- First tranche of €6 million bond issuance and capital increase

of €9 million

- Potential future financings as a second tranche of €4 million

and an additional tranche of €2 million

Regulatory News:

GenSight Biologics (Paris:SIGHT) (Euronext: SIGHT, ISIN:

FR0013183985, PEA-PME eligible) (the "Company" or

"GenSight"), a biopharma company focused on discovering and

developing innovative gene therapies for retinal neurodegenerative

diseases and central nervous system disorders, today announced that

it had obtained committed financing in the form of a bond financing

of up to €12 million from Kreos Capital VI (UK) Limited

("Kreos") and issued a drawdown notice thereunder for the

first tranche of €6 million (the "Kreos Transaction")

concurrently with the completion of a capital increase of €9

million subscribed for by one of its main shareholders Sofinnova

Crossover I SLP ("Sofinnova") and by a new strategic Chinese

investor Strategic International Group Limited, a wholly owned

subsidiary of 3SBio Inc. ("3SBio") (the "3SBio-Sofinnova

Transaction").

Bernard Gilly, Co-founder and Chief Executive Officer of

GenSight, stated: “This successful refinancing transaction is

expanding our financial runway to the end of 2020, with minimal

dilution, as we are entering into a pivotal year for GenSight. We

are thrilled to see Sofinnova renewing their trust at this turning

point, while the entry of 3SBio will pave the way towards creating

additional value in Greater China.”

Dr. Jing Lou, Chairman and Chief Executive Officer of

3SBio, stated: “The investment in Gensight is consistent with our

goal to explore promising therapeutic strategies. Gene therapy

technology will be one of most promising platforms for filling the

unmet medical needs. As trained professional myself with 3SBio

being one of largest biopharmaceutical company in China, I am

excited about the potential opportunities to collaborate with

Gensight in greater China.”

Cédric Moreau, Partner of Sofinnova Crossover I fund,

stated: “We are truly encouraged by the recent progress achieved by

the company, particularly with both ATU granted in France and

REALITY registry interim data, supporting the therapeutic benefit

delivered by LUMEVOQ™.”

The Kreos Transaction includes a €10 million straight

bond issuance divided into two tranches of €6 million and, subject

to a Qualifying Financing1, €4 million, respectively (including 30%

of each tranche to be issued in the form of convertible bonds at

Kreos' option). Each tranche includes a simultaneous issuance of

warrants.

The Company today announces the issuance of a drawdown notice

for the first tranche of the Kreos Transaction for a total amount

of €6 million, including a €4.2 million straight bond issuance and

a €1.8 million convertible bonds issuance.

The second tranche of the Kreos Transaction may be drawn down at

the Company's option, at any time up to September 1st, 2020.

Subject to the mutual consent of the parties, an additional

tranche of €2 million may be made available at a later date,

increasing the total bond financing to €12 million.

The 3SBIO-Sofinnova Transaction includes an aggregate of

€9 million capital increase subscribed by 3SBio, a leading

biopharmaceutical company in China, and Sofinnova, lead investor in

GenSight Biologics, for €5 and €4 million, respectively.

Reasons for the issuance and use of the proceeds

Gross proceeds from the 3SBio-Sofinnova Transaction are €9

million.

Gross proceeds from the first tranche of the Kreos Transaction

will be €6 million.

Gross proceeds from the second tranche of the Kreos Transaction

would be €4 million.

Gross proceeds from the optional third tranche of the Kreos

Transaction would be €2 million.

The estimated net proceeds from the 3SBio-Sofinnova Transaction

and from the first tranche of the Kreos Transaction, excluding any

income related to the ATU in France, will allow the Company to

finance until the end of June 2020 the clinical and pharmaceutical

development of GS010 necessary for the filing of a Marketing

Authorization Application (MAA) in Europe and a Biologics License

Application (BLA) in the United States, and to actively prepare its

commercial launch in Europe.

