false

0001750106

0001750106

2024-09-26

2024-09-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 26, 2024

ALSET

INC.

(Exact

name of registrant as specified in its charter)

| Texas |

|

001-39732 |

|

83-1079861 |

(State

or other

jurisdiction

of incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 4800

Montgomery Lane |

|

|

| Suite

210 |

|

|

| Bethesda,

Maryland |

|

20814 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (301) 971-3940

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Ticker

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

AEI |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement

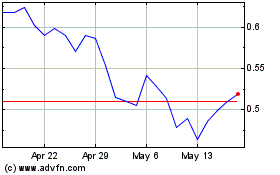

On

September 26, 2024, Alset Inc. (the “Company”) entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”)

with one of the Company’s majority owned subsidiaries, Alset International Limited. Pursuant to the Stock Purchase

Agreement, the Company will purchase 6,500,000 shares (the “Shares”) of HWH International Inc. (“HWH”),

a Nasdaq-listed company controlled by Alset Inc. through its ownership interest in Alset International Limited. As consideration

for the Shares, the Company will issue a secured promissory note to Alset International Limited in the original principal amount of $4,095,000.00

(the “Promissory Note”). The Promissory Note bears an interest rate of 5% per annum and a maturity date of September 26,

2026, and will be secured by collateral specified in a security agreement (the “Security Agreement”), which is annexed

hereto as Exhibit 10.3, between the Company and Alset International Limited.

Our

Chairman, Chief Executive Officer and majority stockholder, Chan Heng Fai, is also the Chairman and Chief Executive Officer of Alset

International Limited and the Chairman of HWH. In addition, certain other members of our board are also officers and/or directors of

Alset International Limited and HWH.

The

closing of the transactions described herein is contingent upon the approval of the stockholders of Alset International Limited and the

satisfaction of other closing conditions.

The

foregoing descriptions of the Stock Purchase Agreement, Promissory Note, and Security Agreement do not purport to be complete and are

qualified in their entirety by reference to the complete text of each, copies of which are filed as Exhibit 10.1, Exhibit 10.2, and Exhibit

10.3 to this Current Report on Form 8-K.

The

Stock Purchase Agreement follows certain other agreements entered into between certain majority owned subsidiaries of the Company:

on September 24, 2024, HWH entered into two (2) debt conversion agreements with creditors (each an “Agreement,” or collectively,

the “Agreements”): (i) Alset International Limited (which is HWH’s majority stockholder); and (ii) Alset Inc. (which

in turn is Alset International Limited’s majority stockholder). Each Agreement converts debt owed by HWH to the respective creditor

into shares of HWH’s common stock.

Under

the terms of their respective Agreements, Alset Inc. shall convert $300,000.00 of HWH’s debt into 476,190 shares of HWH’s

common stock, and Alset International Limited shall convert $3,501,759.00 of HWH’s debt into 5,558,347 shares of HWH’s common

stock. Under the Agreements, the debt conversions shall result in the issuance of newly issued shares of HWH’s common stock. The

price at which the debt conversion was fixed was set at $0.63 per share of HWH common stock. Cumulatively, the newly issued shares contemplated

by the Agreements represent 6,034,537 new shares of HWH’s common stock.

The

Company believes that the conversion of HWH’s debt to equity, and the sale of certain HWH shares from Alset International Limited

to the Company is in the best interests of each of HWH, Alset International Limited and Alset Inc.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Form 8-K to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ALSET

INC. |

| |

|

|

| Dated:

September 27, 2024 |

By: |

/s/

Rongguo Wei |

| |

Name: |

Rongguo

Wei |

| |

Title: |

Co-Chief

Financial Officer |

Exhibit

10.1

STOCK

PURCHASE AGREEMENT

THIS

STOCK PURCHASE AGREEMENT (this “Agreement”) is made as of September 26, 2024 by and between Alset International

Limited, a Singapore corporation, having its registered office address at 9 Temasek Boulevard, #16-04, Suntec Tower Two, Singapore

038989 (the “Seller”) and Alset Inc., having its registered office address at 4800 Montgomery Lane, Suite 210,

Bethesda, MD 20814 (the “Buyer”).

RECITALS

A.

The Seller and the Buyer are executing and delivering this Agreement in reliance upon the exemption from securities registration afforded

by Rule 506(b) of Regulation D (“Regulation D”) as promulgated by the United States Securities and Exchange Commission

(the “SEC”) under the Securities Act of 1933, as amended (the “1933 Act”).

B.

The Buyer wishes to purchase, and the Seller wishes to sell, upon the terms and conditions stated in this Agreement, Six Million and

Five Hundred Thousand (6,500,000) shares of common stock (the “Shares”) in HWH International, Inc., a Delaware corporation

(the “Company”) for US$4,095,000, which will be paid through the issuance of a promissory note in the original principal

amount of US$4,095,000, in the form attached hereto as Exhibit A (the “Note”).

C.

The Note shall be secured by the assets in the Buyer’s brokerage account pursuant to a security agreement, in the form attached

hereto as Exhibit B (the “Security Agreement”).

AGREEMENT

NOW,

THEREFORE, in consideration of the premises and the mutual covenants contained herein and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Seller and the Buyer hereby agree as follows:

| 1. | PURCHASE

AND SALE OF THE SHARES. |

(a)

Shares. Subject to the satisfaction (or waiver) of the conditions set forth in Clauses 6 and 7 below, the Seller shall sell to

the Buyer, and the Buyer shall purchase from the Seller on the Closing Date (as defined below), the Shares.

(b)

Closing. The closing (the “Closing”) of the purchase of the Shares by the Buyer shall occur at the Seller’s

registered office address at 9 Temasek Boulevard, #16-04, Suntec Tower Two, Singapore 038989. The Closing (the “Closing Date”)

shall be twenty-one (21) calendar days from the date when the conditions to the Closing set forth in Clauses 6 and 7 below are satisfied

or waived (or such later date as is mutually agreed to by the Seller and the Buyer). As used herein “Business Day”

means any day other than a Saturday, Sunday or other day on which commercial banks in the United States are authorized or required by

law to remain closed.

(c)

Purchase Price. The purchase price for the Shares to be purchased by the Buyer (the “Purchase Price”) shall

be US$4,095,000.

(d)

Payment of Purchase Price; Delivery of Shares. On the Closing Date, the Buyer shall pay the Purchase Price to the Seller for the

Shares by delivery of the executed Note.

| 2. | THE

BUYER’S REPRESENTATIONS AND WARRANTIES. |

The

Buyer represents and warrants to the Seller that:

(a)

Authority. The Buyer has the requisite power and authority to enter into and to consummate the transactions contemplated by the

Transaction Documents (as defined below) to which it is a party and otherwise to carry out its obligations hereunder and thereunder.

(b)

No Public Sale or Distribution. The Buyer is acquiring the Shares for its own account and not with a view towards, or for resale

in connection with, the public sale or distribution thereof in violation of applicable securities laws, except pursuant to sales registered

or exempted under the 1933 Act. The Buyer does not presently have any agreement or understanding, directly or indirectly, with any Person

to distribute any of the Shares in violation of applicable securities laws. For purposes of this Agreement, “Person”

means an individual, a limited liability company, a partnership, a joint venture, a corporation, a trust, an unincorporated organization,

any other entity or a government or any department or agency thereof.

