Crypto Carnage: Over $800 Million Wiped Out In Market Plunge

March 16 2024 - 6:00AM

NEWSBTC

The recent market plunge has sent shockwaves through the crypto

industry, resulting in hundreds of millions in dollars being wiped

out in a matter of hours. The price of Bitcoin has retreated

violently to a weekly low of $67,500 after a few days of showing

remarkable advances and setting new all-time highs. The altcoins

have experienced a significant decline as well, resulting in nearly

200,000 traders making liquidations during the last 24 hours. The

weekend brought a tremor to the cryptocurrency market, with a

sudden price correction causing short-term panic and hundreds of

millions in liquidated positions. However, despite the wobble,

analysts are divided on whether this signifies a broader market

shift or a mere blip on the bullish radar. Crypto Long Squeeze

Triggers Liquidations Over a 24-hour period ending Friday, March

15th, the global cryptocurrency market capitalization shed a cool

6%. This triggered a wave of automated liquidations, particularly

for investors holding leveraged long positions – essentially large

bets on rising prices. Related Reading: Bitcoin Miners Brace For

Impact As Difficulty Reaches Unprecedented Levels According to

Coinglass, a crypto data analysis platform, over $800 million worth

of long positions were liquidated across the market. Bitcoin itself

bore the brunt of the selling pressure, dipping as low as $67,000 –

its lowest point in over a week. Liquidation heatmap in the 24-hour

timeframe. Source: Coinglass The pain wasn’t evenly distributed.

Over one third of the liquidations, a total of $660 million, came

from long positions on Bitcoin. Altcoin Bloodbath Follows Bitcoin’s

Lead The tremors weren’t confined to Bitcoin. The correction

spilled over to the altcoin market, with popular tokens like

Cardano, Dogecoin, Shiba Inu, and XRP all experiencing significant

price drops. This, in turn, triggered further liquidations for long

positions held on these altcoins. XRP traders alone saw over $10

million liquidated, with nearly $11 million coming from long

positions. Total crypto market cap is currently at $2.5 trillion.

Chart: TradingView Crypto Market Fights Back: Buying The Dip

Despite the week’s fright, the overall sentiment in the crypto

market remains surprisingly bullish. This is primarily fueled by

the swift buying activity observed at key support levels as prices

dipped. Bitcoin, the world’s most sought-after crypto asset, for

example, has already staged a partial recovery, bouncing back to a

little over $69,000 at the time of writing. Similar rebounds have

been observed across several altcoins, suggesting that investors

might be viewing this as a buying opportunity. Related Reading:

Sell Sign Ignites Speculation: Solana Fate Hangs In The Balance?

This correction can be seen as a healthy market reset after a

strong rally, some analysts say. While some leveraged positions got

burned, the fact that investors are stepping in to buy the dip

indicates continued confidence in the long-term potential of

cryptocurrencies. A Continued Balancing Act The weekend’s events

serve as a microcosm of the ongoing struggle within the crypto

market. On one hand, there’s a growing sense of institutional

adoption and mainstream acceptance, fueling a bullish sentiment. On

the other, the inherent volatility of crypto assets continues to

pose a challenge, with sudden price swings capable of inflicting

significant losses on unsuspecting investors. Featured image from

Pexels, chart from TradingView

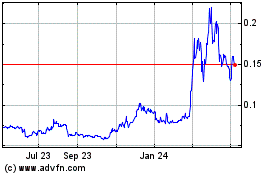

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

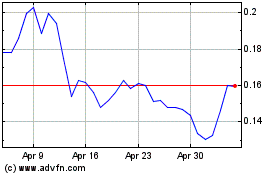

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024