Solana (SOL) Leads Gains Among Top Coins, Is $30 Milestone Possible?

August 10 2023 - 3:00PM

NEWSBTC

The price of Solana (SOL) has fluctuated a lot in the past week,

like many other cryptocurrencies in the market. SOL is currently

trading above $24, gaining 8.01% in its price in the past 7 days

with over $376 million in trading volume in the past 24 hours.

The coin’s movement has now sparked speculation among

investors about the imminent breach of the $30 resistance

threshold. Factors That Could Influence SOL’s Price Solana

has seen significant growth in terms of its total value locked

(TVL). According to Data from Messari, Solana did better than other

chains, with a 14% increase in the amount of funds locked in last

month. Related Reading: Whale Purchases $10 Million stETH In The

past Day, Here Are Possible Reasons Why Additionally, data from

DeFi Llama shows that Solana is now the 9th biggest chain in terms

of locked funds. It has around $320.07 million locked, a big

jump from the $205.11 million it had at the start of the year. This

surge in Solana’s Total Value Locked (TVL) could attract more

people to buy SOL tokens. Importantly, with rising interest,

the price of Solana’s tokens might increase due to higher

demand. However, if there’s suddenly bad news about Solana’s

security or performance, even with a growing TVL, people might get

worried and start selling their SOL tokens. This increased supply

and decreased demand could cause the price to drop. Can SOL

Hit The $30 Milestone? The daily chart shows that the asset has

traded positively in the past 24-hour market circle. The coin is

trading above the Simple Moving Average (SMA) indicator and is

bullish, signaling a potentially strong uptrend and a positive

momentum in its price movement. Additionally, it suggests

that buyers are consistently active, pushing the price higher. This

often indicates sustained demand and can potentially lead to

further price appreciation. Meanwhile, the SMA can act as a support

level if the price dips, preventing the price from falling too

much. However, while the SMA can act as support, it can also

become a resistance level if the price moves significantly above

it. This is because the Relative Strength Index (RSI) at 55

suggests the coin is balanced between overbought and oversold

conditions. The Moving Average Convergence Divergence (MACD)

is also showing an attempt to cross over the signal line, indicated

by the red histogram bar fading. This could signal a potential

shift in momentum, with the upward movement gaining strength.

Related Reading: US Congresswoman Raises Concerns About Paypal

Stablecoin In The Absence Of Regulation Considering the analysis,

SOL could potentially hit the $30 threshold in a few weeks if the

bulls sustain the current market sentiment. So traders can

anticipate a bullish move but should consider other indicators and

market context for a more accurate assessment of the coin’s

direction. Featured image from Pixabay and chart from

TradingView.com

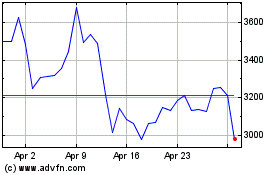

stETH (COIN:STETHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

stETH (COIN:STETHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024