false

0001429764

0001429764

2025-01-22

2025-01-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 22, 2025

| BLINK

CHARGING CO. |

| (Exact

name of registrant as specified in its charter) |

| Nevada |

|

001-38392 |

|

03-0608147 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 5081

Howerton Way, Suite A, Bowie, Maryland |

|

20715 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (305) 521-0200

| N/A |

| (Former

name or former address, if changed since last report.) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

Stock |

|

BLNK

|

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

CURRENT

REPORT ON FORM 8-K

Blink Charging Co. (the “Company”)

January 22, 2025

| Item

5.02. |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Michael

Battaglia Becomes CEO and Joins Blink Board

As

previously disclosed in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (SEC) on August

30, 2024, Michael Battaglia, our current Chief Operating Officer, will assume the duties and positions of the President and Chief Executive

Officer of the Company effective February 1, 2025. On January 22, 2025, the Board of Directors of the Company elected Mr. Battaglia to

become a member of the Board of Directors effective February 1, 2025. Mr. Battaglia’s election increases the size of our Board

to eight members.

Mr.

Battaglia has served as the Company’s Chief Operating Officer since September 2023. Mr. Battaglia joined the Company in July 2020

as the Vice President of Sales. In January 2021, Mr. Battaglia was promoted to Senior Vice President of Sales and Business Development,

and, in December 2022, he was promoted to Chief Revenue Officer. Prior to joining the Company, Mr. Battaglia served in various management

positions for J.D. Power & Associates from March 2006 to July 2020, assisting dealerships and automotive OEMs improve operations

by utilizing data-driven insights and conducting comprehensive analyses. Mr. Battaglia is an automotive and EV charging veteran with

more than 25 years of experience in the industry and has expertise in building high performing sales and operations teams. Throughout

his time with the Company, Mr. Battaglia has worked closely with the operations teams to streamline systems and processes related to

order processing and fulfillment, customer support structures, and new product procurement, which has led to increases in the Company’s

operational efficiency. Mr. Battaglia led the effort to implement Salesforce CRM, tying together field service and accounting functions

globally for the Company. Additionally, Mr. Battaglia has led the Company’s sales and business development efforts for over three

years, resulting in record-high sales and revenue each of the last three years. Mr. Battaglia received a B.S. degree in finance from

the Carroll School of Management at Boston College.

During

the last two years, other than customary arrangements in connection with serving as the Company’s Chief Operating Officer, there

have been no transactions or proposed transactions by the Company in which Mr. Battaglia has had or is to have a direct or indirect material

interest, and there are no family relationships between Mr. Battaglia and any of the Company’s executive officers or directors.

Michael

Battaglia Enters into CEO Employment Agreement

On

January 23, 2025, the Company and Mr. Battaglia entered into a Chief Executive Officer Employment Agreement (the “Employment Agreement”),

pursuant to which Mr. Battaglia will serve as the Company’s President and Chief Executive Officer for a two-year term commencing

on February 1, 2025. The employment term is automatically renewable for successive one-year periods thereafter unless either party provides

timely notice of intent to terminate the Employment Agreement. Mr. Battaglia will receive an annual base salary of $575,000 and will

be eligible for annual grants under the Company’s Executives’ Short-Term Incentive bonus plan (“STI Plan”), with

an annual target amount of 60% of his base salary, and under the Company’s Executives’ Long-Term Incentive bonus plan (“LTI

Plan”), with an annual target amount of 100% of his base salary, as described below. Within 30 days following the effective date

of the Employment Agreement, he will also receive a one-time equity signing bonus of $150,000 worth of restricted common stock that vests

annually in equal one-third installments beginning on the first anniversary of the grant date.

Mr.

Battaglia’s STI bonus is a performance-based cash award, subject to the determination of performance results in accordance with

the terms of the STI Plan. Specific performance targets and potential awards will be determined by the Board’s Compensation Committee

in accordance with the STI Plan and will reflect distinct key performance indicator (KPI) goals tailored specifically for each component,

developed collaboratively by the Board, the Compensation Committee and the Company’s executive team.

Mr.

Battaglia’s LTI bonus is comprised of two components governed by the LTI Plan. The LTI Plan provides that 50% of the bonus is designated

as performance-based stock awards in the form of restricted stock units (RSUs) that vest in four equal installments upon the achievement

of specific stock price performance targets, and 50% of the bonus as time-based stock awards in the form of RSUs that vest annually in

equal one-third increments on each anniversary of the grant date.

The

above bonuses and equity grants are subject to the Company’s “clawback” policies.

If

Mr. Battaglia’s employment is terminated by the Company without Cause (which includes willful material misconduct and willful failure

to materially perform his responsibilities to the Company) or by him for Good Reason (which includes a material adverse change in the

Executive’s authority, duties or responsibilities), he is entitled to receive severance equal to 12 months of base salary plus

his target STI and LTI bonuses for the year of termination in return for his signing of a general release in favor of the Company. If

such termination occurs within six months before or after a “change of control,” the severance payments above will be doubled

and all unvested RSUs will vest. RSUs with performance components will vest and be prorated according to the performance achieved as

of the change of control.

Under

the Employment Agreement, Mr. Battaglia is prohibited from disclosure of confidential information, which includes all information not

generally known to the public regarding the Company and its affiliates, subsidiaries or its businesses. Mr. Battaglia further agreed

that during his employment with the Company and for 12 months thereafter he will not solicit or attempt to solicit any Company clients,

customers or vendors for the purpose of providing services or products that compete with those offered by the Company for the same 12

month period and, for the same period, he will not solicit, hire, recruit or attempt to hire or recruit, or induce the termination of

employment of any employee of the Company.

The

foregoing summary description of the Employment Agreement is qualified by reference to the full text thereof, a copy of which is attached

as Exhibit 10.1 and incorporated herein in its entirety.

| Item

9.01. |

Financial

Statements and Exhibits. |

| (d) |

Exhibits.

The exhibits listed in the following Exhibit Index are filed as part of this current report. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

BLINK

CHARGING CO. |

| |

|

| |

|

| Date:

January 28, 2025 |

By: |

/s/

Brendan S. Jones |

| |

Name: |

Brendan

S. Jones |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

chief

executive officer

EMPLOYMENT

AGREEMENT

This

Chief Executive Officer Employment Agreement (the “Agreement”) is made and entered into this January 23rd,

2025, by and between Michael Battaglia (the “Executive”) and Blink Charging Co., a Nevada corporation (the “Company”).

WHEREAS,

The Company, through its Affiliates and subsidiaries, sells, installs, and maintains electric vehicle charging stations located on

municipal or privately owned real property within designated areas throughout the United States and abroad (the “Business”);

and

WHEREAS,

Executive has been employed by the Company as its Chief Operating Officer under an employment agreement dated September 18, 2023

(the “Ending Agreement”); and

WHEREAS,

the Board of Directors (the “Board”) promoted Executive to the position of President and Chief Executive Officer

and approved promotion in the Board’s meeting dated August 27, 2024; and

WHEREAS,

the Company desires to execute this employment agreement with Executive based on terms and conditions set forth herein; and

WHEREAS,

Executive desires to execute this employment agreement with the Company on such terms and conditions.

