0001023024FALSE00010230242024-05-212024-05-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): May 21, 2024

ANI PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-31812 | 58-2301143 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | |

210 Main Street West Baudette, Minnesota | 56623 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (218) 634-3500

Not Applicable

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which

registered |

| Common Stock | ANIP | Nasdaq Stock Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

ANI Pharmaceuticals, Inc. (the “Company”) held its 2024 Annual Meeting of Stockholders (the “Annual Meeting”) on May 21, 2024. At the Annual Meeting, the stockholders of the Company approved the Amended and Restated 2022 Stock Incentive Plan (the “Amended 2022 Stock Plan”).

The description of the Amended 2022 Stock Plan set forth in the Company’s definitive proxy statement, dated April 5, 2024 (the “Proxy Statement”), section entitled “Proposal 4: Approval of the Amended and Restated 2022 Stock Incentive Plan” beginning on page 47 of the Proxy Statement is incorporated herein by reference. A copy of the full text of the Amended 2022 Stock Plan is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. | | | | | |

| Item 5.07 | Submission of Matters to a Vote of Security Holders |

At the Annual Meeting, the following matters were submitted to a vote of stockholders:1.The election of eight (8) directors to serve until the Company’s 2025 Annual Meeting of Stockholders and until their successors are duly elected and qualified, or until their successors shall have been duly elected and qualified;

2.The ratification of the appointment of EisnerAmper LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024;

3.The approval of the compensation of the Company’s named executive officers, on an advisory basis; and

4.The approval of the Amended 2022 Stock Plan.

At the close of business on March 27, 2024, the record date for the determination of stockholders entitled to vote at the Annual Meeting, there were 25,000 shares of the Company’s Series A Preferred Stock outstanding and entitled to vote at the Annual Meeting, 20,980,307 shares of the Company’s Common Stock outstanding and entitled to vote at the Annual Meeting, and 10,864 shares of the Company’s Class C Special Stock outstanding and entitled to vote at the Annual Meeting. The 25,000 shares of Series A Preferred Stock outstanding as of March 27, 2024 were entitled to cast an aggregate of 610,413 votes and each share of Common Stock and Class C Special Stock was entitled to one vote. Accordingly, there were an aggregate of 21,601,584 votes entitled to be cast at the Annual Meeting, of which an aggregate of 18,106,356 were present virtually or represented by proxy, constituting a quorum.

At the Annual Meeting, (i) the eight directors were elected, (ii) the appointment of the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 was ratified, (iii) the compensation of the Company’s named executive officers, on an advisory basis, was approved, (iv) and the Amended 2022 Stock Plan was approved.

Proposal No. 1 — Election of the Directors

The vote with respect to the election of each of the directors was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nominees | | For | | Against | | Abstain | | Broker Non-Votes |

| Thomas Haughey | | 14,837,619 | | 2,060,363 | | 15,911 | | 1,192,463 |

| Nikhil Lalwani | | 16,838,898 | | 68,125 | | 6,870 | | 1,192,463 |

| Matthew J. Leonard, R.Ph. | | 16,286,549 | | 615,181 | | 12,163 | | 1,192,463 |

| Antonio R. Pera | | 16,451,771 | | 447,404 | | 14,718 | | 1,192,463 |

| Muthusamy Shanmugam | | 16,785,294 | | 116,444 | | 12,155 | | 1,192,463 |

| Renee P. Tannenbaum, Pharm.D. | | 15,830,187 | | 1,068,993 | | 14,713 | | 1,192,463 |

| Jeanne A. Thoma | | 16,487,783 | | 411,401 | | 14,709 | | 1,192,463 |

| Patrick D. Walsh | | 16,477,655 | | 424,150 | | 12,088 | | 1,192,463 |

Proposal No. 2 — Ratification of the Appointment of Independent Registered Public Accounting Firm

The vote with respect to the ratification of the appointment of EisnerAmper LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 was as follows:

| | | | | | | | | | | | | | |

| For | | Against | | Abstain |

| 18,043,078 | | 56,735 | | 6,543 |

Proposal No. 3 — Approval of the Say-on-Pay Proposal

The vote with respect to the approval of the Company’s named executive officers, on an advisory basis, was as follows:

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Votes |

| 16,139,473 | | 762,718 | | 11,702 | | 1,192,463 |

Proposal No. 4 — Approval of the Amended 2022 Stock Plan

The vote with respect to the approval of the Amended 2022 Stock Plan was as follows:

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Votes |

| 16,031,866 | | 871,204 | | 10,823 | | 1,192,463 |

(d)Exhibits

| | | | | |

Exhibit

No. | Description |

| |

| |

| |

| 104 | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Dated: May 23, 2024 | ANI PHARMACEUTICALS, INC. |

| | |

| By: | /s/ Stephen P. Carey |

| Name: | Stephen P. Carey |

| Title: | Senior Vice President Finance and Chief Financial Officer |

ANI PHARMACEUTICALS, INC.

AMENDED AND RESTATED 2022 STOCK INCENTIVE PLAN

NOTICE OF RESTRICTED STOCK GRANT

ANI Pharmaceuticals, Inc., a Delaware corporation (the “Company”), pursuant to its Amended and Restated 2022 Stock Incentive Plan (the “Plan”), hereby grants to the individual listed below (the “Participant”), this grant of shares of restricted Common Stock as set forth below (the “Restricted Shares”) that may become vested subject to the conditions set forth in this Notice of Restricted Stock Grant (this “Notice”), the Restricted Stock Grant Agreement attached hereto as Attachment A (the “Grant Agreement”) and the Plan, each of which is incorporated herein by reference and made part hereof. Unless otherwise defined herein, capitalized terms used in this Notice and the Grant Agreement will have the meanings set forth in the Plan.

| | | | | |

Participant:

| See E*Trade Account |

Date of Grant:

| See E*Trade Account |

| Form of Award: | Restricted Stock Grant |

Shares Underlying Award:

| [See E*Trade Account] Shares of Restricted Stock (the “Restricted Shares”

|

Vesting Schedule:

| The Restricted Shares shall vest as set forth in Section 3 of the Grant Agreement, which generally provides for:

•All of the Restricted Shares shall vest on the earlier of (i) the first anniversary of the Date of Grant and (ii) the date of the first annual meeting of the Company’s stockholders following the Date of Grant (such date, the “Vesting Date”).

•In the event a Change in Control of the Company occurs, all the Restricted Shares shall immediately vest. Upon a termination of the Participant’s service with the Company or any of its Subsidiaries as a result of the Participant’s death or Disability, any Restricted Shares scheduled to vest on the Vesting Date following such termination shall immediately vest. |

Participant Acceptance:

By accepting this award, the Participant agrees to be bound by the terms and conditions of the Plan, the Grant Agreement and this Notice. The Participant acknowledges delivery of the Plan and the Plan prospectus together this with this Notice and the Grant Agreement, as well as the Company’s Insider Trading Policy and the Company’s Clawback Policy (to the extent applicable). The Participant accepts as binding, conclusive and final all decisions or interpretations of the Committee upon any questions arising under the Plan, this Notice, the Grant Agreement, or the Clawback Policy.

The Participant confirms acceptance of this award by clicking the “Accept” (or similar wording) button on the award acceptance screen of the Participant’s Plan account at www.ETRADE.com. If the Participant wishes to reject this award, the Participant must so notify Sherri Bitter, VP, Human Resources, at sherri.bitter@anipharmaceuticals.com or Krista Davis, Chief Human Resources Officer, at krista.davis@anipharmaceuticals.com no later than sixty (60) days after the Date of Grant. If within such sixty (60) day period the Participant neither affirmatively accepts nor affirmatively rejects this award, the Participant will be deemed to have accepted this award at the end of such sixty (60) day period pursuant to the terms and conditions set forth in this Notice, the Award Agreement, and the Plan.

Attachment A

ANI PHARMACEUTICALS, INC.

