Current Report Filing (8-k)

May 25 2023 - 4:00PM

Edgar (US Regulatory)

0000701288

false

--12-31

0000701288

2023-05-22

2023-05-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934.

Date of Report: May 22, 2023

(Date of earliest event reported)

Atrion Corporation

(Exact name of registrant as specified in

its charter)

| Delaware |

001-32982 |

63-0821819 |

| (State or other jurisdiction |

(Commission File |

(I. R. S. Employer |

| of incorporation or organization) |

Number) |

Identification No.) |

| One Allentown Parkway |

|

|

| Allen, Texas |

|

75002 |

| (Address of principal executive offices) |

|

(Zip Code) |

(972)

390-9800

(Registrant's

telephone number, including area code)

Not Applicable

(Former Name

or Former Address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which

registered |

| Common stock, par value $0.10 per share |

|

ATRI |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 | Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On May 23, 2023, the Board of Directors of the Registrant,

upon the recommendation of the Compensation Committee of the Board of Directors approved and adopted the Atrion Corporation 2023 Annual

Incentive Compensation Plan (the "Plan"). The purpose of the Plan is to enable the Registrant to attract and retain employees,

including named executive officers, by providing a competitive cash bonus program that rewards outstanding performance. The Plan is intended

to replace the Short-Term Incentive Compensation Plan adopted in 2013 for awards granted in 2023 and thereafter.

Pursuant to the Plan, executive officers of the

Registrant and salaried employees of the Registrant and its subsidiaries will be eligible to receive compensation based on attainment

of certain performance goals ("Performance Goals"). The Administrator (the Compensation Committee or its delegee) will determine

the individuals that may participate in the Plan, select the period for which performance is calculated, and establish Performance Goals

for each participant.

Performance Goals will be based upon one or more

performance criteria selected by the Administrator, each of which may carry a different weight and may differ from participant to participant.

Performance criteria may include the following business criteria, either individually, alternatively, or in any combination, applied to

either the Registrant as a whole or to a business unit or subsidiary, either individually, alternatively, or in any combination, and measured

either annually or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years’

results, or to a designated comparison peer group, in each case as specified by the Administrator: (i) gross sales or net sales; (ii)

gross margin or cost of goods sold; (iii) selling, general and administrative expenses; (iv) operating income, earnings from operations,

earnings before or after taxes, or earnings before or after interest, depreciation, amortization, or extraordinary or special items; (v)

net income or net income per basic or diluted share of common stock; (vi) return on assets, return on invested capital, or return on equity;

(vii) cash flow, free cash flow, cash flow return on investment, or net cash provided by operations; (viii) economic profit or economic

value created; (ix) stock price or total stockholder return; (x) staffing, diversity, training and development, succession planning, and

employee satisfaction; (xi) acquisitions or divestitures of subsidiaries, affiliates, or joint ventures; (xii) safety; and (xiii) such

other objective or subjective performance criteria as the Administrator may determine. Following the completion of the applicable performance

period, the Administrator will assess and certify the extent that the Performance Goals were achieved or exceeded, and determine the payment

for each participant, if any.

The foregoing summary of the Plan does not purport

to be complete and is qualified in its entirety by reference to the full text of the Plan, a copy of which is filed as Exhibit 10.1 to

this Current Report on Form 8-K.

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On May 22, 2023, the

Board of Directors of the Registrant approved the amendment and restatement of the Registrant’s Bylaws, effective immediately, to:

• Revise

Section 1.05 regarding notice of meetings to include provisions of Article Eleven, which has been deleted in the amended and

restated Bylaws, and address recent amendments to the Delaware General Corporation Law respecting electronic transmission;

• Revise

Section 2.10 to update the disclosure, notification, and other requirements related to nominations of directors and solicitations

of proxies, including requiring compliance with Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”);

• Revise

Section 3.13 to provide that the Board of Directors may assign additional duties and responsibilities to the Lead Director;

• Add

Section 7.08 to permit documents to be executed using facsimile or other forms of electronic signature to the fullest extent permitted

by applicable law; and

• Make

other ministerial and clarifying changes.

The foregoing summary does not purport to be complete

and is qualified in its entirety by reference to the full text of the Bylaws as amended and restated, a copy of which is filed as Exhibit 3.1

to this Current Report on Form 8-K.

| Item 5.07 |

Submission of Matters to a Vote of Security Holders. |

On May 23, 2023, the Registrant held its 2023

annual meeting of stockholders. Stockholders voted on the matters below.