NOW,

THEREFORE, in consideration of the mutual covenants, promises, and obligations set forth herein, the parties agree as follows:

| 1. |

Term.

Executive’s employment hereunder shall be effective as of February 1, 2025 (the “Effective Date”). The period

during which the Company employs Executive hereunder is referred to as the “Term.” The Term will commence on

the Effective Date and continue for two (2) years unless notice of the intent to terminate the Agreement is provided in writing by

either Party to the other at least sixty (60) days before the end of the Term. If neither Party provides notice of intent to terminate

the Agreement at least sixty (60) days before the end of the Term or any Renewal Term, the Term and any subsequent Renewal Term will

automatically renew for successive one (1) year periods (each a “Renewal Term”). For the purposes of the Sections

discussing Severance below, a Termination of this Agreement less than sixty (60) days prior to the end of the Term will be considered

a Termination during the Renewal Term. |

| 2. |

Employment. |

| |

|

|

| |

2.1. |

Appointment.

The Company agrees to promote Executive to the Company’s President and Chief Executive Officer (“CEO”),

which Executive hereby accepts. In this capacity, Executive will report directly to the Company’s Board. During the Term defined

herein, including any renewals, Executive will undertake such duties, authority, and responsibilities as shall be determined from

time to time by the Board of Directors, which duties, authority, and responsibilities as determined by the Board. These responsibilities

will be commensurate with Executive’s position, including, but not limited to, overseeing employment decisions for all non-C-Suite

employees, and entering into agreements with third parties in the ordinary course of business, such as consulting, distribution,

and vendor agreements. Executive will be permitted to work from any Blink location (outlined in schedule A) provided that Executive

maintains a residence in the State of Maryland, or such other location as mutually agreed to in writing. Additionally, Executive

agrees to serve as president, chief executive officer, director, managing member, managing director of the Company’s subsidiaries

or affiliates as needed. The Company may also direct Executive to fulfill similar duties, provided that Executive’s overall

time commitment remains comparable to their current commitment to the Company. Executive commits to serving the Company and its Affiliates

diligently and to the best of his ability. Executive further agrees to be nominated for a Board position and to serve as a Board

member with no additional compensation. |

| |

|

|

| |

2.2. |

Ending

Agreement. Following

the execution of this Agreement and upon the Effective Date, the Ending Agreement will terminate. Upon termination of the Ending

Agreement, Executive will be entitled to all compensation and benefits accrued under the Ending Agreement until such termination,

and all equity awards under such agreement will continue to vest. However, all other forms of compensation, including bonuses and

benefits under the Ending Agreement, will terminate and be replaced by those established under this Agreement. |

| |

|

|

| |

2.3. |

Duties.

During the Term, Executive shall devote substantially all business time and attention to the performance of Executive’s duties

hereunder. Executive shall not engage in any other business, profession, or occupation for compensation or otherwise which may conflict

with or interfere with these responsibilities, either directly or indirectly, without prior written consent from the Board. Notwithstanding

the foregoing, Executive may: (a) serve as a director, trustee, or committee member of a charitable organization with a formal resolution

from the Board, and (b) own less than five percent (5%) of publicly traded securities in any corporation, provided that, such ownership

is a passive investment, and Executive is not a controlling person or part of a controlling. Additionally, activities in clauses

(a) and (b) must not interfere with Executive’s obligations, duties, and responsibilities to the Company as outlined in this

Agreement, including, but not limited to, those in Section 1. |

| 3. |

Compensation. |

| |

|

| |

3.1. |

Base

Salary. The Company shall pay Executive

an annual base salary of five hundred and seventy-five thousand dollars ($575,000) in monthly installments (the “Base Salary”),

less applicable taxes and withholdings, and paid in accordance with the Company’s customary payroll practices and procedures

for all Company’s employees, and applicable wage payment laws. |

| |

|

|

| |

3.2. |

Bonuses. |

| |

|

|

| |

|

3.2.1. |

For

each complete calendar year during the Term (“Grant Date”), Executive shall be eligible for an annual grant (the

“Grant”) of both a Short-Term Incentive Bonus (the “STB”) and a Long-Term Incentive Bonus (the

“LTB”), collectively referred to as the “Annual Bonus.” Executive’s annual target bonus

amount will be 60% of their Base Salary for the STB and an additional 100% of their Base Salary for the LTB (together, the “Target

Bonus”). |

| |

|

|

|

| |

|

3.2.2. |

One-Time

Equity Signing Bonus. |

| |

|

|

|

| |

|

|

The

Company shall grant $150,000 worth of restricted stock to Executive “Signing Bonus”) within 30 days following

the Effective Date. The restricted stock shall vest annually in equal one-third installments beginning on the first anniversary of

the Grant Date. |

| |

|

|

|

| |

|

3.2.3. |

Short-Term

Incentive Bonus (STB). |

| |

|

|

|

| |

|

|

3.2.3.1. |

The

STB is a performance-based award. |

| |

|

|

|

|

| |

|

|

3.2.3.2. |

The

STB will be awarded 100% in cash, with the full cash amount paid to the Executive within six months of the Grant Date, subject to

the determination of performance results, in accordance with the term of the STI plan (Section 3.2.3.3.). |

| |

3.2.3.3. |

Executives’

Short-Term Incentive Plan. Executive’s STB shall be governed by the Company’s Executives’ Short-Term Incentive

(the “STI”) plan, designed to align with the overall objectives of the top executives team (the “Executives

Team”). The STI plan will incorporate relevant financial and strategic goals established by the Company. Specific performance

targets and potential awards will be determined by the Compensation Committee in accordance with the STI plan and will reflect distinct

key performance indicator (“KPI”) goals tailored specifically for each component, developed collaboratively by

the Board, the Compensation Committee and the Company’s Executives Team. |

| |

3.2.4. |

Long-Term

Incentive Bonus (LTB). |

| |

|

|

|

| |

|

3.2.4.1. |

The

LTB is comprised of two components: 50% designated as performance-based stock awards (the “Performance-LTB”) and

50% as time-based stock awards (the “Time-LTB”). |

| |

|

|

|

| |

|

3.2.4.2. |

The

Performance-LTB shall be (a) awarded to Executive in restricted stock units (“RSUs”), (b) subject to achieving

KPIs defined in the LTI vesting schedule outlined hereunder (defined in section 3.2.4.5 below). |

| |

|

|

|

| |

|

3.2.4.3. |

The

Time-LTB shall be (a) awarded to Executive in RSUs, and (b) shall be subject to vesting schedule outlined hereunder. |

| |

|

|

|

| |

|

3.2.4.4. |

Vesting

Schedule – Time Based LTB. The Time-LTB stock award shall vest annually in equal one-third (1/3) increments on each anniversary

of the Grant Date. |

| |

|

|

|

| |

|

3.2.4.5. |

Executives’

Long-Term Incentive Plan. Executive’s Performance-LTB shall be governed by the Company’s Executives’ Long-Term

Incentive (the “LTI”) plan, designed to align with the overall objectives of the Executive Team. The LTI plan

will incorporate relevant financial and strategic goals established by the Company. Specific performance targets and potential awards

will be determined by the Compensation Committee in accordance with the LTI plan and will reflect distinct key performance indicator

(“KPI”) goals tailored specifically for each component, developed collaboratively by the Board, the Compensation

Committee and the Company’s Executives Team. |

| |

|

|

|

| |

|

3.2.4.6. |

Vesting

Schedule - Performance Based LTB. In addition to the general framework outlined in the LTI plan, the vesting of the Executive’s

Performance-LTB component will be subject to specific stock price performance targets, as determined by the Compensation Committee.

