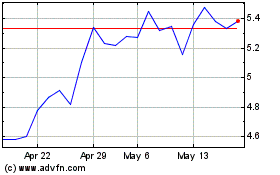

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Dec 2024 to Jan 2025

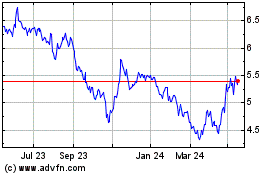

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Jan 2024 to Jan 2025