U.S. Dollar Falls As Asian Shares Traded Higher

March 03 2024 - 8:03PM

RTTF2

The U.S. dollar weakened against other major currencies in the

Asian session on Monday, as investor sentiment edged higher

following the broadly positive cues from global markets on Friday,

amid bets the U.S. Fed will likely cut interest rate in June after

data showed a slowdown in manufacturing activity and a drop in

consumer sentiment in the U.S.

Traders also react to a slew of economic data from the

region.

This week's trading is likely to be driven by a testimony by Fed

Chair Jerome Powell and reaction to the release of the U.S.

services PMI figures and the monthly jobs report.

Powell testifies Tuesday and Wednesday before House and Senate

committees, a semi-annual exercise.

In the Asian trading now, the U.S. dollar fell to 4-day lows of

1.0848 against the euro and 1.2667 against the pound, from last

week's closing quotes of 1.0837 and 1.2650, respectively. If the

greenback extends its downtrend, it is likely to find support

around 1.09 against the euro and 1.27 against the pound.

Against the Swiss franc and the yen, the greenback dropped to

4-day lows of 0.8824 and 149.84 from Friday's closing quotes of

0.8833 and 150.11, respectively. The greenback may test support

near 0.86 against the franc and 147.00 against the yen.

Looking ahead, the Federal Statistical Office releases Swiss

inflation data for February at 2:00 am ET in the pre-European

session.

At 4:30 am ET, the behavioral research Sentix is scheduled to

issue euro area investor confidence survey results for March.

At 11:00 am ET, Federal Reserve Bank of Philadelphia President

Patrick Harker is scheduled to speak on the "Economic Impact of

Higher Education" before the 2024 American Council on Education

Presidents and Chancellors Summit, Washington D.C., U.S.

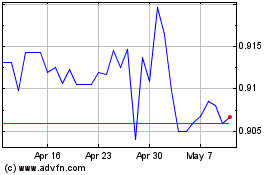

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024