false000107049400010704942025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 26, 2025 |

Acadia Pharmaceuticals Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-50768 |

06-1376651 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

12830 El Camino Real, Suite 400 |

|

San Diego, California |

|

92130 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 558-2871 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

ACAD |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 26, 2025, Acadia Pharmaceuticals Inc. issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2024. A copy of this press release is furnished herewith as Exhibit 99.1. Pursuant to the rules and regulations of the Securities and Exchange Commission, such exhibit and the information set forth therein and in this Item 2.02 have been furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing regardless of any general incorporation language.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Acadia Pharmaceuticals Inc. |

|

|

|

|

Date: |

February 26, 2025 |

By: |

/s/ Jennifer J. Rhodes |

|

|

|

Jennifer J. Rhodes

Executive Vice President, Chief Legal Officer |

Acadia Pharmaceuticals Reports Fourth Quarter and Full Year 2024 Financial Results and Operating Overview

- 2024 total net product sales of $957.8 million, reflecting 32% revenue growth

- Fourth quarter DAYBUE™ (trofinetide) net product sales of $96.7 million and full year 2024 net product sales of $348.4 million

- Fourth quarter NUPLAZID® (pimavanserin) net product sales of $162.9 million and full year 2024 net product sales of $609.4 million

- Full year 2025 total revenue guidance of $1.03 to $1.095 billion including DAYBUE net sales guidance of $380 to $405 million and NUPLAZID net sales guidance of $650 to $690 million

SAN DIEGO, CA, February 26, 2025 – Acadia Pharmaceuticals Inc. (Nasdaq: ACAD), today announced its financial results for the fourth quarter and full year ended December 31, 2024.

“We closed 2024 on a strong note with each of our brands achieving record revenues in the fourth quarter and well-positioned for continued growth in 2025,” said Catherine Owen Adams, Chief Executive Officer. “To support this growth in 2025 we will continue investing in consumer activation to drive market share expansion for NUPLAZID in the US. We plan to expand our DAYBUE field force in the US and build our EU commercial team in anticipation of potentially launching trofinetide there next year. Beyond the growth of our commercial brands, our later-stage pipeline programs are advancing toward key milestones, including topline readouts starting in the first half of 2026, and our ongoing business development efforts continue to produce compelling opportunities like ACP-711 and other programs that we are excited to share more about at our inaugural R&D Day in June.”

Company Updates

•In January, the marketing authorization application for trofinetide was submitted to the European Medicines Agency (EMA) with expected approval in the first quarter of 2026.

•In January, the Company provided timeline updates for its two most advanced clinical development programs:

oFor the COMPASS PWS Phase 3 study of ACP-101 in Prader-Willi Syndrome, the last patient is expected to be enrolled in the fourth quarter of 2025, followed by the announcement of topline results in the first half of 2026.

oFor the RADIANT Phase 2 study of ACP-204 in Alzheimer’s disease psychosis, the last patient is expected to be enrolled in the first quarter of 2026, followed by topline results announcement in mid-2026.

•In January, the Company announced plans for the initiation of a Phase 2 study of ACP-204 for a second indication in Lewy Body Dementia Psychosis in the third quarter of 2025.

•In December 2024, the Company announced the closing of the sale of its Rare Pediatric Disease Priority Review Voucher (PRV) for $150 million before fees and expenses.

•In December 2024, the Company announced the appointment of Thomas Andrew Garner as Chief Commercial Officer.

•In November 2024, the Company announced an exclusive worldwide license agreement with Saniona for the development and commercialization of ACP-711, a potential first-in-class, highly selective GABAA-α3 positive allosteric modulator and plans to initiate a Phase 2 study in essential tremor in 2026.

Financial Results

Revenues

Total revenues, comprised of net product sales from NUPLAZID and DAYBUE, were $259.6 million for the fourth quarter of 2024 and $957.8 million for the full year 2024.

Net product sales of NUPLAZID were $162.9 million for the fourth quarter of 2024, an increase of 13% as compared to $143.9 million for the fourth quarter of 2023. Net product sales of NUPLAZID were $609.4 million for the full year 2024, an increase of 11% as compared to $549.2 million for the full year 2023. The increase in net product sales of NUPLAZID was due to growth in unit sales and a higher average net selling price in 2024 compared to 2023.

