UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 6-K

_______________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2015

Commission file number 0-30752

_______________________________

AETERNA ZENTARIS INC.

_______________________________

1405 du Parc-Technologique Boulevard

Quebec City, Québec

Canada, G1P 4P5

(Address of principal executive offices)

_______________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No ý

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

DOCUMENTS INDEX

| |

99.1 | Press release dated November 5, 2015: Aeterna Zentaris Reports Third Quarter 2015 Financial and Operating Results. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| | | | |

| | | | |

| | AETERNA ZENTARIS INC. |

| | | |

Date: November 5, 2015 | | By: | | /s/ Phil Theodore |

| | | | Phil Theodore |

| | | | Senior Vice President |

Aeterna Zentaris Inc. 1405 du Parc-Technologique Blvd.

Québec (Québec) Canada G1P 4P5 T 418-652-8525

www.aezsinc.com

Press Release

For immediate release

Aeterna Zentaris Reports Third Quarter Financial and Operating Results

Strong fundamentals; dilution from Series B Warrants substantially ended

All amounts are in US Dollars

Third quarter key developments

| |

• | Saizen® promotional activities show early promise |

| |

• | EstroGel® year-over-year new-prescription growth continues ahead of the market in the Company's territories |

| |

• | Zoptrex™ (zoptarelin doxorubicin) receives DSMB recommendation to continue ZoptEC Phase 3 clinical program to completion following review of the final interim efficacy and safety data (after quarter end) |

| |

• | Zoptrex™ meets Phase 2 Primary Endpoint in Men with Heavily Pretreated Castration- and Taxane-Resistant Prostate Cancer |

| |

• | Optimized Erk-Inhibitor Compound Selected for Further Development |

| |

• | Company announces restructuring of Financial Team and closing of Quebec City office (after quarter end) |

| |

• | Series B Share Purchase Warrants substantially eliminated (after quarter end) |

Quebec City, Canada, November 5, 2015 - Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZ) (the “Company”), a specialty biopharmaceutical company engaged in developing and commercializing novel treatments in oncology, endocrinology and women's health, today reported financial and operating results as at and for the third quarter ended September 30, 2015.

Commenting on third quarter results and the Company’s prospects, David A. Dodd, Chairman, President and Chief Executive Officer of the Company, stated, “Despite our continued progress in transforming the Company, the price of our common shares remained under intense pressure during the third quarter as a result of the exercise of Series B Common Share Purchase Warrants (“Series B Warrants”). At the beginning of the quarter, 26,812,308 Series B Warrants were outstanding. We finished the quarter with 6,880,170. As a result of the agreements we reached with the major holders of the Series B Warrants on November 1, only approximately 0.8 million Series B Warrants will remain outstanding, representing approximately 2.7% of the number originally issued. While the dilution caused by the Series B Warrants is substantially ended, we find it necessary to ask our fellow shareholders to approve another share consolidation. We believe that a share consolidation will permit our common shares to remain listed on The Nasdaq Capital Market, which will permit us to raise capital again on reasonable terms, further supporting our focus on developing a profitable, growth-oriented pharmaceutical business.”

Commenting on the Company's lead oncology compound, Mr. Dodd stated, "Our confidence in the commercial potential of Zoptrex™, which is the brand name we selected for zoptarelin doxorubicin, was enhanced by the announcement during the third quarter of the results of an investigator sponsored Phase 2 clinical study of Zoptrex™ in men with in castration- and taxane-resistant prostate cancer. Zoptrex™ achieved its primary endpoint and demonstrated good tolerability during this early-stage study. The primary endpoint was Clinical Benefit, defined as remaining progression-free by RECIST and Prostate Specific Antigen after treatment for 12+ weeks. Shortly after quarter end, we received very encouraging news regarding Zoptrex™ when, following a comprehensive review of the final interim efficacy and safety data, the DSMB recommended that we continue the ZoptEC Phase 3 clinical study to its conclusion. We look forward to the successful completion of the clinical development of ZoptrexTM for our initial indication over the next year."

Continuing with his commentary, Mr. Dodd stated, "During the third quarter, we made progress promoting Saizen®, a leading product in the $1.6 billion US market for the treatment of growth hormone deficiency in children and adults. Our recently commenced promotional efforts for Saizen® show promise and support our belief that detailing this product will contribute to our commercial success. In addition, year-over-year new prescription growth for EstroGel® in our territories increased significantly, compared to its market which is currently flat or declining. Our commercial operation, while not yet a meaningful contributor to our financial results, is an important investment we are making in the transformation of the Company. This demonstrated, effective commercial operation will position us to build our portfolio by in-licensing products. We intend to continue with this investment in parallel with our efforts to successfully in-license products."

