Atlanta Braves Holdings, Inc. (“ABH”) (Nasdaq: BATRA, BATRK)

today reported second quarter 2024 results.

Headlines include:

- Total revenue grew 5% to $283 million in second quarter

- Baseball revenue up 4% to $266 million

- Mixed-use development revenue up 11% to $17 million

- Operating income up 28% to $25 million and Adjusted OIBDA(1) up

9% to $46 million in second quarter

- Announced new and expanded seating options at Truist Park to

open ahead of 2025 season as part of commitment to enhance fan

experience

Discussion of Results

Three months ended

Six months ended

June 30,

June 30,

2023

2024

% Change

2023

2024

% Change

amounts in thousands

amounts in thousands

Baseball revenue

$

254,935

$

266,001

4

%

$

272,496

$

287,971

6

%

Mixed-use development revenue

15,188

16,875

11

%

28,599

31,985

12

%

Total revenue

270,123

282,876

5

%

301,095

319,956

6

%

Operating costs and expenses:

Baseball operating costs

(195,458

)

(205,070

)

(5

)%

(232,229

)

(250,277

)

(8

)%

Mixed-use development costs

(2,273

)

(2,410

)

(6

)%

(4,204

)

(4,663

)

(11

)%

Selling, general and administrative,

excluding stock-based compensation

(30,522

)

(29,646

)

3

%

(54,179

)

(53,020

)

2

%

Adjusted OIBDA

$

41,870

$

45,750

9

%

$

10,483

$

11,996

14

%

Operating income (loss)

$

19,467

$

24,936

28

%

$

(29,790

)

$

(27,419

)

8

%

Regular season home games in period

43

40

43

40

Unless otherwise noted, the following discussion compares

financial information for the three months ended June 30, 2024 to

the same period in 2023.

Baseball revenue is derived from two primary sources on an

annual basis: (i) baseball event revenue (ticket sales,

concessions, advertising sponsorships, suites and premium seat

fees) and (ii) broadcasting revenue (national and local broadcast

rights). Mixed-use development revenue is derived from the Battery

Atlanta mixed-use facilities and primarily includes rental

income.

The following table disaggregates revenue by segment and by

source:

Three months ended

Six months ended

June 30,

June 30,

2023

2024

% Change

2023

2024

% Change

amounts in thousands

amounts in thousands

Baseball:

Baseball event

$

162,368

$

171,350

6

%

$

163,486

$

172,518

6

%

Broadcasting

68,558

70,950

3

%

69,449

73,051

5

%

Retail and licensing

19,747

19,624

(1

)%

24,122

25,277

5

%

Other

4,262

4,077

(4

)

15,439

17,125

11

%

Baseball revenue

254,935

266,001

4

%

272,496

287,971

6

%

Mixed-use development

15,188

16,875

11

%

28,599

31,985

12

%

Total revenue

$

270,123

$

282,876

5

%

$

301,095

$

319,956

6

%

There were 40 home games played in the second quarter of 2024

compared to 43 home games in the prior year period.

Baseball revenue increased 4% in the second quarter due to

growth in baseball event and broadcasting revenue. Baseball event

revenue grew primarily due to new sponsorship agreements and

contractual rate increases on season tickets and existing

sponsorship contracts, partially offset by fewer regular season

home games. Broadcasting revenue increased primarily due to more

regular season games played (home and away) as well as contractual

rate increases. Mixed-use development revenue grew 11% during the

second quarter due to increases in rental income related to tenant

recoveries and higher parking revenue.

Operating income and Adjusted OIBDA increased in the second

quarter as revenue growth more than offset increased baseball

operating costs. Baseball operating costs increased due to higher

player salaries, increases under MLB’s revenue sharing plan and

increased minor league team and player expenses, partially offset

by lower variable concessions and retail expenses driven by fewer

regular season home games. Selling, general and administrative

expense was relatively flat in the second quarter.

FOOTNOTES

1)

For a definition of Adjusted OIBDA (as

defined by ABH) and the applicable reconciliation, see the

accompanying schedule.

Important Notice: Atlanta Braves Holdings, Inc. (Nasdaq:

BATRA, BATRK) will be available to answer questions on Liberty

Media’s earnings conference call which will begin at 10:00 a.m.