Key characteristics of the 3SBio-Sofinnova

Transaction

GenSight Biologics's board of directors, using the delegation of

powers granted by the 21st resolution of the shareholders' general

meeting held on June 11, 2019 (capital increase without the

exercise of preemptive subscription rights in favor of categories

of persons with specific characteristics), has decided today to

realize a capital increase of €9 million, by the issuance of

3,799,071 new shares with a nominal value of €0.025 each (the

"New Shares") for a subscription price of €2.369 each, at no

discount to the last closing price.

3SBio and Sofinnova participated for subscription amounts of €5

million and €4 million respectively.

The subscription price of the New Shares is equal to a 5%

discount to the volume weighted average price of the Company’s

shares on the regulated market of Euronext Paris over the three

last trading days before pricing, ie., December 16, 17 and 18,

2019.

Sofinnova, by subscribing for 1,688,476 ordinary shares in the

transaction, will own approximately 17.09% of the share capital and

voting rights of GenSight Biologics (on a non-diluted basis and

taking into account the share capital and voting rights of the

Company as of the date of this press release) and will in

consequence remain the largest shareholder of the Company.

3SBio, by subscribing for 2,110,595 ordinary shares to the

transaction, will own approximately 6.43% of the share capital and

voting rights of GenSight Biologics (on a non-diluted basis and

taking into account the share capital and voting rights of the

Company as of the date of this press release).

OneHealth Partners acted as Financial Advisor to the Company for

this transaction.

Key characteristics of the Kreos Transaction

The Kreos Transaction is structured as following:

Tranche A

Tranche B

Straight Bonds

Issuance date

December 23rd

At the option of the Company, at any

moment between the Tranche A drawdown date and September 1st

2020

Amount

€4,200,000

€4,000,000

Number

420,000,000 Straight Bonds with a nominal

value of 0.01€

400,000,000 Straight Bonds with a nominal

value of 0.01€

Drawdown conditions

Completion of the 3SBio-Sofinnova

Transaction

Satisfaction of certain conditions

precedent, including completion of a Qualifying Financing

Maturity date

45 months as from the issuance date

42 months as from the issuance date

Fixed interest rate

9.25% per annum

9.25% per annum

Redemption terms

Monthly

Monthly

Convertible Bonds

Issuance date

December 23rd

Simultaneously with the Straight Bonds

Amount

€1,800,000

Up to €1,200,000 (to be deducted from the

amount of the Straight Bonds)

Number

1,800,000 Convertible Bonds with a nominal

value of €1

Up to 1,200,000 Convertible Bonds with a

nominal value of €1

Drawdown conditions

At Kreos' option

At Kreos' option

Maturity date and conversion

deadline

42 months as from the issuance date

42 months as from the issuance date

Interest rate

Identical to the Straight Bonds

Identical to the Straight Bonds

Redemption Terms

Identical to the Straight Bonds

Identical to the Straight Bonds

Conversion ratio (CR)

1 / ( (0.9 * P) – D )

P: 2,494 euros (3-day VWAP prior to

the board pricing meeting ie. December 16, 17 and 18)

D: dividend per share paid by the

Company between the issuance date and the conversion date

1 / ( (0.9 * P) – D )

P: 2,494 euros (3-day VWAP prior to

the board pricing meeting ie. December 16, 17 and 18)

D: dividend per share paid by the

Company between the issuance date and the conversion date

Discount to the 3-days VWAP

10%

10%

Maximum number of shares issued upon

conversion

801,781

534,521

Warrants

Issuance date

December 23rd 2019

Simultaneously with the Straight Bonds

Amount

€1,200,000

€300,000

Number

534,521

133,630

Drawdown conditions

Drawdown of the Straight Bonds

Drawdown of the Straight Bonds

Maturity date and exercise

deadline

The earlier of the following events: (i)

the tenth anniversary of the Warrants A Issuance Date or (ii) the

acceptance by the shareholders of the Company of a third-party bona

fide offer to purchase all outstanding shares of the Company

The earlier of the following events: (i)

the tenth anniversary of the Warrants B Issuance Date or (ii) the

acceptance by the shareholders of the Company of a third-party bona

fide offer to purchase all outstanding shares of the Company

Exercise price

2,245 euros

(3-day VWAP prior to the board pricing

meeting ie. December 16, 17 and 18) discounted by 10%

2,245 euros

(3-day VWAP prior to the board pricing

meeting ie. December 16, 17 and 18) discounted by 10%

Discount to the 3-day VWAP

10%

10%

Maximum number of shares issued upon

exercise of the warrants

534,521

133,630

The Straight Bonds and the Convertible Bonds will be secured by

pledge agreements on Gensight's bank accounts, business assets,

owned intellectual property rights (trademarks, patents, software,

and domain names) and any future receivables.