(c)

Regulation D Representations. The Buyer hereby acknowledges and agrees that:

| (i) | No

Reliance. The Buyer has not relied on and is not relying on any representations, warranties

or other assurances regarding HWH other than the representations and warranties expressly

set forth in this Agreement. |

| (ii) | Accredited

Investor. The Buyer is an accredited investor, within the meaning of Rule 501 of Regulation

D promulgated under the Securities Act, and has such knowledge and experience in financial

and business matters that it is capable of evaluating the merits and risks of investing in

the Company, and all information that the Buyer has provided concerning the Buyer, the Buyer’s

financial position and knowledge of financial and business matters is true, correct and complete.

The Buyer acknowledges and understands that the Company will rely on the information provided

by the Buyer in this Agreement and in the Investor Questionnaire for purposes of complying

with federal and applicable state securities laws. The Buyer hereby represents that neither

the Buyer nor any of its Rule 506(d) Related Parties is a “bad actor” within

the meaning of Rule 506(d) promulgated under the Securities Act. For purposes of this Agreement,

“Rule 506(d) Related Party” shall mean a person or entity covered by the “Bad

Actor disqualification” provision of Rule 506(d) of the Securities Act. |

| (iii) | Risk

Factors. The Buyer understands the various risks of an investment in HWH, and has carefully

reviewed the various risk factors described in HWH’s filings with the SEC. |

| (iv) | Transfer

or Resale. The Buyer understands that: (i) the Shares have not been and are not being

registered under the 1933 Act or any state securities laws, and may not be offered for sale,

sold, assigned, transferred, conveyed or pledged, unless (A) subsequently registered under

the 1933 Act and applicable states securities laws, (B) the sale, assignment or transfer

is made outside the United States to a non-U.S. Person in accordance with the requirements

of Rule 904 of Regulation S and in compliance with applicable local laws and regulations,

(C) the sale, assignment or transfer is made in the United States or to a U.S. Person and

the applicable one year distribution compliance period under Rule 903 of Regulation S has

been satisfied, (D) such Shares to be sold, assigned or transferred may be sold, assigned

or transferred pursuant to any other exemption from registration under the 1933 Act and applicable

state securities laws, or (E) the Buyer provides the Seller with reasonable assurance that

such Shares can be sold, assigned or transferred pursuant to Rule 144A promulgated under

the 1933 Act (or a successor rule thereto) (collectively, “Rule 144A”);

(ii) any sale of the Shares made in reliance on Rule 144A may be made only in accordance

with the terms of Rule 144A, and further, if Rule 144A is not applicable, any resale of the

Shares under circumstances in which the seller (or the Person (as defined below) through

whom the sale is made) may be deemed to be an underwriter (as that term is defined in the

1933 Act) may require compliance with some other exemption under the 1933 Act or the rules

and regulations of the SEC promulgated thereunder; and (iii) neither the Seller nor any other

Person is under any obligation to register the Shares under the 1933 Act or any state securities

laws or to comply with the terms and conditions of any exemption thereunder. |

(d)

Reliance on Exemptions. The Buyer understands that the Shares are being offered and sold to it in reliance on specific exemptions

from the registration requirements of United States federal and state securities laws, that the offer and sale of the Shares are intended

to be exempt from the registration requirements of the 1933 Act pursuant to Rule 506(b) of Regulation D under the 1933 Act, and that

the Seller is relying in part upon the truth and accuracy of, and the Buyer’s compliance with, the representations, warranties,

agreements, acknowledgments and understandings of such Buyer set forth herein in order to determine the availability of such exemptions

and the eligibility of the Buyer to acquire the Shares.

(e)

Information. The Buyer and its advisors, if any, have been furnished with all materials relating to the business, finances and

operations of the Seller and materials relating to the offer and sale of the Shares which have been requested by the Buyer. The Buyer

and its advisors, if any, have been afforded the opportunity to ask questions of the Seller. The Buyer understands that its investment

in the Shares involves a high degree of risk. The Buyer has sought such accounting, legal and tax advice as it has considered necessary

to make an informed investment decision with respect to its acquisition of the Shares.

(f)

No Governmental Review. The Buyer understands that no United States federal or state agency or any other government or governmental

agency has passed on or made any recommendation or endorsement of the Shares or the fairness or suitability of the investment in the

Shares nor have such authorities passed upon or endorsed the merits of the offering of the Shares.

(g)

Validity; Enforcement. This Agreement has been duly and validly authorized, executed and delivered on behalf of the Buyer and

constitutes the legal, valid and binding obligations of the Buyer enforceable against the Buyer in accordance with its terms, except

as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium,

liquidation and other similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies.

(h)

No Conflicts. The execution, delivery and performance by the Buyer of this Agreement and the consummation by the Buyer of the

transactions contemplated hereby will not (i) conflict with, or constitute a default (or an event which with notice or lapse of time

or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement,

indenture or instrument to which the Buyer is a party or (ii) result in a violation of any law, rule, regulation, order, judgment or

decree (including federal and state securities laws) applicable to the Buyer, except for such conflicts, defaults, rights or violations

which would not, individually or in the aggregate, reasonably be expected to have a material adverse effect on the ability of the Buyer

to perform its obligations hereunder.

(i)

Experience of the Buyer. The Buyer, either alone or together with its representatives, has such knowledge, sophistication and

experience in business and financial matters so as to be capable of evaluating the merits and risks of the prospective investment in

the Shares, and has so evaluated the merits and risks of such investment.

| 3. | REPRESENTATIONS

AND WARRANTIES OF THE SELLER. |

The

Seller represents and warrants to the Buyer that:

(a)

Organization and Qualification. The Seller is any entity duly organized and validly existing and in good standing under the laws

of the jurisdiction in which it is formed, and have the requisite power and authorization to own its properties and to carry on its business

as now being conducted and as presently proposed to be conducted. The Seller is duly qualified as a foreign entity to do business and

is in good standing in every jurisdiction in which its ownership of property or the nature of the business conducted by it makes such

qualification necessary, except to the extent that the failure to be so qualified or be in good standing would not have a Material Adverse

Effect. “Material Adverse Effect” means any material adverse effect on (i) the business, properties, assets, liabilities,

operations (including results thereof), condition (financial or otherwise) or prospects of the Seller taken as a whole, (ii) the transactions

contemplated hereby or in any of the other Transaction Documents or (iii) the authority or ability of the Seller to timely perform any

of its obligations under any of the Transaction Documents (as defined below).

(b)

Authorization; Enforcement; Validity. The Seller has the requisite power and authority to enter into and perform its obligations

under this Agreement and the other Transaction Documents and to sell the Shares in accordance with the terms hereof and thereof. The

execution and delivery of this Agreement and the other Transaction Documents by the Seller, and the consummation by the Seller of the

transactions contemplated hereby and thereby (including, without limitation, the sale of the Shares) have been duly authorized by the

Seller’s board of directors (the “Signing Resolutions”), and, no further filing, consent or authorization is

required by the Seller, its board of directors or its shareholders. The Signing Resolutions are valid, in full force and effect and have

not been modified or supplemented in any respect.

