- 2024 total net product sales of $957.8

million, reflecting 32% revenue growth

- Fourth quarter DAYBUE® (trofinetide) net

product sales of $96.7 million and full year 2024 net product sales

of $348.4 million

- Fourth quarter NUPLAZID® (pimavanserin) net

product sales of $162.9 million and full year 2024 net product

sales of $609.4 million

- Full year 2025 total revenue guidance of

$1.03 to $1.095 billion including DAYBUE net sales guidance of $380

to $405 million and NUPLAZID net sales guidance of $650 to $690

million

Acadia Pharmaceuticals Inc. (Nasdaq: ACAD) today announced its

financial results for the fourth quarter and full year ended

December 31, 2024.

“We closed 2024 on a strong note with each of our brands

achieving record revenues in the fourth quarter and well-positioned

for continued growth in 2025,” said Catherine Owen Adams, Chief

Executive Officer. “To support this growth in 2025 we will continue

investing in consumer activation to drive market share expansion

for NUPLAZID in the US. We plan to expand our DAYBUE field force in

the US and build our EU commercial team in anticipation of

potentially launching trofinetide there next year. Beyond the

growth of our commercial brands, our later-stage pipeline programs

are advancing toward key milestones, including topline readouts

starting in the first half of 2026, and our ongoing business

development efforts continue to produce compelling opportunities

like ACP-711 and other programs that we are excited to share more

about at our inaugural R&D Day in June.”

Company Updates

- In January, the marketing authorization application for

trofinetide was submitted to the European Medicines Agency (EMA)

with expected approval in the first quarter of 2026.

- In January, the Company provided timeline updates for its two

most advanced clinical development programs:

- For the COMPASS PWS Phase 3 study of ACP-101 in Prader-Willi

Syndrome, the last patient is expected to be enrolled in the fourth

quarter of 2025, followed by the announcement of topline results in

the first half of 2026.

- For the RADIANT Phase 2 study of ACP-204 in Alzheimer’s disease

psychosis, the last patient is expected to be enrolled in the first

quarter of 2026, followed by the announcement of topline results in

mid-2026.

- In January, the Company announced plans for the initiation of a

Phase 2 study of ACP-204 for a second indication in Lewy Body

Dementia Psychosis in the third quarter of 2025.

- In December 2024, the Company announced the closing of the sale

of its Rare Pediatric Disease Priority Review Voucher (PRV) for

$150 million before fees and expenses.

- In December 2024, the Company announced the appointment of

Thomas Andrew Garner as Chief Commercial Officer.

- In November 2024, the Company announced an exclusive worldwide

license agreement with Saniona for the development and

commercialization of ACP-711, a potential first-in-class, highly

selective GABAA-α3 positive allosteric modulator and plans to

initiate a Phase 2 study in essential tremor in 2026.

Financial Results

Revenues

Total revenues comprising of net product sales from NUPLAZID and

DAYBUE were $259.6 million for the fourth quarter of 2024 and

$957.8 million for the full year 2024.

Net product sales of NUPLAZID were $162.9 million for the fourth

quarter of 2024, an increase of 13% as compared to $143.9 million

for the fourth quarter of 2023. Net product sales of NUPLAZID were

$609.4 million for the full year 2024, an increase of 11% as

compared to $549.2 million for the full year 2023. The increase in

net product sales of NUPLAZID was due to growth in unit sales and a

higher average net selling price in 2024 compared to 2023.

Net product sales of DAYBUE were $96.7 million for the fourth

quarter of 2024, an increase of 11% as compared to $87.1 million

for the fourth quarter of 2023. Net product sales of DAYBUE were

$348.4 million for the full year 2024, an increase of 97% as

compared to $177.2 million for the full year 2023. The increase in

net product sales of DAYBUE was mainly due to the growth in unit

sales in 2024 compared to 2023.

Research and Development

Research and development expenses for the fourth quarter of 2024

were $100.7 million, compared to $66.7 million for the same period

of 2023. For the full years of 2024 and 2023, research and

development expenses were $303.2 million and $351.6 million,

respectively. The decrease in research and development expenses

during 2024 was due to decreased business development payments,

which in the period ending December 31, 2023, included the $100.0

million payment to Neuren Pharmaceuticals Limited under the

expanded license agreement for trofinetide, partially offset by

increased costs from clinical stage programs.

Selling, General and Administrative

Selling, general and administrative expenses for the fourth

quarter of 2024 were $130.1 million, compared to $111.5 million for

the same period of 2023. For the full years of 2024 and 2023,

selling, general and administrative expenses were $488.4 million

and $406.6 million, respectively. The increase in selling, general

and administrative expenses was primarily driven by increased

marketing costs to support the NUPLAZID and DAYBUE franchises in

the U.S. and investments to support commercialization of

trofinetide outside the U.S.

