false

0000351569

0000351569

2024-05-21

2024-05-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| Date of report (Date of earliest event reported): |

May 21, 2024 |

| Ameris Bancorp |

|

(Exact Name of Registrant as Specified in

Charter)

|

| Georgia |

001-13901 |

58-1456434 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| |

3490 Piedmont Road N.E., Suite

1550, Atlanta, Georgia |

30305 |

| |

(Address of Principal Executive Offices) |

(Zip Code) |

| Registrant’s telephone number, including area code: |

(404) 639-6500 |

| |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $1.00 per share |

ABCB |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

In

connection with various upcoming investor meetings, Ameris Bancorp (the “Company”) will be using certain presentation material,

a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated in Item 7.01 of this Current Report

by this reference. The investor presentation material is also available on the “Investor Relations” page of the Company’s

website (http://www.amerisbank.com).

The information contained

in this Item 7.01 and in Exhibit 99.1 attached to this Report is being furnished and shall not be deemed filed for purposes of Section

18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section. Furthermore, such information

shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities

Act of 1933, as amended.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned,

hereunto duly authorized.

| |

AMERIS BANCORP |

| |

|

| |

By: |

/s/ Nicole S. Stokes |

| |

|

Nicole S. Stokes |

| |

|

Chief Financial Officer |

Date: May 21, 2024

Exhibit 99.1

May 2024 Investor Presentation

Cautionary Statements 1 This presentation contains forward - looking statements, as defined by federal securities laws, including, among other forward - looking statements, certain plans, expectations and goals . Words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, as well as similar expressions, are meant to identify forward - looking statements . The forward - looking statements in this presentation are based on current expectations and are provided to assist in the understanding of potential future performance . Such forward - looking statements involve numerous assumptions, risks and uncertainties that may cause actual results to differ materially from those expressed or implied in any such statements, including, without limitation, the following : general competitive, economic, unemployment, political and market conditions and fluctuations, including real estate market conditions, and the effects of such conditions and fluctuations on the creditworthiness of borrowers, collateral values, asset recovery values and the value of investment securities ; movements in interest rates and their impacts on net interest margin, investment security valuations and other performance measures ; expectations on credit quality and performance ; legislative and regulatory changes ; changes in U . S . government monetary and fiscal policy ; competitive pressures on product pricing and services ; the success and timing of other business strategies ; our outlook and long - term goals for future growth ; and natural disasters, geopolitical events, acts of war or terrorism or other hostilities, public health crises and other catastrophic events beyond our control . For a discussion of some of the other risks and other factors that may cause such forward - looking statements to differ materially from actual results, please refer to the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10 - K for the year ended December 31 , 2023 and the Company’s subsequently filed periodic reports and other filings . Forward - looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise forward - looking statements .

Ameris Profile Investment Rationale • Top of peer financial results with culture of discipline – credit, liquidity, expense control, capital • Diversified loan portfolio among geographies and product lines • Strong Southeast markets • Stable core deposit base • Experienced executive team with skills and leadership to continue to grow organically Strong History of Earnings 2 Charlotte MSA Tampa MSA Orlando MSA $0.86 $0.91 $1.16 $1.07 $1.10 1.89% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 1Q23 2Q23 3Q23 4Q23 1Q24 Adjusted Diluted EPS PPNR ROA

1Q 2024 Operating Highlights 3 • Net income of $74.3 million, or $1.08 per diluted share • Adjusted net income (1) of $75.6 million, or $1.10 per diluted share • PPNR ROA (1) of 1.89% for 1Q24, which includes 4bps negative impact from FDIC special assessment • Adjusted efficiency ratio (1) of 54.56% • TCE ratio (1) of 9.71% • Increase in allowance for credit losses to 1.55% of total loans • Net interest margin of 3.51% • Noninterest bearing deposits representing 31.1% of total deposits at March 31, 2024 • Interest bearing deposit costs increased 14bps in 1Q24, compared with a 20bps increase in 4Q23 • Organic loan growth of $331.0 million, or 6.6% annualized • Total deposit growth of $288.9 million, or 5.6% annualized 1 – Considered Non - GAAP measures – See reconciliation of GAAP to Non - GAAP measures in Appendix

