false

--12-31

Q2

0001487197

0001487197

2024-01-01

2024-06-30

0001487197

2024-08-12

0001487197

2024-06-30

0001487197

2023-12-31

0001487197

2024-04-01

2024-06-30

0001487197

2023-04-01

2023-06-30

0001487197

2023-01-01

2023-06-30

0001487197

2022-12-31

0001487197

2023-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerAMember

2024-04-01

2024-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerAMember

2023-04-01

2023-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerAMember

2024-01-01

2024-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerAMember

2023-01-01

2023-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerBMember

2024-04-01

2024-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerBMember

2023-04-01

2023-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerBMember

2024-01-01

2024-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerBMember

2023-01-01

2023-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerCMember

2024-04-01

2024-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerCMember

2023-04-01

2023-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerCMember

2024-01-01

2024-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

BRFH:ManufacturerCMember

2023-01-01

2023-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

2024-04-01

2024-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

2023-04-01

2023-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

2024-01-01

2024-06-30

0001487197

BRFH:PurchasesMember

us-gaap:SupplierConcentrationRiskMember

2023-01-01

2023-06-30

0001487197

BRFH:ManufacturingEquipmentMember

2024-06-30

0001487197

BRFH:ManufacturingEquipmentMember

2023-12-31

0001487197

BRFH:CustomerEquipmentMember

2024-06-30

0001487197

BRFH:CustomerEquipmentMember

2023-12-31

0001487197

2022-01-01

2022-12-31

0001487197

2021-01-01

2021-12-31

0001487197

us-gaap:RelatedPartyMember

2022-07-31

0001487197

srt:MaximumMember

2024-01-01

2024-06-30

0001487197

2024-03-31

0001487197

2023-07-01

2024-03-31

0001487197

2023-10-23

0001487197

2023-10-23

2023-10-23

0001487197

2023-12-19

0001487197

2023-12-19

2023-12-19

0001487197

2024-03-29

0001487197

2024-03-29

2024-03-29

0001487197

us-gaap:CommonStockMember

2022-12-31

0001487197

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001487197

us-gaap:RetainedEarningsMember

2022-12-31

0001487197

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001487197

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001487197

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001487197

us-gaap:CommonStockMember

2024-01-01

2024-06-30

0001487197

us-gaap:CommonStockMember

2023-06-30

0001487197

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001487197

us-gaap:RetainedEarningsMember

2023-06-30

0001487197

us-gaap:CommonStockMember

2023-12-31

0001487197

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001487197

us-gaap:RetainedEarningsMember

2023-12-31

0001487197

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-06-30

0001487197

us-gaap:RetainedEarningsMember

2024-01-01

2024-06-30

0001487197

us-gaap:CommonStockMember

2024-06-30

0001487197

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001487197

us-gaap:RetainedEarningsMember

2024-06-30

0001487197

BRFH:TwoThousandAndTwentyThreePlanMember

2023-06-30

0001487197

BRFH:TwoThousandAndTwentyThreePlanMember

2024-03-31

0001487197

BRFH:TwoThousandAndTwentyThreePlanMember

srt:MaximumMember

2024-03-31

0001487197

us-gaap:PerformanceSharesMember

2023-02-01

2023-02-28

0001487197

us-gaap:PerformanceSharesMember

BRFH:TimeBasedVestingMember

2023-02-01

2023-02-28

0001487197

us-gaap:PerformanceSharesMember

2023-01-01

2023-06-30

0001487197

us-gaap:PerformanceSharesMember

BRFH:TwoThousandAndTwentyFourPerformanceShareUnitsProgramMember

2024-03-01

2024-03-31

0001487197

us-gaap:PerformanceSharesMember

BRFH:TwoThousandAndTwentyFourPerformanceShareUnitsProgramMember

2024-04-01

2024-06-30

0001487197

us-gaap:PerformanceSharesMember

BRFH:TwoThousandAndTwentyFourPerformanceShareUnitsProgramMember

2024-01-01

2024-06-30

0001487197

2023-01-01

2023-12-31

0001487197

BRFH:RestrictedStockAwardAndRestrictedStockUnitMember

2023-12-31

0001487197

BRFH:RestrictedStockAwardAndRestrictedStockUnitMember

2024-01-01

2024-06-30

0001487197

BRFH:RestrictedStockAwardAndRestrictedStockUnitMember

2024-06-30

0001487197

us-gaap:PerformanceSharesMember

2023-12-31

0001487197

us-gaap:PerformanceSharesMember

2024-01-01

2024-06-30

0001487197

us-gaap:PerformanceSharesMember

2024-06-30

0001487197

us-gaap:SubsequentEventMember

2024-08-31

0001487197

us-gaap:SubsequentEventMember

2024-08-01

2024-08-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended June 30, 2024

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from ________________ to ___________________

