It is tough to be the retail king.

Online giant Amazon.com has been facing questions from

regulators, politicians and consumers about its scale and breadth

of its services, and how it leverages data in its business. There

are even calls to break up the retailer.

For an inside look at these challenges, Wall Street Journal

Editor in Chief Matt Murray spoke with Jeff Wilke, Amazon's chief

executive, world-wide consumer, at the WSJ Tech Live conference.

Here are edited excerpts.

MR. MURRAY: The perception of a lot of people is that you've

morphed. This is one of the things the regulators raise -- you're

in so many businesses that you have a data advantage that you've

collected across all of those businesses. So, you get into a new

business and your data advantage allows you to take over that

industry very quickly. In a lot of ways, you're thought of as a

data company more than a retail company.

MR. WILKE: There was a corner pharmacy where I grew up. The

pharmacist had been there forever. When you walked in, he knew what

you liked to buy. He would tell you about new arrivals and where

they were in the store. He'd say, "Hey, Jeff, there's a

bodybuilding magazine back in the corner that we just got that you

might want to read."

That's the same thing we're doing.

Our main purpose in storing your purchases is so that we can

recommend something that you might want to buy the next time. We

don't sell that data to others. We don't use it to understand

anything other than, when you arrive, what should we show you? What

should we show you that you might be inclined to buy? It's a very

different use of data than some other companies.

MR. MURRAY: One of the big criticisms of you is your

private-label brands, that you're using data from retailers on

Amazon. You're seeing what people like, and you're making your own

products with that data that are competing with your own retailers.

You've got a built-in conflict of interest with people using your

platform.

MR. WILKE: Retailers have been doing private label for a long

time. Private label for us is 1% of our sales. If you look at most

of our competitors, it's 15%, 25%, 80% depending on the

competitor.

MR. MURRAY: I've noticed over time, though, if I punch in a

brand and a product, the Amazon brand will often come up in my

search results right at the top or next to the top.

MR. WILKE: A search result is a ranked list of the stuff in

response to the keywords that you type. Private brands don't get an

advantage there. If a private brand shows up in a search result,

it's because lots of customers are clicking on that particular

private brand.

If you're seeing things at the top that aren't very popular,

it's probably because it's a new thing and there's a merchandising

widget that is featuring it. But it's not going to show up at the

top of search results just because it's an Amazon private

brand.

The other thing I would say about private brands is that we have

a very strict policy on how we use data from sellers. We do not

allow individual sellers' data to be used by the retail teams when

they're thinking about what private-label products to launch.

The oversight question

MR. MURRAY: You've said in the past that you welcome scrutiny

from regulators.

MR. WILKE: The reason we welcome scrutiny is we think the things

we're doing are great for customers and great for citizens. We are

growing. We're substantial. We think we deserve the scrutiny. When

I look at retail, it's a giant market. It's probably $25 trillion.

And we represent world-wide a little over 1%, and in the U.S. maybe

4% to 5%.

MR. MURRAY: How do you differentiate between user data and usage

data? You have my user data, my name and other details of me I've

given you, and you have my usage, what I've bought. Are they

organized separately?

MR. WILKE: For a specific recommendation for you, we might look

at your past purchases. If you come to buy toothpaste, you may see

a widget at the top that says, "Reorder this toothpaste that you

bought last time." That's tied to you.

But we also will look at things that you bought, and then what

you bought next, like we do for all customers. That's more of an

anonymized, "People who bought this also bought." That's just

feeding [data] into a machine-learning or other algorithm to see if

you can improve the results. Less personalized.

MR. MURRAY: When are drones really going to be capable to be

doing a lot of Amazon deliveries?

MR. WILKE: Well, drones will make their mark when they're safe

and cost effective. There are some big pros to them, because they

can fly over traffic, they're really good for the environment,

they're electric powered, so you can run them on renewable energy.

But there's a lot of engineering work. All the announcements right

now are pilots on a relatively small scale.

MR. MURRAY: What's the biggest challenge? They'll fly distances.

Is that last specific problem getting to the right doorstep?

Landing without hurting people?

MR. WILKE: We can do that pretty well. It's, "What if you have

bad weather in the middle of a flight? As there are more drones in

the airspace, how do those drones interact with helicopters, for

example?" The FAA is spending a lot of time thinking about

that.

(END) Dow Jones Newswires

October 24, 2019 19:14 ET (23:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

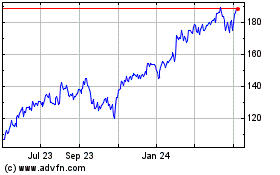

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024