Financial Highlights 4 1 – Considered Non - GAAP measures – See reconciliation of GAAP to Non - GAAP measures in Appendix (dollars in thousands, except per share data) Quarter to Date Results 1Q24 4Q23 Change 1Q23 Change Net Income $ 74,312 $ 65,934 13% $ 60,421 23% Adjusted Net Income (1) $ 75,612 $ 73,568 3% $ 59,935 26% Net Income Per Diluted Share $ 1.08 $ 0.96 13% $ 0.87 24% Adjusted Net Income Per Share (1) $ 1.10 $ 1.07 3% $ 0.86 28% Return on Assets 1.18% 1.03% 14% 0.98% 21% Adjusted Return on Assets (1) 1.20% 1.15% 4% 0.97% 24% Return on Equity 8.63% 7.73% 12% 7.54% 14% Return on TCE (1) 12.66% 11.48% 10% 11.50% 10% Adjusted Return on TCE (1) 12.88% 12.81% 0% 11.41% 13% Efficiency Ratio 55.64% 56.80% - 2% 52.08% 7% Adjusted Efficiency Ratio (1) 54.56% 52.87% 3% 51.99% 5% Net Interest Margin 3.51% 3.54% - 1% 3.76% - 7%

Strong Net Interest Margin 5 • Net interest income (TE) of $202.3 million in 1Q24, compared with $207.0 million in 4Q23 – Interest income (TE) decreased $2.8 million – Interest expense increased $2.0 million • Average earning assets stable at $23.2 billion • Total deposit costs up 13bp in 1Q24, compared with a 16bp increase in 4Q23 • Noninterest bearing deposits remain above historical levels and were 31.1% of total deposits at quarter end Spread Income and Margin Interest Rate Sensitivity • Asset sensitivity is approaching neutrality in anticipation of a FOMC cut in rates: – - 1.0% asset sensitivity in - 100bps – - 0.5% asset sensitivity in - 50bps – +0.5% asset sensitivity in +50bps – +0.9% asset sensitivity in +100bps • Approximately $10.0 billion of total loans reprice within one year through either maturities or floating rate indices • Cumulative weighted - average beta for all non - maturity deposits through this cycle has been 33% $212.6 $210.5 $208.7 $207.0 $202.3 3.76% 3.60% 3.54% 3.54% 3.51% 3.25% 3.50% 3.75% 4.00% 4.25% 4.50% 4.75% 5.00% 5.25% $180.0 $185.0 $190.0 $195.0 $200.0 $205.0 $210.0 $215.0 $220.0 $225.0 $230.0 1Q23 2Q23 3Q23 4Q23 1Q24 Net Interest Income (TE) (in millions) NIM

Diversified Revenue Stream 6 • Strong revenue base of net interest income from core banking division • Additional revenue provided by our diversified lines of business Mortgage Banking Activity • Mortgage banking activity was 15% of total revenue in 1Q24 • Purchase business increased to 87% in 1Q24 due to strong core relationships with builders and realtors • Gain on sale margin improved to 2.49% in 1Q24 from 1.93% in 4Q23 Other Noninterest Income • Other Noninterest Income has been stable contributor to total revenue • Other Noninterest Income includes: • Fee income from equipment finance group • BOLI income • Gains on sales of SBA loans 79% 76% 77% 79% 75% 12% 15% 13% 12% 15% 9% 9% 10% 9% 10% $268.6 $277.8 $271.9 $263.3 $268.2 0% 20% 40% 60% 80% 100% 120% 1Q23 2Q23 3Q23 4Q23 1Q24 FTE Revenue Sources (in millions) FTE Net Interest Income Mortgage Banking Activity Other Noninterest Income 2.49% 0.00% 1.00% 2.00% 3.00% 1Q23 2Q23 3Q23 4Q23 1Q24 Mortgage Gain on Sale Margin