Commission

File Number: 001-41228

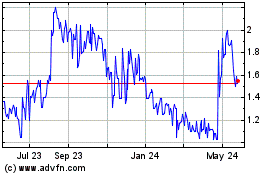

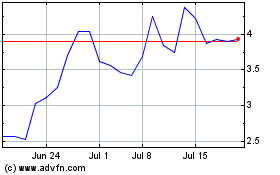

BARFRESH

FOOD GROUP INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

27-1994406 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

3600

Wilshire Blvd., Suite 1720,

Los

Angeles, California |

|

90010 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

310-598-7113

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name, former address and former fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, $0.000001 par value |

|

BRFH |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☐ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by the check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 14,746,172

shares as of August 12, 2024.

TABLE

OF CONTENTS

Item

1. Financial Statements.

Barfresh Food Group Inc.

Condensed Consolidated Balance Sheets

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

(audited) | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 383,000 | | |

$ | 1,891,000 | |

| Trade accounts receivable, net | |

| 671,000 | | |

| 821,000 | |

| Other receivables | |

| 19,000 | | |

| 160,000 | |

| Inventory, net | |

| 1,534,000 | | |

| 1,214,000 | |

| Prepaid expenses and other current assets | |

| 122,000 | | |

| 67,000 | |

| Total current assets | |

| 2,729,000 | | |

| 4,153,000 | |

| Property, plant and equipment, net of depreciation | |

| 300,000 | | |

| 409,000 | |

| Intangible assets, net of amortization | |

| 210,000 | | |

| 241,000 | |

| Other non-current assets | |

| 92,000 | | |

| 7,000 | |

| Total assets | |

$ | 3,331,000 | | |

$ | 4,810,000 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 843,000 | | |

$ | 1,670,000 | |

| Disputed co-manufacturer accounts payable (Note 4) | |

| 499,000 | | |

| 499,000 | |

| Accrued expenses | |

| 155,000 | | |

| 85,000 | |

| Accrued payroll and employee related | |

| 47,000 | | |

| 53,000 | |

| Total current liabilities | |

| 1,544,000 | | |

| 2,307,000 | |

| Other non-current liabilities | |

| 111,000 | | |

| - | |

| Total liabilities | |

| 1,655,000 | | |

| 2,307,000 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.000001 par value, 400,000 shares authorized, none issued or outstanding | |

| - | | |

| - | |

| Common stock, $0.000001 par value; 23,000,000 shares authorized; 14,723,906 and 14,420,105 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | |

| - | | |

| - | |

| Additional paid in capital | |

| 63,932,000 | | |

| 63,299,000 | |

| Accumulated deficit | |

| (62,256,000 | ) | |

| (60,796,000 | ) |

| Total stockholders’ equity | |

| 1,676,000 | | |

| 2,503,000 | |

| Total liabilities and stockholders’ equity | |

$ | 3,331,000 | | |

$ | 4,810,000 | |

See

the accompanying notes to the condensed consolidated financial statements

Barfresh Food Group Inc.

Condensed Consolidated Statements of Operations

For the three and six months ended June 30, 2024 and 2023

(Unaudited)

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

For the three months

ended June 30, | | |

For the six months

ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue | |

$ | 1,464,000 | | |

$ | 1,511,000 | | |

$ | 4,293,000 | | |

$ | 3,602,000 | |

| Cost of revenue | |

| 955,000 | | |

| 1,037,000 | | |

| 2,614,000 | | |

| 2,273,000 | |

| Gross profit | |

| 509,000 | | |

| 474,000 | | |

| 1,679,000 | | |

| 1,329,000 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, marketing and distribution | |

| 583,000 | | |

| 625,000 | | |

| 1,277,000 | | |

| 1,293,000 | |

| General and administrative | |

| 871,000 | | |

| 493,000 | | |

| 1,729,000 | | |

| 1,487,000 | |

| Depreciation and amortization | |

| 66,000 | | |

| 98,000 | | |

| 133,000 | | |

| 196,000 | |

| Total operating expenses | |

| 1,520,000 | | |

| 1,216,000 | | |

| 3,139,000 | | |

| 2,976,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,011,000 | ) | |

$ | (742,000 | ) | |

$ | (1,460,000 | ) | |

$ | (1,647,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Per share information - basic and fully diluted: | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding | |

| 14,722,020 | | |

| 13,003,000 | | |

| 14,611,000 | | |

| 12,290,000 | |

| Net loss per share | |

$ | (0.07 | ) | |

$ | (0.06 | ) | |

$ | (0.10 | ) | |

$ | (0.13 | ) |

See

the accompanying notes to the condensed consolidated financial statements

Barfresh

Food Group Inc.

