Solana Price Eyes Surge To $260, But Losing $190 Could Ruin The Rally

February 16 2025 - 9:00AM

NEWSBTC

Solana has extended its price decline below $200, but technical

analysis shows that it continues to trade within a bullish setup.

At the time of writing, Solana finds itself trading close to a

support level that could determine its next major move. This is

because technical analysis shows that Solana is currently trading

in a parallel channel that could drive prices to new highs, but

holding above the $190 support level is crucial to this outlook.

Related Reading: XRP To 3 Digits? The ‘Signs’ That Could Confirm

It, Basketball Analyst Says Solana’s Parallel Channel Supports

Bullish Expectations Solana’s price action in the past seven days

has been highlighted by a notable resistance at $205. Particularly,

Solana’s rallies have faced rejection at this price point about

three times throughout the past seven days. This rejection is

particularly notable given that Solana recently reached a new

all-time high of $293 in the last 30-day timeframe. The stark

contrast between this all-time high and the most recent struggle at

$205 shows the intense volatility Solana has experienced in recent

weeks. Despite these fluctuations, technical indicators suggest

that Solana remains in a well-defined parallel channel that has

been directing its price movements since July 2024. This structured

price channel consists of a sequence of higher highs and higher

lows. Although there have been occasional pullbacks, the broader

trend suggests that buyers are still in control and preventing a

major breakdown to keep Solana’s bullish structure intact. The

presence of this parallel channel was emphasized in a recent

technical analysis by Ali Martinez, a well-known crypto analyst.

Martinez highlighted that as long as Solana maintains its position

within this formation, there’s still the possibility for a recovery

to $225, with a further extension toward $260. These price

projections are derived from Fibonacci extension levels,

specifically the 0.786 and 1.0 Fibonacci levels, projected from

Solana’s October 2023 low of $125. However, for this bullish

outlook to remain valid, the analyst cautioned that Solana must

hold above $190. Failure to maintain this support level could

invalidate the upward momentum and cause a downside move. Image

from X: Ali_Charts Why $190 Is A Critical Level For Solana Despite

the bullish trajectory, Solana’s ability to maintain support at

$190 is crucial for sustaining upward momentum. This is because

$190 is around the lower trendline of the parallel channel.

Solana has tested this $190 price level multiple times since the

beginning of the month, even breaking below it when it bottomed at

$184 on February 3. Although it has since recovered as buyers were

active in defending the price, the continued proximity to $190

indicates lingering weakness and the risk of a deeper correction if

bears manage to overpower bullish defenses. Related Reading: No

$200K Bitcoin? Popular Trader Explains Why It’s Unlikely This

Decade At the time of writing, Solana is trading at $193, down by

about 1.47% in the past 24 hours. Featured image from Medium,

chart from TradingView

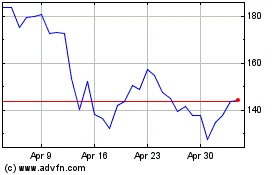

Solana (COIN:SOLUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025