RESTRICTED STOCK GRANT AGREEMENT

(Pursuant to the Amended and Restated 2022 Stock Incentive Plan)

THIS RESTRICTED STOCK GRANT AGREEMENT (this “Agreement”), which is attached as Attachment A to a Notice of Grant Agreement (the “Notice”), is entered into as of the date set forth on the Notice and is entered into by and between ANI Pharmaceuticals, Inc., a Delaware corporation (the “Company”), and the individual identified as the “Participant” on the Notice. The parties hereto hereby agree as follows:

1. Grant of Shares. The Company hereby grants to the Participant the number of shares of the Company’s Common Stock, $0.0001 par value, that are described as the Restricted Shares on the Notice, subject to the vesting conditions set forth in the Notice and this Agreement.

2. Grant of Restricted Shares. The grant of Restricted Shares contemplated hereby is made pursuant to the Company’s Amended and Restated 2022 Stock Incentive Plan (the “Plan”), which Plan is incorporated herein by reference. This Agreement constitutes a “Restricted Stock Award” within the meaning of the Plan. Capitalized terms used herein and not otherwise defined have the meanings set forth in the Plan.

3. Vesting.

(a) Upon the termination of Participant’s service with the Company and all Subsidiaries for any reason (including, subject to Section 3(b), as a result of Participant’s death or disability), any then unvested Restricted Shares will be automatically forfeited for no payment or consideration.

(b) Unless otherwise provided in the Notice, on the earlier of (i) the first anniversary of the Date of Grant and (ii) the date of the first annual meeting of the Company’s stockholders following the Date of Grant, all of the Restricted Shares subject to the award shall vest, (such date, the “Vesting Date”); provided, however, that (x) if a Change in Control of the Company occurs, all of the Restricted Shares shall immediately vest; and (y) upon the termination of Participant’s service with the Company and all Subsidiaries as a result of the Participant’s death or Disability, any Restricted Shares scheduled to vest on the Vesting Date following such termination shall immediately vest.

(c) The vesting of the Restricted Shares shall be cumulative, but shall not exceed 100% of the shares of Restricted Shares. If the foregoing schedule would produce fractional shares, the number of shares that vest shall be rounded down to the nearest whole share and the fractional shares will be accumulated so that the resulting whole shares will be included in the number of shares that become vested on the last Vesting Date.

4. Adjustments to the Restricted Shares. If, from time to time, during the Restriction Period (as defined below) there is any change affecting the Company’s outstanding Common Stock as a class that is effected without the receipt of consideration by the Company (through merger, consolidation, reorganization, reincorporation, stock dividend, dividend in property other than cash, stock split, liquidating dividend, combination of shares, change in corporation structure or other transaction not involving the receipt of consideration by the Company), then Section 4.3 of the Plan shall apply to the Restricted Shares.

5. Breach of Consulting, Confidentiality or Non-Compete Agreements. Notwithstanding anything in this Agreement to the contrary and in addition to the rights of the Committee under Section 12.4 of the Plan, in the event that the Participant materially breaches the terms of any employment, consulting, confidentiality or non-compete agreement entered into with the Company or any Subsidiary (including an employment, consulting, confidentiality or non-compete agreement made in connection with the grant of the Restricted Shares), whether such breach occurs before or after termination of the Participant’s employment with the Company or any Subsidiary, the Committee in its sole discretion may require the Participant to surrender shares of Common Stock received, and to disgorge any profits (however defined by the Committee),

made or realized by the Participant in connection with this Agreement or the Restricted Shares granted hereunder, in each case to the extent disgorgement or forfeiture of such amounts is required under a policy of the Company or any successor, or its or their subsidiaries, adopted to comply with applicable requirements of law (including Section 10D of the Securities Exchange Act of 1934, as amended) or of any applicable stock exchange.

6. Rights of Participant. Subject to the provisions of this Agreement, Participant (but not any unapproved transferee) shall, during the term of this Agreement, exercise all rights and privileges of a stockholder of the Company with respect to the Restricted Shares. Participant shall be deemed to be the holder for purposes of receiving any dividends that may be paid with respect to such Restricted Shares and for the purpose of exercising any voting rights relating to such Restricted Shares, even if some or all of such Restricted Shares have not yet vested.