Consolidated

Statements of Cash Flows

For

the six months ended June 30, 2024 and 2023

(Unaudited)

| | |

2024 | | |

2023 | |

| Net

loss | |

$ | (1,460,000 | ) | |

$ | (1,647,000 | ) |

| Adjustments

to reconcile net loss to net cash used in operating activities | |

| | | |

| | |

| | |

| | | |

| | |

| Stock-based

compensation | |

| 517,000 | | |

| 211,000 | |

| Depreciation

and amortization | |

| 144,000 | | |

| 205,000 | |

| Stock

and options issued for services | |

| - | | |

| 8,000 | |

| Changes

in assets and liabilities | |

| | | |

| | |

| Accounts

receivable | |

| 150,000 | | |

| (236,000 | ) |

| Other

receivables | |

| 141,000 | | |

| (7,000 | ) |

| Inventories | |

| (320,000 | ) | |

| 78,000 | |

| Prepaid

expenses and other assets | |

| 14,000 | | |

| (22,000 | ) |

| Accounts

payable | |

| (756,000 | ) | |

| (759,000 | ) |

| Accrued

expenses | |

| 21,000 | | |

| 120,000 | |

| Net

cash used in operating activities | |

| (1,549,000 | ) | |

| (2,049,000 | ) |

| | |

| | | |

| | |

| Investing

activities | |

| | | |

| | |

| Purchase

of property and equipment | |

| (4,000 | ) | |

| - | |

| Net

cash used in investing activities | |

| (4,000 | ) | |

| - | |

| | |

| | | |

| | |

| Financing

activities | |

| | | |

| | |

| Issuance

of debt | |

| 65,000 | | |

| - | |

| Repurchases

from stock compensation program | |

| (20,000 | ) | |

| (18,000 | ) |

| Net

cash provided by (used in) financing activities | |

| 45,000 | | |

| (18,000 | ) |

| Net

decrease in cash | |

| (1,508,000 | ) | |

| (2,067,000 | ) |

| Cash, beginning of period | |

| 1,891,000 | | |

| 3,019,000 | |

| Cash, end of period | |

$ | 383,000 | | |

$ | 952,000 | |

| | |

| | | |

| | |

| Cash

paid during the period for: | |

| | | |

| | |

| Amounts

included in the measurement of lease liabilities | |

$ | - | | |

$ | 20,000 | |

| | |

| | | |

| | |

| Non-cash

financing and investing activities: | |

| | | |

| | |

| Convertible

notes issued in exchange for trade payables | |

$ | 71,000 | | |

$ | - | |

| Conversion

of debt and interest to equity | |

$ | 136,000 | | |

$ | - | |

| Acquisition

of long-term software license in exchange for contract payable | |

$ | 154,000 | | |

$ | - | |

| Value

of shares relinquished in modification of stock-based compensations awards | |

$ | - | | |

$ | 24,000 | |

See

the accompanying notes to the condensed consolidated financial statements

Barfresh

Food Group Inc.

Notes

to Condensed Consolidated Financial Statements

June

30, 2024

(Unaudited)

Note

1. Description of the Business, Basis of Presentation, and Summary of Significant Accounting Policies

Barfresh

Food Group Inc., (“we,” “us,” “our,” and the “Company”) was incorporated on February

25, 2010 in the State of Delaware. The Company is engaged in the manufacturing and distribution of ready-to-drink and ready-to-blend

beverages, particularly, smoothies, shakes and frappes.

Basis

of Presentation

The

accompanying condensed consolidated financial statements are unaudited. These unaudited interim condensed consolidated financial statements

have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) and

applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) regarding interim financial reporting.

Certain information and footnote disclosures normally included in the financial statements prepared in accordance with GAAP have been

condensed or omitted pursuant to such rules and regulations. Accordingly, these interim condensed consolidated financial statements should

be read in conjunction with the audited consolidated financial statements for the fiscal year ended December 31, 2023 included in the

Company’s Annual Report on Form 10-K, as filed with the SEC on March 22, 2024. In management’s opinion, the unaudited interim

condensed consolidated financial statements reflect all adjustments, which are of a normal and recurring nature, that are necessary for

a fair presentation of financial results for the interim periods presented. Operating results for any quarter are not necessarily indicative

of the results for the full fiscal year.