Net Income (Loss)

For the fourth quarter of 2024, Acadia reported net income of

$143.7 million, or $0.86 per common share, compared to a net income

of $45.8 million, or $0.28 per common share, for the same period in

2023. Net income for the fourth quarters of 2024 and 2023 included

$10.5 million and $18.0 million, respectively, of non-cash

stock-based compensation expense. For the full year 2024, Acadia

reported a net income of $226.5 million, or $1.37 per common share,

compared to a net loss of $61.3 million, or $0.37 per common share,

for the same period in 2023. Net income in the fourth quarter and

for the full year of 2024 included a one-time gain on sale of a

non-financial asset as we sold the PRV to a third party for the

aggregate net proceeds of $146.5 million. The net income and loss

for the full years of 2024 and 2023 included $67.0 million and

$66.4 million, respectively, of non-cash stock-based compensation

expense.

Cash and Investments

At December 31, 2024, Acadia’s cash, cash equivalents, and

investment securities totaled $756.0 million, compared to $438.9

million at December 31, 2023.

Full Year 2025 Financial Guidance

- Total Revenues (U.S. only) of $1.03 to $1.095 billion

- NUPLAZID net product sales in the range of $650 to $690

million.

- DAYBUE net product sales (U.S. only) in the range of $380 to

$405 million

- R&D expense in the range of $310 to $330 million

- SG&A expense in the range of $535 to $565 million

Conference Call and Webcast Information

Acadia will host a conference call to discuss the fourth quarter

and full year December 31, 2024 results today, Wednesday, February

26, 2025 at 1:30 p.m. PT/4:30 p.m. ET. The conference call may be

accessed by registering for the call here. Once registered,

participants will receive an email with the dial-in number and

unique PIN number to use for accessing the call.

About NUPLAZID® (pimavanserin)

Pimavanserin is a selective serotonin inverse agonist and

antagonist preferentially targeting 5-HT2A receptors. These

receptors are thought to play an important role in neuropsychiatric

disorders. In vitro, pimavanserin demonstrated no appreciable

binding affinity for dopamine (including D2), histamine,

muscarinic, or adrenergic receptors. Pimavanserin was approved for

the treatment of hallucinations and delusions associated with

Parkinson’s disease psychosis by the U.S. Food and Drug

Administration in April 2016 under the trade name NUPLAZID.

About DAYBUE® (trofinetide)

Trofinetide is a synthetic version of a naturally occurring

molecule known as the tripeptide glycine-proline-glutamate (GPE).

The mechanism by which trofinetide exerts therapeutic effects in

patients with Rett syndrome is unknown. Trofinetide was approved

for the treatment of Rett syndrome in adults and pediatric patients

2 years of age and older by the U.S. Food and Drug Administration

in March 2023 under the trade name DAYBUE.

About Acadia Pharmaceuticals

Acadia is advancing breakthroughs in neuroscience to elevate

life. Since our founding we have been working at the forefront of

healthcare to bring vital solutions to people who need them most.

We developed and commercialized the first and only FDA-approved

drug to treat hallucinations and delusions associated with

Parkinson’s disease psychosis and the first and only approved drug

in the United States and Canada for the treatment of Rett syndrome.

Our clinical-stage development efforts are focused on Prader-Willi

syndrome, Alzheimer’s disease psychosis and multiple other programs

targeting neuroscience and neuro-rare diseases. For more

information, visit us at Acadia.com and follow us on LinkedIn and

X.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements include all statements other than

statements of historical fact and can be identified by terms such

as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,”

“anticipates,” “believes,” “estimates,” “projects,” “predicts,”

“potential,” “continue” and similar expressions (including the

negative thereof) intended to identify forward-looking statements.