Net product sales of DAYBUE were $96.7 million for the fourth quarter of 2024, an increase of 11% as compared to $87.1 million for the fourth quarter of 2023. Net product sales of DAYBUE were $348.4 million for the full year 2024, an increase of 97% as compared to $177.2 million for the full year 2023. The increase in net product sales of DAYBUE was mainly due to the growth in unit sales in 2024 compared to 2023.

Research and Development

Research and development expenses for the fourth quarter of 2024 were $100.7 million, compared to $66.7 million for the same period of 2023. For the full years of 2024 and 2023, research and development expenses were $303.2 million and $351.6 million, respectively. The decrease in research and development expenses during 2024 was due to decreased business development payments, which in the period ending December 31, 2023 included the $100.0 million payment to Neuren Pharmaceutical Limited under the expanded license agreement for trofinetide, partially offset by increased costs from clinical stage programs.

Selling, General and Administrative

Selling, general and administrative expenses for the fourth quarter of 2024 were $130.1 million, compared to $111.5 million for the same period of 2023. For the full years of 2024 and 2023, selling, general and administrative expenses were $488.4 million and $406.6 million, respectively. The increase in selling, general and administrative expenses was primarily driven by increased marketing costs to support the NUPLAZID and DAYBUE franchises in the U.S. and investments to support commercialization of trofinetide outside the U.S.

Net Income (Loss)

For the fourth quarter of 2024, Acadia reported net income of $143.7 million, or $0.86 per common share, compared to a net income of $45.8 million, or $0.28 per common share, for the same period in 2023. Net income for the fourth quarters of 2024 and 2023 included $10.5 million and $18.0 million, respectively, of non-cash stock-based compensation expense. For the full year 2024, Acadia reported a net income of $226.5 million, or $1.37 per common share, compared to a net loss of $61.3 million, or $0.37 per common share, for the same period in 2023. Net income in the fourth quarter and for the full year of 2024 included a one-time gain on sale of a non-financial asset as we sold the PRV to a third party for the

aggregate net proceeds of $146.5 million. The net income and loss for the full years of 2024 and 2023 included $67.0 million and $66.4 million, respectively, of non-cash stock-based compensation expense.

Cash and Investments

At December 31, 2024, Acadia’s cash, cash equivalents, and investment securities totaled $756.0 million, compared to $438.9 million at December 31, 2023.

Full Year 2025 Financial Guidance

•Total Revenues (U.S. only) of $1.03 to $1.095 billion

•NUPLAZID net product sales in the range of $650 to $690 million.

•DAYBUE net product sales (U.S. only) in the range of $380 to $405 million.

•R&D expense in the range of $310 to $330 million.

•SG&A expense in the range of $535 to $565 million.

Conference Call and Webcast Information

Acadia will host a conference call to discuss the fourth quarter and full year December 31, 2024 results today, Wednesday, February 26, 2025 at 1:30 p.m. PT/4:30 p.m. ET. The conference call may be accessed by registering for the call here. Once registered, participants will receive an email with the dial-in number and unique PIN number to use for accessing the call.

About NUPLAZID® (pimavanserin)

Pimavanserin is a selective serotonin inverse agonist and antagonist preferentially targeting 5-HT2A receptors. These receptors are thought to play an important role in neuropsychiatric disorders. In vitro, pimavanserin demonstrated no appreciable binding affinity for dopamine (including D2), histamine, muscarinic, or adrenergic receptors. Pimavanserin was approved for the treatment of hallucinations and delusions associated with Parkinson’s disease psychosis by the U.S. Food and Drug Administration in April 2016 under the trade name NUPLAZID.

About DAYBUE™ (trofinetide)

Trofinetide is a synthetic version of a naturally occurring molecule known as the tripeptide glycine-proline-glutamate (GPE). The mechanism by which trofinetide exerts therapeutic effects in patients with Rett syndrome is unknown. Trofinetide was approved for the treatment of Rett syndrome in adults and pediatric patients 2 years of age and older by the U.S. Food and Drug Administration in March 2023 under the trade name DAYBUE.

