Analyst Reveals Bitcoin’s Hidden Price Zones: Key Levels Investors Need To Watch

November 21 2024 - 2:30AM

NEWSBTC

A recent analysis by CryptoQuant analyst tugbachain sheds light on

an important aspect of Bitcoin market behaviour — the UTXO Realized

Price Age Distribution. This metric plays a significant role in

understanding the holding patterns of different investor groups and

the market’s response to price fluctuations. The realized price,

calculated as the Realized Cap divided by the total supply, is

pivotal for identifying cost bases among long-term holders and

recent buyers. According to tugbachain, the realized price levels

for one-month and three-month periods often serve as critical zones

during bull market corrections. These levels provide a lens through

which market sentiment, especially among smaller investors, can be

analyzed, offering insights into the underlying dynamics that drive

buying and selling activity. Related Reading: Is $135,000 Bitcoin’s

Current Ceiling? This Model Says So Key Support Levels For BTC The

analyst identifies two specific realized price levels—$75,100 and

$62,400—as key cost bases for small investors. These levels are

significant because they act as support zones during periods of

market volatility. tugbachain noted that historically, when

Bitcoin’s price tests these levels, it often triggers buying

reactions, highlighting the psychological and financial influence

of these price points on smaller investors. The CryptoQuant analyst

also points out that these support levels reveal not only the

patterns of small investors but also how their actions can be

influenced, or even manipulated, in a bull market. In bullish

cycles, it’s common for market dynamics to amplify fear among

smaller investors, often prompting panic selling. tugbachain

concluded noting: Monitoring these levels closely can provide

valuable insights for making informed investment decisions. Bitcoin

Market Performance Meanwhile, Bitcoin has just renewed its all-time

high (ATH). So far BTC’s peak stand at $94,784. However, at the

time of writing, the asset has retraced slightly away from this

peak with a current trading price of $94,523 albeit still up by

3.1% in the past day. While the asset has seen consistent upward

momentum in recent weeks, CryptoQuant has shared an interesting

analysis on whether it is time to sell or still hold BTC in a

recent post on its official X account. Citing major key metrics,

CryptoQuant mentioned BTC’s MVRV ratio. Related Reading: Bitcoin’s

Market Is Still In An ‘Healthy Growth’ Phase, Says Analyst—Here’s

Why According to the on-chain data provider platform, historically,

an MVRV ratio greater than 3.7 suggests that Bitcoin has marked a

market top. Fortunately, latest data shows BTC’s MVRV still remains

below this level with a figure of 2.62 as of November 19. Bitcoin

Hits ATH: Is It Time to Sell or Hold? MVRV > 3.7 has

historically marked market tops. Explore these 4 additional key

metrics to better understand market timing and make more informed

decisions. Details below 👇 pic.twitter.com/ewavOhofBR —

CryptoQuant.com (@cryptoquant_com) November 19, 2024 Featured image

created with DALL-E, Chart from TradingView

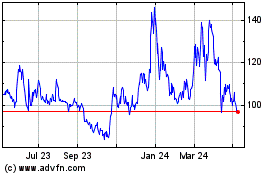

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

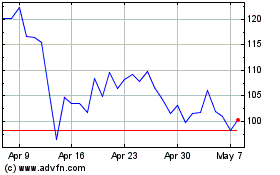

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024