(c)

This Agreement has been, and the other Transaction Documents will be prior to the Closing, duly executed and delivered by the Seller,

and each constitutes the legal, valid and binding obligations of the Seller, enforceable against the Seller in accordance with its respective

terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization,

moratorium, liquidation or similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and

remedies and except as rights to indemnification and to contribution may be limited by federal or state securities law and public policy,

and the remedy of specific performance and injunctive and other forms of equitable relief may be subject to equitable defenses and to

the discretion of the court before which any proceeding therefor may be brought. “Transaction Documents” means, collectively,

this Agreement, the Note and each of the other agreements and instruments entered into or delivered by any of the parties hereto in connection

with the transactions contemplated hereby and thereby, as may be amended from time to time.

(d)

Sale of the Shares. The sale of the Shares is duly authorized and, upon sale in accordance with the terms of the Transaction Documents,

will be validly issued, fully paid and non-assessable and free from all preemptive or similar rights, taxes, liens, charges and other

encumbrances with respect to the issue thereof, with the holders being entitled to all rights accorded to a holder of Common Stock. Subject

to the accuracy of the representations and warranties of the Buyer in this Agreement, the offer and sale of the Shares are exempt from

registration under the 1933 Act. “Common Stock” means (i) the shares of common stock in HWH International, Inc., and

(ii) any capital stock into which such common stock shall have been changed or any share capital resulting from a reclassification of

such common stock.

(e)

No Conflicts. The execution, delivery and performance of the Transaction Documents by the Seller and the consummation by the Seller

of the transactions contemplated hereby and thereby (including, without limitation, the sale of the Shares) will not (i) result in a

violation of the Seller’s articles of incorporation, as amended and as in effect on the date hereof (the “Charter”)

(including, without limitation, any certificate of designation contained therein) or other organizational documents of the Seller, any

capital stock of the Seller or the Seller’s constitution, as amended and as in effect on the date hereof (the “Bylaws”),

(ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or

give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which

the Seller is a party or (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including, without limitation,

foreign, federal and state securities laws) applicable to the Seller or by which any property or asset of the Seller is bound or affected

other than, in the case of clause (ii) above, such conflicts, defaults or rights that could not reasonably be expected to have a Material

Adverse Effect.

(f)

Consents. The Seller is not required to obtain any consent from, authorization or order of, or make any filing or registration

with, any court, governmental agency or any regulatory or self-regulatory agency or any other Person in order for it to execute, deliver

or perform any of its respective obligations under, or contemplated by, the Transaction Documents, in each case, in accordance with the

terms hereof or thereof. All consents, authorizations, orders, filings and registrations which the Seller is required to obtain at or

prior to the Closing have been obtained or effected on or prior to the Closing Date, and the Seller is not aware of any facts or circumstances

which might prevent the Seller from obtaining or effecting any of the registration, application or filings contemplated by the Transaction

Documents.

(g)

No General Solicitation; Placement Agent’s Fees. Neither the Seller, nor any of its affiliates, nor any Person acting on

its or their behalf, has engaged in any form of general solicitation or general advertising (within the meaning of Regulation D) in connection

with the offer or sale of the Shares. The Seller shall be responsible for the payment of any placement agent’s fees, financial

advisory fees, or brokers’ commissions (other than for Persons engaged by the Buyer or its investment advisor) relating to or arising

out of the transactions contemplated hereby. The Seller has not engaged any placement agent or other agent in connection with the offer

or sale of the Shares.

(h)

No Integrated Offering. None of the Seller or any of its affiliates, nor, to the knowledge of the Seller, any Person acting on

their behalf has, directly or indirectly, made any offers or sales of any security or solicited any offers to buy any security, under

circumstances that would require registration of the sale of any of the Shares under the 1933 Act, whether through integration with prior

offerings or otherwise, or cause this offering of the Shares to require approval of stockholders of the Seller under any applicable stockholder

approval provisions. None of the Seller, its affiliates nor, to the knowledge of the Seller, any Person acting on their behalf will take

any action or steps that would require registration of the sale of any of the Shares under the 1933 Act or cause the offering of any

of the Shares to be integrated with other offerings of securities of the Seller.

(i)

Conduct of Business; Regulatory Permits. The Seller is not in violation of any term of or in default under its Charter, any certificate

of designation, preferences or rights of any other outstanding series of preferred stock of the Seller or Bylaws. The Seller is not in

violation of any judgment, decree or order or any statute, ordinance, rule or regulation applicable to the Seller and the Seller will

not conduct its business in violation of any of the foregoing, except in all cases for possible violations which could not, individually

or in the aggregate, have a Material Adverse Effect. The Seller possesses all certificates, authorizations and permits issued by the

appropriate regulatory authorities necessary to conduct it business, except where the failure to possess such certificates, authorizations

or permits would not have, individually or in the aggregate, a Material Adverse Effect, and the Seller has not received any notice of

proceedings relating to the revocation or modification of any such certificate, authorization or permit.

(j)

1933 Act Exemption. The offer and sale of the Shares in accordance with the Transaction Documents are exempt from the registration

requirements of the 1933 Act pursuant to Regulation D promulgated under the 1933 Act. The Seller has implemented all necessary offering

restrictions applicable to the transactions contemplated by this Agreement under Regulation D promulgated under the 1933 Act.

(a)

Covenants. The Buyer shall use its reasonable best efforts to timely satisfy each of the conditions to be satisfied by it as provided

in Clause 6 of this Agreement. The Seller shall use its reasonable best efforts to timely satisfy each of the conditions to be satisfied

by it as provided in Clause 7 of this Agreement.

(a)

Legends. The Buyer understands that the Shares will be issued pursuant to an exemption from registration or qualification under

the 1933 Act and applicable state securities laws, and except as set forth in Clause 5(b) below, the Shares shall bear any legend as

required by the “blue sky” laws of any state and a restrictive legend in substantially the following form (and a stop-transfer

order may be placed against transfer of such stock certificates and the Seller shall be required to refuse to register any transfer of

the Shares not made in accordance with applicable U.S. securities laws):

“THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”),

OR THE SECURITIES LAWS OF ANY STATE. THE SECURITIES MAY NOT BE TRANSFERRED EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER

SUCH ACT AND APPLICABLE STATE SECURITIES LAWS OR PURSUANT TO AN APPLICABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF SUCH ACT AND

SUCH LAWS.”

(b)

Removal of Legends. The legend set forth above shall be removed, and the Seller shall issue a certificate without such legend

to the transferee of the Shares represented thereby, if, unless otherwise required by state securities laws, (i) such Shares have been

sold under an effective registration statement under the 1933 Act, (ii) the Seller (or applicable, the Seller’s transfer agent)

shall have been furnished with an opinion of counsel (which opinion shall be in form, substance and scope customary for opinions of counsel

in comparable transactions) to the effect that the Shares to be sold or transferred may be sold or transferred pursuant to an exemption

from such registration or (iii) such legend is not required under applicable requirements of the 1933 Act (including judicial interpretations

and pronouncements issued by the staff of the Commission).

| 6. | CONDITIONS

TO THE SELLER’S OBLIGATION TO SELL. |

(a)

The obligation of the Seller hereunder to issue and sell the Shares to the Buyer at the Closing is subject to the satisfaction, at or

before the Closing Date, of each of the following conditions, provided that these conditions are for the Seller’s sole benefit

and may be waived by the Seller at any time in its sole discretion by providing the Buyer with prior written notice thereof:

(i)

The Buyer shall have executed this Agreement and each of the other Transaction Documents to which it is a party and delivered the same

to the Seller.

