CLASQUIN: Q3 2023 Business* and Gross Profit up Slightly Versus Q3 2022

November 07 2023 - 10:45AM

Business Wire

*: number of shipments and volumes

Regulatory News:

CLASQUIN (Paris:ALCLA):

9 months

Quarters

Sept 2023 9 months

Sept 2022 9 months

Change

Like for like (lfl)***

Q3 2023/

Q3 2022

Q2 2023/

Q2 2022

Q1 2023/

Q1 2022

CONSOLIDATED (unaudited)

Number of shipments**

247,861

236,962

+4.6%

+2.6%

+2.5%

+6.8%

+4.6%

Sales (€m)*

417.0

699.9

-40.4%

-46.7%

-44.0%

-36.7%

-40.5%

Gross profit (€m)

103.1

107.3

-3.9%

-14.1%

+0.6%

+1.4%

-14.1%

* Sales is not a relevant indicator of business in our sector,

as it is greatly impacted by changing air and sea freight rates,

fuel surcharges, exchange rates (particularly versus USD), etc.

Changes in the number of shipments, volumes shipped and, in

financial terms, gross profit are relevant indicators. ** The

number of shipments does not include the TIMAR acquisition. ***

Like for like: excluding acquisitions of Exaciel (01/07/2022), CVL

(01/07/2022), TIMAR (28/03/2023) and Log System disposal

(01/03/2022) & constant exchange rates.

BUSINESS VOLUMES AND GROSS PROFIT

The market conditions experienced in H1 2023 persisted in

Q3:

- Fall in demand due to pressure on household purchasing

power and persistently high inventory levels

- Increased supply for:

- shipping companies through a major delivery programme for new

vessels;

- airlines following the return to service of almost all

passenger flights in summer 2023.

This dual trend continued to weigh on sea freight rates,

which returned to and sometimes dipped below pre-COVID levels,

particularly on European export routes.

Air freight rates continued to show stronger resistance

and remained higher than in the pre-pandemic period.

Against this backdrop, the Group continued to outperform the

market, maintaining overall growth of 2.6% (excluding the

acquisition of the TIMAR Group*) in the number of shipments in

Q3 (up 4.6% for the first 9 months).

The air freight business was particularly buoyant,

bolstered by a 7.1% increase in volumes shipped in Q3, an 11.0%

rise in the number of shipments (excluding the TIMAR Group*) and

virtually stable gross profit, down 0.6% due to a highly

challenging basis for comparison in terms of unit margins,

which nonetheless remained higher than in the pre-COVID

period (up at least 30%).

Sea freight volumes also increased in Q3: volumes shipped

up 1.9% and number of shipments (excluding the TIMAR Group*) up

0.9%. However, as in the air freight business, the decline in

unit margins due to the exceptional performance in 2022

impacted sea freight gross profit, down 19.3% in Q3.

Gross profit for the road brokerage business doubled in

Q3 (up 107%) driven by the TIMAR Group* acquisition and the

7.9% expansion of the historic consolidation scope.

For the second consecutive quarter and despite a highly

challenging basis for comparison, Group gross profit remained

above the exceptional level reached in 2022 thanks to:

- the TIMAR Group* acquisition;

- the acquisition of new clients;

- business development with key accounts.

Furthermore, TIMAR Group* Q3 gross profit amounted to

€4.9m, down from Q2 2023 due to seasonal trends, as the summer

months are traditionally sluggish in North Africa.