7. Limitations on Transfer. In addition to any other limitation on transfer created by applicable securities laws, during the period before the Restricted Shares vest in accordance with Section 3 (the “Restriction Period”), Participant shall not assign, hypothecate, donate, encumber or otherwise dispose of any interest in any of the unvested Restricted Shares.

8. Share Certificates. Reasonably promptly following the Date of Grant, the Company shall reflect ownership thereof in book entry form on the Company’s books and records, or, in its discretion cause to be issued to the Participant a certificate in respect of the Restricted Shares. If certificates representing the Restricted Shares are issued, they shall be issued in the name of the Participant, but held in the physical possession of the Company, and the Participant shall execute in blank a stock power in a form provided by the Company, allowing the Company to transfer the shares of Restricted Shares in the event they are forfeited pursuant to the terms of this Grant Agreement. Such certificates shall bear the following (or a similar) legend in addition to any other legends that may be required under federal or state securities laws:

“THE TRANSFERABILITY OF THIS CERTIFICATE AND THE SHARES OF COMMON STOCK REPRESENTED HEREBY ARE SUBJECT TO THE TERMS AND CONDITIONS (INCLUDING FORFEITURE) CONTAINED IN THE ANI PHARMACEUTICALS, INC. AMENDED AND RESTATED 2022 STOCK INCENTIVE PLAN AND A RESTRICTED STOCK GRANT AGREEMENT BETWEEN THE STOCKHOLDER AND ANI PHARMACEUTICALS, INC. A COPY OF THE PLAN AND THE GRANT AGREEMENT ARE ON FILE WITH ANI PHARMACEUTICALS, INC.”

9. Section 83(b) Election. Participant understands that Section 83(a) of the Internal Revenue Code of 1986, as amended (the “Code”), taxes as ordinary income the difference between the amount paid for the Restricted Shares and the fair market value of the Restricted Shares as of the date any restrictions on the Restricted Shares lapse. Participant understands that Participant may elect to be taxed at the time the Restricted Shares are awarded, rather than when and as the Restricted Shares vest, by filing an election under Section 83(b) of the Code (an “83(b) Election”) with the Internal Revenue Service within thirty (30) days from the date of purchase. A copy of an 83(b) Election form that can be used for this purpose can be attained on request from the Company. Even if the fair market value of the Restricted Shares at the time of the execution of this Agreement equals the amount paid for the Restricted Shares, the 83(b) Election must be made to avoid income under Section 83(a) in the future. Participant understands that failure to file such an 83(b) Election in a timely manner may result in adverse tax consequences for Participant. Participant further understands that an additional copy of such 83(b) Election is required to be filed with his or her federal income tax return for the calendar year in which the date of this Agreement falls. Participant further acknowledges and understands that it is Participant’s sole obligation and responsibility to timely file such 83(b) Election, and neither the Company nor the Company’s legal or financial advisors shall have any obligation or responsibility with respect to such filing. Participant acknowledges that the foregoing is only a summary of the effect of United States federal income taxation with respect to purchase of the Restricted Shares hereunder, and does not purport to be complete. Participant further acknowledges that the Company has directed Participant to seek independent advice regarding the applicable provisions of the Code, the income tax laws of any municipality, state or foreign country in which Participant may reside, and the tax consequences of Participant’s death. Participant assumes all responsibility for completing and filing an 83(b) Election and paying all taxes resulting from such election or the lapse of the restrictions on the Restricted Shares.

10. Refusal to Transfer. The Company or its transfer agent shall not be required (a) to transfer on its books any Restricted Shares that shall have been transferred in violation of any of the provisions set forth in this Agreement or (b) to treat as owner of such shares or to accord the right to vote as such owner or to pay dividends to any transferee to whom such Restricted Shares shall have been so transferred.