(ii)

The Buyer shall have delivered to the Seller the Purchase Price in the form of the Promissory Note for the Shares being purchased by

the Buyer at the Closing.

(iii)

The representations and warranties of the Buyer shall be true and correct in all material respects as of the date when made and as of

the Closing Date as though originally made at that time (except for representations and warranties that speak as of a specific date,

which shall be true and correct as of such date), and the Buyer shall have performed, satisfied and complied in all material respects

with the covenants, agreements and conditions required by this Agreement to be performed, satisfied or complied with by such Buyer at

or prior to the Closing Date.

(iv)

No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed

by any court or governmental authority of competent jurisdiction that prohibits the consummation of any of the transactions contemplated

by the Transaction Documents.

(v)

The Buyer shall have delivered to the Seller such other documents, instruments or certificates relating to the transactions contemplated

by this Agreement as the Seller or its counsel may reasonably request.

(vi)

The Seller shall have obtained approval of the transactions contemplated by this Agreement by its shareholders in accordance with the

Singapore’s listing rules prior to the Closing.

| 7. | CONDITIONS

TO THE BUYER’S OBLIGATION TO PURCHASE. |

(a)

The obligation of the Buyer hereunder to purchase the Shares at the Closing is subject to the satisfaction, at or before the Closing

Date, of each of the following conditions, provided that these conditions are for the Buyer’s sole benefit and may be waived by

the Buyer at any time in its sole discretion by providing the Seller with prior written notice thereof:

(i)

The Seller shall have duly executed and delivered to the Buyer this Agreement and each of the other Transaction Documents to which it

is a party and the Seller shall have duly issued and delivered the Shares being purchased by the Buyer at the Closing pursuant to this

Agreement.

(ii)

Each and every representation and warranty of the Seller shall be true and correct as of the date when made and as of the Closing Date

as though originally made at that time (except for representations and warranties that speak as of a specific date, which shall be true

and correct as of such date) and the Seller shall have performed, satisfied and complied in all respects with the covenants, agreements

and conditions required to be performed, satisfied or complied with by the Seller at or prior to the Closing Date.

(iii)

No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed

by any court or governmental authority of competent jurisdiction that prohibits the consummation of any of the transactions contemplated

by the Transaction Documents.

(iv)

Since the date of execution of this Agreement, no event or series of events shall have occurred that reasonably would have or result

in a Material Adverse Effect.

(v)

The Seller shall have delivered to the Buyer such other documents, instruments or certificates relating to the transactions contemplated

by this Agreement as the Buyer or its counsel may reasonably request.

The

Seller shall have the right to terminate its obligations under this Agreement at any time without liability of the Seller to any other

party. Nothing contained in this Clause 8 shall be deemed to release any party from any liability for any breach by such party of the

terms and provisions of this Agreement or the other Transaction Documents or to impair the right of any party to compel specific performance

by any other party of its obligations under this Agreement or the other Transaction Documents.

(a)

In addition and without prejudice to any other rights and remedies available to the Buyer, the Buyer irrevocably undertakes to fully

indemnify the Seller on demand against any and all any loss or damages, losses, liabilities, costs and expenses whatsoever (including

but not limited to all expenses of investigation and enforcement of these indemnities), which the Buyer may incur, suffer or be liable

for, arising out of or connected to or contributed to by any breach of the terms and conditions set forth herein or non-performance of

this Agreement by the Buyer.

(b)

All sums payable by the Buyer under this Agreement will be paid free of all deductions or withholdings unless the deduction or withholding

is required by law, in which event the Buyer will pay such additional amount as will be required to ensure that the net amount received

by the Seller will equal the full amount which would have been received by the Seller had no such deduction or withholding been required

to be made.

(a)

Governing Law; Jurisdiction. All questions concerning the construction, validity, enforcement and interpretation of this Agreement

shall be governed by the State of Maryland, without giving effect to any choice of law or conflict of law provision or rule that would

cause the application of the laws of any jurisdictions other than Maryland. Each party hereby irrevocably submits to the exclusive jurisdiction

of the courts sitting in Maryland for the adjudication of any dispute hereunder or under any of the other Transaction Documents or in

connection herewith or with any transaction contemplated hereby or thereby or discussed herein or therein, and hereby irrevocably waives,

and agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of any such

court, that such suit, action or proceeding is brought in an inconvenient forum or that the venue of such suit, action or proceeding

is improper. Each party hereby irrevocably waives personal service of process and consents to process being served in any such suit,

action or proceeding by mailing a copy thereof to such party at the address for such notices to it under this Agreement and agrees that

such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall limit, or be

deemed to limit, in any way any right to serve process in any manner permitted by law.

(b)

Dispute Resolution. Any dispute arising out of, or in connection with this Agreement, including any question regarding its existence,

validity or termination, shall be referred to and finally resolved by arbitration administered in accordance with the arbitration law

of the State of Maryland.

(c)

Counterparts. This Agreement may be executed in two or more counterparts, all of which shall be considered one and the same agreement

and shall become effective when counterparts have been signed by each party and delivered to the other party. In the event that any signature

is delivered by facsimile transmission or by an e-mail which contains a portable document format (.pdf) file of an executed signature

page, such signature page shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed)

with the same force and effect as if such signature page were an original thereof.

(d)

Headings; Gender. The headings of this Agreement are for convenience of reference and shall not form part of, or affect the interpretation

of, this Agreement. Unless the context clearly indicates otherwise, each pronoun herein shall be deemed to include the masculine, feminine,

neuter, singular and plural forms thereof. The terms “including,” “includes,” “include” and words

of like import shall be construed broadly as if followed by the words “without limitation.” The terms “herein,”

“hereunder,” “hereof” and words of like import refer to this entire Agreement instead of just the provision in

which they are found.

(e)

Severability. If any provision of this Agreement is prohibited by law or otherwise determined to be invalid or unenforceable by

a court of competent jurisdiction, the provision that would otherwise be prohibited, invalid or unenforceable shall be deemed amended

to apply to the broadest extent that it would be valid and enforceable, and the invalidity or unenforceability of such provision shall

not affect the validity of the remaining provisions of this Agreement so long as this Agreement as so modified continues to express,

without material change, the original intentions of the parties as to the subject matter hereof and the prohibited nature, invalidity

or unenforceability of the provision(s) in question does not substantially impair the respective expectations or reciprocal obligations

of the parties or the practical realization of the benefits that would otherwise be conferred upon the parties. The parties will endeavor

in good faith negotiations to replace the prohibited, invalid or unenforceable provision(s) with a valid provision(s), the effect of

which comes as close as possible to that of the prohibited, invalid or unenforceable provision(s). Notwithstanding anything to the contrary

contained in this Agreement or any other Transaction Document (and without implication that the following is required or applicable),

it is the intention of the parties that in no event shall amounts and value paid by the Seller, or payable to or received by the Buyer,

under the Transaction Documents (including without limitation, any amounts that would be characterized as “interest” under

applicable law) exceed amounts permitted under any applicable law. Accordingly, if any obligation to pay, payment made to the Seller,

or collection by the Seller pursuant the Transaction Documents is finally judicially determined to be contrary to any such applicable

law, such obligation to pay, payment or collection shall be deemed to have been made by mutual mistake of the Seller and the Buyer and

such amount shall be deemed to have been adjusted with retroactive effect to the maximum amount or rate of interest, as the case may

be, as would not be so prohibited by the applicable law. Such adjustment shall be effected, to the extent necessary, by reducing or refunding,

at the option of the Seller, the amount of interest or any other amounts which would constitute unlawful amounts required to be paid

or actually paid to the Seller under the Transaction Documents. For greater certainty, to the extent that any interest, charges, fees,

expenses or other amounts required to be paid to or received by the Seller under any of the Transaction Documents or related thereto

are held to be within the meaning of “interest” or another applicable term to otherwise be in violation of applicable law,

such amounts shall be pro-rated over the period of time to which they relate.