The Performance-LTB will vest in four equal installments upon the achievement of the following stock price conditions, based on the

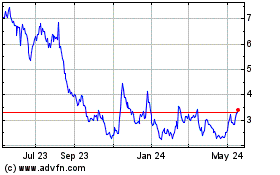

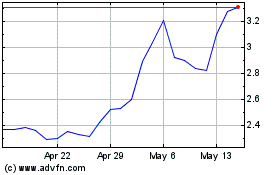

stock price reaching the specified threshold, without regard to the 90-day average stock price: |

| |

|

|

|

| |

|

|

1.First

1/4 Vesting: The first 1/4 of the Performance-LTB will vest when the stock price exceeds $3.00

for a period of 90 consecutive days. |

| |

|

|

|

| |

|

|

2.Second

1/4 Vesting: The next 1/4 of the Performance-LTB will vest when the stock price exceeds $5.00

for a period of 90 consecutive days. |

| |

|

|

|

| |

|

|

3.Third

1/4 Vesting: The next 1/4 of the Performance-LTB will vest when the stock price exceeds $7.50

for a period of 90 consecutive days. |

| |

|

|

|

| |

|

|

4.Final

1/4 Vesting: The final 1/4 of the Performance-LTB will vest when the stock price exceeds $9.50

for a period of 90 consecutive days. |

| |

|

|

|

| |

|

|

If

performance falls below the established thresholds or other criteria set by the Compensation Committee, the minimum Performance-LTB

granted will be 50% of the total potential Performance-LTB component. Conversely, if performance

exceeds expectations, the Compensation Committee may award an increased amount of the Performance-LTB component, as determined under

the terms of the LTI plan. |

| |

|

3.2.5. |

Vesting.

In addition to the vesting conditions outlined herein, all vesting under this Agreement is contingent upon Executive’s continued

employment as CEO of the Company at the date the Annual Bonuses are paid, as well as the fulfillment of any KPIs, performance or

tenure criteria established by the Board or its Compensation Committee. |

| |

|

|

|

| |

|

3.2.6. |

KPIs.

In this Agreement the term “KPIs” shall mean any key performance indicator goals established by the Board or its

Compensation Committee in collaboration with Executive and/or the Company’s Executives Team, including for utilizing in STIs,

LTIs, or any other bonus or equity award programs. |

| |

|

|

|

| |

|

3.2.7. |

Prorated

Annual Bonus. From the Effective Date through the end of the relevant calendar year, Executive will receive a prorated Annual

Bonus, calculated by taking the Annual Bonus that would have been awarded for the entire year and multiplying it by a fraction where

the numerator represents the number of days from the Effective Date to the end of the calendar year, and the denominator represents

the total number of days in that year. The Annual Bonus will be subject to the terms of the Company’s 2018 Incentive Compensation

Plan, or any successor plan (the “Incentive Plan”). |

| |

|

|

|

| |

|

3.2.8. |

Additional

Equity Awards. During the Term, Executive

shall be eligible to participate in additional bonus or equity award programs that the Board might set up under the terms of the

Incentive Plan or any successor plan, subject to the terms of the Incentive Plan or successor plan, as determined by the Board or

the Compensation Committee, in its discretion. |

| |

|

|

|

| |

3.3. |

Employee

Benefits. During the Term, Executive shall

be entitled to participate in all employee benefit plans, practices, and programs maintained by the Company, as in effect from time

to time (collectively, “Employee Benefit Plans”), including, but not limited to, pension and other retirement

plans, including any 401K Plan, group life insurance, dental insurance, medical insurance, sick leave, vacation and holidays at no

cost to Executive, on a basis which is no less favorable than is provided to other similarly situated executives of the Company,

to the extent consistent with applicable law and the terms of the applicable Employee Benefit Plans. The Company reserves the right

to amend or terminate any Employee Benefit Plans at any time in its sole discretion, subject to the terms of such Employee Benefit

Plan and applicable law. |

| |

|

|

| |

3.4. |

Paid

Time Off. During the Term, Executive shall be entitled to thirty (30) days of paid vacation days per calendar year (prorated

for partial years) in accordance with the Company’s vacation policies, as in effect from time to time. Executive shall receive

other paid time off in accordance with the Company’s policies for executive officers, as such policies may exist from time

to time. |

| |

|

|

| |

3.5. |

Relocation

Expenses. The Company shall pay, or reimburse

Executive for, all reasonable and necessary cash-out relocation expenses incurred by Executive relating to Executive’s relocation

to Maryland in accordance with the terms of the Company’s relocation policy. |

| |

|

|

| |

3.6. |

Business

Expenses. Executive shall be entitled to

reimbursement for all reasonable and necessary out-of-pocket business, entertainment, and travel expenses incurred by Executive in

connection with the performance of Executive’s duties hereunder in accordance with the Company’s expense reimbursement

policies and procedures. |

| |

|

|

| 4. |

D&O

Insurance. The Company shall secure and pay all premiums and other expenses associated with a directors and officers

liability policy for Executive’s benefit in an amount the Company reasonably deems sufficient considering, among other things,

the Company’s size and industry and Executive’s duties. |

| 5. |

Indemnification.

The Company shall indemnify and hold harmless Executive to the fullest extent permitted by applicable law against any and all losses,

expenses, liabilities, and claims, including reasonable attorneys’ fees, incurred by Executive in connection with or arising

out of Executive’s service as an officer or employee of the Company or any of its affiliates. This indemnification shall apply

to matters arising from actions taken or not taken by Executive in good faith while performing duties on behalf of the Company (including

its affiliates and subsidiaries). The Company shall advance expenses incurred by Executive in connection with such indemnification,

subject to Executive’s obligation to repay such amounts if it is ultimately determined that Executive is not entitled to indemnification

under this Agreement or applicable law. |

| |

|

|

|

|

| 6. |

Key

Person Insurance. The Company may elect to obtain a Key Man term life insurance policy on Executive, and the Company will

be named the payee/beneficiary on such policy. |

| |

|

|

|

|

| 7. |

Clawback

Provisions. Notwithstanding any other provisions

in this Agreement to the contrary, any incentive-based or other compensation paid to Executive under this Agreement or any other

agreement or arrangement with the Company that is subject to recovery under any law, government regulation, or stock exchange listing

requirement will be subject to such deductions and clawback as may be required to be made pursuant to such law, government regulation,

or stock exchange listing requirement or any policy adopted by the Company, whether in existence as of the Effective Date or later

adopted. The Company will make any determination for clawback or recovery in its sole discretion in accordance with any applicable

law, regulation or policy. |

| |

|

| 8. |

Termination

of Employment. |

| |

|

| |

8.1. |

The

Term and Executive’s employment hereunder may be terminated by either the Company or Executive at any time and for any or no

reason, provided that, unless otherwise provided herein, either party shall be required to give the other party at least 30 days

advance written notice of any termination of Executive’s employment. On termination of Executive’s employment during

the Term, Executive shall be entitled to the compensation and benefits described in this Section and shall have no further rights

to any compensation or any other benefits from the Company or any of its affiliates. |

| |

|

|

| |

8.2. |

Termination

for Cause or Without Good Reason. |

| |

|

|

| |

|

8.2.1. |

Executive’s

employment hereunder may be terminated by the Company for Cause or by Executive without Good Reason. If Executive’s employment

is terminated by the Company for Cause or by Executive without Good Reason, Executive shall be entitled to receive: |

| |

|

|

|

| |

|

|

8.2.1.1. |

any

accrued but unpaid Base Salary and accrued but unused vacation which shall be paid on the pay date immediately following the Termination