11. No Employment or Service Rights. This Agreement is not an employment or service contract and nothing in this Agreement shall affect in any manner whatsoever the right or power of the Company (or any parent or subsidiary of the Company) to terminate Participant’s relationship with the Company for any reason at any time, with or without cause and with or without notice.

12. Miscellaneous.

(a) Notices. Any notice or other communication required or permitted to be delivered to any party under this Agreement shall be in writing and shall be deemed properly delivered, given and received when delivered (by hand, by registered mail, or by courier or express delivery service) to the address or facsimile number set forth beneath the name of such party on the signature page hereto (or to such other address or facsimile number as such party shall have specified in a written notice given to the other parties hereto).

(b) Successors and Assigns. This Agreement shall bind and inure to the benefit of the successors and assigns of the Company and, subject to the restrictions on transfer herein set forth, inure to the benefit of and be binding upon Participant and Participant’s heirs, executors, administrators, successors, and assigns. Without limiting the generality of the foregoing, this Agreement shall be assignable by the Company at any time or from time to time, in whole or in part.

(c) Governing Law. This Agreement shall be governed by and construed and enforced in accordance with the laws of the State of Delaware.

(d) Further Assurances. The parties agree to execute all such further instruments and to take all such further action as may reasonably be necessary to carry out the intent of this Agreement.

(e) Amendment. This Agreement may not be amended, modified or revoked, in whole or in part, except by an agreement in writing signed by each of the parties hereto.

(f) Severability. In the event that any provision of this Agreement, or the application of any such provision to any person or set of circumstances, shall be determined to be invalid, unlawful, void or unenforceable to any extent, the remainder of this Agreement, and the application of such provision to persons or circumstances other than those as to which it is determined to be invalid, unlawful, void or unenforceable, shall not be impaired or otherwise affected and shall continue to be valid and enforceable to the fullest extent permitted by law.

(g) Counterparts. This Agreement may be executed in two or more counterparts and signature pages may be delivered via facsimile, each of which shall be deemed an original and all of which together shall constitute one instrument.

ANI PHARMACEUTICALS, INC.

AMENDED AND RESTATED 2022 STOCK INCENTIVE PLAN

NOTICE OF RESTRICTED STOCK GRANT

ANI Pharmaceuticals, Inc., a Delaware corporation (the “Company”), pursuant to its Amended and Restated 2022 Stock Incentive Plan (the “Plan”), hereby grants to the individual listed below (the “Participant”), this grant of shares of restricted Common Stock as set forth below (the “Restricted Shares”) that may become vested subject to the conditions set forth in this Notice of Restricted Stock Grant (this “Notice”), the Restricted Stock Grant Agreement attached hereto as Attachment A (the “Grant Agreement”) and the Plan, each of which is incorporated herein by reference and made part hereof. Unless otherwise defined herein, capitalized terms used in this Notice and the Grant Agreement will have the meanings set forth in the Plan.

| | | | | |

Participant:

| See E*Trade Account |

Date of Grant:

| See E*Trade Account |

| Form of Award: | Restricted Stock Grant |

Shares Underlying Award:

| [See E*Trade Account] Shares of Restricted Stock (the “Restricted Shares”

|

Vesting Schedule:

| The Restricted Shares shall vest as set forth in Section 3 of the Grant Agreement, which generally provides for:

•On the first anniversary of the Date of Grant 25% of the Restricted Shares shall vest, on the second anniversary of the Date of Grant an additional 25% of the Restricted Shares shall vest, on the third anniversary of the Date of Grant an additional 25% of the Restricted Shares shall vest and on the fourth anniversary of the Date of Grant all of the remaining Restricted Shares shall vest (each such anniversary of the Date of Grant, a “Vesting Date”); provided in each case Participant is employed and in good standing through the applicable Vesting Date.