(f)

Entire Agreement; Amendments. This Agreement, the other Transaction Documents and the schedules and exhibits attached hereto and

thereto and the instruments referenced herein and therein supersede all other prior oral or written agreements between the Buyer, the

Seller, their affiliates and Persons acting on their behalf solely with respect to the matters contained herein and therein, and this

Agreement, the other Transaction Documents, the schedules and exhibits attached hereto and thereto and the instruments referenced herein

and therein contain the entire understanding of the parties solely with respect to the matters covered herein and therein. For clarification

purposes, the Recitals are part of this Agreement. No provision of this Agreement may be amended other than by an instrument in writing

signed by the Seller and the Buyer, and any amendment to any provision of this Agreement made in conformity with the provisions of this

Clause 10(f) shall be binding on the Buyer. No waiver shall be effective unless it is in writing and signed by an authorized representative

of the waiving party, provided that the Buyer may waive any provision of this Agreement, and any waiver of any provision of this Agreement

made in conformity with the provisions of this Clause 10(f) shall be binding on the Buyer. The Seller has not, directly or indirectly,

made any agreements with the Buyer relating to the terms or conditions of the transactions contemplated by the Transaction Documents

except as set forth in the Transaction Documents. Without limiting the foregoing, the Seller confirms that, except as set forth in this

Agreement, the Buyer has not made any commitment or promise or has any other obligation to provide any financing to the Seller.

(g)

Notices. Any notices, consents, waivers or other communications required or permitted to be given under the terms of this Agreement

must be in writing and will be deemed to have been delivered: (i) upon receipt, if delivered personally; (ii) when sent, if sent by facsimile

(provided confirmation of transmission is mechanically or electronically generated and kept on file by the sending party); (iii) when

sent, if sent by e-mail (provided that such sent e-mail is kept on file (whether electronically or otherwise) by the sending party and

the sending party does not receive an automatically generated message from the recipient’s e-mail server that such e-mail could

not be delivered to such recipient) and (iv) if sent by overnight courier service, one (1) Business Day after deposit with an overnight

courier service with next day delivery specified, in each case, properly addressed to the party to receive the same. The addresses, facsimile

numbers and/or e-mail addresses for such communications are as follows:

If

to the Seller:

| Alset International Limited |

| Address: |

9 Temasek Boulevard |

| |

#16-04, Suntec Tower Two |

| |

Singapore 038989 |

| Attention: |

Mr. Alan Lui |

| Email: |

|

If

to the Buyer:

| Alset Inc. |

|

| Address: |

4800 Montgomery Lane, Suite 210, Bethesda, MD 20814 |

| Attention: |

Mr. Rongguo Wei |

| Email: |

|

or

to such other address, facsimile number or e-mail address and/or to the attention of such other Person as the recipient party has specified

by written notice given to each other party five (5) days prior to the effectiveness of such change. Written confirmation of receipt

(A) given by the recipient of such notice, consent, waiver or other communication, (B) mechanically or electronically generated by the

sender’s facsimile machine containing the time, date and recipient facsimile number or (C) provided by an overnight courier service

shall be rebuttable evidence of personal service, receipt by facsimile or receipt from an overnight courier service in accordance with

clause (i), (ii) or (iv) above, respectively. A copy of the e-mail transmission containing the time, date and recipient e-mail address

shall be rebuttable evidence of receipt by e-mail in accordance with clause (iii) above.

(h)

Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors

and assigns. Neither the Seller nor the Buyer shall assign this Agreement or any rights or obligations hereunder without the prior written

consent of the other party (which may be granted or withheld in the sole discretion of such party). Any such purported assignment shall

be deemed void ab initio.

(i)

No Third Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective permitted

successors and assigns, and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

(j)

Survival. The representations, warranties, agreements and covenants shall survive the Closing.

(k)

Further Assurances. Each party shall do and perform, or cause to be done and performed, all such further acts and things, and

shall execute and deliver all such other agreements, certificates, instruments and documents, as any other party may reasonably request

in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated

hereby.

(l)

Construction. The language used in this Agreement will be deemed to be the language chosen by the parties to express their mutual

intent, and no rules of strict construction will be applied against any party. No specific representation or warranty shall limit the

generality or applicability of a more general representation or warranty. Each and every reference to share prices, shares of Common

Stock and any other numbers in this Agreement that relate to the Common Stock shall be automatically adjusted for stock splits, stock

dividends, stock combinations and other similar transactions that occur with respect to the Common Stock after the date of this Agreement.

(m)

Payment Set Aside; Currency. To the extent that the Buyer makes a payment or payments to the Seller hereunder or pursuant to any

of the other Transaction Documents or the Seller enforces or exercises its rights hereunder or thereunder, and such payment or payments

or the proceeds of such enforcement or exercise or any part thereof are subsequently invalidated, declared to be fraudulent or preferential,

set aside, recovered from, disgorged by or are required to be refunded, repaid or otherwise restored to the Buyer, a trustee, receiver

or any other Person under any law (including, without limitation, any bankruptcy law, foreign, state or federal law, common law or equitable

cause of action), then to the extent of any such restoration the obligation or part thereof originally intended to be satisfied shall

be revived and continued in full force and effect as if such payment had not been made or such enforcement or setoff had not occurred.

Unless otherwise expressly indicated, all dollar amounts referred to in this Agreement and the other Transaction Documents are in United

States Dollars (“U.S. Dollars”), and all amounts owing under this Agreement and all other Transaction Documents shall

be paid in U.S. Dollars. All amounts denominated in other currencies (if any) shall be converted into the U.S. Dollar equivalent amount

in accordance with the Exchange Rate on the date of calculation. “Exchange Rate” means, in relation to any amount

of currency to be converted into U.S. Dollars pursuant to this Agreement, the U.S. Dollar exchange rate as published in the Wall Street

Journal on the relevant date of calculation.

[The

remainder of this page is intentionally left blank and signature page follows.]