Concluding, Mr. Dodd addressed the Company's earlier stage development efforts as follows: "We also made significant progress with respect to our pipeline of internally developed products, selecting an optimized Erk-inhibitor compound for further development. We are looking for other parties to assist us with the further development of the compound because we believe it could represent an important new category of cancer therapy."

Third Quarter Financial Highlights

Research and development (“R&D”) costs were $4.1 million for the three-month period ended September 30, 2015, as compared to $6.1 million for the same period in 2014. A substantial portion of this decrease is mainly due to the realization of cost savings in connection with the Company’s global resource optimization program, as well as to the weakening, in 2015, of the euro against the US dollar. The decrease was partly offset by higher costs associated with the Company’s ZoptEC and Macrilen™ Phase 3 trials.

Selling expenses were $1.7 million for the three-month period ended September 30, 2015, as compared to $0.9 million for the same period in 2014. This increase is mainly attributable to the implementation of our promotional activities associated with EstroGel®, which commenced in late 2014. We also expanded the size of our contracted sales force from 19 to 23 sales representatives during the quarter in order to support our promotional efforts associated with Saizen®.

General and administrative expenses were $1.9 million for the three-month period ended September 30, 2015, as compared to $2.8 million for the same period in 2014. General and administrative expenses were lower in the current-year quarter mainly due to the realization of costs savings in connection with the Company’s global resource optimization program.

Net finance costs were $7.9 million for the three-month period ended September 30, 2015, as compared to net finance costs of $1.8 million for the same period in 2014. The increase in net finance costs of $6.1 million is mainly related to the change in the estimated fair value of the Company's warrant liability.

Net loss for the three-month period ended September 30, 2015 was $15.3 million or $0.07 per basic and diluted share, as compared to $11.3 million or $0.20 per basic and diluted share for the same period in 2014. This increase is predominantly due to higher comparative net finance costs and to higher comparative selling expenses, partially offset by lower comparative R&D costs.

At the opening of the third quarter, the Company had 139.9 million issued and outstanding common shares. On September 30 and November 4, 2015, the Company had 492.5 million and 632.7 million issued and outstanding common shares, respectively. The increase in the Company’s outstanding shares during the quarter and subsequent to quarter-end through November 4, 2015, results from the issuance of 492.8 million common shares upon the alternate cashless exercise of Series B Warrants.

Cash and cash equivalents were $38.3 million as at September 30, 2015, compared to $34.9 million as at December 31, 2014.

Conference Call

The Company will host a conference call and live webcast to discuss these results on Friday, November 6, 2015, at 8:30 a.m., Eastern Time. Participants may access the live webcast via the Company's website at Aeterna Zentaris Q3 2015, or by telephone using the following numbers: in Canada, 514-807-9895 or 647-427-7450, outside Canada, 888-231-8191. A replay of the webcast will also be available on the Company’s website for a period of 30 days.

For reference, the Management’s Discussion and Analysis of Financial Condition and Results of Operations for the third quarter of 2015, as well as the Company’s interim consolidated financial statements as at September 30, 2015 and for the three-month and nine-month periods ended September 30, 2015 and 2014, can be found at www.aezsinc.com in the “Investors” section. About Aeterna Zentaris Inc.

Aeterna Zentaris is a specialty biopharmaceutical company engaged in developing and commercializing novel treatments in oncology, endocrinology and women's health. For more information, visit www.aezsinc.com.

Forward-Looking Statements

This press release contains forward-looking statements made pursuant to the safe harbor provisions of the US Securities Litigation Reform Act of 1995. Forward-looking statements may include, but are not limited to statements preceded by, followed by, or that include the words “expects,” “believes,” “intends,” “anticipates,” and similar terms that relate to future events, performance, or our results. The following statements in the press release are forward-looking statements:

| |

• | The statement that effecting a share consolidation will permit us to consummate a financing in the future on favorable terms; and |

| |

• | The statement that our promotion of Saizen® will contribute to our commercial success. |

Forward-looking statements involve known and unknown risks and uncertainties that could cause the Company's actual results to differ materially from those in the forward looking statements. Such risks and uncertainties include, among others, the availability of funds and resources to pursue R&D projects and clinical trials, the successful and timely completion of clinical studies, the risk that safety and efficacy data from any of our Phase 3 trials may not coincide with the data analyses from previously reported Phase 1 and/or Phase 2 clinical trials, the ability of the Company to efficiently commercialize one or more of its products or product candidates, the ability of the Company to take advantage of business opportunities in the pharmaceutical industry, uncertainties related to the regulatory process, the ability to protect our intellectual property, the potential of liability arising from shareholder lawsuits and general changes in economic conditions. Investors

should consult the Company's quarterly and annual filings with the Canadian and US securities commissions for additional information on risks and uncertainties relating to forward-looking statements. Investors are cautioned not to place undue reliance on these forward-looking statements. The Company does not undertake to update these forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments, unless required to do so by a governmental authority or by applicable law.