Working capital statement

As of today, the Company does not have sufficient net working

capital to meet its obligations during the next 12 months. As of

September 30, 2019, the Company had a cash position of €5.1 million

available. Adding €4.3 million of Research Tax Credit to be

received shortly, the Company can meet its obligations until

mid-January 2020. Before the 3SBio-Sofinnova Transaction and the

Kreos Transaction, the Company's lack of net capital is estimated

to be 15.6 million for the next twelve months. To finance the

pursuit of its activities necessary for its development over the

next twelve months, a bond issuance associated with a capital

increase constitute the preferred solution for the Company. For the

period of twelve months following the date hereof, considering the

net proceeds from the 3SBio-Sofinnova Transaction and the first

tranche of the Kreos Transaction, and including additional expected

income related to the ATU in France, the Company has sufficient net

working capital to meet its obligations until November 2020 and the

lack of net working capital is estimated to be €1.3 million, taking

into account the need of the Company to finance its ongoing

activities, including the active preparation for the launch of its

GS010 product in Europe in 2021, if approved by regulatory

authorities. In order to meet these obligations, the Company is

already in a position to receive a second tranche of €4.0 million

under the Kreos Transaction, subject to the realization of a

Qualifying Financing of €10 million. The Company will explore other

financing options through debt or equity in order to complete its

working capital needs and to finance its operating expenses. In

this respect, an additional drawdown of €2 million could be made

available to the Company at a later date.

Admission of the New Shares and of the new shares to be

issued under the conversion of the Convertible Bonds and upon

exercise of the Warrants

The New Shares and the shares to be issued upon conversion of

the Convertible Bonds and upon exercise of the Warrants will carry

dividend rights as from their issuance date and be immediately

fungible in all respects with the Company’s existing shares. They

will be admitted to trading under the same code as the existing

shares (ISIN FR0013183985) on the regulated market of Euronext

Paris.

The Straight Bonds, the Convertible Bonds and the Warrants will

neither be listed nor admitted to trading on Euronext Paris or any

other financial market.

A listing prospectus, incorporating the 2018 universal

registration document, will be filed with the AMF together with a

Securities Note, containing a summary of the prospectus in French

and in English, will be submitted to the AMF, with a view to

receiving its approval on or about December 20, 2019.

Impact of the offering on the share capital

Shareholders

Shareholders before the

3SBio-Sofinnova Transaction and Kreos Transaction

Shareholders after the

3SBio-Sofinnova Transaction

Shareholders after the

issuance of the shares to be issued upon the conversion of the

maximum number of Convertible Bonds and Warrants

Number of shares and voting

rights

% of share

capital and voting

rights

Number of shares and voting

rights

% of share capital and voting

rights

Number of shares and voting

rights

% of share capital and voting

rights

5% Shareholders

Sofinnova

3,921,568

13.51%

5,610,044

17.09%

5,610,044

16.11%

3SBio

-

-

2,110,595

6.43%

2,110,595

6.06%

Kreos Capital (Expert Fund) LP

-

-

-

-

2,004,453

5.75%

Versant

3,280,381

11.30%

3,280,381

9.99%

3,280,381

9.42%

Bpifrance Participations

2,000,000

6.89%

2,000,000

6.09%

2,000,000

5.74%

Bpifrance Investissement

975,666

3.36%

975,666

2.97%

975,666

2.80%

Directors and Executive

Officers

1,105,210

3.81%

1,105,210

3.37%

1,105,210

3.17%

Employees

360,500

1.24%

360,500

1.10%

360,500

1.03%

Other shareholders (total)

17,384,966

59.89%

17,384,966

52.96%

17,384,966

49.91%

Total

29,028,291

100.00%

32,827,362

100.00%

34,831,815

100.00%

Following the settlement-delivery of the 3SBio-Sofinnova

Transaction and the first tranche of the Kreos Transaction which

are expected to occur on December 23, 2019, GenSight Biologics's

share capital will amount €820,684.05 divided into 32,827,362

shares (nominal value €0.025).