Date (as defined below) in accordance with the Company’s customary payroll procedures; |

| |

|

|

|

|

| |

|

|

8.2.1.2. |

reimbursement

for unreimbursed business expenses properly incurred by Executive, which shall be subject to and paid in accordance with the Company’s

expense reimbursement policy; and |

| |

|

|

|

|

| |

|

|

8.2.1.3. |

such

employee benefits (including equity compensation), if any, to which Executive may be entitled under the Company’s employee

benefit plans as of the Termination Date, provided that, in no event shall Executive be entitled to any payments in the nature of

severance or termination payments except as specifically provided herein. |

| |

|

|

|

|

| |

|

|

8.2.1.4. |

Items

4.1(a)(i) through 4.1(a)8.2.1.2 are referred to herein collectively as the “Accrued Amounts.” |

| |

8.2.2. |

For

purposes of this Agreement, “Cause” shall mean: |

| |

|

|

| |

|

8.2.2.1. |

Executive’s

failure to perform Executive’s duties (other than any such failure resulting from incapacity due to physical or mental illness)

for which Executive failed to cure in the thirty (30) days following written notice by the Board of Directors detailing such failure;

or if such violation is not reasonably curable within such thirty (30) day period but Executive is proceeding diligently and in good

faith to cure such violation, such longer period as is reasonably needed by Jones, not to exceed forty-five (45) days following the

date of such notice; |

| |

|

|

|

| |

|

8.2.2.2. |

Executive’s

failure to comply with any valid and legal directive of the Board of Directors for which Executive failed to cure in the fourteen(14)

days following written notice by the Board of Directors detailing such failure; |

| |

|

|

|

| |

|

8.2.2.3. |

Executive’s

engagement in dishonesty, illegal conduct, misconduct, which is, in each case, injurious to the Company or its affiliates; |

| |

|

|

|

| |

|

8.2.2.4. |

Executive’s

embezzlement, misappropriation, or fraud, whether or not related to Executive’s employment with the Company; |

| |

|

|

|

| |

|

8.2.2.5. |

Executive’s

conviction of or plea of guilty or nolo contendere to a crime that constitutes a felony (or state law equivalent) or a crime that

constitutes a misdemeanor involving moral turpitude; |

| |

|

|

|

| |

|

8.2.2.6. |

Executive’s

violation of the Company’s written policies or codes of conduct for which Executive failed to cure in the seven (7) days following

written notice by the Board of Directors detailing such violation, except that such cure period does not apply with respect to the

violation of the Company’s written policies related to discrimination, harassment, performance of illegal or unethical activities,

and ethical misconduct; |

| |

|

|

|

| |

|

8.2.2.7. |

Executive’s

unauthorized disclosure of Confidential Information (as defined below); |

| |

|

|

|

| |

|

8.2.2.8. |

Executive’s

breach of any material obligation under this Agreement or any other written agreement between Executive and the Company for which

Executive failed to cure in the thirty (30) days following written notice by the Board of Directors detailing such failure; or |

| |

|

|

|

| |

|

8.2.2.9. |

Executive’s

engagement in conduct that brings or is reasonably likely to bring the Company negative publicity or into public disgrace, embarrassment,

or disrepute. |

| |

|

|

|

| |

8.2.3. |

For

purposes of this Agreement, “Good Reason” shall mean the occurrence of any of the following, in each case during

the Term without Executive’s written consent: |

| |

|

|

| |

|

8.2.3.1. |

any

material breach by the Company of any material provision of this Agreement; |

| |

|

|

|

| |

|

8.2.3.2. |

any

significant reduction amounting to ten (10%) or more in Base Salary or Target Bonus, or any such reduction applied uniformly to all

or certain executives of the Company. Notwithstanding the foregoing, in the event the Board resolves to decrease the Company’s

Executives Team compensation by ten (10%) or more, such decrease shall not be considered as “Good Reason”; or |

| |

|

|

|

| |

|

8.2.3.3. |

a

material, adverse change in Executive’s authority, duties, or responsibilities (other than temporarily while Executive is physically

or mentally incapacitated or as required by applicable law). |

| |

|

|

|

| 8.3. |

Termination

Without Cause or for Good Reason. The Term

and Executive’s employment hereunder may be terminated by the Company without Cause or by Executive for Good Reason. Executive

cannot terminate employment for Good Reason unless Executive has provided written notice to the Company of the existence of the circumstances

providing grounds for termination for Good Reason within fourteen (14) days of the initial existence of such grounds and the Company

has had at least thirty (30) days from the date on which such notice is provided to cure such circumstances. If Executive does not

terminate employment for Good Reason within fourteen (14) days after the end of the Company’s cure period, then Executive will

be deemed to have waived the right to terminate for Good Reason with respect to such grounds. |

| |

|

8.3.1. |

In

the event of such termination under Section 8.4, Executive shall be entitled to receive the Accrued Amounts and subject to Executive’s

compliance with this Agreement and Executive’s execution of a release (that is not revoked by Executive under applicable law)

of any and all waivable claims in favor of the Company, its affiliates, and their respective officers and directors in a form provided

by the Company (the “Release”) and such Release becoming effective following the Termination Date, Executive shall

be entitled to receive the following: |

| |

|

|

|

| |

|

|

8.3.1.1. |

A

lump sum payment equal to the full amount of Executive’s annual Base Salary and an amount equal to the full amount of Executive’s

Target Bonus in effect for the year in which the Termination Date occurs (except if the grounds for Good Reason is the reduction

in Base Salary and/or Target Bonus, the amount in effect prior to such reduction), which shall be paid within 30 days following the

Termination Date. Such lump sum payment will include only cash compensation (Base Salary and Target Bonus) and will not include any

new equity grants. When the Target Bonus involves RSUs or any other form of equity award, the outstanding non-vested portion for

the relevant year shall be prorated based on the time elapsed in the year and become due to the Executive. The Executive will not

receive any additional equity grants upon termination, only the pro-rated portion of existing equity awards. |

| |

|

|

|

|

| |

|

|

8.3.1.2. |

Any

outstanding equity awards, including RSUs, shall vest in full as of the Termination Date if Executive’s employment is terminated

by the Company without cause or by Executive for good reason. The unvested portion of any equity awards shall accelerate to fully

vested upon such termination. Executive will be entitled to receive the full value of both vested and accelerated equity awards as

of the Termination Date, and no equity awards shall be forfeited in the event of termination without cause or by Executive for good

reason. No additional equity grants will be made upon termination, except as otherwise expressly provided in this Agreement. |

| |

|

|

|

|

| |

8.4. |

COBRA.