•Upon a termination of the Participant’s employment with the Company or any of its Subsidiaries as a result of the Participant’s death or Disability, any Restricted Shares scheduled to vest on the first Vesting Date following such termination shall immediately vest. |

Participant Acceptance:

By accepting this award, the Participant agrees to be bound by the terms and conditions of the Plan, the Grant Agreement and this Notice. The Participant acknowledges delivery of the Plan and the Plan prospectus together this with this Notice and the Grant Agreement, as well as the Company’s Insider Trading Policy and the Company’s Clawback Policy. The Participant accepts as binding, conclusive and final all decisions or interpretations of the Committee upon any questions arising under the Plan, this Notice, the Grant Agreement, or the Clawback Policy.

The Participant confirms acceptance of this award by clicking the “Accept” (or similar wording) button on the award acceptance screen of the Participant’s Plan account at www.ETRADE.com. If the Participant wishes to reject this award, the Participant must so notify Sherri Bitter, VP, Human Resources, at sherri.bitter@anipharmaceuticals.com or Krista Davis, Chief Human Resources Officer, at krista.davis@anipharmaceuticals.com no later than sixty (60) days after the Date of Grant. If within such sixty (60) day period the Participant neither affirmatively accepts nor affirmatively rejects this award, the Participant will be deemed to have accepted this award at the end of such sixty (60) day period pursuant to the terms and conditions set forth in this Notice, the Award Agreement, and the Plan.

Attachment A

ANI PHARMACEUTICALS, INC.

RESTRICTED STOCK GRANT AGREEMENT

(Pursuant to the Amended and Restated 2022 Stock Incentive Plan)

THIS RESTRICTED STOCK GRANT AGREEMENT (this “Agreement”), which is attached as Attachment A to a Notice of Grant Agreement (the “Notice”), is entered into as of the date set forth on the Notice and is entered into by and between ANI Pharmaceuticals, Inc., a Delaware corporation (the “Company”), and the individual identified as the “Participant” on the Notice. The parties hereto hereby agree as follows:

1. Grant of Shares. The Company hereby grants to the Participant the number of shares of the Company’s Common Stock, $0.0001 par value, that are described as the Restricted Shares on the Notice, subject to the vesting conditions set forth in the Notice and this Agreement.

2. Grant of Restricted Shares. The grant of Restricted Shares contemplated hereby is made pursuant to the Company’s Amended and Restated 2022 Stock Incentive Plan (the “Plan”), which Plan is incorporated herein by reference. This Agreement constitutes a “Restricted Stock Award” within the meaning of the Plan. Capitalized terms used herein and not otherwise defined have the meanings set forth in the Plan.

3. Vesting.

(a) Subject to any vesting acceleration protections set forth in a written agreement between Participant and the Company (a “Written Agreement”), upon the termination of Participant’s employment with the Company and all Subsidiaries for any reason (including, subject to Section 3(b), as a result of Participant’s death or disability), any then unvested Restricted Shares will be automatically forfeited for no payment or consideration.

(b) Unless otherwise provided in the Notice, on the first anniversary of the Date of Grant 25% of the Restricted Shares shall vest, on the second anniversary of the Date of Grant an additional 25% of the Restricted Shares shall vest, on the third anniversary of the Date of Grant an additional 25% of the Restricted Shares shall vest and on the fourth anniversary of the Date of Grant all of the remaining Restricted Shares shall vest (each such anniversary of the Date of Grant , a “Vesting Date”); provided, however, that (i) the vesting acceleration provisions in any applicable Written Agreement shall apply as set forth therein; (ii) vesting may accelerate pursuant to Section 14 of the Plan; and (iii) upon the termination of Participant’s employment with the Company and all Subsidiaries as a result of the Participant’s death or Disability, any Restricted Shares scheduled to vest on the first Vesting Date following such termination shall immediately vest.

(c) The vesting of the Restricted Shares shall be cumulative, but shall not exceed 100% of the shares of Restricted Shares. If the foregoing schedule would produce fractional shares, the number of shares that vest shall be rounded down to the nearest whole share and the fractional shares will be accumulated so that the resulting whole shares will be included in the number of shares that become vested on the last Vesting Date.

(d) In the event of a Change in Control or Corporate Transaction (as each term is defined in the Plan), Section 14 of the Plan shall apply to the Restricted Shares.

