Since China’s Mining Ban, Bitcoin Hashrate Has Recovered by 68% And Counting

September 09 2021 - 4:35PM

NEWSBTC

Bitcoin is a perpetual motion machine. The Bitcoin hashrate is

slowly climbing to pre-China-ban levels, and the service continued

uninterrupted without a hiccup. Such is the power of well-placed

incentives. Pantera Capital’s CEO Dan Morehead adds one more factor

to the equation. “The bitcoin network has recovered 68% of the drop

in hashrate that our difficulty model attributed to China’s

ban—likely in places with cleaner energy.” The recovery is

happening exactly as forecast. The #bitcoin network has recovered

68% of the drop in hashrate that our difficulty model attributed to

China's ban—likely in places with cleaner energy. The transition to

renewables is underway. Sep Letter: https://t.co/xLyaLpPQQN

pic.twitter.com/UsK9ML3BU8 — Dan Morehead (@dan_pantera) September

9, 2021 In the company’s newsletter, Pantera fleshes out the

argument: “Although difficult to know with certainty, it seems very

likely that much of the reboot in mining power is occurring in

places with cleaner energy than those utilized by Chinese

miners. The transition to renewables is well underway.”

Regarding The Bitcoin Hashrate, Are ESG Concerns Even Important?

Here at NewsBTC we’ve determined that China’s Bitcoin mining tended

to go to provinces with abundant green energy. Bitcoin incentivizes

that. The Bitcoin hashrate tends to go where the energy is cheap.

We’ve also determined that the environment doesn’t seem to be the

reason for the Bitcoin mining ban. “The fact that the electricity

for crypto mining in Sichuan came from clean hydropower meant that

many thought the province would be a safe haven for Bitcoin miners.

As pressure on local governments to cut carbon emissions mounts,

projects were successfully shuttered in some other provincial-level

regions — such as Xinjiang and Inner Mongolia — where the mining

was chiefly fueled by coal.” The only thing we can know for

sure about the Chinese government’s plan is this: the environment

is not on their radar. They’re closing these mining operations for

other reasons altogether. It’s also important to remember

that China’s Bitcoin hashrate dominance was already on decline

before the mining ban. “According to Arcane Research, CBECI

numbers say that: China’s share of total Bitcoin mining power has

declined from 75.5% in September 2019 to 46% in April 2021 — before

the restrictions on Chinese miners were even imposed. That figure

is much lower than the older estimate of 65%. That’s a sharp

decline. Why did China’s miners lose so much ground before the

ban?” None of this invalidates Pantera Capital’s original thesis,

though. “The transition to renewables is well underway,” that

certainly seems to be the case. And the Bitcoin hashrate keeps

climbing. BTC price chart for 09/09/2021 on Timex | Source:

BTC/USD on TradingView.com Do Bitcoin Halvins Imply Cuts In Energy

Consumption? Another interesting idea present in the mentioned

newsletter is this one: “Bitcoin has a built-in mechanism to reduce

energy consumption over time. The number of bitcoin issued in

the every-ten-minutes block reward is cut in half every four

years. Ceteris paribus, the amount of electricity Bitcoin

consumes will be cut by 50% every four years. For comparison,

the Paris Accord only requires 7% cuts every four years.” Of

course, Bitcoin’s price fluctuates when related to fiat currencies.

So, the value of every Bitcoin stays the same, but the price might

– and usually does – increase more than twofold. Even though the

miner’s rewards are cut in half, their earnings might increase.

That extra money could bring even more competition and a Bitcoin

hashrate increase with it. Taking that into account, Pantera

poses: “Perhaps a more realistic scenario is if the price of

bitcoin were to double every four years in parallel with the

halvings – putting bitcoin at $320,000 /BTC in 2032 – electricity

consumption would be no greater than it is today.” Enough About The

Bitcoin Hashrate, What About The Price? Another point that the

newsletter makes is this one.“This is China’s third ban of

Bitcoin. The reverse hex is still working – the price is up

57%.” Related Reading | New To Bitcoin? Learn To Trade Crypto With

The NewsBTC Trading Course Is this a bullish signal? Bitcoin’s

price has “only” increased by 57% since the Chinese mining ban sent

the Bitcoin hashrate in death spiral for a few seconds. Bitcoin

paid the price and resisted sabotage like a hero. We’re not sure if

a “reverse hex” could be considered reliable information, but…

maybe this IS a bullish signal? Featured Image by Diana Polekhina

on Unsplash - Charts by TradingView and Pantera Capital

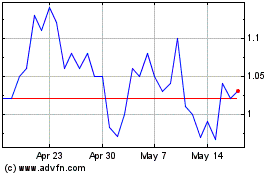

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Perpetual (Cryptocurrency): 0 recent articles

More Perpetual News Articles