Contact

Philip A. Theodore

Senior Vice President

ptheodore@aezsinc.com

-30-

Attachment: Financial summary

Condensed Interim Consolidated Statements of Comprehensive Loss Information

|

| | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

(in thousands) | | 2015 | | 2014 | | 2015 | | 2014 |

| | $ | | $ | | $ | | $ |

Revenues | | | | | | | | |

Sales commissions, license fees and other | | 173 |

| | — |

| | 443 |

| | — |

|

| | 173 |

| | — |

| | 443 |

| | — |

|

Operating expenses | | | | | | | | |

Research and development costs | | 4,050 |

| | 6,142 |

| | 12,991 |

| | 17,434 |

|

General and administrative expenses | | 1,910 |

| | 2,763 |

| | 7,355 |

| | 7,207 |

|

Selling expenses | | 1,714 |

| | 938 |

| | 5,123 |

| | 1,807 |

|

| | 7,674 |

| | 9,843 |

| | 25,469 |

| | 26,448 |

|

Loss from operations | | (7,501 | ) | | (9,843 | ) | | (25,026 | ) | | (26,448 | ) |

Finance income | | 40 |

| | 1,091 |

| | 279 |

| | 5,266 |

|

Finance costs | | (7,940 | ) | | (2,877 | ) | | (15,438 | ) | | — |

|

Net finance (costs) income | | (7,900 | ) | | (1,786 | ) | | (15,159 | ) | | 5,266 |

|

Net loss from continuing operations | | (15,401 | ) | | (11,629 | ) | | (40,185 | ) | | (21,182 | ) |

Net income from discontinued operations | | 111 |

| | 292 |

| | 60 |

| | 465 |

|

Net loss | | (15,290 | ) | | (11,337 | ) | | (40,125 | ) | | (20,717 | ) |

Other comprehensive (loss) income : | | | | | | | | |

Items that may be reclassified subsequently to profit or loss: | | | | | | | | |

Foreign currency translation adjustments | | (21 | ) | | (387 | ) | | 1,260 |

| | (481 | ) |

Items that will not be reclassified to profit or loss: | | | | | | | | |

Actuarial gain (loss) on defined benefit plans | | — |

| | (1,099 | ) | | 960 |

| | (3,169 | ) |

Comprehensive loss | | (15,311 | ) | | (12,823 | ) | | (37,905 | ) | | (24,367 | ) |

Net loss per share (basic and diluted) from continuing operations | | (0.07 | ) | | (0.20 | ) | | (0.29 | ) | | (0.37 | ) |

Net income per share (basic and diluted) from discontinued operations | | 0.00 | | 0.00 | | 0.00 | | 0.01 |

Net loss per share (basic and diluted) | | (0.07 | ) | | (0.20 | ) | | (0.29 | ) | | (0.36 | ) |

Weighted average number of shares outstanding: | | | | | | | | |

Basic and diluted | | 229,450,370 |

| | 59,163,710 |

| | 137,825,986 |

| | 56,881,919 |

|

Condensed Interim Consolidated Statement of Financial Position Information

|

| | | | | | |

| | As at September 30, | | As at December 31, |

(in thousands) | | 2015 | | 2014 |

| | $ | | $ |

Cash and cash equivalents1 | | 38,345 |

| | 34,931 |

|

Trade and other receivables and other current assets | | 1,206 |

| | 1,286 |

|

Restricted cash equivalents | | 262 |

| | 760 |

|

Other non-current assets | | 9,088 |

| | 10,458 |

|

Total assets | | 48,901 |

| | 47,435 |

|

Payables and other current liabilities | | 4,861 |

| | 7,574 |

|

Warrant liability (current and non-current portions) | | 16,752 |

| | 8,225 |

|

Non-financial non-current liabilities2 | | 14,464 |

| | 17,152 |

|

Total liabilities | | 36,077 |

| | 32,951 |

|

Shareholders' equity | | 12,824 |

| | 14,484 |

|

Total liabilities and shareholders' equity | | 48,901 |

| | 47,435 |

|

_________________________

| |

1 | Of which approximately $3.1 million was denominated in EUR as at September 30, 2015 ($3.6 million as at December 31, 2014) |

| |

2 | Comprised mainly of employee future benefits and provisions for onerous contracts. |

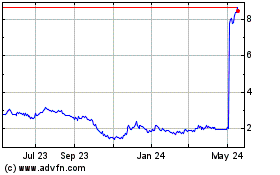

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Mar 2024 to Apr 2024

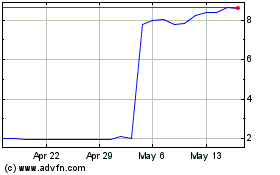

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024