4. Adjustments to the Restricted Shares. If, from time to time, during the Restriction Period (as defined below) there is any change affecting the Company’s outstanding Common Stock as a class that is effected without the receipt of consideration by the Company (through merger, consolidation, reorganization, reincorporation, stock dividend, dividend in property other than cash, stock split, liquidating dividend, combination of shares, change in corporation structure or other transaction not involving the receipt of consideration by the Company), then Section 4.3 of the Plan shall apply to the Restricted Shares.

5. Breach of Consulting, Confidentiality or Non-Compete Agreements. Notwithstanding anything in this Agreement to the contrary and in addition to the rights of the Committee under Section 12.4 of the Plan, in the event that the Participant materially breaches the terms of any employment, consulting, confidentiality or non-compete agreement entered into with the Company or any Subsidiary (including an employment, consulting, confidentiality or non-compete agreement made in connection with the grant of the Restricted Shares), whether such breach occurs before or after termination of the Participant’s employment with the Company or any Subsidiary, the Committee in its sole discretion may require the Participant to surrender shares of Common Stock received, and to disgorge any profits (however defined by the Committee), made or realized by the Participant in connection with this Agreement or the Restricted Shares granted hereunder, in each case to the extent disgorgement or forfeiture of such amounts is required under a policy of the Company or any successor, or its or their subsidiaries, adopted to comply with applicable requirements of law (including Section 10D of the Securities Exchange Act of 1934, as amended) or of any applicable stock exchange.

6. Rights of Participant. Subject to the provisions of this Agreement, Participant (but not any unapproved transferee) shall, during the term of this Agreement, exercise all rights and privileges of a stockholder of the Company with respect to the Restricted Shares. Participant shall be deemed to be the holder for purposes of receiving any dividends that may be paid with respect to such Restricted Shares and for the purpose of exercising any voting rights relating to such Restricted Shares, even if some or all of such Restricted Shares have not yet vested.

7. Limitations on Transfer. In addition to any other limitation on transfer created by applicable securities laws, during the period before the Restricted Shares vest in accordance with Section 3 (the “Restriction Period”), Participant shall not assign, hypothecate, donate, encumber or otherwise dispose of any interest in any of the unvested Restricted Shares.

8. Share Certificates. Reasonably promptly following the Date of Grant, the Company shall reflect ownership thereof in book entry form on the Company’s books and records, or, in its discretion cause to be issued to the Participant a certificate in respect of the Restricted Shares. If certificates representing the Restricted Shares are issued, they shall be issued in the name of the Participant, but held in the physical possession of the Company, and the Participant shall execute in blank a stock power in a form provided by the Company, allowing the Company to transfer the shares of Restricted Shares in the event they are forfeited pursuant to the terms of this Grant Agreement. Such certificates shall bear the following (or a similar) legend in addition to any other legends that may be required under federal or state securities laws:

“THE TRANSFERABILITY OF THIS CERTIFICATE AND THE SHARES OF COMMON STOCK

REPRESENTED HEREBY ARE SUBJECT TO THE TERMS AND CONDITIONS (INCLUDING

FORFEITURE) CONTAINED IN THE ANI PHARMACEUTICALS, INC. AMENDED AND

RESTATED 2022 STOCK INCENTIVE PLAN AND A RESTRICTED STOCK GRANT AGREEMENT

BETWEEN THE STOCKHOLDER AND ANI PHARMACEUTICALS, INC. A COPY OF THE PLAN

AND THE GRANT AGREEMENT ARE ON FILE WITH ANI PHARMACEUTICALS, INC.”