About Acadia Pharmaceuticals

Acadia is advancing breakthroughs in neuroscience to elevate life. Since our founding we have been working at the forefront of healthcare to bring vital solutions to people who need them most. We developed and commercialized the first and only FDA-approved drug to treat hallucinations and delusions associated with Parkinson’s disease psychosis and the first and only approved drug in the United States and Canada for the treatment of Rett syndrome. Our clinical-stage development efforts are focused on Prader-Willi syndrome, Alzheimer’s disease psychosis and multiple other programs targeting neuroscience and neuro-rare diseases. For more information, visit us at Acadia.com and follow us on LinkedIn and X.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements other than statements

of historical fact and can be identified by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential,” “continue” and similar expressions (including the negative thereof) intended to identify forward-looking statements. Forward-looking statements contained in this press release, include, but are not limited to, statements about: (i) our business strategy, objectives and opportunities, including support for and innovations in our pipeline assets and business development opportunities, investments in consumer activation, expansion of our DAYBUE sales force in the US, and building of our EU commercial team, and potential for enhanced shareholder value; (ii) plans for, including timing, development and progress of commercialization or regulatory timelines for our products, including NUPLAZID and DAYBUE, and our product candidates; (iii) benefits to be derived from and efficacy of our products, including the potential advantages of our products; (iv) the timing and conduct of our clinical trials, including continued enrollment of our clinical trials in Prader-Willi syndrome and Alzheimer’s disease psychosis, the initiation of our clinical trial in Lewy Body Dementia Psychosis, and the timing and content of our presentations or announcements regarding our clinical trials; (v) our estimates regarding our future financial performance, profitability or capital requirements, including our full year 2025 financial guidance, and (vi) our ability to successfully complete additional business development transactions. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implied by our forward-looking statements. Such risks, uncertainties and other factors include, but are not limited to: our dependency on the continued successful commercialization of our products and our ability to maintain or increase sales of our products; our plans to commercialize DAYBUE in Canada and trofinetide in the EU; the costs of our commercialization plans and development programs, and the financial impact or revenues from any commercialization we undertake; our ability to obtain necessary regulatory approvals for our product candidates and, if and when approved, market acceptance of our products; the risks associated with clinical trials and their outcomes, including risks of unsuccessful enrollment and negative or inconsistent results; our dependence on third-party collaborators, clinical research organizations, manufacturers, suppliers and distributors; the impact of competitive products and therapies; our ability to generate or obtain the necessary capital to fund our operations; our ability to grow, equip and train our specialized sales forces; our ability to manage the growth and complexity of our organization; our ability to maintain, protect and enhance our intellectual property; and our ability to continue to stay in compliance with applicable laws and regulations. Given the risks and uncertainties, you should not place undue reliance on these forward-looking statements. For a discussion of these and other risks, uncertainties and other factors that may cause our actual results, performance or achievements to differ, please refer to our quarterly report on Form 10-Q for the quarter ended September 30, 2024, filed on November 7, 2024, as well as our subsequent filings with the Securities and Exchange Commission from time to time. The forward-looking statements contained herein are made as of the date hereof, and we undertake no obligation to update them after this date, except as required by law.

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Years Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Product sales, net |