IN

WITNESS WHEREOF, the Buyer and the Seller have caused this Agreement to be duly executed by their respective representatives hereunto

authorized as of the day and year first above written.

| |

By

the Seller: |

| |

|

|

| |

alset

INTERNATIONAL limited |

| |

|

|

| |

By: |

/s/

Alan Lui |

| |

Name: |

Alan

Lui |

| |

Title: |

Chief

Financial Officer |

| |

By

the Buyer: |

| |

|

|

| |

ALSET

INC. |

| |

|

|

| |

By: |

/s/

Rongguo Wei |

| |

Name: |

Rongguo

Wei |

| |

Title: |

Co-Chief

Financial Officer |

EXHIBIT

A

NOTE

EXHIBIT

B

SECURITY

AGREEMENT

Exhibit

10.2

SECURED

PROMISSORY NOTE

THIS

SECURED PROMISSORY NOTE (this “Note”) is made as of September 26, 2024 (the “Effective Date”) by

and between Alset International Limited, a Singapore corporation, having its registered office address at 9 Temasek Boulevard, #16-04,

Suntec Tower Two, Singapore 038989 or its assignee(s) (the “Lender”) and Alset Inc., a Texas corporation, having its

registered office address at 4800 Montgomery Lane, Suite 210, Bethesda, MD 20814 (the “Borrower”). The Borrower and

the Lender may also be individually known herein as a “Party”, and collectively be known herein as the “Parties”.

WHEREAS,

the Borrower wishes to purchase and the Lender wishes to sell Six Million and Five Hundred Thousand (6,500,000) shares of common stock

of HWH International Inc., a Delaware corporation, in accordance with the terms and conditions set out in the stock purchase agreement

entered into between the Parties on September 26, 2024 (the “Stock Purchase Agreement”), in exchange for this Note

in the amount of US$4,095,000 (the “Principal”); and

WHEREAS,

for value received, the Borrower hereby issues to the Lender this Note and promises to repay to the order of the Lender, the Principal

in accordance with the terms and conditions set out in this Note.

NOW,

THEREFORE, in consideration of the mutual promises, covenants and conditions set forth herein, the Parties hereto agree as follows:

1.

Interest. The Parties agree that interest at the rate of five percent (5%) per annum which shall be charged on the Principal balance

from time to time remaining unpaid prior to maturity until paid in full by the Maturity Date (defined below) (the “Interest”)

unless otherwise waived by the Lender. In no event shall the Interest rate on the Principal exceed the maximum rate allowed by law.

2.

Repayment. The Borrower shall, on the earlier of (the earlier of such events being the “Maturity Date”) (a)

two (2) years from the Effective Date; or (b) upon the occurrence of an Event of Default (defined below), pay the Principal and Interest

accrued on the Principal to the Lender’s designated bank account (to be provided by the Lender) via wire transfer.

3.

Prepayment. The Borrower shall have the right to prepay all or any portion of the Principal and Interest accrued on the Principal,

without premium and penalty, upon ten (10) days’ notice to the Lender.

4.

Event of Default. The occurrence of any of the following events shall constitute a default under and material breach of this Note

by the Borrower (the “Event of Default”):

(a)

The Borrower’s failure to pay the Principal, accrued Interest and any payment when due under this Note.

(b)

The Borrower fails to comply with or to perform any other term, obligation, covenant or condition contained in this Note or in any of

the related documents or to comply with or to perform any term, obligation, covenant or condition contained in any other agreement between

the Lender and the Borrower.

(c)

If at any time the Borrower denies the enforceability of any loan documents related to this Note, in whole or in part, including, but

not limited to any loan, extension of credit, guaranty agreement, security agreement, or any other agreement related to this Note or

any extension and renewal thereof.

(d)

The Borrower defaults under any loan, extension of credit, security agreement, sale and purchase agreement, or any other agreement, in

favor of any other creditor or Person that may materially affect any of the Borrower’s property or the Borrower’s ability

to repay this Note or perform the Borrower’s obligations under this Note or any of the related documents.

(e)

Any warranty, representation or statement made or furnished to the Lender by the Borrower or on the Borrower’s behalf under this

Note or the related documents is false or misleading in any material respect, either now or at the time made or furnished or becomes

false or misleading at any time thereafter.

(f)

The insolvency of the Borrower, the appointment of a receiver for any part of the Borrower’s property, any assignment for the benefit

of creditors, any type of creditor workout, or the commencement of any proceeding under any bankruptcy or insolvency laws by or against

the Borrower.

(g)

A Material Adverse Effect occurs in the Borrower’s financial condition, or the Lender believes the prospect of payment or performance

of this Note is impaired.

(h)

The Lender in good faith believes itself insecure based upon a deemed Material Adverse Effect to the Borrower.

5.

Security. This Note is given pursuant to the terms of the Stock Purchase Agreement and is secured under the terms of a Security

Agreement of even date herewith made between the Lender and the Borrower (the “Security Agreement”). The Lender shall

be entitled to all the benefits of the security as provided in the Security Agreement. Notwithstanding anything to the contrary stated

herein, the Lender agrees that for payment of this Note it will look solely to the Collateral (as defined in the Security Agreement),

and no other assets of the Borrower shall be subject to levy, execution or other enforcement procedure for the satisfaction of the remedies

of the Lender, or for any payment required to be made under this Note. For the avoidance of doubt, immediately upon such transfer of

the Collateral from the Borrower to the Lender, (i) the Security Agreement and this Note shall be deemed to have terminated and of no

further effect; (ii) all obligations of the Borrower under this Note and the Security Agreement shall be deemed to have fully and properly

performed, satisfied and fulfilled; and (iii) there shall be no other claims and/or whatsoever against the Borrower in relation to the

Collateral and this Note.

6.

Additional Provisions Regarding an Event of Default.

(a)

Cure of Default. Upon occurrence of an Event of Default, the Lender shall give the Borrower written notice of default. The Borrower

shall have thirty (30) days after receipt of written notice of default from the Lender to cure the Event of Default. If the Event of

Default is due solely to the Borrower’s failure to make timely payment required under this Note, the Borrower may cure the Event

of Default by making full payment of the past due amount. Any Event of Default by the Borrower which is not cured within thirty (30)

days after receiving a written notice of default from the Lender constitutes a material breach of this Note by the Borrower.

(b)

Indemnification. The Borrower agrees to indemnify, defend and hold the Lender or any other Person assigned by the Lender or representing

the Lender (each, an “Indemnified Person”) harmless against: (i) all Borrower’s demands, claims, liabilities

and obligations to pay when due any debts, principal, interest, fees, expenses, and other amounts the Borrower owes the Lender now or

later, whether under this Note, or otherwise, including, without limitation, all obligations, liabilities, or obligations of the Borrower

assigned to the Lender, and to perform Borrower’s duties under this Note (collectively, the “Claims”) claimed

or asserted by any other party in connection with the transactions contemplated by this Note; and (ii) all losses or expenses in any

way suffered, incurred, or paid by such Indemnified Person as a result of, following from, consequential to, or arising from transactions

between the Lender and the Borrower (including reasonable attorneys’ fees and expenses), except for Claims and/or losses directly

caused by such Indemnified Person’s gross negligence or willful misconduct. This Clause 6(b) shall survive until all statutes of

limitation with respect to the Claims, losses, and expenses for which indemnity is given shall have run.

(c)

Remedies upon an Event of Default. Upon the occurrence and during the continuance of an Event of Default that is not timely cured

in accordance with this Note, or waived by the Lender, all unpaid Principal, Interest accrued thereon and all late charges for past due

sums due hereunder shall become immediately due and payable to the Lender.

