Is Bitcoin’s Rally Over? Top Analysts Predict Imminent Price Corrections

May 16 2024 - 10:00PM

NEWSBTC

As Bitcoin navigates through significant price changes, varying

analyses from crypto analysts have painted a diverse picture of its

short-term trajectory. A prominent crypto analyst, Ali, identified

a sell signal on Bitcoin’s short-term charts using the TD

Sequential indicator. Related Reading: Is The Crypto Winter

Thawing? US Bitcoin ETFs Record First Inflows In Weeks – Coinshares

According to Ali’s analysis, the TD Sequential indicator suggested

that Bitcoin’s current uptrend might be losing momentum. This could

potentially lead to a correction over the next one to four

candlesticks, particularly noticeable on the four-hour chart. The

TD Sequential presents a sell signal on the #Bitcoin 4-hour chart,

anticipating a one to four candlesticks correction for $BTC.

pic.twitter.com/OC9Clv0Tat — Ali (@ali_charts) May 16, 2024

Diverging Bitcoin Views From Top Crypto Analysts Contrasting this

perspective, another prominent analyst, Rekt Capital, recently

provided a more optimistic view. According to Rekt Capital, Bitcoin

ended its downtrend in mid-April, breaking into an uptrend with its

price surpassing previous resistance levels. This change has been

marked by Bitcoin forming its first higher high since its drop to

$56,000, as highlighted by Rekt Capital. This indicates a possible

continuation of the bull market despite periodic market attempts to

unsettle investors. The TD Sequential indicator’s sell signal comes

as Bitcoin has shown a 7.6% increase over the past seven days,

reaching a 24-hour high of $66,567 before retracing slightly to

$65,592. Rekt Capital noted the significance of the $60,000 support

level, suggesting that maintaining this level is crucial for

further positive momentum. He remarked that the recent breakout to

$66,000 is a testament to how quickly market sentiment can shift

toward a bullish trend. The analyst disclosed: The Bitcoin Bull

Market is not over. But time and time again, the market will try to

shake you out of your positions before you are able to profit

significantly from them. Insights From Galaxy CEO On BTC’s Future

Trends Meanwhile, Mike Novogratz of Galaxy Digital commented on the

broader market trends, noting that the crypto sector is at a

critical juncture where narratives are evolving, and the market

landscape could change rapidly, especially with impending

regulatory developments in the US. Related Reading: Bitcoin Could

Crash Below $55,000, Top Analyst Sounds The Alarm Mike Novogratz

further expanded on the macro view, suggesting that the next few

months could be pivotal for the crypto market as it responds to new

narratives and regulatory developments. It’s been a fascinating

week in crypto. Narratives are forming and odds are shifting. It’ll

be interesting to watch the next few months play out, and even more

interesting to watch the jump shift that’ll occur as soon as

there’s regulatory clarity around crypto in the U.S.…

pic.twitter.com/t0g5rTIKjP — Mike Novogratz (@novogratz) May 16,

2024 He also recently predicted that Bitcoin’s price will oscillate

between $55,000 and $75,000 for some time, indicating a phase of

consolidation before any major moves. Featured image from Unsplash,

Chart from TradingView

Gala (COIN:GALAUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

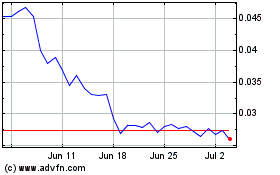

Gala (COIN:GALAUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024