1. Election

of Directors. The nominees listed below were elected to serve as directors until the 2026 annual meeting of stockholders and until

their successors are duly elected and qualified, based on the following votes:

| Director | |

Votes For | |

Votes Against | |

Abstentions | |

Broker Non-Votes |

| Emile A Battat | |

1,366,266 | |

59,245 | |

1,519 | |

199,970 |

| Ronald N. Spaulding | |

923,801 | |

501,502 | |

1,727 | |

199,970 |

2. Ratification

of Appointment of Independent Registered Public Accounting Firm. The Registrant’s stockholders ratified the appointment of Grant

Thornton LLP as the Registrant’s independent registered public accounting firm for the year ending December 31, 2023, based

on the following votes:

| Votes For | |

Votes Against | |

Abstentions | |

Broker Non-Votes |

| 1,618,687 | |

4,761 | |

3,552 | |

0 |

3. Advisory

Vote to Approve Executive Officer Compensation. The Registrant’s stockholders approved, on an advisory basis, the compensation

of the Registrant's executive officers, based on the following votes:

| Votes For | |

Votes Against | |

Abstentions | |

Broker Non-Votes |

| 1,412,395 | |

12,859 | |

1,776 | |

199,970 |

4. Advisory

Vote on Frequency of the Advisory Voting on Executive Officer Compensation. As reflected in the votes set forth below, the Registrant’s

stockholders expressed a preference that the advisory voting on executive officer compensation be held every year.

| One Year | |

Two Years | |

Three Years | |

Abstain | |

Broker Non-Votes |

| 1,323,922 | |

347 | |

100,487 | |

2,274 | |

199,970 |

Based on these results, and the Board of Directors’ prior recommendation,

the Board of Directors has determined to continue to hold an advisory vote to approve executive officer compensation on an annual basis

(i.e. every year) until such time as the next advisory vote is submitted to stockholders regarding the frequency of advisory

votes on executive compensation or the Board of Directors otherwise determines that a different frequency for such advisory voting is

in the best interests of the stockholders.

Section 2.10 of the Registrant’s Bylaws

provides that stockholders who intend to solicit proxies in support of director nominees other than the Registrant’s nominees in

connection with an annual meeting of stockholders must deliver written notice to the Registrant’s Secretary at the Registrant’s

principal executive offices setting forth the information required by said section, including the information required by Rule 14a-19

under the Exchange Act, not earlier than the close of business on the 150th day and not later than the close of business on the 120th

day prior to the annual meeting and must comply with the additional requirements of Rule 14a-19. Accordingly, such notice for the

2024 annual meeting must be delivered not earlier than December 25, 2023 and not later than January 24, 2024. However, in the

event the date of the annual meeting is more than 30 days before or more than 60 days after May 23, 2024, notice by the stockholder

to be timely must be received by the Registrant’s Secretary not earlier than the close of business on the 150th day prior to such

meeting and not later than the close of business on the later of the 120th day prior to the date of such meeting or, if the first public

announcement of the date of such advanced or delayed annual meeting is less than 130 days prior to the date of such meeting, the tenth

day following the date on which public announcement of the date of the meeting is first made.

| Item 9.01 | Financial Statements and

Exhibits. |

(d) Exhibits.

The following exhibits are filed herewith:

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ATRION CORPORATION |

| |

|

|

| |

|

|

| Date: May 25, 2023 |

By: |

/s/ Cindy Ferguson |

| |

|

Cindy Ferguson

Vice President and Chief Financial Officer, Secretary and Treasurer |

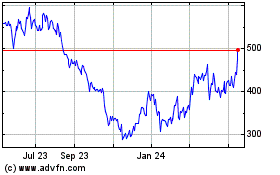

ATRION (NASDAQ:ATRI)

Historical Stock Chart

From Jun 2024 to Jul 2024

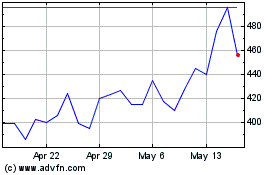

ATRION (NASDAQ:ATRI)

Historical Stock Chart

From Jul 2023 to Jul 2024