Provided that Executive timely elects continuation coverage pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985,

as amended (“COBRA”) for Executive and Executive’s eligible dependents, a lump sum payment from the Company

equal to the amount of the COBRA premiums for such coverage (at the coverage levels in effect immediately prior to such termination)

for twelve (12) months following the Termination Date, which shall be paid within 30 days following the Executive’s election

for COBRA continuation coverage. |

| |

|

|

|

|

| 9. |

Death

or Disability. Executive’s employment hereunder shall terminate automatically on Executive’s death during the

Term, and the Company may terminate Executive’s employment on account of Executive’s disability. |

| |

|

| |

9.1. |

If

Executive’s employment is terminated during the Term on account of Executive’s Death or Disability, Executive (or Executive’s

estate and/or beneficiaries, as the case may be) shall be entitled to receive the Accrued Amounts. Notwithstanding any other provision

contained herein, all payments made in connection with Executive’s Disability shall be provided in a manner that is consistent

with federal and state law. |

| |

|

|

| |

9.2. |

For

purposes of this Agreement, “Disability” shall mean a condition that entitles Executive to receive long-term disability

benefits under the Company’s long-term disability plan, or if there is no such plan, Executive’s inability, due to physical

or mental incapacity, to perform the essential functions of Executive’s job, with or without reasonable accommodation, for

one hundred eighty (180) days out of any three hundred sixty-five (365) day period Any question as to the existence of Executive’s

Disability as to which Executive and the Company cannot agree shall be determined in writing by a qualified independent physician

mutually acceptable to Executive and the Company. If Executive and the Company cannot agree on a qualified independent physician,

each shall appoint such a physician, and those two physicians shall select a third who shall make such determination in writing.

The determination of Disability made in writing to the Company and Executive shall be final and conclusive for all purposes of this

Agreement. |

| 10. |

Change

of Control. Notwithstanding any other provision contained herein, if Executive’s employment hereunder is terminated

by Executive for Good Reason or by the Company without Cause (other than on account of Executive’s death or Disability), in

each case within six (6) months before or within six (6) months following a Change in Control (“CIC”), Executive

shall be entitled to receive an amount equal to two (2) times the amount of Executive’s annual Base Salary and the full amount

of Executive’s Target Bonus for the year in which the Termination Date occurs (except if the grounds for Good Reason is the

reduction in Base Salary and/or Target Bonus, the amount in effect prior to such reduction). The vesting of any unvested RSUs held

by Executive shall automatically accelerate in full and become vested as of the Termination Date, and Executive shall have the right

to receive the shares underlying those RSUs as soon as administratively possible. Such payment and RSUs acceleration shall be subject

to Executive’s compliance with Sections 15, 16, 17, 18 and 19 of this Agreement and Executive’s execution of a Release,

which becomes effective within 30 days following the Termination Date. In the event of a CIC without termination, no payment will

be made. |

| |

|

| |

10.1. |

Performance

Awards and KPIs in the Event of a Change of Control. |

| |

|

|

| |

|

10.1.1. |

Stock

Price Goals: In the event of a Change of Control, any outstanding performance-based equity awards, including but not limited

to stock options or RSUs with performance conditions tied to stock price goals, shall be treated as follows: |

| |

|

|

|

| |

|

|

10.1.1.1. |

If

the performance target (e.g., stock price goals) has been partially met as of the CIC, the portion of the award corresponding to

the portion of the target achieved prior to the CIC will become vested immediately. |

| |

|

|

|

|

| |

|

|

10.1.1.2. |

If

the performance target has not been met as of the CIC, such awards will vest on a prorated basis based on the time elapsed and the

performance achieved up to the date of the CIC, and the Executive shall be entitled to a pro-rata payout of the award as if the performance

target had been satisfied for that period. |

| |

|

|

|

|

| |

|

10.1.2. |

Future

Performance Awards and Regular KPIs. Any performance-based equity or cash awards for future periods that are tied to KPIs

shall be handled as follows: |

| |

|

|

|

| |

|

|

10.1.2.1. |

In

the event of a CIC, any future grants or awards tied to KPIs (including regular bonus plans or long-term incentive programs) will

be automatically prorated based on the time elapsed between the last KPI measurement period and the date of the CIC. |

| |

|

|

|

|

| |

|

|

10.1.2.2. |

If

the performance period has not yet ended or is not determinable by the CIC date, the CIC-triggered payout will be calculated based

on the Executive’s actual performance at the time of the CIC (using available metrics and reasonable estimates). |

| |

|

|

|

|

| |

|

10.1.3. |

General

Provisions. Any unvested performance-based awards, whether tied to stock price goals or KPIs, will be eligible for acceleration

upon a termination of employment as described above, provided the Executive complies with the requirements of this Agreement and

executes a Release. |

| |

10.2. |

For

purposes of this Agreement, “Change in Control” shall mean the occurrence of any of the following after the Effective

Date: (i) one person (or more than one person acting as a group) acquires ownership of stock of the Company that, together with the

stock held by such person or group, constitutes more than 50% of the total fair market value or total voting power of the stock of

such corporation; (ii) one person (or more than one person acting as a group) acquires (or has acquired during the twelve-month period

ending on the date of the most recent acquisition) ownership of the Company’s stock possessing 30% or more of the total voting

power of the Company’s stock; (iii) a majority of the members of the Board are replaced during any twelve-month period by directors

whose appointment or election is not endorsed by a majority of the Board before the date of appointment or election; or (iv) the

sale of all or substantially all of the Company’s assets. Notwithstanding the foregoing, a Change in Control shall not occur

unless such transaction constitutes a change in the ownership of the Company, a change in effective control of the Company, or a

change in the ownership of a substantial portion of the Company’s assets under Section 409A of the Internal Revenue Code of

1986, as amended (“Section 409A”). |

| |

|

|

|

| 11. |

Notice

of Termination. Any termination of Executive’s

employment hereunder by the Company or by Executive during the Term (other than termination on account of Executive’s death

shall be communicated by written notice of termination (“Notice of Termination”) to the other party hereto in accordance

with Section 35. The Notice of Termination shall specify, to the extent applicable, the facts and circumstances claimed to provide

a basis for termination of Executive’s employment under the provision so indicated and the applicable Termination Date. |

| |

|

| |

11.1. |

Termination

Date. Executive’s “Termination Date”

shall be: |

| |

|

|

| |

|

11.1.1. |

If

Executive’s employment hereunder terminates on account of Executive’s death, the date of Executive’s death; |

| |

|

|

|

| |

|

11.1.2. |

If

Executive’s employment hereunder is terminated on account of Executive’s Disability, the date that it is determined that

Executive has a Disability; |

| |

|

|

|

| |

|

11.1.3. |

If

the Company terminates Executive’s employment hereunder for Cause, the date the Notice of Termination is delivered to Executive; |

| |

|

|

|

| |

|

11.1.4. |

If

the Company terminates Executive’s employment hereunder without Cause, the date specified in the Notice of Termination, which

shall be no less than five days following the date on which the Notice of Termination is delivered; |

| |

|

|

|

| |

|

11.1.5. |

If

Executive terminates Executive’s employment hereunder with or without Good Reason, the date specified in Executive’s

