Axie Infinity Springs Back To Life With Surprise 35% Rally – Details

December 28 2023 - 6:00AM

NEWSBTC

In the dynamic realm of cryptocurrencies, Axie Infinity’s AXS token

has embarked on a remarkable ascent, witnessing an impressive surge

of over 35% in the past 24 hours and currently trading at $9.26.

This rally catapults AXS to the forefront of gaming

cryptocurrencies, boasting a market capitalization of $1.4 billion

and a circulating supply of 132 million coins. The driving force

behind this impressive upswing can be traced to a recent major game

update, which introduces a transformative element to the Axie

Infinity ecosystem. Related Reading: $2 In Sight? Mina Protocol’s

47% Growth Raises Price Target Hopes Axie Infinity’s Evolution

Transforms Game Economy This update focuses on the evolution of

Axies, creatures analogous to Pokemons, offering players the

opportunity to enhance their digital companions with additional

features and abilities. Beyond the surface modifications, this

evolution introduces a deflationary mechanism that radically

modifies the Axie Infinity economy. This system can lower the total

number of Axies, which would raise the value of already-existing

Axies and strengthen ties between players and their virtual

counterparts. However, amidst this surge, a note of caution

emerges. The market’s rebound and Bitcoin’s push towards $45,000

have fueled momentum in AXS’s price, but concerns loom over a

potential sharp correction. Impatient holders, grappling with

losses, are becoming a focal point of concern. The surge prompted a

significant number of sellers to liquidate their positions, with

data from Coinglass indicating approximately $2.4 million in short

positions liquidated, defying bearish predictions. As the market

adjusts, the data reveals a potential for a significant correction.

The number of profitable addresses has increased to nearly 30%, yet

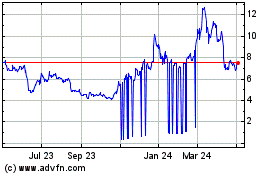

it is eclipsed by the 51,000 holders currently in the red. AXSUSD

currently trading at $9.31250000 on the daily chart:

TradingView.com This scenario suggests that the ongoing upward

trend in AXS price might entice loss-incurring holders to exit the

market in an effort to minimize their losses. AXS Technical

Analysis: Key Levels And Caution In terms of technical analysis,

AXS has established key resistance levels at $10.41, $11.37, and

$12.01, with immediate support at $9.09 and additional support at

$8.54 and $8.06. 🚀 #AxieInfinity (AXS) showcases dynamic market

movement! 📈 Trading near $9.73 with key resistances ahead. RSI at

81 signals strong buying trend, but caution advised. 📊Bullish above

$9.70 with eyes set on surpassing $10.41. Stay tuned for more

updates! #Crypto #TradingTrends 🌟 — Arslan Ali (@forex_arslan)

December 25, 2023 The Relative Strength Index (RSI), a crucial

indicator of market sentiment, is currently at an elevated level of

81, signaling an overbought condition. While this suggests a strong

buying trend, caution is advised, as an overbought condition may

indicate the potential for reversals in the market. Related

Reading: ARB Soars 25% In 24 Hours As Arbitrum Preps For Major

Projects In 2024 Axie Infinity’s AXS has undergone a remarkable

surge fueled by a significant game update, amplifying excitement in

the digital asset landscape as the new year approaches. Despite the

positive momentum, caution prevails, with market participants wary

of a potential correction and the impatience among holders

grappling with losses. The unique economic dynamics introduced by

the game update add a layer of intrigue to AXS’s trajectory in the

ever-evolving cryptocurrency market. Featured image from

Shutterstock

Axie Infinity Shard (COIN:AXSUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Axie Infinity Shard (COIN:AXSUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025