Buy Dogecoin Now? Analyst Says This Is the Spot

March 05 2025 - 12:30PM

NEWSBTC

Crypto analyst Kevin (known on X as @Kev_Capital_TA) has outlined

what he deems a potentially ideal accumulation window for Dogecoin.

In a series of posts, he highlighted key technical indicators,

regulatory conditions, and macroeconomic shifts that could converge

to propel the meme-inspired asset in the near to mid-term. Why

Buying Dogecoin Now Could Be A Good Idea Kevin points out that

Dogecoin’s weekly Relative Strength Index (RSI) is currently

situated at a threshold it last occupied in October of last year,

when the DOGE price hovered around $0.10. According to him, this

low RSI level, combined with a critical trend line that has held

since early 2023, underscores a possibility of an oversold state:

“The Dogecoin weekly RSI is at the same level it was at when price

was at .10 cents in October of last year. We are also at a critical

trend line that we have been holding since 2023 and the macro 0.5

Fib retrace at .19 cents. Lots of oversold indicators. If you were

looking to accumulate some DOGE not a bad spot to start. With

proper allocations of course just in case.” He also notes that the

3-day Moving Average Convergence Divergence (MACD) indicator is on

track for a potential bullish reversal, an event he believes to be

vital for timing entries and exits. This, combined with fairly high

odds for a spot DOGE ETF in the United States and the expected

launch of X Payments, presents an ideal opportunity: “Odds favor by

63% a Dogecoin ETF by end of year. Imagine that and X payments

after the correction is over and 3Day MACD is fully reversed.

Timing is everything.” On the macroeconomic front, Kevin references

comments made by MicroStrategy founder Michael Saylor, who

suggested that former US President Donald Trump’s tariffs might

function as a form of stealth quantitative easing—weakening the US

dollar, fueling inflation, and thereby compelling the Federal

Reserve to soften interest rates or expand its balance sheet. Kevin

praised Saylor’s viewpoint: “Omg everyone look, it’s someone who

understands macroeconomics and is trying to tell you what Trump’s

endgame is with Tariffs. This is why I have been showing you the

DXY chart overlaid with altcoins with the comparison to his last

administration.” Kevin argues that such macro dynamics can swiftly

bring liquidity back into risk markets, especially altcoins.

Another crucial factor, according to Kevin, is President Donald

Trump’s pro-crypto stance. Kevin perceives ongoing regulatory

developments to be historically favorable for the industry: “Let me

break it down for you. We have the most bullish and free regulatory

environment in crypto history along with the largest mass adoption

in history. At the same time we have the worst monetary policy and

macro environment arguably in crypto history. One of them is going

to inevitably change soon and the other will continue to grow. Sign

me up.” While cautioning that no entry point is without risks,

Kevin’s analysis suggests he views the present landscape—technical,

macroeconomic, and regulatory—as notably supportive for those

looking to accumulate Dogecoin. Whether the RSI, critical trend

lines, and looming macro shifts ultimately align to trigger a

sustained bullish swing remains to be seen. At press time, Dogecoin

traded at $0.20. Featured image created with DALL.E, chart from

TradingView.com

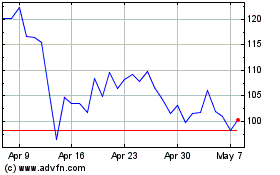

Quant (COIN:QNTUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

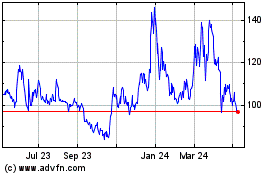

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025