BlackRock’s Tokenized Fund News Sends Hedera (HBAR) Soaring 100%, The Reason May Surprise You

April 24 2024 - 9:00PM

NEWSBTC

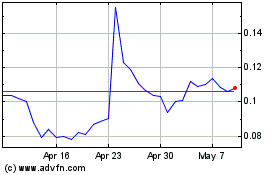

In a surprising turn of events, the native token of the

decentralized ledger platform Hedera, HBAR, experienced a

significant price surge of over 100% during the early hours of

Tuesday. Starting from a low of $0.0875, HBAR skyrocketed to reach

the $0.1821 mark by Wednesday. The sudden surge was triggered

by the news of BlackRock’s tokenized fund, BUIDL, which generated

high expectations among HBAR investors regarding a potential

collaboration between the prominent asset manager and the Hedera

protocol. Not Directly Connected To Hedera? Launched by BlackRock

in March 2024, BUIDL operates as a tokenized fund on the Ethereum

blockchain, providing US dollar yields through tokenization.

Related Reading: Newbie Bitcoin Whales Hold 2x As Much As Veterans:

What’s Behind This Trend? Initially, an announcement led to

confusion among investors, who mistakenly believed that BlackRock

would directly tokenize the fund on the Hedera network. This

misunderstanding triggered a significant surge in the HBAR price.

Upon closer examination of the announcement, it became clear that

BlackRock and Hedera had no direct connection, although the initial

reaction to the news was noteworthy. Crypto analysts, who use

the pseudonym “CrediBull” on social media site X (formerly

Twitter), shed light on the situation, emphasizing that explicit

permission from BlackRock was unnecessary to list tokenized

versions of their funds. It was not a deliberate decision by

BlackRock to tokenize on Hedera; rather, an existing platform on

the network took the liberty of tokenizing one of BlackRock’s

funds. However, for the analyst, the fact that a platform on Hedera

was among the first to tokenize a BlackRock fund reflects the

platform’s leadership in the space. Analyst Clarifies Misconception

Further examination reveals that Archax, the company behind the

tokenized BlackRock fund on Hedera, is a portfolio company of ABRDN

Investments, the largest asset manager in the UK, with

approximately $500 billion in assets under management (AUM).

Additionally, CrediBull emphasizes that BlackRock happens to be the

fourth-largest shareholder of ABRDN. Notably, around ten months

ago, Archax tokenized one of ABRDN’s money market funds, preceding

their launch of the BlackRock fund. An interview by the Head of

Digital Assets at ABRDN clarifies their involvement in the

tokenization process on Archax. A “distribution agreement” was

signed permitting the tokenization to proceed. If a similar

agreement were reached with BlackRock, it would imply the asset

manager’s endorsement of the product. Related Reading: Analysts

Identify Key Scenario For Bitcoin Hitting $100,000 Ultimately, the

interview with the head of digital assets at ABRDN underscores the

fact that significant players are utilizing and contributing to the

growth of Hedera behind the scenes. Following the clarification of

the situation, the price of HBAR has retraced to $0.1199.

Nevertheless, it remains up 8% over the past 24 hours and has

recorded an impressive gain of nearly 60% in the past seven

days. CoinGecko data highlights a substantial surge in HBAR’s

trading volume, which has increased by over 1,100% in the past few

days. This surge in trading volume indicates the widespread

confusion sparked by the initial news announcement. Featured image

from Shutterstock, chart from TradingView.com

Hedera Hashgraph (COIN:HBARUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hedera Hashgraph (COIN:HBARUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024