Ethereum Indicator Flashes Buy Signal On The Weekly Chart – Potential For A Rebound?

February 14 2025 - 4:00PM

NEWSBTC

Ethereum has been struggling below the $2,800 mark for weeks,

unable to reclaim it as support and spark a recovery rally. This

critical resistance level has kept bulls at bay, leaving the price

action stagnant and fueling negative sentiment in the market.

Analysts call for a bearish continuation, citing Ethereum’s

inability to break through key supply zones. The broader market

uncertainty and the persistent selling pressure have only added to

concerns, making investors increasingly cautious about Ethereum’s

short-term prospects. Related Reading: Cardano Echoes 2020-2021

Pattern – Is A Parabolic Rally On The Horizon? However, not

everyone is bearish. Some investors remain optimistic that Ethereum

could soon enter a recovery phase. Top analyst Ali Martinez

recently shared a technical analysis revealing that Ethereum might

be showing signs of a potential rebound. Martinez noted that the TD

Sequential indicator—a widely used tool for identifying potential

trend reversals—has flashed a buy signal on the weekly chart. This

indicator, known for its accuracy in pinpointing moments of trend

exhaustion, suggests that Ethereum could be nearing a turning

point. As Ethereum consolidates at current levels, the coming weeks

will be crucial in determining its next move. Will the buy signal

lead to a rally, or will bearish sentiment dominate? For now, all

eyes are on the $2,800 mark and whether Ethereum can reclaim it.

Ethereum Prepares For A Rebound After last week’s dramatic

sell-off, Ethereum plummeted from $3,150 to $2,150 in less than two

days, shaking the confidence of investors and leaving the market in

turmoil. Although the price has since recovered strongly, climbing

back into the $2,600–$2,700 range, Ethereum has struggled to

reclaim key supply levels, keeping bearish sentiment alive. The

road to recovery remains challenging, with ETH needing to break

above the $3,000 mark to signal a reversal of the current bearish

trend. Top analyst Ali Martinez has provided some hope for Ethereum

bulls, sharing positive data on X that suggests a potential rebound

may be on the horizon. According to Martinez’s technical analysis,

Ethereum is showing signs of recovery as the TD Sequential

indicator flashes a buy signal on the weekly chart. The TD

Sequential, a well-respected tool in technical analysis, is

specifically designed to identify moments of trend exhaustion and

signal potential price reversals. A buy signal on the weekly chart

is a particularly strong indicator, suggesting that ETH could be

nearing a critical turning point. Related Reading: Avalanche Shows

Signs Of Recovery As Key Indicator Flashes A Buy Signal – Details

If Ethereum manages to step above the $3,000 mark and reclaim it as

support, it would confirm a trend reversal and could spark a rally

into higher price levels. However, until this key level is

breached, uncertainty remains, and bearish pressure could still

dominate. For now, the market is watching closely to see if

Ethereum can capitalize on these positive signals and regain its

footing. The coming weeks will be crucial in determining whether

ETH can shake off its bearish trend and resume a path toward

recovery. ETH Price Testing Crucial Supply Ethereum is currently

trading at $2,695, consolidating after days of ranging between

$2,525 and $2,795. The market remains indecisive, with both bulls

and bears waiting for a breakout in either direction. Bulls face

the critical challenge of reclaiming the $2,800 level as support to

gain momentum and push the price toward $3,000. A move above $3,000

would confirm a recovery rally and potentially mark the beginning

of a bullish phase for Ethereum. However, the current price levels

are crucial to maintaining a recovery phase. Sustaining the $2,600

support level is essential for bulls to build confidence and

attract more buying pressure. Losing this level could disrupt the

recovery momentum and spark a deeper correction, pushing ETH into

lower demand zones that could see it retest levels below $2,500.

Related Reading: Can Bitcoin Hold $97K? – 1-3 Month Holders’ Data

Reveals Crucial BTC Demand The next few days will be pivotal for

Ethereum’s short-term direction as it continues to hover near key

levels. If bulls succeed in reclaiming $2,800 and pushing above

$3,000, it could attract renewed interest from buyers and fuel a

rally into higher supply zones. Conversely, failure to hold current

levels could give bears the upper hand, leading to increased

selling pressure and further price declines. For now, Ethereum

remains in a critical consolidation phase. Featured image from

Dall-E, chart from TradingView

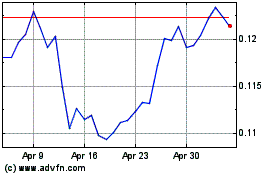

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025