(E.T.) on August 8, 2024. The call can be accessed by dialing (877)

704-2829 or (215) 268-9864, passcode 13742818 at least 10 minutes

prior to the start time. The call will also be broadcast live

across the Internet and archived on our website. To access the

webcast go to

https://www.bravesholdings.com/investors/news-events/ir-calendar.

Links to this press release will also be available on the ABH

website.

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements about business strategies, product

and marketing strategies, future financial performance and

prospects and other matters that are not historical facts. These

forward-looking statements involve many risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by such statements, including, without

limitation, ABH’s historical financial information not being

representative of its future financial position, results of

operations, or cash flows, ABH’s ability to recognize anticipated

benefits from the Split-Off, possible changes in the regulatory and

competitive environment in which ABH operates (including an

expansion of MLB), the unfavorable outcome of pending or future

litigation, operational risks of ABH and its business affiliates,

including operations outside of the U.S., ABH’s indebtedness and

its ability to obtain additional financing on acceptable terms and

cash in amounts sufficient to service debt and other financial

obligations, tax matters, ABH’s ability to use net operating loss

and disallowed business interest carryforwards, compliance with

government regulations and potential adverse outcomes of regulatory

proceedings, changes in the nature of key strategic relationships

with broadcasters, partners, vendors and joint venturers, the

impact of organized labor, the performance and management of the

mixed-use development, disruptions in ABH’s information systems and

information system security, ABH’s use and protection of personal

data and the impact of inflation and weak economic conditions on

consumer demand. These forward-looking statements speak only as of

the date of this press release, and ABH expressly disclaims any

obligation or undertaking to disseminate any updates or revisions

to any forward-looking statement contained herein to reflect any

change in ABH’s expectations with regard thereto or any change in

events, conditions or circumstances on which any such statement is

based. Please refer to the publicly filed documents of ABH,

including the most recently filed Forms 10-K and 10-Q, for

additional information about ABH and about the risks and

uncertainties related to ABH’s business which may affect the

statements made in this press release.

NON-GAAP FINANCIAL MEASURES AND SUPPLEMENTAL

DISCLOSURES

SCHEDULE 1: Reconciliation of Adjusted OIBDA to Operating Income

(Loss)

To provide investors with additional information regarding our

financial results, this press release includes a presentation of

Adjusted OIBDA, which is a non-GAAP financial measure, for ABH

together with reconciliations to operating income, as determined

under GAAP. ABH defines Adjusted OIBDA as operating income (loss)

plus depreciation and amortization, stock-based compensation,

separately reported litigation settlements, restructuring,

acquisition and impairment charges.

ABH believes Adjusted OIBDA is an important indicator of the

operational strength and performance of its businesses by

identifying those items that are not directly a reflection of each

business’ performance or indicative of ongoing business trends. In

addition, this measure allows management to view operating results

and perform analytical comparisons and benchmarking between

businesses and identify strategies to improve performance. Because

Adjusted OIBDA is used as a measure of operating performance, ABH

views operating income as the most directly comparable GAAP

measure. Adjusted OIBDA is not meant to replace or supersede

operating income or any other GAAP measure, but rather to

supplement such GAAP measures in order to present investors with

the same information that ABH management considers in assessing the

results of operations and performance of its assets.

The following table provides a reconciliation of Adjusted OIBDA

for ABH to operating income (loss) calculated in accordance with

GAAP for the three and six months ended June 30, 2023 and June 30,

2024.

Three months ended

Six months ended

June 30,

June 30,

(amounts in thousands)

2023

2024

2023

2024

Operating income (loss)

$

19,467

$

24,936

$

(29,790

)

$

(27,419

)

Stock-based compensation

3,153

3,705

6,344

7,424

Depreciation and amortization

19,250

17,109

33,929

31,991

Adjusted OIBDA

$

41,870

$

45,750

$

10,483

$

11,996

Baseball

$

37,183

$

37,391

$

1,348

$

(4,325

)

Mixed-use development

10,166

11,509

19,319

21,442

Corporate and other

(5,479

)

(3,150

)

(10,184

)

(5,121

)

SCHEDULE 2: Cash and Debt

The following presentation is provided to separately identify

cash and debt information. ABH cash decreased $60 million during

the second quarter due to cash used in operations primarily driven

by seasonal working capital changes as well as increases in

restricted cash held and capital expenditures, partially offset by

net borrowings. ABH debt increased $20 million in the second

quarter primarily due to borrowings on the mixed-use development

credit facilities to support current capital projects.