Disciplined Expense Control Adjusted Operating Expenses (1) and Efficiency Ratio (1) Expense Highlights 7 • Management continues to deliver high performing operating efficiency • Adjusted efficiency ratio of 54.56% in 1Q24, compared with 52.87% in 4Q23 • Total adjusted operating expenses increased $6.5 million in 1Q24 compared with 4Q23 ‒ Increase of $1.0 million in 1Q24 banking division operating expenses primarily due to cyclical payroll tax and 401(k) increase, partially offset by a decrease in incentive expense – Net increase of $5.5 million in 1Q24 lines of business operating expenses primarily due to variable and cyclical compensation increases • Disciplined expense control throughout the Company with identified reallocation of resources utilized to fund future technology and innovation costs 1 – Considered Non - GAAP measures – See reconciliation of GAAP to Non - GAAP measures in Appendix $100.7 $107.6 $101.2 $104.4 $105.4 $38.7 $40.8 $40.3 $35.0 $40.4 20.0 40.0 60.0 80.0 100.0 120.0 140.0 160.0 180.0 1Q23 2Q23 3Q23 4Q23 1Q24 Adjusted Operating Expenses (in millions) Banking LOBs 51.99% 53.41% 52.02% 52.87% 54.56% 40.00% 45.00% 50.00% 55.00% 60.00% 65.00% 1Q23 2Q23 3Q23 4Q23 1Q24 Adjusted Efficiency Ratio

Strong Core Deposit Base 8 Deposits by Product Type Deposit Type Balance (in 000s) % of Total Count Average per account (in 000’s) NIB 6,538,322 31.1% 301,275 21.7 NOW 3,868,998 18.4% 44,215 87.5 MMDA 6,132,745 29.2% 32,030 191.5 Savings 788,665 3.8% 64,427 12.2 CD 3,668,660 17.5% 41,129 89.2 Total 20,997,390 100% 483,076 43.5 Managed Uninsured Deposit Exposure Consumer 37% Commercial 42% Public 15% Brokered 6% Deposits by Customer 1Q24 $9.08 (43.0%) $6.16 (29.1%) $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 $10.0 1Q23 2Q23 3Q23 4Q23 1Q24 Uninsured Deposits (in billions) Uninsured Deposits Uninsured Deposits Excl. Municipal Deposits • Total deposits grew $288.9 million, or 5.6% annualized, during 1Q24 • Noninterest bearing deposits remained strong at 31.1% of total deposits • Uninsured and uncollateralized deposits represent 29.1% of total deposits 1Q24 Highlights

Capital Strength 9 Capital Highlights • Ameris is well capitalized with minimal unrealized losses in the investment portfolio • CET1 ratio is strong at 11.36% • CET1, net of unrealized losses on bond portfolio, remains strong at 11.11% • Net unrealized losses in AFS portfolio were $50 million at March 31, 2024, and represents approximately 3% of book value • No transfers to held - to - maturity (HTM) portfolio – all securities classified as HTM were previously purchased for CRA purposes • Earnings expected to add between 25 - 35 basis points to capital each quarter assuming flat balance sheet • Repurchase plan announced in October 2023 of $100 million with approximately $94.7 million remaining at March 31, 2024 9.26% 9.27% 9.62% 9.93% 10.15% 10.10% 10.25% 10.82% 11.23% 11.36% 13.16% 13.40% 14.01% 14.45% 14.55% 1Q23 2Q23 3Q23 4Q23 1Q24 Strong Capital Base Leverage Ratio CET1/Tier 1 Capital Ratio Total Capital Ratio

