Yen Extends Rise On BoJ Governor Ueda Comments

September 11 2023 - 12:40AM

RTTF2

The Japanese yen extended its early gain against other major

currencies in the European session on Monday, as traders sentiment

boosted after the remarks from the Bank of Japan Governor Kazuo

Ueda that the central bank could end its negative interest rate

policy.

In an interview with the Yomiuri newspaper, the BoJ Governor

Ueda said that the BOJ could have enough information by year-end to

determine whether it can end negative rates when the achievement of

its 2 percent inflation target is in sight.

The safe-haven yen continued its gain against its major

counterparts from the Asian session today.

In European trading today, the yen rose to a 6-week high of

156.58 against the euro and a 10-day high of 145.91 against the

U.S. dollar, from early lows of 157.70 and 147.14, respectively. If

the yen extends its uptrend, it is likely to find resistance around

151.00 against the euro and 142.00 against the greenback.

Against the pound and the Swiss franc, the yen advanced to

1-month highs of 182.69 and 163.84 from early lows of 183.78 and

164.95, respectively. The yen may test resistance near 176.00

against the pound and 158.00 against the franc.

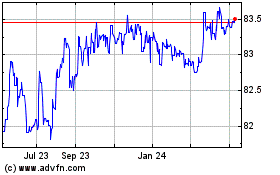

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

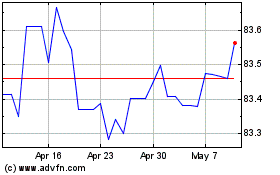

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024