Australian Dollar Rises As Upbeat CPI Data Damps Rate Cut Hopes

June 25 2024 - 9:58PM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Wednesday, as the nation's

inflation accelerated more than expected in May, suggesting the

Reserve Bank of Australia will remain hawkish at the August

meeting.

Data from the Australian Bureau of Statistics showed that the

consumer price inflation rose to 4.0 percent in May from 3.6

percent in April. Inflation was expected to rise to 3.8

percent.

Annual trimmed mean inflation accelerated to 4.4 percent in May

from 4.1 percent in April. The most significant contributors to the

annual increase were housing, food and non-alcoholic beverages,

transport and alcohol and tobacco prices.

Markets bet on the possibility for slashing interest rates only

in the first quarter of 2025 rather than in the last quarter of

this year.

Asian stock markets are trading mostly higher, following the

mixed cues from Wall Street overnight, as traders remained cautious

ahead of the release of some crucial economic data form the U.S.,

including a report on personal income & spending due later in

the week. The data will provide clues about the outlook for the

U.S. Fed's monetary policy moves.

In the Asian trading today, the Australian dollar rose to a

17-year high of 106.89 against the yen and a 1-year high of 1.6004

against the euro, from yesterday's closing quotes of 106.11 and

1.6117, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 108.00 against the yen and 1.59

against the euro.

Against the U.S., the Canada and the New Zealand dollars, the

aussie advanced to a 2-week high of 0.6689, a 6-day high of 0.9135

and more than a 1-month high of 1.0932 from yesterday's closing

quotes of 0.6645, 0.9074 and 1.0853, respectively. The aussie may

test resistance near 0.67 against the greenback, 0.92 against the

loonie and 1.10 against the kiwi.

Looking ahead, the Confederation of British Industry's

distributive trades survey data for June is due to be released at

6:00 am ET in the European session.

In the New York session, U.S. weekly mortgage approvals data,

new home sales data for May and U.S. EIA weekly crude oil data,

Canada manufacturing and wholesale sales data and Swiss National

Bank's quarterly bulletin are slated for release.

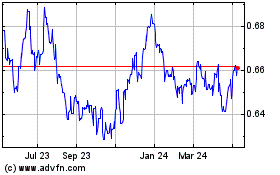

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From May 2024 to Jun 2024

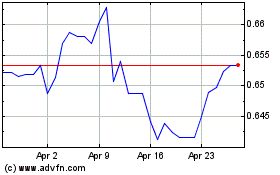

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Jun 2023 to Jun 2024