19.73 20.81 20.29 20.81 20.44 20.90 22.46 23.69 25.27 26.45 27.46 26.26 26.84 27.89 28.62 29.92 30.79 31.42 32.38 33.64 34.52 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 Tangible Book Value Capital and TBV Proven Stewards of Shareholder Value 10 • Management focused on long term growth in TBV (1) , such that over the past five years TBV has grown by 12% annualized • TBV increased $0.88 per share in 1Q24: – $0.93 from retained earnings – ($0.06) from impact of OCI – $0.01 from all other items including stock compensation and share repurchases • Repurchased 45,174 shares at an average cost of $46.58 during the quarter • TCE Ratio of 9.71% at March 31, 2024 1 – Considered Non - GAAP measures – See reconciliation of GAAP to Non - GAAP measures in Appendix Equipment Finance Acquisition LION Acquisition CECL Adoption

Diversified Loan Portfolio 1 Q24 Loan Portfolio 11 • Loan portfolio is well diversified across loan types and geographies and managed by a seasoned credit staff • Asset quality metrics remain stable and better than historic averages • CRE and C&D concentrations were 281% and 76%, respectively, at 1Q24 • Non - owner - occupied office loans totaled $1.44 billion at 1Q24, or 7.0% of total loans • ACL increased to 1.55% of total loans during 1Q24, which allows the Bank to be well - positioned to address possible negative economic conditions • SNC exposure is limited to approximately 1.3% of loans Portfolio Highlights

Loan Balance Changes 1Q24 Loan Balance Changes 12 • Loan balances increased $331 million during 1Q24, or 6.5% annualized, the majority being the result of fundings on existing construction loans and seasonal funding of warehouse lines (in millions) $135 $73 $71 $70 $52 $(9) $(10) $(15) $(36) $(60) $(40) $(20) $- $20 $40 $60 $80 $100 $120 $140 $160 RE - C&D Warehouse Lending RE - CRE CFIA Premium Finance Consumer Indirect Municipal RE - RES

Allowance for Credit Losses 13 • Increase in reserve during 1Q24 due to forecasted economic conditions • The ACL on loans equated to 1.55% of total loans at 1Q24, compared with 1.52% at 4 Q23 • The ACL on loans totaled $320.0 million at 1Q24, a net increase of $ 12.9 mil lion, or 4.2%, from 4Q23 • During 1Q24, a provision expense of $21.1 million was recorded 1 Q24 CECL Reserve Reserve Summary (in millions) 1Q24 Allowance Coverage Outstanding Balance (MM's) ALLL (MM's) % ALLL Gross Loans 20,600.3$ 320.0$ 1.55% Unfunded Commitments 4,231.5$ 37.1$ 0.88% ACL / Total Loans + Unfunded 24,831.7$ 357.2$ 1.44%

Allowance for Credit Losses 14 1Q24 CECL Reserve by Loan Type Reserve Methodology • Moody’s March 2024 Baseline forecast model provided material inputs into ACL • Primary model drivers included: • US and regional unemployment rates & home price indices • US GDP • US and state - level CRE price index for our five - state footprint • US & Regional multifamily vacancy rates Loan Type Net Outstanding (MM's) ALLL (MM's) % ALLL 12/31/23 ALLL (MM's) Change from 4Q23 CFIA 2,758.7$ 63.8$ 2.31% 64.1$ (0.3)$ Consumer 233.0$ 3.9$ 1.67% 3.9$ -$ Indirect 24.0$ -$ 0.00% 0.1$ (0.1)$ Municipal 477.6$ 0.1$ 0.02% 0.3$ (0.2)$ Premium Finance 998.7$ 0.6$ 0.06% 0.6$ -$ RE - C&D 2,264.3$ 72.1$ 3.18% 61.0$ 11.1$ RE - CRE 8,131.2$ 110.7$ 1.36% 110.1$ 0.6$ RE - RES 4,821.3$ 67.0$ 1.39% 65.3$ 1.7$ Warehouse Lending 891.3$ 1.8$ 0.20% 1.7$ 0.1$ Grand Total 20,600.3$ 320.0$ 1.55% 307.1$ 12.9$