|

$ |

259,602 |

|

|

$ |

231,041 |

|

|

$ |

957,797 |

|

|

$ |

726,437 |

|

Total revenues |

|

|

259,602 |

|

|

|

231,041 |

|

|

|

957,797 |

|

|

|

726,437 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales (1)(2) |

|

|

21,803 |

|

|

|

17,891 |

|

|

|

81,841 |

|

|

|

41,638 |

|

Research and development (2) |

|

|

100,731 |

|

|

|

66,741 |

|

|

|

303,249 |

|

|

|

351,619 |

|

Selling, general and administrative (2) |

|

|

130,080 |

|

|

|

111,465 |

|

|

|

488,428 |

|

|

|

406,559 |

|

Gain on sale of non-financial asset |

|

|

(146,515 |

) |

|

|

— |

|

|

|

(146,515 |

) |

|

|

— |

|

Total operating expenses |

|

|

106,099 |

|

|

|

196,097 |

|

|

|

727,003 |

|

|

|

799,816 |

|

Income (loss) from operations |

|

|

153,503 |

|

|

|

34,944 |

|

|

|

230,794 |

|

|

|

(73,379 |

) |

Interest income, net |

|

|

7,007 |

|

|

|

4,759 |

|

|

|

25,458 |

|

|

|

17,234 |

|

Other income |

|

|

575 |

|

|

|

— |

|

|

|

1,823 |

|

|

|

5,109 |

|

Income (loss) before income taxes |

|

|

161,085 |

|

|

|

39,703 |

|

|

|

258,075 |

|

|

|

(51,036 |

) |

Income tax expense (benefit) |

|

|

17,343 |

|

|

|

(6,094 |

) |

|

|

31,624 |

|

|

|

10,250 |

|

Net income (loss) |

|

$ |

143,742 |

|

|

$ |

45,797 |

|

|

$ |

226,451 |

|

|

$ |

(61,286 |

) |

Earnings (net loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.86 |

|

|

$ |

0.28 |

|

|

$ |

1.37 |

|

|

$ |

(0.37 |

) |

Diluted |

|

$ |

0.86 |

|

|

$ |

0.28 |

|

|

$ |

1.36 |

|

|

$ |

(0.37 |

) |

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

166,535 |

|

|

|

164,812 |

|

|

|

165,717 |

|

|

|

163,819 |

|

Diluted |

|

|

166,696 |

|

|

|

166,510 |

|

|

|

166,362 |

|

|

|

163,819 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes license fees and royalties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Includes the following share-based compensation expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales, license fees and royalties |

|

$ |

421 |

|

|

$ |

363 |

|

|

$ |

1,319 |

|

|

$ |

1,007 |

|

Research and development |

|

$ |

2,395 |

|

|

$ |

4,707 |

|

|

$ |

14,100 |

|

|

$ |

17,408 |

|

Selling, general and administrative |

|

$ |

7,634 |

|

|

$ |

12,953 |

|

|

$ |

51,630 |

|

|

$ |

48,006 |

|

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

December 31,

2024 |

|

|

December 31,

2023 |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

Cash, cash equivalents and investment securities |

|

$ |

755,993 |

|

|

$ |

438,865 |

|

Accounts receivable, net |

|

|

98,739 |

|

|

|

98,267 |

|

Interest and other receivables |

|

|

5,956 |

|

|

|

4,083 |

|

Inventory |

|

|

21,949 |

|

|

|

35,819 |

|

Prepaid expenses |

|

|

55,681 |

|

|

|

39,091 |

|

Total current assets |

|

|

938,318 |

|

|

|

616,125 |

|

Property and equipment, net |

|

|

4,215 |

|

|

|

4,612 |

|

Operating lease right-of-use assets |

|

|

46,571 |

|

|

|

51,855 |

|

Intangible assets, net |

|

|

119,782 |

|

|

|

65,490 |

|

Restricted cash |

|

|

8,770 |

|

|

|

5,770 |

|

Long-term inventory |

|

|

69,741 |

|

|

|

4,628 |

|

Other assets |

|

|

359 |

|

|

|

476 |

|

Total assets |

|

$ |

1,187,756 |

|

|

$ |

748,956 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Accounts payable |

|

$ |

16,192 |

|

|

$ |

17,543 |

|

Accrued liabilities |

|

|

378,678 |

|

|

|

236,711 |

|

Total current liabilities |

|

|

394,870 |

|

|

|

254,254 |

|

Operating lease liabilities |

|

|

42,037 |

|

|

|

47,800 |

|

Other long-term liabilities |

|

|

18,056 |

|

|

|

15,147 |

|

Total liabilities |

|

|

454,963 |

|

|

|

317,201 |

|

Total stockholders’ equity |

|

|

732,793 |

|

|

|

431,755 |

|

Total liabilities and stockholders’ equity |

|

$ |

1,187,756 |

|

|

$ |

748,956 |

|

Investor Contact:

Acadia Pharmaceuticals Inc.

Al Kildani

(858) 261-2872

ir@acadia-pharm.com

Media Contact:

Acadia Pharmaceuticals Inc.

Deb Kazenelson

(818) 395-3043

media@acadia-pharm.com

v3.25.0.1

Document And Entity Information

|

Feb. 26, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 26, 2025

|

| Entity Registrant Name |

Acadia Pharmaceuticals Inc.

|

| Entity Central Index Key |

0001070494

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

000-50768

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

06-1376651

|

| Entity Address, Address Line One |

12830 El Camino Real, Suite 400

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92130

|

| City Area Code |

(858)

|

| Local Phone Number |

558-2871

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ACAD

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

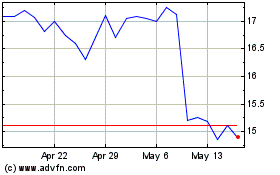

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Mar 2024 to Mar 2025