9. Section 83(b) Election. Participant understands that Section 83(a) of the Internal Revenue Code of 1986, as amended (the “Code”), taxes as ordinary income the difference between the amount paid for the Restricted Shares and the fair market value of the Restricted Shares as of the date any restrictions on the Restricted Shares lapse. Participant understands that Participant may elect to be taxed at the time the Restricted Shares are awarded, rather than when and as the Restricted Shares vest, by filing an election under Section 83(b) of the Code (an “83(b) Election”) with the Internal Revenue Service within thirty (30) days from the date of purchase. A copy of an 83(b) Election form that can be used for this purpose can be attained on request from the Company. Even if the fair market value of the Restricted Shares at the time of the execution of this Agreement equals the amount paid for the Restricted Shares, the 83(b) Election must be made to avoid income under Section 83(a) in the future. Participant understands that failure to file such an 83(b) Election in a timely manner may result in adverse tax consequences for Participant. Participant further understands that an additional copy of such 83(b) Election is required to be filed with his or her federal income tax return for the calendar year in which the date of this Agreement falls. Participant further acknowledges and understands that it is Participant’s sole obligation and responsibility to timely file such 83(b) Election, and neither the Company nor the Company’s legal or financial advisors shall have any obligation or responsibility with respect to such filing. Participant acknowledges that the foregoing is only a summary of the effect of United States federal income taxation with respect to purchase of the Restricted Shares hereunder, and does not purport to be complete. Participant further acknowledges that the Company has directed Participant to seek independent advice regarding the applicable provisions of the Code, the income tax laws of any municipality, state or foreign country in which Participant

may reside, and the tax consequences of Participant’s death. Participant assumes all responsibility for completing and filing an 83(b) Election and paying all taxes resulting from such election or the lapse of the restrictions on the Restricted Shares.

10. Refusal to Transfer. The Company or its transfer agent shall not be required (a) to transfer on its books any Restricted Shares that shall have been transferred in violation of any of the provisions set forth in this Agreement or (b) to treat as owner of such shares or to accord the right to vote as such owner or to pay dividends to any transferee to whom such Restricted Shares shall have been so transferred.

11. No Employment Rights. This Agreement is not an employment contract and nothing in this Agreement shall affect in any manner whatsoever the right or power of the Company (or any parent or subsidiary of the Company) to terminate Participant’s relationship with the Company for any reason at any time, with or without cause and with or without notice.

12. Miscellaneous.

(a) Notices. Any notice or other communication required or permitted to be delivered to any party under this Agreement shall be in writing and shall be deemed properly delivered, given and received when delivered (by hand, by registered mail, or by courier or express delivery service) to the address or facsimile number set forth beneath the name of such party on the signature page hereto (or to such other address or facsimile number as such party shall have specified in a written notice given to the other parties hereto).

(b) Successors and Assigns. This Agreement shall bind and inure to the benefit of the successors and assigns of the Company and, subject to the restrictions on transfer herein set forth, inure to the benefit of and be binding upon Participant and Participant’s heirs, executors, administrators, successors, and assigns. Without limiting the generality of the foregoing, this Agreement shall be assignable by the Company at any time or from time to time, in whole or in part.

(c) Governing Law. This Agreement shall be governed by and construed and enforced in accordance with the laws of the State of Delaware.

(d) Further Assurances. The parties agree to execute all such further instruments and to take all such further action as may reasonably be necessary to carry out the intent of this Agreement.

(e) Amendment. This Agreement may not be amended, modified or revoked, in whole or in part, except by an agreement in writing signed by each of the parties hereto.

(f) Severability. In the event that any provision of this Agreement, or the application of any such provision to any person or set of circumstances, shall be determined to be invalid, unlawful, void or unenforceable to any extent, the remainder of this Agreement, and the application of such provision to persons or circumstances other than those as to which it is determined to be invalid, unlawful, void or unenforceable, shall not be impaired or otherwise affected and shall continue to be valid and enforceable to the fullest extent permitted by law.

(g) Counterparts. This Agreement may be executed in two or more counterparts and signature pages may be delivered via facsimile, each of which shall be deemed an original and all of which together shall constitute one instrument.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

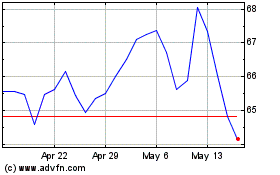

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From May 2024 to Jun 2024

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Jun 2023 to Jun 2024