NPA / Charge - Off Trend 15 • NPAs, as a percentage of total assets, continue to normalize and remain at an acceptable level • Total NPAs in creased $8.4 million, to $182.7 million, primarily a result of: • $5.6 million increase in commercial loans • $5.2 million net increase in mortgage loans • Offset by a $4.0 million decrease in OREO properties • Net charge - offs totaled $12.6 million, which equated to an annualized NCO ratio of 0.25% 1Q24 Credit Summary ($ in millions) 0.61% 0.57% 0.58% 0.69% 0.71% 0.33% 0.30% 0.27% 0.33% 0.38% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 1Q23 2Q23 3Q23 4Q23 1Q24 Non - Performing Assets NPA / Total Assets NPA x GNMA / Total Assets 0.22% 0.28% 0.23% 0.26% 0.25% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 1Q23 2Q23 3Q23 4Q23 1Q24 Net Charge - Offs Net Charge-offs NCO Ratio (Annualized)

Criticized/Classified Loan Trends 16 • Total criticized loans (including special mention ), excluding GNMA - guaranteed mortgage loans, de creased $37.7 million in 1Q24 • For 1Q24, classified loans, excluding GNMA - guaranteed mortgage loans, in creased $28.8 million • The majority of criticized loans is comprised of residential mortgages and assisted living facilities Highlights (in millions) Note: Criticized, Classified and Nonperforming loan totals exclude GNMA - guaranteed loans. Ratios expressed as a percent of Total Loans Net of GNMA - backed Mortgage Loans 1.34% 1.40% 1.52% 1.64% 1.43% 0.76% 0.57% 0.59% 0.63% 0.76% 0.38% 0.34% 0.33% 0.38% 0.47% $0 $50 $100 $150 $200 $250 $300 $350 1Q23 2Q23 3Q23 4Q23 1Q24 Criticized Loans Classified Loans Nonperforming Loans Total Loans Criticized Loans Classified Loans Nonperforming Loans GNMA-guaranteed Loans $76.5 $70.4 $65.7 $77.9 $96.3 $75.0 $69.7 $80.8 $90.2 $84.2 $268.6 $287.3 $307.4 $332.4 $294.7 $152.3 $116.3 $120.0 $128.7 $157.5 1Q23 2Q23 3Q23 4Q23 1Q24 $19,997.9 $20,471.8 $20,201.1 $20,269.3 $20,600.3

Investor CRE Loans 17 Stratification of Investor CRE Portfolio • Non - Owner Occupied CRE portfolio is well diversified • Over 80% of CRE loans are located in MSAs in the Bank’s five - state footprint, which exhibit population growth forecasts exceeding the national average • Overall, past dues for investor CRE loans were 0.01% and NPLs 0.04% CRE Positioned in Growing Markets Outstanding Loans (MMs) 5-Yr Proj Population Growth Rate Atlanta-Sandy Springs-Alpharetta GA 2,287.2$ 4.4% Jacksonville FL 797.9$ 6.5% Orlando-Kissimmee-Sanford FL 674.2$ 6.3% Tampa-St Petersburg-Clearwater FL 344.7$ 5.5% Greenville-Anderson SC 283.7$ 5.2% Charleston-North Charleston SC 291.8$ 6.2% Columbia, SC 253.5$ 3.7% Charlotte-Concord-Gatonia NC 316.0$ 5.8% Miami-Ft Lauderdale-Pompano Beach FL 213.1$ 2.0% Tallahassee FL 134.0$ 3.2% U.S. National Average 2.4% Investor CRE 25% C&D 11% Multi - Family 5% Loan Type Outstanding (MM's) % NPL % PD Avg Size Commitment (000's) Construction Loans: RRE - Presold 313.9$ 0.09% 0.09% 457.5$ RRE - Spec & Models 206.4$ 0.00% 0.00% 446.1$ RRE - Lots & Land 111.6$ 0.00% 0.11% 457.1$ RRE - Subdivisions 16.2$ 0.00% 0.00% 2,088.6$ Sub-Total RRE Construction 648.1$ 0.04% 0.06% 447.4$ CML - Improved 1,572.8$ 0.00% 0.00% 15,586.7$ CML - Raw Land & Other 43.5$ 0.00% 0.75% 362.3$ Sub-Total CRE Construction 1,616.3$ 0.00% 0.02% 5,898.4$ Total Construction Loans 2,264.4$ 0.01% 0.03% 1,684.4$ Term Loans: Office 1,236.0$ 0.00% 0.00% 3,004.5$ Anchored Retail 1,128.9$ 0.00% 0.00% 5,424.7$ Multi-Family 1,025.2$ 0.00% 0.01% 6,182.9$ Warehouse / Industrial 692.9$ 0.00% 0.00% 3,124.7$ Strip Center, Non-Anchored 583.0$ 0.00% 0.06% 1,452.6$ Hotels / Motels 451.3$ 0.61% 0.00% 4,666.3$ General Retail 366.1$ 0.00% 0.00% 2,476.9$ Mini-Storage Warehouse 338.4$ 0.00% 0.00% 3,578.6$ Assisted Living Facilities 133.1$ 0.00% 0.00% 6,502.8$ Misc CRE (Church, etc) 121.6$ 0.00% 0.00% 1,253.5$ Sub-Total CRE Term Loans 6,076.5$ 0.05% 0.01% 3,249.3$ Grand Total Investor CRE Loans 8,340.9$ 0.04% 0.01% 2,196.0$