(d)

Certain Terms Defined. “Person(s)” means any natural person, corporation, limited liability company, trust,

joint venture, association, company, partnership, Governmental Authority or other entity. “Governmental Authority”

means the government of the United States or any other nation, or of any political subdivision thereof, whether state or county or provincial

or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative,

judicial, taxing, regulatory or administrative powers or functions of or pertaining to government. “Law(s)” means,

collectively, all international, foreign, federal, state and local statutes, treaties, rules, guidelines, regulations, ordinances, codes

and administrative or judicial precedents or authorities, including the interpretation or administration thereof by any Governmental

Authority charged with the enforcement, interpretation or administration thereof, and all applicable administrative orders, directed

duties, requests, licenses, authorizations and permits of, and agreements with, any Governmental Authority, in each case whether or not

having the force of law. “Material Adverse Effect” means (i) a material adverse change in, or a material adverse effect

upon, the financial condition of the Borrower, taken as a whole; (ii) a material impairment of the ability of the Borrower to perform

its obligations under any loan agreement to which it is a party; or (iii) a material adverse effect upon the legality, validity, binding

effect or enforceability against the Borrower of any loan agreement to which it is a party.

7.

Warranties and Representations by the Borrower. The Borrower warrants and represents to the Lender as follows:

(a)

Authorization; No Contravention. The execution, delivery and performance by the Borrower of this Note have been duly authorized

by all necessary corporate or other organizational action (where applicable), and do not and will not (i) conflict with or result in

any breach or contravention of any material contractual obligation to which the Borrower is a party or that is affecting the Borrower

or the properties of the Borrower; or (ii) violate any Laws, where such violations would not reasonably be expected, individually or

in the aggregate, to have a Material Adverse Effect.

(b)

Governmental Authorization; Other Consents. No approval, consent, exemption, authorization, or other action by, or notice to,

or filing with, any Governmental Authority or any other Person is required in connection with the execution, delivery or performance

by, or enforcement against, the Borrower of this Note other than (i) those that have already been obtained and are in full force and

effect; and (ii) approvals, consents, exemptions, authorizations, actions and notices the absence of which would not reasonably be expected

to result in a Material Adverse Effect.

(c)

Binding Effect. This Note will have been duly executed and delivered by the Borrower. This Note shall constitute a legal, valid

and binding obligation of the Borrower, enforceable against the Borrower in accordance with its terms, subject to applicable bankruptcy,

insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of

equity, regardless of whether considered in a proceeding in equity or at law. The Principal and Interest accrued thereon are valid corporate

debts of the Borrower.

(d)

Litigation. There are no actions, suits, proceedings, claims or disputes pending or, to the knowledge of the Borrower, threatened

in writing, at law, in equity, in arbitration or before any Governmental Authority, by or against the Borrower or any of its subsidiaries

that (i) either individually or in the aggregate, would reasonably be expected to have a Material Adverse Effect and that has not been

publicly disclosed prior to the Effective Date; or (ii) purport to enjoin or restrain the execution or delivery of this Note, or any

of the transactions contemplated hereby.

(e)

Compliance with Laws. Each of the Borrower and its operating subsidiaries is in compliance in all material respects with the requirements

of all Laws, except in such instances in which (i) such requirement of Laws is being contested in good faith by appropriate proceedings

diligently conducted; or (ii) the failure to comply therewith, either individually or in the aggregate, would not reasonably be expected

to result in a Material Adverse Effect.

8.

Warranties and Representations by the Lender. The Lender warrants and represents to the Borrower as follows:

(a)

Existence, Qualification and Power. The Lender (i) is duly organized or formed, validly existing and, as applicable, in good standing

under the laws of the jurisdiction of its incorporation or organization; and (ii) has all requisite power and authority and all requisite

governmental licenses, authorizations, consents and approvals to execute, deliver and perform its obligations under this Note.

(b)

No Lien. There is no lien on sums loaned hereunder and no third-party restrictions on the making of the loan under this Note.

9.

Entire Agreement. This Note sets forth the entire agreement between the Parties with regard to the subject matter hereof. All

prior agreements, representations and warranties, express or implied, oral or written, with respect to the subject matter hereof, are

superseded by this Note.

10.

Severability. In the event any provision of this Note is deemed to be void, invalid, or unenforceable, that provision shall be

severed from the remainder of this Note so as not to cause the invalidity or unenforceability of the remainder of this Note. All remaining

provisions of this Note shall then continue in full force and effect. If any provision shall be deemed invalid due to its scope or breadth,

such provision shall be deemed valid to the extent of the scope and breadth permitted by Laws.

11.

Modification. Except as otherwise provided in this Note, this Note may be modified, superseded, or voided only upon the written

and signed agreement of the Parties.

12.

Exclusive Jurisdiction. Any action or proceeding arising out of or relating to this Note shall be brought in the courts of the

State of Maryland, and each of the Parties irrevocably submits to the exclusive jurisdiction of the courts of the State of Maryland in

any such action or proceeding, waives any objection it or he may now or hereafter have to venue or to convenience of forum, agrees that

all claims in respect of the action or proceeding shall be heard and determined only by the courts of the State of Maryland and agrees

not to bring any action or proceeding arising out of or relating to this Note in any other courts.

13.

Governing Law. This Note shall be interpreted under, and governed by, the laws of the State of Maryland, without reference to

any conflict or choice of law rules or doctrines of the State of Maryland.

14.

Dispute Resolution. Any dispute arising out of, or in connection with this Agreement, including any question regarding its existence,

validity or termination, shall be referred to and finally resolved by arbitration administered in accordance with the laws of the State

of Maryland.

15.

Counterparts. This Note may be executed by one or more of the Parties on any number of separate counterparts (including by telecopy),

and all of said counterparts taken together shall be deemed to constitute one and the same instrument and agreement. Delivery of an executed

counterpart to this Note by facsimile transmission or by electronic mail in pdf. format shall be as effective as delivery of a manually

executed counterpart hereof. Each Party agrees that the electronic signatures, whether digital or encrypted, of the Parties are intended

to authenticate this writing and to have the same force and effect as manual signatures. Electronic signature and, when used elsewhere

in this Note, “electronic transmission” means any electronic sound, symbol, or process attached to or logically associated

with a record and executed and adopted by a Party with the intent to sign such record, including facsimile or email electronic signatures.

16.

Assignment; Binding Effect. The provisions of this Note shall be binding upon and inure to the benefit of the Parties and their

respective successors and assigns permitted hereby. The Borrower may not assign or otherwise transfer any of its rights or obligations

hereunder without prior written consent of the Lender. This Note and any of the rights, interests, or obligations incurred hereunder,

in part or as a whole, at any time with effect from the Effective Date, are freely assignable by the Lender.

17.

Survival of Representations and Warranties. All representations and warranties made hereunder or any other documents delivered

pursuant hereto or thereto or in connection herewith or therewith shall survive the execution and delivery hereof and thereof. Such representations

and warranties shall continue in full force and effect as long as any amount of Principal or Interest accrued thereon shall remain unpaid

but shall expire upon payment in full of those amounts.

18.

