Bitcoin Price Surges 4% as Crypto Exchange BitMEX Initiates Maintenance

August 22 2018 - 6:45AM

ADVFN Crypto NewsWire

Over the past 12 hours, the Bitcoin price has increased by more

than 4 percent, rising from $6,400 to $6,700 within a short period

of time.

Analysts have attributed the abrupt increase in the price of

Bitcoin to the temporary downtime of BitMEX, a crypto exchange

widely recognized for its margin trading system that enables users

to trade Bitcoin and Ethereum with leverage against the US

dollar.

As investors could not log into BitMEX and alter their trade

orders, analysts stated that Bitcoin short contracts, which

achieved a new monthly high on August 21, were liquidated, pushing

the price of Bitcoin up 4 percent.

BitMEX Situation

On August 19, the BitMEX cautioned its users regarding a system

maintenance that was planned to be held on August 21. The

maintenance was executed as previously planned and the system was

down briefly for a couple of hours, disallowing traders from

logging into the platform and executing trades.

BitMEX postponed the resumption of its system for several

minutes, after some users reported difficulty logging in. Apart

from the minor hiccup in the logging in process, the maintenance

was executed properly, without major delays.

“Some users are reporting difficulty in logging in. We are

diagnosing. We have postponed resumption of trading for 5 minutes

to 01:35. We will report back shortly,” BitMEX said on August 21,

following up with a short update, “Trading resumption deferred

until login is stable. We will report back shortly. Login has

stabilized. We encountered a large DDoS upon restarting web

services. We will resume trading at 02:00 UTC (in 7 minutes).”

Within hours, the BitMEX trading platform was restored and it

resumed its normal operations, enabling traders to execute trades

and orders.

But, analysts have said that the surge in the price of Bitcoin

demonstrated manipulation in the market by large-scale retail

traders that took advantage of the downtime of BitMEX, a period in

which investors can no longer short the market, to drive up the

price of Bitcoin.

Alex Kruger, a cryptocurrency trader and trading analyst at

large FX market maker, said that the BTC price surge on August 22

has shown the concerns of the US Securities and Exchange Commission

(SEC) regarding market manipulation.

“The BTC lightning +7% breakout during Bitmex’s downtime shows

why odds of SEC approving the CBOE bitcoin ETF proposal should be

close to zero. Even if no manipulation (that’s debatable) this

stresses the importance of BitMEX, a fully unregulated market with

40% market share,” Kruger said.

Last month, the US SEC disapproved the exchange-traded fund

(ETF) application filed by the Winklevoss twins, citing an issue

with the ETF’s dependance on Gemini, a US-based cryptocurrency

exchange, as the main source of price.

Market Needs to Mature

For the crypto market to mature, it will need some stability in

the market and if it can be affected by minor events like a

scheduled maintenance of BitMEX, then the market is still clearly

at its infancy, which may decrease the probability of an ETF or any

public instrument being approved.

Source:

ccn.com

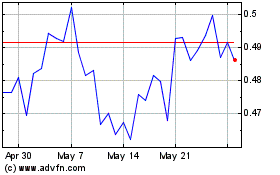

Ripple (COIN:XRPEUR)

Historical Stock Chart

From Feb 2025 to Mar 2025

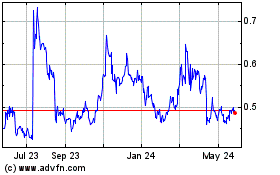

Ripple (COIN:XRPEUR)

Historical Stock Chart

From Mar 2024 to Mar 2025