ATN International, Inc. (Nasdaq: ATNI), a leading provider of

digital infrastructure and communications services, invites

investors to log on as Brad Martin and Carlos Doglioli lead a

webcasted presentation and participate in a fireside chat at the

Sidoti Spring 2024 Small Cap Virtual Conference today at 9:15am ET.

Management will highlight the Company’s progress executing its

three-year strategy to invest in growth and drive sustainable

shareholder value-creation, as well as provide further details on

the Company’s minimal ACP exposure. The Company also will host

one-on-one meetings with investors at the conference.

Key Takeaways:

- ATN reiterates its full-year 2024 outlook

- ATN remains well positioned to increase subscribers, revenues

and Adjusted EBITDA1 as the Company leverages the investments made

through its Glass & Steel™ and First-to-Fiber growth

strategies

- The Company’s

exposure to the Affordable Connectivity Program (ACP) is not

expected to impact previously provided revenue and Adjusted EBITDA

guidance

ATN remains on track to deliver on its

previously stated full-year 2024 guidance.

Consistent with its previously issued 2024

outlook, ATN continues to expect:

- Revenue for full year 2024 to be in

the range of $750 to $770 million, excluding construction

revenue;

- Adjusted EBITDA1 for full year 2024

to be in the range of $200 to $208 million;

- Capital expenditures for full year

2024 to be in the range of $110 to $120 million (net of

reimbursements); and

- Net Debt Ratio2

to be in the range of 2.25x to 2.40x exiting 2024.

For the Company’s full year 2024 outlook for

Adjusted EBITDA, the Company is not able to provide without

unreasonable effort the most directly comparable GAAP financial

measures, or reconciliations to such GAAP financial measures, on a

forward-looking basis. Please see “Use of Non-GAAP Financial

Measures” below for a full description of items excluded from the

Company’s expected Adjusted EBITDA.

ATN’s three-year strategic investment

plan (FY2022 to FY2024) anchored by its Glass &

Steel™ and First-to-Fiber growth strategies

are driving growth across the enterprise.

- Through year-end 2024, ATN is expected to have invested a total

of nearly $450 million upgrading and expanding its network, in line

with its three-year strategic investment growth plan, which is set

to conclude at the end of 2024.

- Since launching its strategy at the start of 2022, ATN has

expanded its fiber network reach by nearly 30% through the end of

2023.

- Over the same period, ATN has increased high-speed broadband

subscribers by 39%, and nearly doubled homes passed by high-speed

broadband.

ATN has limited exposure to the

Affordable Connectivity Program (ACP) and has mitigation measures

in place to offset any potential impacts to the

Company.

- In total, ATN has approximately 15,000 subscribers that

participate in the ACP, many of which were existing

subscribers.

- ATN is actively working with customers to mitigate the impact

of any potential disruptions to the ACP.

- Discontinuation

of the ACP is not expected to impact the Company’s 2024

outlook.

Presentation Date: Thursday,

March 14th

Presentation Time: 9:15am

ET

To view the webcast, please visit the Events

& Presentation page of the ATN investor relations website via

the following link: https://ir.atni.com/events-and-presentations.

An on-demand replay of the presentation will be available in the

same location shortly after the conclusion of the presentation.

Use of Non-GAAP Financial Measures and Definition of

Terms

In addition to financial measures prepared in accordance with

generally accepted accounting principles (GAAP), this press release

also contains non-GAAP financial measures. Specifically, the

Company has included EBITDA, Adjusted EBITDA, Net Debt, and Net

Debt Ratio in this release and the tables included herein.

EBITDA is defined as Operating income (loss)

before depreciation and amortization expense.

Adjusted EBITDA is defined as Operating income

(loss) before depreciation and amortization expense,

transaction-related charges, restructuring expenses, one-time

impairment or special charges, and the gain (loss) on disposition

of assets and contingent consideration. In order to more closely

align with similar calculations presented by companies in its

industry, beginning in the first quarter of 2023, the Company

excluded non-cash stock-based compensation in its adjustment to

derive Adjusted EBITDA. Prior periods have been restated to conform

to this definition change.

Net Debt is defined as total debt less cash and

cash equivalents and restricted cash.

Net Debt Ratio is defined as Net Debt divided

by the trailing four quarters’ ended total Adjusted EBITDA at the

measurement date.

The Company believes that the inclusion of these non-GAAP

financial measures helps investors gain a meaningful understanding

of the Company's core operating results and enhances the usefulness

of comparing such performance with prior periods. Management uses

these non-GAAP measures, in addition to GAAP financial measures, as

the basis for measuring the Company’s core operating performance

and comparing such performance to that of prior periods. The

non-GAAP financial measures included in this press release are not

meant to be considered superior to or a substitute for results of

operations prepared in accordance with GAAP. Reconciliations of

these non-GAAP financial measures to the most directly comparable

GAAP financial measures are set forth in the text of, and the

accompanying tables to, this press release. While non-GAAP

financial measures are an important tool for financial and

operational decision-making and for evaluating the Company’s own

operating results over different periods of time, the Company urges

investors to review the reconciliation of these financial measures

to the comparable GAAP financial measures included below, and not

to rely on any single financial measure to evaluate its

business.

