MakerDAO Stakeholder-Focused Updates Drive MKR Price Up By 10%

March 21 2024 - 8:00PM

NEWSBTC

Blockchain protocol MakerDAO (MKR) continues to see significant

gains, maintaining a strong upward trend throughout the

year. MKR has seen significant growth of over 358%,

accompanied by positive metrics reflecting increased adoption and

usage of the protocol. In addition, upcoming voting initiatives aim

to further increase the platform’s benefits for its stakeholders.

MakerDAO Announces Plans For Rate System Changes In a recent

announcement, MakerDAO stated that it closely monitors developments

in the cryptocurrency market and has gained a better understanding

of the impact of recent proposals. As a result, the protocol

is recommending the next set of changes to its rate system.

MakerDAO emphasized that further adjustments will likely be

introduced shortly, contingent upon market dynamics, such as

prices, leverage demand, and the external rate environment

encompassing centralized finance (CeFi) funding rates and

decentralized (DeFi) effective borrowing rates. Related

Reading: US Spot Bitcoin ETFs Experience Record Outflows, Losing

$740 Million In Three Days The protocol further noted that the

Maker rate system will be adjusted accordingly if the external rate

environment continues to exhibit signs of decline. Efforts are

underway to update the rate system language within the Stability

Scope, including developing a new iteration of the Exposure model.

These updates aim to ensure that the system can adjust rates more

gradually and effectively in the future. Based on recommendations

from BA Labs, a blockchain infrastructure provider, the Stability

Facilitator proposes various parameter changes to the Maker Rate

system, which will be subject to an upcoming Executive vote.

As shown in the table above, the proposed changes include reducing

the Stability Fee by 2 percentage points for various collateral

types such as ETH-A, ETH-B, ETH-C, WSTETH-A, WSTETH-B, WBTC-A,

WBTC-B, WBTC-C. In addition, the Dai Savings Rate (DSR) and the

Effective DAI Borrowing Rate for Spark will also be reduced by 2

percentage points. However, one active protocol user offered an

alternative viewpoint, suggesting using the demand shock

opportunity to expand the net interest margin. While agreeing with

the proposed 2% interest rate reduction for borrowers, the user

advocates for a larger 4% reduction in the DSR, which he believes

will further benefit MakerDAO’s net interest margin. Ultimately,

the outcome of the voting process will determine whether these

proposed changes are implemented and benefit the stakeholders of

MakerDAO. Further decisions regarding rates and fees will be made

based on the results. Market Cap Skyrockets According to data

from Token Terminal, MakerDAO has demonstrated significant growth

and positive performance across various key metrics over the past

30 days. In terms of market capitalization, MakerDAO’s fully

diluted market cap has reached approximately $3.07 billion,

reflecting a notable increase of 40.9% over the past 30 days. The

circulating market cap is around $2.82 billion, showing a similar

growth rate of 41.1%. On another note, the total value locked (TVL)

in MakerDAO has increased by 10.1% over the past 30 days to

approximately $7.05 billion. The token trading volume for

MakerDAO has surged 126.6% over the past month, reaching

approximately $4.35 billion. This increase in trading volume

suggests heightened market activity and interest in the protocol.

In terms of user activity, MakerDAO has seen an increase in daily

active users, with an increase of 32.2% to 193 users. On the other

hand, weekly active users decreased by 22.6% to 783 users. However,

monthly active users have shown a positive growth rate of 10.0%,

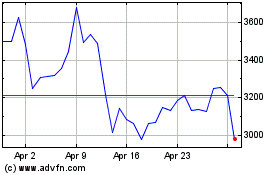

reaching 2.88k users. Short-Term Outlook For MKR Regarding price

action, MKR is currently trading at $3,158, reflecting a 4.8%

growth in the past 24 hours, 10% in the past seven days, and an

impressive 49% increase in the past fourteen and thirty-day time

frames. The token has encountered a support wall for the short term

at $3,048. This support level is significant for the token’s growth

prospects. Another key support level is at $2,884, which further

contributes to the token’s short-term stability and potential

growth. Related Reading: Crypto Expert Reveals The Possibility Of

Bitcoin Reaching $500,000 On the other hand, the nearest resistance

level is observed at its 28-month high of $3,321. This level

represents the highest point reached by the token since November

2021. Featured image from Shutterstock, chart from

TradingView.com

stETH (COIN:STETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

stETH (COIN:STETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024