Office Portfolio • Central Business District (CBD) locations represented 8 % of Investor properties ; Charleston, SC, Orlando, FL and Tampa, FL represent the largest CBD MSAs ( 88 % of total CBD properties) • The portion of the ACL allocated to Investor office loans increased from 1 . 87 % to 2 . 81 % in 1 Q 24 * Results based on term loans > $ 1 million, or 95 % of total loans 18 $- $100 $200 $300 $400 $500 2024 2025 2026 2027 2028 and beyond Scheduled Investor Office Maturities Fixed Rate Variable Rate Construction , $333 Investor CRE $1,307 Owner - Occupied $542 Total Office Portfolio by Loan Type (Total Committed Exposure) Class A 32% Class B 30% Class C 3% Essential Use 17% MOB 18% Investor Office Portfolio by Property Class * Outstanding $1.44B Unfunded $0.20B Total Commited Exposure $1.64B Allowance Coverage 2.81% PD Ratio 0.00% NPL Ratio 0.00% Criticized Ratio 0.75% Criticized ACL Coverage 375% Average LTV* 57% Average DSC* 1.66 Class A, Essential Use, & MOB 67% Investor Office

Equipment Finance Portfolio 19 • Total loans were $1.35 billion, or 6.6% of the Bank’s total portfolio • The overall average loan size was $52,600 • Loan production totaled $181.8 million in 1Q24; the average FICO score on new loans was 749 • 30 - 89 day accruing past due loans were 1.11% of total loans • Non - performing loans improved to 0.29% of total loans • The portion of the ACL attributed to the Equipment Finance division totaled $50.2 million, or 3.72% of loans Highlights (in millions) $1,115 $1,175 $1,210 $1,287 $1,351 $197 $168 $157 $200 $182 $- $200 $400 $600 $800 $1,000 $1,200 $1,400 1Q23 2Q23 3Q23 4Q23 1Q24 Total Loans (MM's) Quarterly Originations (MM's) 0.95% 1.03% 0.85% 1.01% 1.11% 0.87% 0.65% 0.39% 0.41% 0.29% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1Q23 2Q23 3Q23 4Q23 1Q24 30-89 days Accruing Past Dues Non-Performing Loans

Appendix

21 Reconciliation of GAAP to Non - GAAP Measures (dollars in thousands) 1Q24 4Q23 1Q23 Net Income $ 74,312 $ 65,934 $ 60,421 Adjustment items Gain on BOLI proceeds (998) - (486) FDIC special assessment 2,909 11,566 - Gain on sale of premises - (1,903) - Tax effect of adjustment items (611) (2,029) - After tax adjustment items 1,300 7,634 (486) Adjusted Net Income $ 75,612 $ 73,568 $ 59,935 Weighted average number of shares - diluted 69,014,116 69,014,793 69,322,664 Net income per diluted share $ 1.08 $ 0.96 $ 0.87 Adjusted net income per diluted share $ 1.10 $ 1.07 $ 0.86 Average assets 25,295,088 25,341,990 25,115,927 Return on average assets 1.18% 1.03% 0.98% Adjusted return on average assets 1.20% 1.15% 0.97% Average common equity 3,462,871 3,383,554 3,250,289 Average tangible common equity 2,361,544 2,277,810 2,130,856 Return on average common equity 8.63% 7.73% 7.54% Return on average tangible common equity 12.66% 11.48% 11.50% Adjusted return on average tangible common equity 12.88% 12.81% 11.41% For the quarter