Undertakings related to the transactions

Under the terms of a subscription agreement concluded with the

Company on December 19, 2019, 3SBio and Sofinnova have undertaken

to subscribe in full to the 3SBio-Sofinnova Transaction. Neither

3SBio nor Sofinnova have entered into a lock-up agreement relating

to the shares of the Company.

These subscription commitments are subject in particular to the

absence of any material adverse effect on the Company prior to the

settlement and delivery of the 3SBio-Sofinnova Transaction.

In relation to the subscription for the New Shares by 3SBio, the

Company has agreed to grant 3SBio a right of first refusal for

potential licensing or co-development, encompassing manufacturing

rights on its two lead assets, GS010 and GS030, in the Territory of

Greater China (which right of first refusal may be bought back by

the Company in the event of a global licensing deal or M&A

transaction). The Company and 3SBio have also agreed to enter

discussions on a potential licensing or co-development

collaboration for the Company’s two lead assets for Greater China

shortly after the financing is completed.

Sofinnova subscribed for 1,688,476 new shares of the Company and

will hold, after the completion of the 3SBio-Sofinnova Transaction

17.09% of the Company's share capital.

3SBio subscribed for 2,110,595 new shares of the Company and

will hold, after the completion of the 3SBio-Sofinnova Transaction

6.43% of the Company's share capital.

Under the terms of a subscription agreement concluded with the

Company on December 19, 2019, Kreos has undertaken to subscribe for

the entirety of the Kreos Transaction. In relation to its

subscription under the Kreos Transaction, Kreos will be granted an

observer seat (censeur) at the Company's board of directors.

About GenSight Biologics

GenSight Biologics S.A. is a clinical-stage biopharma company

focused on discovering and developing innovative gene therapies for

retinal neurodegenerative diseases and central nervous system

disorders. GenSight Biologics’ pipeline leverages two core

technology platforms, the Mitochondrial Targeting Sequence (MTS)

and optogenetics to help preserve or restore vision in patients

suffering from blinding retinal diseases. GenSight Biologics’ lead

product candidate, GS010, is in Phase III trials in Leber

Hereditary Optic Neuropathy (LHON), a rare mitochondrial disease

that leads to irreversible blindness in teens and young adults.

Using its gene therapy-based approach, GenSight Biologics’ product

candidates are designed to be administered in a single treatment to

each eye by intravitreal injection to offer patients a sustainable

functional visual recovery.

Disclaimer

This announcement and the information contained herein do not

constitute either an offer to sell or purchase, or the solicitation

of an offer to sell or purchase, securities of GenSight Biologics

S.A. (the “Company”).

No communication or information in respect of the offering by

the Company of its shares may be distributed to the public in any

jurisdiction where registration or approval is required. No steps

have been taken or will be taken in any jurisdiction where such

steps would be required. The offering or subscription of shares may

be subject to specific legal or regulatory restrictions in certain

jurisdictions. The Company takes no responsibility for any

violation of any such restrictions by any person.

This announcement does not, and shall not, in any circumstances,

constitute a public offering nor an invitation to the public in

connection with any offer. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes are required to inform themselves

about and to observe any such restrictions.

This announcement is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 (the "Prospectus

Regulation"), as implemented in each member State of the

European Economic Area. The listing prospectus, once approved by

the AMF, will be available on the Company's website

(www.gensight-biologics.com) and on the AMF website

(www.amf-france.org).