Notice of Termination, which shall be no less than five days following the date on which the Notice of Termination is delivered;

provided that, the Company may waive all or any part of the five day notice period for no consideration by giving written notice

to Executive and for all purposes of this Agreement, Executive’s Termination Date shall be the date determined by the Company. |

| |

|

|

|

| |

|

11.1.6. |

Notwithstanding

anything contained herein, the Termination Date shall not occur until the date on which Executive incurs a “separation from

service” within the meaning of Section 409A. |

| |

|

|

|

| 12. |

Resignation

of All Other Positions. On termination of

Executive’s employment hereunder for any reason, Executive shall be deemed to have resigned from all positions that Executive

holds as an officer or member of the Board (or a committee thereof) of the Company or any of its affiliates. |

| 13. |

Section

280G. If any of the payments or benefits

received or to be received by Executive (including, without limitation, any payment or benefits received in connection with Executive’s

termination of employment, whether pursuant to the terms of this Agreement or any other plan, arrangement or agreement, or otherwise)

(all such payments collectively referred to herein as the “280G Payments”) constitute “parachute payments”

within the meaning of Section 280G of the Code and would, but for this Section, be subject to the excise tax imposed under Section

4999 of the Code (the “Excise Tax,” then prior to making the 280G Payments, a calculation shall be made comparing

(i) the Net Benefit (as defined below) to Executive of the 280G Payments after payment of the Excise Tax to (ii) the Net Benefit

to Executive if the 280G Payments are limited to the extent necessary to avoid being subject to the Excise Tax. Only if the amount

calculated under (i) above is less than the amount under (ii) above will the 280G Payments be reduced to the minimum extent necessary

to ensure that no portion of the 280G Payments is subject to the Excise Tax. “Net Benefit” shall mean the present

value of the 280G Payments net of all federal, state, local, foreign income, employment, and excise taxes. Any reduction made pursuant

to this Section shall be made in a manner determined by the Company that is consistent with the requirements of Section 409A. |

| |

|

|

| 14. |

Cooperation.

The parties agree that certain matters in which Executive will be involved during the Term may necessitate Executive’s cooperation

in the future. Accordingly, following the termination of Executive’s employment for any or no reason, to the extent reasonably

requested by the Board, Executive shall cooperate with the Company in connection with matters arising out of Executive’s service

to the Company, provided that the Company shall make reasonable efforts to minimize disruption of Executive’s other activities.

The Company shall reimburse Executive for reasonable expenses incurred in connection with such cooperation, and to the extent that

Executive is required to spend substantial time on such matters, the Company shall compensate Executive at a reasonable hourly rate. |

| |

|

|

| 15. |

Confidential

Information. Executive understands and acknowledges

that during the Term, Executive will have access to and learn about Confidential Information, as defined below. For purposes of this

Agreement, “Confidential Information” includes, but is not limited to, all information not generally known to

the public, in spoken, printed, electronic, or any other form or medium, of the Company and it affiliates, subsidiaries or its businesses

(the “Company’s Group”) or any existing or prospective customer, supplier, investor or other associated

third party, or of any other person or entity that has entrusted information to the Company Group in confidence. |

| |

|

| |

15.1. |

Executive

understands that the above list is not exhaustive, and that Confidential Information also includes other information that is marked

or otherwise identified as confidential or proprietary, or that would otherwise appear to a reasonable person to be confidential

or proprietary in the context and circumstances in which the information is known or used. Executive understands and agrees that

Confidential Information includes information developed by Executive in the course of employment by the Company as if the Company

furnished the same Confidential Information to Executive in the first instance. Confidential Information shall not include information

that is generally available to and known by the public at the time of disclosure to Executive, provided that such disclosure is through

no direct or indirect fault of Executive or person(s) acting on Executive’s behalf. |

| |

|

|

| |

15.2. |

Company

Creation and Use of Confidential Information. Executive understands and acknowledges that the Company Group has invested, and

continues to invest, substantial time, money, and specialized knowledge into developing its resources, creating a customer base,

generating customer and potential customer lists, training its employees, and improving its offerings. Executive understands and

acknowledges that as a result of these efforts, the Company Group has created and continues to use and create Confidential Information.

This Confidential Information provides the Company Group with a competitive advantage over others in the marketplace. |

| |

15.3. |

Permitted

disclosures. Nothing herein shall be construed to prevent disclosure of Confidential Information as may be required by applicable

law or regulation, or pursuant to the valid order of a court of competent jurisdiction or an authorized government agency, provided

that the disclosure does not exceed the extent of disclosure required by such law, regulation, or order. In addition, nothing herein

prohibits or restricts Executive from voluntarily communicating with, participating in, or fully cooperating with any investigation

or proceeding that may be conducted by any government agency, including providing documents or other information, without prior notice

to or approval from the Company. Nothing in this Agreement is intended or shall be interpreted to prevent the Executive from discussing

the Executive’s wages or other terms and conditions of Executive’s employment as permitted by the National Labor Relations

Act. Similarly, nothing in this Agreement is intended or shall be interpreted to prohibit the Executive from reporting possible violations

of law or regulation to any governmental agency or entity having responsibility to investigate the same or from making any truthful

statements in connection with any legal proceeding or investigation by any governmental agency or entity. |

| |

|

|

| |

15.4. |

Executive

understands and acknowledges that Executive’s obligations under this Agreement with regard to any particular Confidential Information

shall commence immediately upon Executive first having access to such Confidential Information (whether before or after Executive

begins employment by the Company) and shall continue during and after Executive’s employment by the Company until such time

as such Confidential Information has become public knowledge other than as a result of Executive’s breach of this Agreement

or breach by those acting in concert with Executive or on Executive’s behalf. |

| |

|

|

| |

15.5. |

Pursuant

to the Defend Trade Secrets Act of 2016, 18 USC § 1833(b)(1), Executive acknowledges and understands the following immunity

Notice: |

| |

|

|

| |

|

Immunity.

An individual shall not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a

trade secret that (A) is made (i) in confidence to a Federal, State, or local government official, either directly or indirectly,

or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made in

a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. |

| |

|

|

| |

|

Use

of Trade Secret Information in Anti-Retaliation Lawsuit. An individual who files a lawsuit for retaliation by an employer for reporting

a suspected violation of law may disclose the trade secret to the attorney of the individual and use the trade secret information

in the court proceeding, if the individual (A) files any document containing the trade secret under seal; and (B) does not disclose

the trade secret, except pursuant to court order. |

| |

|

|

| 16. |

Restrictive

Covenants. Executive understands that the

nature of Executive’s position gives Executive access to and knowledge of Confidential Information and places Executive in

a position of trust and confidence with the Company Group. Executive understands and acknowledges that the intellectual or artistic

services Executive provides to the Company Group are unique, special, or extraordinary. Executive further understands and acknowledges

that the Company Group’s ability to reserve these for the exclusive knowledge and use of the Company Group is of great competitive

importance and commercial value to the Company Group and that improper use or disclosure by Executive is likely to result in unfair

or unlawful competitive activity. Executive acknowledges that the benefits provided to Executive under this Agreement, including

but not limited to the amount of Executive’s compensation, as well as Executive’s access to Confidential Information,

constitute sufficient consideration to support the Restrictive Covenants contained in this Agreement. |

| 17. |

Non-Solicitation

of Employees and Clients. Executive agrees

and covenants not to directly or indirectly solicit, hire, recruit, or attempt to hire or recruit, or induce the termination of employment

of any employee of the Company Group, for a period of twelve (12) months beginning on the last day of the Executive’s employment

with the Company. Additionally, the Executive agrees not to solicit or attempt to solicit any clients, customers or vendors of the

Company Group, who have had a business relations with the Company Group during all times that Executive has been working for the

Company, for the purpose of providing services or products that compete with those offered by the Company Group for the same twelve

(12) month period. |

| |

|

| 18. |

Non-Disparagement.