22 Reconciliation of GAAP to Non - GAAP Measures (dollars in thousands) 1Q24 4Q23 3Q23 2Q23 1Q23 Adjusted Noninterest Expense Total noninterest expense 148,711$ 149,011$ 141,446$ 148,403$ 139,421$ Adjustment items: FDIC special assessment (2,909) (11,566) - - - Gain on sale of premises - 1,903 - - - Adjusted noninterest expense 145,802$ 139,348$ 141,446$ 148,403$ 139,421$ Total Revenue Net interest income 201,388$ 206,101$ 207,751$ 209,540$ 211,652$ Noninterest income 65,878 56,248 63,181 67,349 56,050 Total revenue 267,266$ 262,349$ 270,932$ 276,889$ 267,702$ Adjusted Total Revenue Net interest income (TE) 202,338$ 207,048$ 208,701$ 210,488$ 212,587$ Noninterest income 65,878 56,248 63,181 67,349 56,050 Total revenue (TE) 268,216$ 263,296$ 271,882$ 277,837$ 268,637$ Adjustment items: (Gain) loss on securities 7 288 16 6 (6) Gain on BOLI proceeds (998) - - - (486) Adjusted total revenue (TE) 267,225$ 263,584$ 271,898$ 277,843$ 268,145$ Efficiency ratio 55.64% 56.80% 52.21% 53.60% 52.08% Adjusted efficiency ratio (TE) 54.56% 52.87% 52.02% 53.41% 51.99% Quarter to Date

23 Reconciliation of GAAP to Non - GAAP Measures (dollars in thousands) 1Q24 4Q23 3Q23 2Q23 1Q23 Total shareholders' equity 3,484,738$ 3,426,747$ 3,347,069$ 3,284,630$ 3,253,195$ Less: Goodwill 1,015,646 1,015,646 1,015,646 1,015,646 1,015,646 Other intangibles, net 83,527 87,949 92,375 96,800 101,488 Total tangible shareholders' equity 2,385,565$ 2,323,152$ 2,239,048$ 2,172,184$ 2,136,061$ Period end number of shares 69,115,263 69,053,341 69,138,461 69,139,783 69,373,863 Book value per share (period end) 50.42$ 49.62$ 48.41$ 47.51$ 46.89$ Tangible book value per share (period end) 34.52$ 33.64$ 32.38$ 31.42$ 30.79$ Total assets $ 25,655,445 $ 25,203,699 $ 25,697,830 $ 25,800,618 $ 26,088,384 Less: Goodwill 1,015,646 1,015,646 1,015,646 1,015,646 1,015,646 Other intangibles, net 83,527 87,949 92,375 96,800 101,488 Total tangible assets 24,556,272$ 24,100,104$ 24,589,809$ 24,688,172$ 24,971,250$ Equity to Assets 13.58% 13.60% 13.02% 12.73% 12.47% Tangible Common Equity to Tangible Assets 9.71% 9.64% 9.11% 8.80% 8.55% Quarter to Date

