Tether To Conduct An Audit To Negate Claims Concerning Transparency

July 24 2021 - 9:04PM

NEWSBTC

The Tether general counsel has declared an official audit in few

months. USDT is a popular stablecoin occupying the third position

in global digital assets. As it’s on blockchain that cybersecurity

experts deem unhackable, the majority today trusts its security.

Related Reading | Cardano Aims To Facilitate Users With Smart

Contracts However, many people in the crypto community have been

waiting for a financial audit of the stablecoin. Now, it seems that

the ongoing regulatory issues in the crypto industry have

galvanized the Tether team into action. As a result, they’re

declaring that an audit will take place soon. Tether Executives

Grants Media Interview Another rare incident is an interview in

which the Tether CTO Paolo Arduino and Stu Hoegner, the general

counsel, participated on CNBC. During the interview, the hosts

asked the duo some questions about USDT’s transparency and backing.

In response, the general counsel stated that the team is working to

be the first in their sector to get financial audits. The crypto

market has just turned bullish as the USDT trades in the green zone

| Source: USDTUSD on TradingView.com He also mentioned that the

audits would come in months and not years. As for backing, he

stated that the stablecoin is backed with reserves. But Hoegner

mentioned that some of the reserves are not US dollars. But the

reserves are more US dollars plus other cash equivalents, secured

loans, crypto assets, bonds, and others. Related Reading

| Anthony Di Lorio To Leave Cryptocurrency Space For

Philanthropic Initiatives However, in the Transparency report which

Tether published, the market cap for USDT stands at $62 billion.

Even though the number has increased by 195% since 2021 started, it

is still behind competitors such as BUSD and USDC. When Circle

released a reserve report yesterday, July 21, it showed that 61% of

the USDC reserves are cash & cash equivalent. The remaining 39%

are in treasuries, bonds, and commercial paper accounts. Taxes

Decides To Attack Paxos is a rival to Tether and recently attacked

the stablecoin and Circle through its blog post on July 21, 2021.

In the post, Paxos claims that the duo is not operating under

financial regulators. In his words, both USDC and Tether are simply

Stablecoins in name only. Paxos disclosed that its stablecoin

reserves are a combination of cash or cash equivalents to support

its claims. Related Reading | Ether EFT Gets Approval From

Brazilian Securities Regulator But in May, Tether disclosed the

total backing that USDT has, which were cash 3.87%, fiduciary

deposits 24.20%, treasury bills 2.94%, cash equivalents, commercial

papers, which make up 65.39% plus others. This action was because

the US lawmakers are closely scrutinizing its operations. Also,

Tether started submitting reports about its reserves after it

reached a settlement agreement with the NY Attorney General’s

Office 5 months ago. The firm has continued to send these reports

since then. Featured image from Pexels, chart from TradingView.com

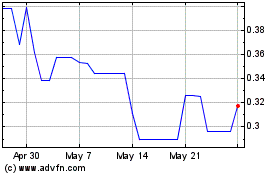

Ontology (COIN:ONTUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

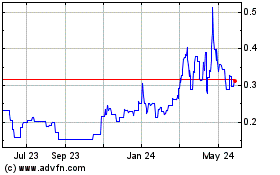

Ontology (COIN:ONTUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Ontology (Cryptocurrency): 0 recent articles

More Ontology News Articles