These Are The Altcoins Drawing Whale Interest, Santiment Reveals

February 15 2024 - 1:00PM

NEWSBTC

The on-chain analytics firm Santiment has revealed some altcoins

currently witnessing high interest from the whales. Whale

Transactions Have Spiked For These Altcoins Recently In a new post

on X, Santiment has discussed how several altcoins have been

showing interest from the whales. The on-chain indicator of

relevance here is the “Whale Transaction Count,” which keeps track

of the total number of transfers carrying a value of at least

$100,000 taking place every day on the blockchain for any given

cryptocurrency. Such large transfers are generally assumed to be

coming from the whale entities, as they can only move around

amounts this large with single transactions. Related Reading:

Litecoin Whale Deposits Big To Binance, LTC’s 3% Drop To Extend?

When the metric’s value is high, the whales make many transfers.

This trend implies that these humongous investors are highly

interested in trading around the asset in question. On the other

hand, the low indicator suggests the whales may not be paying

attention to the cryptocurrency as they aren’t making that many

moves on the network. Now, here is the chart shared by the

analytics firm that shows the trend in the Whale Transaction Count

for some altcoins over the past month: The value of the metric

appears to have been quite high in recent days | Source: Santiment

on X As displayed in the above graph, these five altcoins have all

seen some boost in their Whale Transaction Counts recently:

Injective (INJ), Rocket Pool (RPL), PlayDapp (PLA), STP (STPT), and

Basic Attention Token (BAT). Given this close surge in the

indicator for all of these assets, it would appear possible that

the whales have now started playing around with alts after gaining

confidence from the sharp rally that Bitcoin has enjoyed. Now, what

does this fresh whale interest mean for these altcoins? Usually, a

high value of the Whale Transaction count is a predictor of

volatility for any cryptocurrency. This is because the whales’

transfers carry a significant value. Of course, any single

transaction will likely not be big enough to move the market

appreciably on its own, but if many such transfers occur at once,

the asset could feel some turbulence. Related Reading: Extreme

Greed Is Back For Bitcoin, Is It Time To Sell? However, any such

volatility that may arise out of this high whale trading activity

can theoretically go in either direction. The Whale Transaction

Count only measures the pure number of large transfers happening on

the network and doesn’t provide any information about whether these

are buying or selling moves. As such, the only thing that can be

said about these altcoins observing high interest from these

humongous holders is that they are now more likely to display some

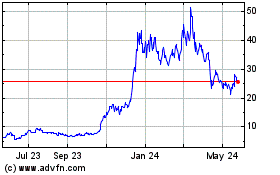

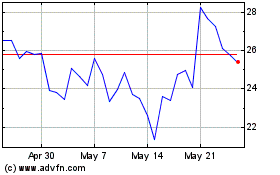

volatility, the direction of which is uncertain. INJ Price The

31st-placed coin in the market cap list, Injective, is trading

around $35 after going up more than 4% in the past week. Looks like

the price of the asset has been consolidating recently | Source:

INJUSD on TradingView Featured image from Vivek Kumar on

Unsplash.com, Santiment.net, chart from TradingView.com

Injective Token (COIN:INJUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Injective Token (COIN:INJUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025