0001541157falsetrue00015411572024-10-012024-10-010001541157aktx:OrdinarySharesParValue00001PerShareMember2024-10-012024-10-010001541157sic:Z88802024-10-012024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 1, 2024

Akari Therapeutics, Plc

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

England and Wales |

|

001-36288 |

|

98-1034922 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

22 Boston Wharf Road FL 7

Boston, MA 02210

(Address, including zip code, of Principal Executive Offices)

Registrant’s telephone number, including area code: (929) 274-7510

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

American Depositary Shares, each representing 2,000 Ordinary Shares |

|

AKTX |

|

The Nasdaq Capital Market |

Ordinary Shares, par value $0.0001 per share* |

|

|

|

|

*Trading, but only in connection with the American Depositary Shares.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously disclosed, on April 5, 2024, Akari Therapeutics, Plc (the “Company”) received a letter from the Listing Qualifications Staff (the “Staff”) of The Nasdaq Capital Market (“Nasdaq”) indicating that it did not comply with the minimum $2,500,000 stockholders’ equity requirement for continued listing set forth in Listing Rule 5550(b) (the “Stockholders’ Equity Requirement”) (the “Original Notice”). At that time, the Company was provided 45 days to submit a compliance plan to regain compliance with the Stockholders’ Equity Requirement. On May 20, 2024, the Company submitted a plan to regain compliance with the Stockholders’ Equity Requirement (the “Compliance Plan”) for the Staff’s consideration. On August 5, 2024, the Company was notified by the Staff that it had been granted an extension until September 30, 2024 to comply with the Compliance Plan and evidence compliance with the Stockholders’ Equity Requirement.

On October 1, 2024, the Company received a delisting determination letter (“Delisting Determination Letter”) from the Staff notifying the Company that it did not meet the terms of an extension granted by Nasdaq to regain compliance with the Stockholders’ Equity Requirement. The Delisting Determination Letter states that unless the Company requests a hearing before a Nasdaq Hearing Panel (“Panel”) by October 8, 2024, trading of the Company’s American Depositary Shares (“ADSs”) will be suspended.

Accordingly, the Company intends to request a hearing before the Panel, which request will automatically stay any suspension/delisting action by the Staff at least until the hearing process concludes and any extension granted by the Panel expires. The Company expects that it will regain compliance with the Stockholders’ Equity Requirement upon closing of its pending merger with Peak Bio, Inc. (“Peak Bio”).

There can be no assurance that the Company will be able to regain compliance with the Stockholders’ Equity Requirement or will otherwise be in compliance with other applicable Nasdaq listing rules, that the Panel will grant the Company an additional extension period to remain listed on Nasdaq, or that the Company’s appeal of the delisting determination will be successful.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), about Akari. Actual events or results may differ materially from these forward-looking statements. Words such as “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “future,” “opportunity” “will likely result,” “target,” variations of such words, and similar expressions or negatives of these words are intended to identify such forward-looking statements, although not all forward-looking statements contain these identifying words. These statements are based on Akari’s and Peak Bio’s current plans, estimates and projections. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific. A number of important factors, including those described in this communication, could cause actual results to differ materially from those contemplated in any forward-looking statements. Factors that may affect future results and may cause these forward-looking statements to be inaccurate include, without limitation: uncertainties as to the timing for completion of the Merger; uncertainties as to Peak Bio’s and/or Akari’s ability to obtain the approval of Akari’s shareholders or Peak Bio’s stockholders required to consummate the Merger; the possibility that competing offers will be made by third parties; the occurrence of events that may give rise to a right of one or both of Akari and Peak Bio to terminate the Merger Agreement; the possibility that various closing conditions for the proposed Merger may not be satisfied or waived on a timely basis or at all, including the possibility that a governmental entity may prohibit, delay, or refuse to grant approval, if required, for the consummation of the proposed Merger (or only grant approval subject to adverse conditions or limitations); the difficulty of predicting the timing or outcome of consents or regulatory approvals or actions, if any; the possibility that the proposed Merger may not be completed in the time frame expected by Akari and Peak Bio, or at all; the risk that Akari and Peak Bio may not realize the anticipated benefits of the proposed Merger in the time frame expected, or at all; the effects of the proposed Merger on relationships with Akari’s or Peak Bio’s employees, business or collaboration partners or governmental entities; the ability to retain and hire key personnel; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed Merger; significant or unexpected costs, charges or expenses resulting from the proposed Merger; the potential impact of unforeseen liabilities, future capital expenditures, revenues, costs, expenses, earnings, synergies, economic

performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of the combined business after the consummation of the proposed Merger; potential negative effects related to this announcement or the consummation of the proposed Merger on the market price of Akari’s American Depositary Shares or Peak Bio’s common stock and/or Akari’s or Peak Bio’s operating or financial results; uncertainties as to the long-term value of Akari’s American Depositary Shares (and the ordinary shares represented thereby), including the dilution caused by Akari’s issuance of additional American Depositary Shares (and the ordinary shares represented thereby) in connection with the proposed Merger; unknown liabilities related to Akari or Peak Bio; the nature, cost and outcome of any litigation and other legal proceedings involving Akari, Peak Bio or their respective directors, including any legal proceedings related to the proposed Merger; risks related to global as well as local political and economic conditions, including interest rate and currency exchange rate fluctuations; potential delays or failures related to research and/or development of Akari’s or Peak Bio’s programs or product candidates; risks related to any loss of Akari’s or Peak Bio’s patents or other intellectual property rights; any interruptions of the supply chain for raw materials or manufacturing for Akari or Peak Bio’s product candidates, the nature, timing, cost and possible success and therapeutic applications of product candidates being developed by Akari, Peak Bio and/or their respective collaborators or licensees; the extent to which the results from the research and development programs conducted by Akari, Peak Bio, and/or their respective collaborators or licensees may be replicated in other studies and/or lead to advancement of product candidates to clinical trials, therapeutic applications, or regulatory approval; uncertainty of the utilization, market acceptance, and commercial success of Akari’s or Peak Bio’s product candidates, and the impact of studies (whether conducted by Akari, Peak Bio or others and whether mandated or voluntary) on any of the foregoing; unexpected breaches or terminations with respect to Akari’s or Peak Bio’s material contracts or arrangements; risks related to competition for Akari’s or Peak Bio’s product candidates; Akari’s or Peak Bio’s ability to successfully develop or commercialize Akari’s or Peak Bio’s product candidates; Akari’s, Peak Bio’s, and their collaborators’ abilities to continue to conduct current and future developmental, preclinical and clinical programs; potential exposure to legal proceedings and investigations; risks related to changes in governmental laws and related interpretation thereof, including on reimbursement, intellectual property protection and regulatory controls on testing, approval, manufacturing, development or commercialization of any of Akari’s or Peak Bio’s product candidates; unexpected increase in costs and expenses with respect to the potential transaction or Akari’s or Peak Bio’s business or operations; and risks and uncertainties related to epidemics, pandemics or other public health crises and their impact on Akari’s and Peak Bio’s respective businesses, operations, supply chain, patient enrollment and retention, preclinical and clinical trials, strategy, goals and anticipated milestones and other risks described in our reports filed from time to time with the Securities and Exchange Commission (the “SEC”).

Additional Information and Where to Find It

In connection with the proposed Merger, on September 13, 2024, Akari and Peak Bio filed with the SEC a Registration Statement on Form S-4, as amended on September 30, 2024. The Registration Statement on Form S-4 includes a prospectus of Akari and a joint proxy statement of Akari and Peak Bio. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY THE REGISTRATION STATEMENT ON FORM S-4, JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN, IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER, RELATED MATTERS AND THE PARTIES TO THE PROPOSED MERGER.

You may obtain a free copy of the Registration Statement on Form S-4, joint proxy statement/prospectus and other relevant documents (if and when they become available) that are or will be filed with the SEC for free at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Akari will be available free of charge on Akari’s website at http://investor.akaritx.com/ or by contacting Akari’s Investor Relations Department at http://investor.akaritx.com/investor-resources/contact-us. Copies of the documents filed with the SEC by Peak Bio will be available free of charge on Peak Bio’s website at https://peak-bio.com/investors or by contacting Peak Bio’s Investor Relations Department at https://peak-bio.com/contact.

Participants in the Solicitation

Akari, Peak Bio and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed Merger. Information about the directors and executive officers of Akari, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Akari’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 29, 2024, subsequent quarterly and current reports on Form 10-Q and 8-K, respectively, and other documents that may be filed from time to time with the SEC. Information about the directors and executive officers of Peak Bio, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Peak Bio’s proxy statement for its 2022 Special Meeting of Stockholders, which was filed with the SEC on October 19, 2022, the Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on August 6, 2024, subsequent quarterly and current reports on Form 10-Q and Form 8-K, respectively, and other documents that may be filed from time to time with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the joint proxy statement/prospectus included in the Registration Statement on Form S-4 and other relevant materials filed and to be filed with the SEC regarding the proposed Merger when such materials become available. Security holders, potential investors and other readers should read the joint proxy statement/prospectus, included in the Registration Statement on Form S-4 carefully before making any voting or investment decision. You may obtain free copies of these documents from Akari or Peak Bio using the sources indicated above.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Akari Therapeutics, Plc |

|

|

Date: October 4, 2024 |

By: |

/s/ Samir R. Patel, M.D. |

|

|

Samir R. Patel, M.D. |

|

|

Interim President and Chief Executive Officer |

v3.24.3

Cover Page

|

Oct. 01, 2024 |

| Document Information Line Items |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 01, 2024

|

| Entity File Number |

001-36288

|

| Entity Registrant Name |

Akari Therapeutics, Plc

|

| Entity Central Index Key |

0001541157

|

| Entity Tax Identification Number |

98-1034922

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity Address, Address Line One |

22 Boston Wharf Road FL 7

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02210

|

| City Area Code |

929

|

| Local Phone Number |

274-7510

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| ADR [Member] |

|

| Document Information Line Items |

|

| Title of 12(b) Security |

American Depositary Shares, each representing 2,000 Ordinary Shares

|

| Trading Symbol |

AKTX

|

| Security Exchange Name |

NASDAQ

|

| Ordinary Shares, par value $0.0001 per share [Member] |

|

| Document Information Line Items |

|

| Title of 12(b) Security |

Ordinary Shares, par value $0.0001 per share*

|

| No Trading Symbol Flag |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sic_Z8880 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aktx_OrdinarySharesParValue00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

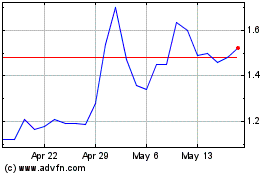

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Dec 2023 to Dec 2024