Battleground At $60,000: Bitcoin Faces Pivotal Test As Bulls Aim To Reclaim Key Support

August 21 2024 - 2:00AM

NEWSBTC

The world’s largest cryptocurrency, Bitcoin (BTC), has struggled to

maintain a foothold above the critical $60,000 price level in

recent trading sessions, as the digital asset finds itself caught

in a tug-of-war between bullish and bearish forces. After

recovering from a dip below $49,000 earlier this month, Bitcoin has

been vacillating around the $60,000 mark, unable to consolidate

above this key psychological and technical threshold. This

price level has emerged as a battlefield between the bulls and

bears, with the outcome poised to have significant implications for

Bitcoin’s near-term trajectory. Bitcoin Faces Decisive Test At

$60,000 According to market analyst Mark Cullen, Bitcoin’s ability

to reclaim and hold above $60,000 by the end of the day could pave

the way for a move higher towards the mid-to-high $60,000

range. However, should Bitcoin fail to decisively push

through the $59,500 level, Cullen warns that the technical outlook

could turn more bearish, with the potential for a sweep of the

August 7th low. Related Reading: Dogecoin Faces Supply Squeeze:

What This Means For Price Further complicating the continuation of

the price recovery witnessed the past week after the August 5

market crash, is the presence of a sizable 1,000 BTC sell order

currently protecting the $60,500 level, as noted by crypto analyst

InspoCrypto. According to the analyst, a failed retest of

this resistance zone could potentially catalyze the formation of a

bearish double top pattern, which would be a concerning development

for the bulls in the near term price action. InspoCrypto said: The

$60,500 level is currently protected by a 1,000 BTC sell order. A

failed retest of Bitcoin at $60,500 could potentially complicate

the situation. Technical analysts might identify a double top

formation in such a scenario. Moreover, the latest updates on the

options data do not paint an entirely optimistic picture for

Bitcoin in the short term, according to InspoCrypto, who emphasized

the need to closely monitor the situation. Worst-Case Scenario For

BTC According to crypto analyst Daan Crypto Trades, the fact that

Bitcoin is currently trading above the $59,000 mark is a positive

sign, as it represents a return to the asset’s Daily

200-Exponential Moving Average (EMA). However, Daan Crypto

Trades noted that the real test for the bulls will come at the

$63,000 level, which corresponds with the cryptocurrency’s local

highs. “It’s an important level to break for the bulls to get the

party started,” the analyst stated. Should Bitcoin fail to

decisively surpass this resistance, the bears could regain control,

with the $56,500 level serving as a potential support zone. Related

Reading: XRP Spikes 6%: Can It Overcome $0.66 For Further Upside?

Fellow technical analyst EmperorBTC echoed a similar sentiment,

highlighting the significance of Bitcoin’s ability to reclaim its

“macro range” and the resistance at the $62,200 level. The

analyst advised against opening fresh long positions at current

levels, instead suggesting that traders should look to “bid on

pullbacks near the weekly VWAP (Volume-Weighted Average Price) at

$58,800.” In a somewhat more cautious tone, EmperorBTC also

acknowledged the possibility of a worst-case scenario, wherein

Bitcoin could potentially retrace to the $52,000

level. However, the analyst emphasized that this would be a

“gift to buy and hold” in the lead-up to September, hinting at the

possibility of a more favorable market environment in the coming

months. Featured image from DALL-E, chart from TradingView.com

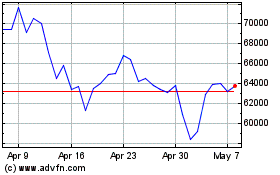

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024