About ATN

ATN International, Inc. (Nasdaq: ATNI), headquartered

in Beverly, Massachusetts, is a leading provider of digital

infrastructure and communications services for all. The Company

operates in the United States and internationally,

including the Caribbean region, with a focus on rural and

remote markets with a growing demand for infrastructure

investments. The Company’s operating subsidiaries today primarily

provide: (i) advanced wireless and wireline connectivity to

residential, business, and government customers, including a range

of high-speed Internet and data services, fixed and mobile wireless

solutions, and video and voice services; and (ii) carrier and

enterprise communications services, such as terrestrial and

submarine fiber optic transport, and communications tower

facilities. For more information, please

visit www.atni.com.

Cautionary Language Concerning

Forward-Looking Statements

This press release contains forward-looking

statements relating to, among other matters, the Company’s future

financial performance, business goals and objectives, results of

operations, expectations regarding the transition of its US Telecom

business, its future revenues, operating income, operating margin,

cash flows, network and operating costs, Adjusted EBITDA, Net Debt

Ratio, capital investments, demand for the Company’s services and

industry trends; the Company’s liquidity, the expansion of the

Company’s customer base and networks, receipt of certain government

grants, and management’s plans, expectations and strategy for the

future. These forward-looking statements are based on estimates,

projections, beliefs, and assumptions and are not guarantees of

future events or results. Actual future events and results could

differ materially from the events and results indicated in these

statements as a result of many factors, including, among others,

(1) the general performance of the Company’s operations, including

operating margins, revenues, capital expenditures, and the

retention of and future growth of the Company’s subscriber base;

(2) the Company’s reliance on a limited number of key suppliers and

vendors for timely supply of equipment and services relating to the

Company’s network infrastructure; (3) the Company’s ability to

satisfy the needs and demands of the Company’s major carrier

customers; (4) the Company’s ability to realize expansion plans for

its fiber markets; (5) the adequacy and expansion capabilities of

the Company’s network capacity and customer service system to

support the Company’s customer growth; (6) the Company’s ability to

efficiently and cost-effectively upgrade the Company’s networks and

information technology platforms to address rapid and significant

technological changes in the telecommunications industry; (7) the

Company’s continued access to capital and credit markets on terms

it deems favorable; (8) government subsidy program availability and

regulation of the Company’s businesses, which may impact the

Company’s telecommunications licenses, the Company’s revenue and

the Company’s operating costs; (9) the Company’s ability to

successfully transition its US Telecom business away from wholesale

mobility to other carrier and consumer-based services; (10) ongoing

risk of an economic downturn, political, geopolitical and other

risks and opportunities facing the Company’s operations, including

those resulting from the continued inflation and other

macroeconomic headwinds including increased costs and supply chain

disruptions; (11) management transitions, and the loss of, or an

inability to recruit skilled personnel in the Company’s various

jurisdictions, including key members of management; (12) the

Company’s ability to find investment or acquisition or disposition

opportunities that fit the strategic goals of the Company; (13) the

occurrence of weather events and natural catastrophes and the

Company’s ability to secure the appropriate level of insurance

coverage for these assets; and (14) increased competition. These

and other additional factors that may cause actual future events

and results to differ materially from the events and results

indicated in the forward-looking statements above are set forth

more fully under Item 1A “Risk Factors” of the Company’s Annual

Report on Form 10-K for the year ended December 31, 2022, filed

with the SEC on March 15, 2023, and the other reports the Company

files from time to time with the SEC. The Company undertakes no

obligation and has no intention to update these forward-looking

statements to reflect actual results, changes in assumptions, or

changes in other factors that may affect such forward-looking

statements, except as required by law.

|

Contact: |

|

|

|

|

|

Michele Satrowsky |

Ian Rhoades |

|

Treasurer |

Investor Relations |

|

978-619-1300 |

ATNI@investorrelations.com |

|

|

|

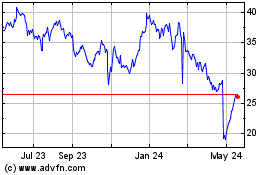

ATN (NASDAQ:ATNI)

Historical Stock Chart

From Nov 2024 to Dec 2024

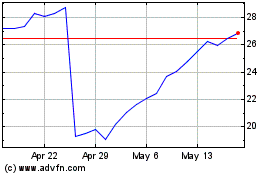

ATN (NASDAQ:ATNI)

Historical Stock Chart

From Dec 2023 to Dec 2024