Executive agrees and covenants that Executive will not at any time make, publish or communicate to any person or entity or in any

public forum any defamatory or disparaging remarks, comments, or statements concerning the Company Group or its businesses, or any

of its employees, officers, and existing and prospective customers,

suppliers, investors, and other associated third parties. This Section does not, in any way, restrict or impede Executive from exercising

protected rights to the extent that such rights cannot be waived by agreement or from complying with any applicable law or regulation

or a valid order of a court of competent jurisdiction or an authorized government agency, provided that such compliance does not

exceed that required by the law, regulation, or order. |

| |

|

| 19. |

Acknowledgment.

Executive acknowledges and agrees that the services to be rendered by Executive to the Company are of a special and unique character;

that Executive will obtain knowledge and skill relevant to the Company’s industry, methods of doing business and marketing

strategies by virtue of Executive’s employment; and that the restrictive covenants and other terms and conditions of this Agreement

are reasonable and reasonably necessary to protect the legitimate business interest of the Company Group. Executive further acknowledges

that the benefits provided to Executive under this Agreement, including the amount of Executive’s compensation reflects, in

part, Executive’s obligations and the Company’s rights under this Agreement; that Executive has no expectation of any

additional compensation, royalties or other payment of any kind not otherwise referenced herein in connection herewith; and that

Executive will not suffer undue hardship by reason of full compliance with the terms and conditions of this Agreement or the Company’s

enforcement thereof. |

| |

|

| 20. |

Remedies.

In the event of a breach or threatened breach by Executive or the Company of any provision of this Agreement, Executive and the Company

hereby consent and agree that the other non-breaching party shall be entitled to seek, in addition to other available remedies, a

temporary or permanent injunction or other equitable relief against such breach or threatened breach from any court of competent

jurisdiction, and that money damages would not afford an adequate remedy, without the necessity of showing any actual damages, and

without the necessity of posting any bond or other security. The aforementioned equitable relief shall be in addition to, not in

lieu of, legal remedies, monetary damages, or other available forms of relief. |

| 21. |

Proprietary

Rights. |

| |

|

| |

21.1. |

Work

Product. Executive acknowledges and agrees that all right, title, and interest in and to all writings, works of authorship,

technology, inventions, discoveries, processes, techniques, methods, ideas, concepts, research, proposals, materials, and all other

work product of any nature whatsoever, that are created, prepared, produced, authored, edited, amended, conceived, or reduced to

practice by Executive individually or jointly with others during the Term and relate in any way to the business or contemplated business,

products, activities, research, or development of the Company or result from any work performed by Executive for the Company (in

each case, regardless of when or where prepared or whose equipment or other resources is used in preparing the same), all rights

and claims related to the foregoing, and all printed, physical and electronic copies, and other tangible embodiments thereof (collectively,

“Work Product”), as well as any and all rights in and to US and foreign (a) patents, patent disclosures and inventions

(whether patentable or not), (b) trademarks, service marks, trade dress, trade names, logos, corporate names, and domain names, and

other similar designations of source or origin, together with the goodwill symbolized by any of the foregoing, (c) copyrights and

copyrightable works (including computer programs), and rights in data and databases, (d) trade secrets, know-how, and other confidential

information, and (e) all other intellectual property rights, in each case whether registered or unregistered and including all registrations

and applications for, and renewals and extensions of, such rights, all improvements thereto and all similar or equivalent rights

or forms of protection in any part of the world (collectively, “Intellectual Property Rights”), shall be the sole

and exclusive property of the Company. For purposes of this Agreement, “Work Product” includes, but is not limited

to, Company Group information. |

| |

|

|

| |

21.2. |

Work

Made for Hire; Assignment. Executive acknowledges

that, by reason of being employed by the Company at the relevant times, to the extent permitted by law, all of the Work Product consisting

of copyrightable subject matter is “work made for hire” as defined in 17 U.S.C. § 101 and such copyrights are therefore

owned by the Company. To the extent that the foregoing does not apply, Executive hereby irrevocably assigns to the Company, for no

additional consideration, Executive’s entire right, title, and interest in and to all Work Product and Intellectual Property

Rights therein, including the right to sue, counterclaim, and recover for all past, present, and future infringement, misappropriation,

or dilution thereof, and all rights corresponding thereto throughout the world. Nothing contained in this Agreement shall be construed

to reduce or limit the Company’s rights, title, or interest in any Work Product or Intellectual Property Rights so as to be

less in any respect than that the Company would have had in the absence of this Agreement. |

| |

|

|

| 22. |

Further

Assurances; Power of Attorney. During and

after the Term, Executive agrees to reasonably cooperate with the Company to (a) apply for, obtain, perfect, and transfer to the

Company the Work Product as well as any and all Intellectual Property Rights in the Work Product in any jurisdiction in the world;

and (b) maintain, protect and enforce the same, including, without limitation, giving testimony and executing and delivering to the

Company any and all applications, oaths, declarations, affidavits, waivers, assignments, and other documents and instruments as shall

be requested by the Company. Executive hereby irrevocably grants the Company power of attorney to execute and deliver any such documents

on Executive’s behalf in Executive’s name and to do all other lawfully permitted acts to transfer the Work Product to

the Company and further the transfer, prosecution, issuance, and maintenance of all Intellectual Property Rights therein, to the

full extent permitted by law, if Executive does not promptly cooperate with the Company’s request (without limiting the rights

the Company shall have in such circumstances by operation of law). The power of attorney is coupled with an interest and shall not

be affected by Executive’s subsequent incapacity. |

| |

|

|

| 23. |

No

License. Executive understands that this

Agreement does not, and shall not be construed to, grant Executive any license or right of any nature with respect to any Work Product

or Intellectual Property Rights or any Confidential Information, materials, software, or other tools made available to Executive

by the Company. |

| |

|

| 24. |

Publicity.

Executive hereby irrevocably consents to any and all uses and displays, by the Company Group and its agents, representatives and

licensees, of Executive’s name, voice, likeness, image, appearance, and biographical information in, on or in connection with

any pictures, photographs, audio and video recordings, digital images, websites, television programs and advertising, other advertising

and publicity, sales and marketing brochures, books, magazines, other publications, CDs, DVDs, tapes, and all other printed and electronic

forms and media throughout the world, at any time during or after the Term, for all legitimate commercial and business purposes of

the Company Group (“Permitted Uses”) without further consent from or royalty, payment, or other compensation to Executive.