No Waiver; Cumulative Remedies; Enforcement. No failure by the Lender to exercise and no delay in exercising, any right, remedy,

power or privilege hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power

or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

The rights, remedies, powers and privileges herein provided, and provided under each other Note, are cumulative and not exclusive of

any rights, remedies, powers and privileges provided by Laws. Without limiting the generality of the foregoing, the execution and delivery

of this Note shall not be construed as a waiver of any default by the Lender.

19.

Costs and Expenses. The Lender may hire an attorney to help collect this Note if the Borrower does not pay, and the Borrower will

pay the Lender’s reasonable legal fees. The Borrower also will pay the Lender all other amounts the Lender actually incurs as court

costs, lawful fees for filing, recording, releasing to any public office any instrument securing this Note, where applicable.

20.

Definitions. The definitions of terms herein shall apply equally to the singular and plural forms of the terms defined. Whenever

the context may require, any pronoun shall include the corresponding masculine, feminine and neuter forms. The words “include”,

“includes” and “including” shall be deemed to be followed by the phrase “without limitation”. The

word “will” shall be construed to have the same meaning and effect as the word “shall”. Unless the context requires

otherwise, (a) any definition of or reference to any agreement, instrument or other document shall be construed as referring to such

agreement, instrument or other document as from time to time amended, supplemented or otherwise modified (subject to any restrictions

on such amendments, supplements or modifications set forth herein); (b) any reference herein to any Person shall be construed to include

such Person’s successors and permitted assigns; (c) the words “hereto”, “herein”, “hereof”

and “hereunder”, and words of similar import shall be construed to refer to this Note in its entirety and not to any particular

provision thereof; (d) all references in this Note to Paragraphs, Sections and Clauses shall be construed to refer to paragraphs, sections

and clauses of this Note; (e) any reference to any law shall include all statutory and regulatory provisions consolidating, amending,

replacing or interpreting such law and any reference to any law or regulation shall, unless otherwise specified, refer to such law or

regulation as amended, modified or supplemented from time to time; and (f) the words “asset” and “property” shall

be construed to have the same meaning and effect and to refer to any and all tangible and intangible assets and properties, including

cash, securities, accounts and contract rights.

21.

Notices. Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall be in

writing and shall be deemed given and effective on the earliest of (a) the date of transmission, if such notice or communication is delivered

via electronic transmission prior to 5:00 p.m., Eastern Standard Time, on a business day, (b) the next business day after the date of

transmission, if such notice or communication is delivered via electronic transmission on a day that is not a business day or later than

5:00 p.m., Eastern Standard Time, on any business day, (c) the business day following the date of mailing, if sent by overnight courier

service with next day delivery specified, or (d) upon actual receipt by the party to whom such notice is required to be given. The address

and email address for such notices and communications shall be as follows:

| If

to the Borrower: |

|

Alset

Inc.

Address:

4800 Montgomery Lane, Suite 210

Bethesda,

MD 20814

Attention:

Mr. Ronald Wei

Email:

|

| |

|

|

| If

to the Lender: |

|

Alset

International Limited

Address:

9 Temasek Boulevard, #16-04,

Suntec

Tower Two, Singapore 038989

Attention:

Mr. Alan Lui

Email: |

22.

Release and Waiver of Claims. In consideration of (a) the modifications, renewals, extensions, and/or waivers as herein provided,

and (b) the other benefits received by the Borrower hereunder, the Borrower hereby releases, relinquishes and forever discharges the

Lender, as well as its predecessors, successors, assigns, agents, officers, directors, employees, representatives, attorneys, insurers,

affiliates, parent corporations and all other persons, entities, associations, partnerships and corporations with whom any of the former

have been, are now or may hereafter be affiliated (collectively, the “Lender Parties”) of and from any and all claims,

demands, obligations, liabilities, actions and causes of action of any and every kind, character or nature whatsoever, known or unknown,

past or present, which the Borrower may have against any of the Lender Parties arising out of or with respect to (i) any right or power

to bring any claim against the Lender for usury or to pursue any cause of action against the Lender based on any claim of usury, and

(ii) any and all transactions and events relating to any loan documents occurring on or prior to the date hereof, including any loss,

cost or damage, of any kind, character or nature whatsoever, arising out of, in any way connected with, or in any way resulting from

the acts, actions, or omissions of any of the Lender Parties, including, but not limited to, any breach of fiduciary duty, breach of

any duty of fair dealing, breach of confidence, breach of funding commitment, undue influence, duress, economic coercion, conflict of

interest, negligence, bad faith, malpractice, intentional or negligent infliction of mental distress, tortuous interference with contractual

relations, tortuous interference with corporate governance or prospective business advantage, breach of contract, deceptive trade practices,

libel, slander or conspiracy, and/or arising out of any attempt to collect any sums due or claimed to be due to the Lender, but in each

case only to the extent permitted by Laws.

[The

remainder of this page is intentionally left blank and signature page follows.]

IN

WITNESS WHEREOF and acknowledging acceptance and agreement of the foregoing, the Borrower and the Lender affix their signatures hereto.

| |

By

the Lender: |

| |

|

|

| |

ALSET INTERNATIONAL LIMITED

|

| |

|

|

| |

By: |

/s/

Alan Lui |

| |

Name:

|

Alan

Lui |

| |

Title: |

Chief

Financial Officer |

| |

By

the Borrower: |

| |

|

|

| |

ALSET INC. |

| |

|

|

| |

By: |

/s/

Rongguo Wei |

| |

Name:

|

Rongguo

Wei |

| |

Title:

|

Co-Chief

Financial Officer

|

Exhibit

10.3

SECURITY

AGREEMENT

THIS

SECURITY AGREEMENT (the “Security Agreement”) is made and entered into this 26 day of September 2024, by and

between Alset Inc., a Texas corporation, having its registered office at 4800 Montgomery Lane, Suite 210, Bethesda, MD 20814 (the “Buyer”)

and Alset International Limited, a Singapore corporation, having its registered office address at 9 Temasek Boulevard, #16-04, Suntec

Tower Two, Singapore 038989 or its assignee(s) (the “Seller” or the “Secured Party”). Capitalized

terms used herein but not otherwise defined have the meanings ascribed to such terms in the Stock Purchase Agreement (as defined below)

and in the Note (as defined below).

RECITALS

A.

The Buyer has purchased from the Seller Six Million and Five Hundred Thousand (6,500,000) shares of common stock of HWH International

Inc., a Delaware corporation (the “Shares”) pursuant to the Stock Purchase Agreement of even date herewith (the “Stock

Purchase Agreement”).

B.

The Seller has accepted the Buyer’s promissory note of even date herewith (the “Note”) in payment for the

Shares.

C.

In consideration of the sale of the Shares and as security for the payment of the Note, the Buyer has agreed to execute this Security

Agreement.

NOW,

THEREFORE, in consideration of the mutual promises contained herein and other good and valuable consideration, the receipt and sufficiency

of which is hereby acknowledged, it is agreed as follows:

(a)

The Buyer hereby grants and assigns to the Seller a security interest in all the assets in the Buyer’s designated brokerage account

into which it deposited the Shares (the “Collateral”) to secure payment of the Note. The Buyer shall provide the Seller

with the designated brokerage account details in due course. The Buyer agrees that, without obtaining prior written approval of the Seller,

the Buyer shall not (i) transfer any Shares in the designated brokerage account, or (ii) withdraw any monies from the designated brokerage