24 Reconciliation of GAAP to Non - GAAP Measures (dollars in thousands) 1Q24 4Q23 3Q23 2Q23 1Q23 Net income 74,312$ 65,934$ 80,115$ 62,635$ 60,421$ Plus: Income taxes 23,138 24,452 24,912 20,335 18,131 Provision for credit losses 21,105 22,952 24,459 45,516 49,729 Pre-tax pre-provision net revenue (PPNR) 118,555$ 113,338$ 129,486$ 128,486$ 128,281$ Average Assets $ 25,295,088 $ 25,341,990 $ 25,525,913 $ 25,631,846 $ 25,115,927 Return on Average Assets (ROA) 1.18% 1.03% 1.25% 0.98% 0.98% PPNR ROA 1.89% 1.77% 2.01% 2.01% 2.07% Quarter to Date

25 Reconciliation of GAAP to Non - GAAP Measures (dollars in thousands) 1Q24 4Q23 3Q23 2Q23 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21 3Q21 Total shareholders' equity 3,484,738$ 3,426,747$ 3,347,069$ 3,284,630$ 3,253,195$ 3,197,400$ 3,119,070$ 3,073,376$ 3,007,159$ 2,966,451$ 2,900,770$ Less: Goodwill 1,015,646 1,015,646 1,015,646 1,015,646 1,015,646 1,015,646 1,023,071 1,023,056 1,022,345 1,012,620 928,005 Other intangibles, net 83,527 87,949 92,375 96,800 101,488 106,194 110,903 115,613 120,757 125,938 60,396 Total tangible shareholders' equity 2,385,565$ 2,323,152$ 2,239,048$ 2,172,184$ 2,136,061$ 2,075,560$ 1,985,096$ 1,934,707$ 1,864,057$ 1,827,893$ 1,912,369$ Period end number of shares 69,115,263 69,053,341 69,138,461 69,139,783 69,373,863 69,369,050 69,352,709 69,360,461 69,439,084 69,609,228 69,635,435 Book value per share (period end) 50.42$ 49.62$ 48.41$ 47.51$ 46.89$ 46.09$ 44.97$ 44.31$ 43.31$ 42.62$ 41.66$ Tangible book value per share (period end) 34.52$ 33.64$ 32.38$ 31.42$ 30.79$ 29.92$ 28.62$ 27.89$ 26.84$ 26.26$ 27.46$ 2Q21 1Q21 4Q20 3Q20 2Q20 1Q20 4Q19 3Q19 2Q19 1Q19 Total shareholders' equity 2,837,004$ 2,757,596$ 2,647,088$ 2,564,683$ 2,460,130$ 2,437,150$ 2,469,582$ 2,420,723$ 1,537,121$ 1,495,584$ Less: Goodwill 928,005 928,005 928,005 928,005 928,005 931,947 931,637 911,488 501,140 501,308 Other intangibles, net 63,783 67,848 71,974 76,164 80,354 85,955 91,586 97,328 52,437 55,557 Total tangible shareholders' equity 1,845,216$ 1,761,743$ 1,647,109$ 1,560,514$ 1,451,771$ 1,419,248$ 1,446,359$ 1,411,907$ 983,544$ 938,719$ Period end number of shares 69,767,209 69,713,426 69,541,481 69,490,546 69,461,968 69,441,274 69,503,833 69,593,833 47,261,584 47,585,309 Book value per share (period end) 40.66$ 39.56$ 38.06$ 36.91$ 35.42$ 35.10$ 35.53$ 34.78$ 32.52$ 31.43$ Tangible book value per share (period end) 26.45$ 25.27$ 23.69$ 22.46$ 20.90$ 20.44$ 20.81$ 20.29$ 20.81$ 19.73$ As of As of

Ameris Bancorp Press Release & Financial Highlights March 31, 2024

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

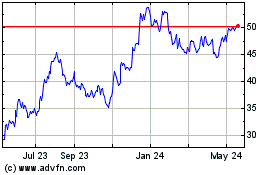

Ameris Bancorp (NASDAQ:ABCB)

Historical Stock Chart

From May 2024 to Jun 2024

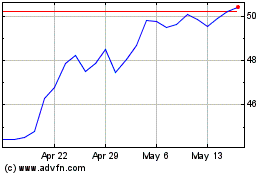

Ameris Bancorp (NASDAQ:ABCB)

Historical Stock Chart

From Jun 2023 to Jun 2024