Executive hereby forever waives and releases the Company Group and its directors, officers, employees, and agents from any and all

claims, actions, damages, losses, costs, expenses, and liability of any kind, arising under any legal or equitable theory whatsoever

at any time during or after the Term, arising directly or indirectly from the Company Group’s and its agents’, representatives’,

and licensees’ exercise of their rights in connection with any Permitted Uses. |

| 25. |

Governing

Law: Jurisdiction and Venue. This Agreement

shall be governed by the laws of Maryland, without regard to conflicts of law principles. Any dispute arising out of or relating

to this Agreement, including its breach, enforcement, or interpretation, shall be resolved through binding arbitration in Maryland,

administered by JAMS under its Comprehensive Arbitration Rules. Judgment on the arbitration award may be entered in any court of

competent jurisdiction. This clause does not preclude seeking provisional remedies from a court. The prevailing party in any arbitration

shall be entitled to reasonable costs and attorneys’ fees. The arbitrator may not award punitive or exemplary damages, except

where permitted by law, and the parties waive the right to such damages. The parties agree to keep the arbitration proceedings and

award confidential, except as necessary for the arbitration process, court applications for remedies, or as required by law. |

| |

|

| 26. |

Entire

Agreement. Unless specifically provided

herein, this Agreement contains all of the understandings and representations between Executive and the Company pertaining to the

subject matter hereof and supersedes all prior and contemporaneous understandings, agreements, representations, and warranties, both

written and oral, with respect to such subject matter. The parties mutually agree that the Agreement can be specifically enforced

in court and can be cited as evidence in legal proceedings alleging breach of the Agreement. |

| |

|

| 27. |

Modification

and Waiver. No provision of this Agreement

may be amended or modified unless such amendment or modification is agreed to in writing and signed by Executive and by the Company.

No waiver by either of the parties of any breach by the other party hereto of any condition or provision of this Agreement to be

performed by the other party hereto shall be deemed a waiver of any similar or dissimilar provision or condition at the same or any

prior or subsequent time, nor shall the failure of or delay by either of the parties in exercising any right, power, or privilege

hereunder operate as a waiver thereof to preclude any other or further exercise thereof or the exercise of any other such right,

power, or privilege. |

| |

|

| 28. |

Severability.

Should any provision of this Agreement be held by a court of competent jurisdiction to be enforceable only if modified, or if any

portion of this Agreement shall be held as unenforceable and thus stricken, such holding shall not affect the validity of the remainder

of this Agreement, the balance of which shall continue to be binding upon the parties with any such modification to become a part

hereof and treated as though originally set forth in this Agreement. The parties further agree that any such court is expressly authorized

to modify any such unenforceable provision of this Agreement in lieu of severing such unenforceable provision from this Agreement

in its entirety, whether by rewriting the offending provision, deleting any or all of the offending provision, adding additional

language to this Agreement, or by making such other modifications as it deems warranted to carry out the intent and agreement of

the parties as embodied herein to the maximum extent permitted by law. The parties expressly agree that this Agreement as so modified

by the court shall be binding upon and enforceable against each of them. In any event, should one or more of the provisions of this

Agreement be held to be invalid, illegal, or unenforceable in any respect, such invalidity, illegality, or unenforceability shall

not affect any other provisions hereof, and if such provision or provisions are not modified as provided above, this Agreement shall

be construed as if such invalid, illegal, or unenforceable provisions had not been set forth herein. |

| 29. |

Headings.

Captions and headings of the sections and paragraphs of this Agreement are intended solely for convenience and no provision of this

Agreement is to be construed by reference to the caption or heading of any section or paragraph. |

| |

|

| 30. |

Counterparts.

This Agreement may be executed in separate counterparts, each of which shall be deemed an original, but all of which taken together

shall constitute one and the same instrument. |

| |

|

|

|

| 31. |

Tolling.

Should Executive violate any of the terms of the restrictive covenant obligations articulated herein, the obligation at issue will

run from the first date on which Executive ceases to be in violation of such obligation. |

| |

|

| 32. |

Section

409A. |

| |

|

| |

32.1. |

General

Compliance. This Agreement is intended to comply

with Section 409A or an exemption thereunder and shall be construed and administered in accordance with Section 409A. Notwithstanding

any other provision of this Agreement, payments provided under this Agreement may only be made upon an event and in a manner that

complies with Section 409A or an applicable exemption. Any payments under this Agreement that may be excluded from Section 409A either

as separation pay due to an involuntary separation from service or as a short-term deferral shall be excluded from Section 409A to

the maximum extent possible. For purposes of Section 409A, each installment payment provided under this Agreement shall be treated

as a separate payment. Any payments to be made under this Agreement upon a termination of employment shall only be made upon a “separation

from service” under Section 409A. Notwithstanding the foregoing, the Company makes no representations that the payments and

benefits provided under this Agreement comply with Section 409A, and in no event shall the Company be liable for all or any portion

of any taxes, penalties, interest, or other expenses that may be incurred by Executive on account of non-compliance with Section

409A. |

| |

|

|

| |

32.2. |

Specified

Employees. Notwithstanding any other provision

of this Agreement, if any payment or benefit provided to Executive in connection with Executive’s termination of employment

is determined to constitute “nonqualified deferred compensation” within the meaning of Section 409A and Executive

is determined to be a “specified employee” as defined in Section 409A(a)(2)(b)(i), then such payment or benefit shall

not be paid until the first payroll date following the six-month anniversary of the Termination Date or, if earlier, on Executive’s

death (the “Specified Employee Payment Date”). The aggregate of any payments that would otherwise have been paid

before the Specified Employee Payment Date shall be paid to Executive in a lump sum on the Specified Employee Payment Date and thereafter,

any remaining payments shall be paid without delay in accordance with their original schedule. |

| |

|

|

| |

32.3. |

Reimbursements.

To the extent required by Section 409A, each reimbursement or in-kind benefit provided under this Agreement shall be provided in

accordance with the following: |

| |

|

|

| |

|

32.3.1. |

the

amount of expenses eligible for reimbursement, or in-kind benefits provided, during each calendar year cannot affect the expenses

eligible for reimbursement, or in-kind benefits to be provided, in any other calendar year; |

| |

|

|

|

| |

|

32.3.2. |

any

reimbursement of an eligible expense shall be paid to Executive on or before the last day of the calendar year following the calendar

year in which the expense was incurred; and |

| |

|

|

|

| |

|

32.3.3. |

any

right to reimbursements or in-kind benefits under this Agreement shall not be subject to liquidation or exchange for another benefit. |

| 33. |

Successors

and Assigns. This Agreement is personal

to Executive and may not be assigned by Executive. Any attempt by Executive to assign this Agreement be deemed null and void from

the date of the attempted assignment. The Company may assign this Agreement to any successor or assignee, whether through purchase,

merger, consolidation, or otherwise, involving all or substantially all of its business or assets. This Agreement shall inure to

the benefit of the Company and its permitted successors and assigns. |

| |

|

| 34. |

Notice.

Notices and all other communications provided for in this Agreement shall be in writing and shall be delivered personally or sent

by registered or certified mail, return receipt requested, or by overnight carrier to the parties at the addresses set forth below