Forward-looking statements contained in this press release,

include, but are not limited to, statements about: (i) our business

strategy, objectives and opportunities, including support for and

innovations in our pipeline assets and business development

opportunities, investments in consumer activation, expansion of our

DAYBUE sales force in the US, and building of our EU commercial

team, and potential for enhanced shareholder value; (ii) plans for,

including timing, development and progress of commercialization or

regulatory timelines for our products, including NUPLAZID and

DAYBUE, and our product candidates; (iii) benefits to be derived

from and efficacy of our products, including the potential

advantages of our products; (iv) the timing and conduct of our

clinical trials, including continued enrollment of our clinical

trials in Prader-Willi syndrome and Alzheimer’s disease psychosis,

the initiation of our clinical trial in Lewy Body Dementia

Psychosis, and the timing and content of our presentations or

announcements regarding our clinical trials; (v) our estimates

regarding our future financial performance, profitability or

capital requirements, including our full year 2025 financial

guidance, and (vi) our ability to successfully complete additional

business development transactions. Forward-looking statements are

subject to known and unknown risks, uncertainties, assumptions and

other factors that may cause our actual results, performance or

achievements to differ materially and adversely from those

anticipated or implied by our forward-looking statements. Such

risks, uncertainties and other factors include, but are not limited

to: our dependency on the continued successful commercialization of

our products and our ability to maintain or increase sales of our

products; our plans to commercialize DAYBUE in Canada and

trofinetide in the EU; the costs of our commercialization plans and

development programs, and the financial impact or revenues from any

commercialization we undertake; our ability to obtain necessary

regulatory approvals for our product candidates and, if and when

approved, market acceptance of our products; the risks associated

with clinical trials and their outcomes, including risks of

unsuccessful enrollment and negative or inconsistent results; our

dependence on third-party collaborators, clinical research

organizations, manufacturers, suppliers and distributors; the

impact of competitive products and therapies; our ability to

generate or obtain the necessary capital to fund our operations;

our ability to grow, equip and train our specialized sales forces;

our ability to manage the growth and complexity of our

organization; our ability to maintain, protect and enhance our

intellectual property; and our ability to continue to stay in

compliance with applicable laws and regulations. Given the risks

and uncertainties, you should not place undue reliance on these

forward-looking statements. For a discussion of these and other

risks, uncertainties and other factors that may cause our actual

results, performance or achievements to differ, please refer to our

quarterly report on Form 10-Q for the quarter ended September 30,

2024, filed on November 7, 2024, as well as our subsequent filings

with the Securities and Exchange Commission from time to time. The

forward-looking statements contained herein are made as of the date

hereof, and we undertake no obligation to update them after this

date, except as required by law.

ACADIA PHARMACEUTICALS

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per share

amounts)

(Unaudited)

Three Months Ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Revenues

Product sales, net

$

259,602

$

231,041

$

957,797

$

726,437

Total revenues

259,602

231,041

957,797

726,437

Operating expenses

Cost of product sales (1)(2)

21,803

17,891

81,841

41,638

Research and development (2)

100,731

66,741

303,249

351,619

Selling, general and administrative

(2)

130,080

111,465

488,428

406,559

Gain on sale of non-financial asset

(146,515

)

—

(146,515

)

—

Total operating expenses

106,099

196,097

727,003

799,816

Income (loss) from operations

153,503

34,944

230,794

(73,379

)

Interest income, net

7,007

4,759

25,458

17,234

Other income

575

—

1,823

5,109

Income (loss) before income taxes

161,085

39,703

258,075

(51,036

)

Income tax expense (benefit)

17,343

(6,094

)

31,624

10,250

Net income (loss)

$

143,742

$

45,797

$

226,451

$

(61,286

)

Earnings (net loss) per share:

Basic

$

0.86

$

0.28

$

1.37

$

(0.37

)

Diluted

$

0.86

$

0.28

$

1.36

$

(0.37

)

Weighted average common shares

outstanding:

Basic

166,535

164,812

165,717

163,819

Diluted

166,696

166,510

166,362

163,819

(1) Includes license fees and

royalties

(2) Includes the following share-based

compensation expenses

Cost of product sales, license fees and

royalties

$

421

$

363

$

1,319

$

1,007

Research and development

$

2,395

$

4,707

$

14,100

$

17,408

Selling, general and administrative

$

7,634

$

12,953

$

51,630

$

48,006

ACADIA PHARMACEUTICALS

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(Unaudited)

December 31, 2024

December 31, 2023

Assets

Cash, cash equivalents and investment

securities

$

755,993

$

438,865

Accounts receivable, net

98,739

98,267

Interest and other receivables

5,956

4,083

Inventory

21,949

35,819

Prepaid expenses

55,681

39,091

Total current assets

938,318

616,125

Property and equipment, net

4,215

4,612

Operating lease right-of-use assets

46,571

51,855

Intangible assets, net

119,782

65,490

Restricted cash

8,770

5,770

Long-term inventory

69,741

4,628

Other assets

359

476

Total assets

$

1,187,756

$

748,956

Liabilities and stockholders’

equity

Accounts payable

$

16,192

$

17,543

Accrued liabilities

378,678

236,711

Total current liabilities

394,870

254,254

Operating lease liabilities

42,037

47,800

Other long-term liabilities

18,056

15,147

Total liabilities

454,963

317,201

Total stockholders’ equity

732,793

431,755

Total liabilities and stockholders’

equity

$

1,187,756

$

748,956

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226806678/en/

Investor Contact: Acadia Pharmaceuticals Inc. Al Kildani (858)

261-2872 ir@acadia-pharm.com

Media Contact: Acadia Pharmaceuticals Inc. Deb Kazenelson (818)

395-3043 media@acadia-pharm.com

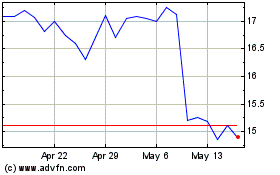

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Mar 2024 to Mar 2025