Aedifica NV/SA: Interim financial report – Q3 2024

October 29 2024 - 11:40AM

UK Regulatory

Aedifica NV/SA: Interim financial report – Q3 2024

Please find below Aedifica’s interim financial

report for the 3rd quarter of the 2024 financial

year.

Robust operational performance driving strong

results above budget

- EPRA Earnings* amounted to €178.3 million (+7% compared to

30 Sept. 2023) or €3.75/share

- Rental income increased to €251.0 million (+7% compared to 30

Sept. 2023)

- 3.3% increase in rental income on a like-for-like basis in the

first 9 months of the year

- Weighted average unexpired lease term of 19 years and occupancy

rate of 100%

Real estate portfolio* of over €6.1 billion as at 30

September 2024

- 630 healthcare properties for more than 48,300 end users across

8 countries

- Valuation of marketable investment properties increased by 0.1%

in Q3 and 0.4% YTD on a like-for-like basis

- Investment programme of €236 million in pre-let development

projects and acquisitions in progress, of which €93 million remains

to be invested. Over the 3rd quarter, 5 projects from

the committed pipeline were delivered for a total investment budget

of approx. €61.5 million

Solid balance sheet and strong

liquidity

- 41.5% debt-to-assets ratio as at 30 September 2024

- €634 million of headroom on committed credit lines to finance

CAPEX and liquidity needs

- Average cost of debt* including commitment fees stable at

1.9%

- BBB investment-grade credit rating with a stable outlook

reaffirmed by S&P

Improved outlook for 2024

- Estimated EPRA Earnings* per share for the full 2024 financial

year are increased to at least €4.90/share (previously

€4.85/share)

- Proposed dividend for the 2024 financial year reconfirmed:

€3.90/share (gross)

- Interim financial report Q3 2024 - EN

- Rapport financier intermédiaire Q3 2024 - FR

- Tussentijds financieel verslag Q3 2024 - NL

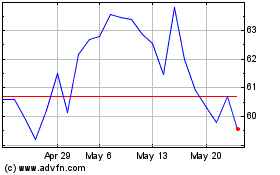

Aedifica (EU:AED)

Historical Stock Chart

From Feb 2025 to Mar 2025

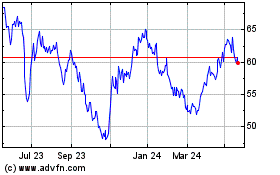

Aedifica (EU:AED)

Historical Stock Chart

From Mar 2024 to Mar 2025