(amounts in thousands)

March 31, 2024

June 30, 2024

ABH Cash (GAAP)(a)

$

181,461

$

121,239

Debt:

Baseball

League wide credit facility

$

—

$

—

MLB facility fund - term

30,000

30,000

MLB facility fund - revolver

40,825

40,250

TeamCo revolver

—

—

Term debt

162,119

162,119

Mixed-use development

350,428

370,908

Total ABH Debt

$

583,372

$

603,277

Deferred financing costs

(3,459

)

(3,241

)

Total ABH Debt (GAAP)

$

579,913

$

600,036

a)

Excludes restricted cash held in reserves

pursuant to the terms of various financial obligations of $28

million and $40 million as of March 31, 2024 and June 30, 2024,

respectively.

ATLANTA BRAVES HOLDINGS

CONDENSED CONSOLIDATED BALANCE SHEET INFORMATION June 30, 2024

(unaudited)

June 30,

December 31,

2024

2023

amounts in thousands,

except share amounts

Assets

Current assets:

Cash and cash equivalents

$

121,239

125,148

Restricted cash

40,117

12,569

Accounts receivable and contract assets,

net of allowance for credit losses of $523 and $332,

respectively

58,730

62,922

Other current assets

28,210

17,380

Total current assets

248,296

218,019

Property and equipment, at cost

1,149,681

1,091,943

Accumulated depreciation

(348,617

)

(325,196

)

801,064

766,747

Investments in affiliates, accounted for

using the equity method

107,321

99,213

Intangible assets not subject to

amortization:

Goodwill

175,764

175,764

Franchise rights

123,703

123,703

299,467

299,467

Other assets, net

117,669

120,884

Total assets

$

1,573,817

1,504,330

Liabilities and Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

99,483

73,096

Deferred revenue and refundable

tickets

146,281

111,985

Current portion of debt

137,673

42,153

Other current liabilities

4,733

6,439

Total current liabilities

388,170

233,673

Long-term debt

462,363

527,116

Finance lease liabilities

102,450

103,586

Deferred income tax liabilities

47,566

50,415

Pension liability

13,262

15,222

Other noncurrent liabilities

35,288

33,676

Total liabilities

1,049,099

963,688

Equity:

Preferred stock, $.01 par value.

Authorized 50,000,000 shares; zero shares issued at June 30, 2024

and December 31, 2023

—

—

Series A common stock, $.01 par value.

Authorized 200,000,000 shares; issued and outstanding 10,318,162

and 10,318,197 at June 30, 2024 and December 31, 2023,

respectively

103

103

Series B common stock, $.01 par value.

Authorized 7,500,000 shares; issued and outstanding 977,776 and

977,776 at June 30, 2024 and December 31, 2023, respectively

10

10

Series C common stock, $.01 par value.

Authorized 200,000,000 shares; issued and outstanding 50,676,231

and 50,577,776 at June 30, 2024 and December 31, 2023,

respectively

507

506

Additional paid-in capital

1,096,021

1,089,625

Accumulated other comprehensive earnings

(loss), net of taxes

(7,429

)

(7,271

)

Retained earnings (deficit)

(576,539

)

(554,376

)

Total stockholders' equity

512,673

528,597

Noncontrolling interests in equity of

subsidiaries

12,045

12,045

Total equity

524,718

540,642

Commitments and contingencies

Total liabilities and equity

$

1,573,817

1,504,330

ATLANTA BRAVES HOLDINGS

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS INFORMATION June 30,

2024 (unaudited)

Three months ended

Six months ended

June 30,

June 30,

2024

2023

2024

2023

amounts in thousands,

except per share

amounts

Revenue:

Baseball revenue

$

266,001

254,935

$

287,971

272,496

Mixed-use development revenue

16,875

15,188

31,985

28,599

Total revenue

282,876

270,123

319,956

301,095

Operating costs and expenses:

Baseball operating costs

205,070

195,458

250,277

232,229

Mixed-use development costs

2,410

2,273

4,663

4,204

Selling, general and administrative,

including stock-based compensation

33,351

33,675

60,444

60,523

Depreciation and amortization

17,109

19,250

31,991

33,929

257,940

250,656

347,375

330,885

Operating income (loss)

24,936

19,467

(27,419

)

(29,790

)

Other income (expense):

Interest expense

(9,713

)

(9,448

)

(19,156

)

(18,360

)

Share of earnings (losses) of affiliates,

net

11,622

11,462

13,249

10,659

Realized and unrealized gains (losses) on

intergroup interests, net

—

(49,409

)

—

(62,786

)

Realized and unrealized gains (losses) on

financial instruments, net

931

3,840

3,905

3,079

Other, net

2,217

3,316

3,986

4,157

Earnings (loss) before income taxes

29,993

(20,772

)

(25,435

)

(93,041

)

Income tax benefit (expense)

(884

)

(8,141

)

3,272

6,152

Net earnings (loss)

$

29,109

(28,913

)

$

(22,163

)

(86,889

)

Basic net earnings (loss) attributable to

Series A, Series B and Series C Atlanta Braves Holdings, Inc.

shareholders per common share

$

0.47

(0.47

)

$

(0.36

)

(1.41

)

Diluted net earnings (loss) attributable

to Series A, Series B and Series C Atlanta Braves Holdings, Inc.

shareholders per common share

$

0.46

(0.47

)

$

(0.36

)

(1.41

)

ATLANTA BRAVES HOLDINGS

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS INFORMATION June 30,

2024 (unaudited)

Six months ended

June 30,

2024

2023

amounts in thousands

Cash flows from operating activities:

Net earnings (loss)

$

(22,163

)

(86,889

)

Adjustments to reconcile net earnings

(loss) to net cash provided by (used in) operating activities:

Depreciation and amortization

31,991

33,929

Stock-based compensation

7,424

6,344

Share of (earnings) losses of affiliates,

net

(13,249

)

(10,659

)

Realized and unrealized (gains) losses on

intergroup interests, net

—

62,786

Realized and unrealized (gains) losses on

financial instruments, net

(3,905

)

(3,079

)

Deferred income tax expense (benefit)

(2,801

)

(7,014

)

Cash receipts from returns on equity

method investments

5,838

6,225

Net cash received (paid) for interest rate

swaps

3,036

2,200

Other charges (credits), net

(1,480

)

(3,754

)

Net change in operating assets and

liabilities:

Current and other assets

(8,574

)

(14,338

)

Payables and other liabilities

60,635

50,141

Net cash provided by (used in) operating

activities

56,752

35,892

Cash flows from investing activities:

Capital expended for property and

equipment

(57,432

)

(29,700

)

Investments in equity method affiliates

and equity securities

(714

)

—

Other investing activities, net

41

110

Net cash provided by (used in) investing

activities

(58,105

)

(29,590

)

Cash flows from financing activities:

Borrowings of debt

33,405

15,815

Repayments of debt

(4,787

)

(18,893

)

Contribution from noncontrolling

interest

—

11,289

Other financing activities, net

(3,626

)

(4,756

)

Net cash provided by (used in) financing

activities

24,992

3,455

Net increase (decrease) in cash, cash

equivalents and restricted cash

23,639

9,757

Cash, cash equivalents and restricted cash

at beginning of period

137,717

172,813

Cash, cash equivalents and restricted cash

at end of period

$

161,356

182,570

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807965906/en/

Shane Kleinstein (720) 875-5432

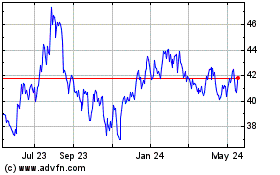

Atlanta Braves (NASDAQ:BATRA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Atlanta Braves (NASDAQ:BATRA)

Historical Stock Chart

From Dec 2023 to Dec 2024