No action has been undertaken or will be undertaken to make

available any shares to any retail investor in the European

Economic Area. For the purposes of this press release:

-the expression "retail investor" means a person who is

one (or more) of the following:

- a retail client as defined in point (11) of Article 4(1) of

Directive 2014/65/EU (as amended, "MiFID II"); or

- a customer within the meaning of Directive 2016/97/EU, as

amended, where that customer would not qualify as a professional

client as defined in point (10) of Article 4(1) of MiFID II; or not

a "qualified investor" as defined in the Prospectus Regulation;

and

-the expression "offer" includes the communication in any

form and by any means of sufficient information on the terms of the

offer and the shares to be offered so as to enable an investor to

decide to purchase or subscribe the shares.

The Company's shares in connection with the Capital Increase

will not be offered or sold, directly or indirectly, to the public

in France to persons other than qualified investors. Any offer or

transfer of shares of the Company or distribution of offer

documents has only been and will only be made in France to

qualified investors as defined by Article 2(e) of the Prospectus

Regulation and in accordance with Articles L. 411-1 and L. 411-2 of

the French Monetary and Financial Code.

This document may not be distributed, directly or indirectly, in

or into the United States. This document does not constitute an

offer of securities for sale nor the solicitation of an offer to

purchase securities in the United States or any other jurisdiction

where such offer may be restricted. Securities may not be offered

or sold in the United States absent registration under the U.S.

Securities Act of 1933, as amended (the “Securities Act”)

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements thereof. The securities

of the Company have not been and will not be registered under the

Securities Act, and the Company does not intend to make a public

offering of its securities in the United States. Copies of this

document are not being, and should not be, distributed in or sent

into the United States.

The distribution of this document (which term shall include any

form of communication) is restricted pursuant to Section 21

(Restrictions on financial promotion) of Financial Services and

Markets Act 2000 (“FMSA”). This document is only being

distributed to and directed at persons who (i) are outside the

United Kingdom, (ii) have professional experience in matters

relating to investments and who fall within the definition of

investment professionals in Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005 (as amended)

(the “Financial Promotion Order”), (iii) are persons falling

within Article 49(2)(a) to (d) (high net worth companies,

unincorporated associations, etc.) of the Financial Promotion Order

or (iv) are persons to whom this communication may otherwise

lawfully be communicated (all such persons referred to in (i),

(ii), (iii) and (iv) above together being referred to as

“Relevant Persons”). This document must not be acted on or

relied on in the United Kingdom by persons who are not Relevant

Persons. Any investment or investment activity to which this

document relates is available only to Relevant Persons, and will be

engaged in only with such persons in the United Kingdom.

This document may not be distributed, directly or indirectly, in

or into the United States, Canada, Australia or Japan.

1 Qualifying Financing means a financing of the Company

in the form of equity (or Non-Dilutive Payment or subordinated

convertible bonds, or a combination of the above) from existing

shareholders and/or new top tier investors reasonably satisfactory

to Kreos, with a minimal amount of gross proceeds of €10 million,

being specified that such amount may be reduced, up to a maximal

amount of €2 million, by the proceeds susceptible to be received by

the Company under Autorisations Temporaires d’Utilisation payantes.

In this definition, Non-Dilutive Payment means an upfront or

milestone related payment under a licensing agreement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191219005865/en/

GenSight Biologics Thomas Gidoin Chief Financial Officer

tgidoin@gensight-biologics.com +33 (0)1 76 21 72 20

RooneyPartners Media Relations Marion Janic

mjanic@rooneyco.com +1-212-223-4017

The Trout Group US Investor Relations Chad Rubin

crubin@troutgroup.com +1-646-378-2947

James Palmer Europe Investor Relations

j.palmer@orpheonfinance.com +33 7 60 92 77 74

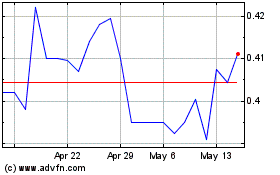

GenSight Biologics (EU:SIGHT)

Historical Stock Chart

From Dec 2024 to Jan 2025

GenSight Biologics (EU:SIGHT)

Historical Stock Chart

From Jan 2024 to Jan 2025