* TIMAR: a Moroccan group in which the CLASQUIN Group acquired a

controlling interest on 28 March 2023

BREAKDOWN BY BUSINESS LINE

NUMBER OF SHIPMENTS**

GROSS PROFIT (€m)

At current scope

and exchange rates

9M 2023

9M 2022

Change

9M 2023/

9M 2022

Change

Q3 2023/

Q3 2022

9M 2023

9M 2022

9M 2023/

9M 2022

Q3 2023/

Q3 2022

Sea freight

102,485

103,154

-0.6%

+0.9%

50.3

60.9

-17.3%

-19.3%

Air freight

65,013

55,555

+17.0%

+11.0%

27.9

30.7

-9.1%

-0.6%

Road Brokerage*

54,603**

52,262

+4.5%

+2.2%

19.1

10.8

+77.1%

+107.0%

Other (rail, customs, logistics)

25,760

25,991

-0.9%

-9.5%

5.9

4.6

+28.9%

+63.8%

TOTAL OVERSEAS BUSINESS

247,861

236,962

+4.6%

+2.5%

103.1

106.9

-3.6%

+0.6%

Log System (sold on 01/03/2022)

N/A

0.4

N/A

N/A

Consolidation entries

N/A

(0.1)

N/A

N/A

TOTAL CONSOLIDATED

103.1

107.3

-3.9%

+0.6%

* Road brokerage includes the road haulage business previously

included in “Other businesses” and the RORO business (roll on/roll

off). ** Excluding the TIMAR Group

VOLUMES

9M 2023

9M 2022

9M 2023/

9M 2022

Q3 2023/

Q3 2022

Sea freight

196,697 TEUs*

200,505 TEUs*

-1.9%

+1.9%

Air freight

51,804T**

50,685T**

+2.2%

+7.1%

* Twenty-foot equivalent units ** Tons

POST-Q3 2023 HIGHLIGHTS

On 1 November 2023, the Group exceeded the threshold of 95%

of TIMAR SA’s share capital. A mandatory squeeze-out offer

was filed on 7th November with the Moroccan Capital Market

Authority (AMMC).

2023 OUTLOOK

2023 MARKET International trade by volume: up 0.8% (WTO – Oct

2023)

CLASQUIN 2023 Business (number of shipments and volumes):

outperform market growth

UPCOMING EVENTS (publication after

market closure)

- Wednesday 21 February 2024

- Wednesday 20 March 2024

- Thursday 25 April 2024

- Thursday 25 July 2024

- Tuesday 17 September 2024

- Tuesday 29 October 2024

Q4 2023 business report

2023 annual results

Q1 2024 business report

Q2 2024 business report

H1 2024 results

Q3 2024 business report

CLASQUIN is an air and sea

freight forwarding and overseas logistics specialist. The Group

designs and manages the entire overseas transport and logistics

chain, organising and coordinating the flow of client shipments

between France and the rest of the world and, more specifically, to

and from Asia-Pacific, North America, North Africa and sub-Saharan

Africa.

Its shares are listed on EURONEXT

GROWTH, ISIN FR0004152882, Reuters ALCLA.PA, Bloomberg ALCLA FP.

Read more at www.clasquin.com.

CLASQUIN confirms its eligibility

for the share savings plan for MSCs (medium-sized companies) in

accordance with Article D. 221-113-5 of the French Monetary and

Financial Code established by decree number 2014-283 of 4 March

2014 and with Article L. 221-32-2 of the French Monetary and

Financial Code, which set the conditions for eligibility (less than

5,000 employees and annual sales of less than €1,500m or balance

sheet total of less than €2,000m).

CLASQUIN is listed on the

Enternext© PEA-PME 150 index.

LEI: 9695004FF6FA43KC4764

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231107768264/en/

CLASQUIN Philippe LONS – Deputy Managing Director/Group

CFO Domitille CHATELAIN – Group Head of Communication &

Marketing Tel.: +33 (0)4 72 83 17 00 – Fax: +33 (0)4 72 83 17

33

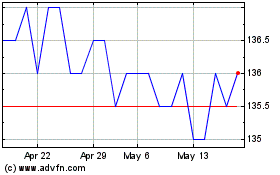

Clasquin (EU:ALCLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

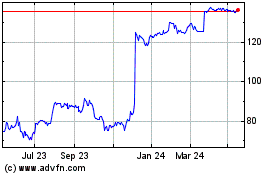

Clasquin (EU:ALCLA)

Historical Stock Chart

From Apr 2023 to Apr 2024