Regulatory News:

SFL (Paris:FLY):

Rental income: €130.0 million

Consolidated

revenue by business segment (€000's)

2021 (9 months)

2020 (9 months)

Rental income

129,982

137,667

o/w

Paris Central Business District

105,571

121,877

Paris Other

22,842

25,786

Western Crescent

1,569

1,407

Other revenue

0

0

Total consolidated revenue

129,982

137,667

Consolidated rental income for the first nine months of 2021

amounted to €130.0 million, down €7.7 million or 5.6% from the

€137.7 million reported for the same period of 2020:

- On a like-for-like basis (i.e., excluding

all changes in the portfolio affecting period-on-period

comparisons), rental income climbed €2.9 million, up 2.4%, buoyed

by higher rental income from the Edouard VII, Rives de Seine and

106 Haussmann properties.

- Rental income from units being redeveloped

or renovated in the periods concerned was down by €6.1 million, due

to the renovation of several floors that were vacated in late 2020,

mainly in the Cézanne Saint-Honoré and Washington Plaza buildings,

partially offset by initial revenues from the 83 Marceau

property.

- The sale of the 112 Wagram and 9 Percier

buildings in early 2021 led to a €4.5-million contraction in rental

income for the period.

The rent recovery rate currently stands at 98%, a very

satisfactory level, confirming that the vast majority of SFL's

clients are seeing a return to normal levels of activity.

Business review

In a rental market significantly affected by a lacklustre four

months at the start of the year, SFL maintained a strong level of

business, signing leases on some 37,000 sq.m. in the first nine

months. The main leases concerned:

- Cézanne Saint-Honoré: lease on 3,700 sq.m.

signed with Wendel and a lease on 3,300 sq.m. with Lacourte Raquin

Tatar, bringing the pre-lease rate for units scheduled for delivery

in 2022 to 72%;

- #Cloud.paris: new lease and extensions

signed with an existing tenant, for a total of nearly 13,700

sq.m.;

- Washington Plaza: leases signed on 8,600

sq.m., with four main agreements;

- Edouard VII: leases signed on 3,600 sq.m.,

with two main agreements;

- 103 Grenelle: three leases signed on 2,000

sq.m.;

- 92 Champs-Elysées: commercial lease on 900

sq.m. signed with PSG.

The new office leases were signed at an average nominal rent of

€776 per sq.m., corresponding to an effective rent of €656 per

sq.m, for an average non-cancellable term of 7.5 years,

demonstrating that the rental conditions for the Group’s properties

are holding firm.

The physical occupancy rate for revenue-generating properties

rose to 93.9% at 30 September 2021 compared with 93.7% at 31

December 2020. The remaining vacant units are located mainly in the

Le Vaisseau building in Issy-les-Moulineaux and at Washington

Plaza. The EPRA vacancy rate was 5.5%, versus 6.0% at 31 December

2020.

SFL/Predica partnership – Colonial transaction involving SFL

shares

Operations relating to the change in the partnership between SFL

and Predica were finalised on 4 August 2021 (see SFL press release

of 4 August 2021) and the simplified mixed tender offer launched by

Colonial for the SFL shares not yet held by Colonial and Predica

closed on 25 August 2021.

Following these operations:

- SFL took over 100% of the former

partnerships for the Washington Plaza, 106 Haussmann, 90

Champs-Elysées and Galerie des Champs-Elysées properties and

entered into new partnerships for #Cloud.paris, Cézanne

Saint-Honoré, 92 Champs-Elysées and 103 Grenelle of which it sold

49% to Predica while retaining overall control.

- Colonial holds 98.33% of SFL's share

capital and voting rights.

Financing

SFL’s consolidated net debt at 30 September 2021 amounted to

€1,790 million, compared with €1,890 million at 31 December 2020,

representing a loan-to-value ratio of 22.8% based on the

portfolio’s appraisal value at 30 June 2021. The average cost of

debt after hedging was 1.1% and the average maturity was 3.8 years.

At end-September 2021, the interest coverage ratio stood at

4.6x.

In addition, SFL had €890 million in undrawn lines of credit at

30 September 2021.

About SFL

Leader in the prime segment of the Parisian commercial real

estate market, Société Foncière Lyonnaise stands out for the

quality of its property portfolio, which is valued at €7.3 billion

and is focused on the Central Business District of Paris

(#cloud.paris, Edouard VII, Washington Plaza, etc.) and for the

quality of its client portfolio, which is composed of prestigious

companies in the consulting, media, digital, luxury, finance and

insurance sectors. As France’s oldest property company, SFL

demonstrates year after year an unwavering commitment to its

strategy focused on creating a high value in use for users and,

ultimately, substantial appraisal values for its properties.

Stock market: Euronext Paris Compartment A – Euronext Paris ISIN

FR0000033409 – Bloomberg: FLY FP – Reuters: FLYP PA

S&P rating: BBB+ stable outlook

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211103006025/en/

SFL - Thomas Fareng - T +33 (0)1 42 97 27 00 -

t.fareng@fonciere-lyonnaise.com Evidence - Grégoire Silly -

T +33 (0)6 99 10 78 99 - gregoire.silly@evidenceparis.fr

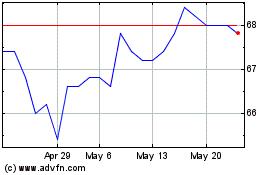

Fonciere Lyonnaise (EU:FLY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Fonciere Lyonnaise (EU:FLY)

Historical Stock Chart

From Jan 2024 to Jan 2025