Principles

of Consolidation

The

consolidated financial statements include the financial statements of the Company and our wholly owned subsidiaries, Barfresh Inc. and

Barfresh Corporation Inc. (formerly known as Smoothie, Inc.). All inter-company balances and transactions among the companies have been

eliminated upon consolidation.

Use

of Estimates

The

preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities in the balance sheets and revenues and expenses during the years reported. Actual results may differ

from these estimates.

Vendor

Concentrations

The

Company is exposed to supply risk as a result of concentration in its vendor base resulting from the use of a limited number of contract

manufacturers. Purchases from the Company’s significant contract manufacturers as a percentage of all finished goods purchased

were as follows:

Schedule

of Contract Manufacturers Percentage of Finished Goods

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

For the three months ended June 30, | | |

For the six months ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Manufacturer A | |

| 45 | % | |

| 34 | % | |

| 56 | % | |

| 41 | % |

| Manufacturer B | |

| 49 | % | |

| 50 | % | |

| 41 | % | |

| 49 | % |

| Manufacturer C | |

| 6 | % | |

| 16 | % | |

| 3 | % | |

| 10 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Concentration risk percentage | |

| 100 | % | |

| 100 | % | |

| 100 | % | |

| 100 | % |

Summary

of Significant Accounting Policies

There

have been no changes to our significant accounting policies described in our Annual Report on Form 10-K for the year ended December 31,

2023, as filed with the SEC on March 22, 2024 that have had a material impact on our condensed consolidated financial statements and

related notes.

Financial

Instruments

The

Company’s financial instruments consist of cash, accounts receivable and accounts payable. The carrying value of the Company’s

financial instruments approximates their fair value.

Accounts

Receivable and Allowances

Accounts

receivable are recorded and carried at the original invoiced amount less allowances for credits and for any potential uncollectible amounts

due to credit losses. We make estimates of the expected credit and collectability trends for the allowance for credit losses based on

our assessment of various factors, including historical experience, the age of the accounts receivable balances, credit quality of our

customers, current economic conditions, and other factors that may affect our ability to collect from our customers. Expected credit

losses are recorded as general and administrative expenses on our condensed consolidated statements of operations. As of June 30, 2024

and December 31, 2023, there was no allowance for credit losses. There was no credit loss expense for the three and six months ended

June 30, 2024 and 2023.

Other

Receivables

Other

receivables consist of the Company’s 2021 Employer Retention Credit “ERC” claim, which the Company collected in March

2024, amounts due from vendors for materials acquired on their behalf for use in manufacturing the Company’s products, vendor rebates

and freight claims.

ERC

claims can be made in a variety of circumstances with varying degrees of subjectivity and clear authoritative guidance. Paid claims are

subject to IRS inspection which may occur prior to expiration of the statute of limitations. The Company’s ERC claim was based

on objectively calculated declines in revenue using methods that are clearly defined in the Coronavirus Aid, Relief, and Economic Security

Act and various regulations and interpretations thereof.

Revenue

Recognition

In

accordance with ASC 606, Revenue from Contracts with Customers, revenue is recognized when a customer obtains ownership of promised goods.

The amount of revenue recognized reflects the consideration to which the Company expects to be entitled to receive in exchange for these

goods. The Company applies the following five steps:

| |

1) |

Identify

the contract with a customer |

| |

|

|

| |

|

A

contract with a customer exists when (i) the Company enters into an enforceable contract with a customer that defines each party’s

rights, (ii) the contract has commercial substance and, (iii) the Company determines that collection of substantially all consideration

for goods or services that are transferred is probable. For the Company, the contract is the approved sales order, which may also

be supplemented by other agreements that formalize various terms and conditions with customers. |

| |

2) |

Identify

the performance obligation in the contract |

| |

|

|

| |

|

Performance

obligations promised in a contract are identified based on the goods or services that will be transferred to the customer. For the

Company, this consists of the delivery of frozen beverages, which provide immediate benefit to the customer. |

| |

|

|

| |

3) |

Determine

the transaction price |

| |

|

|

| |

|

The

transaction price is determined based on the consideration to which the Company will be entitled in exchange for transferring goods

and is generally stated on the approved sales order. Variable consideration, which typically includes rebates or discounts, are estimated

utilizing the most likely amount method. Provisions for refunds are generally provided for in the period the related sales are recorded,

based on management’s assessment of historical and projected trends. |

| |

4) |

Allocate

the transaction price to performance obligations in the contract

Since

the Company’s contracts contain a single performance obligation, delivery of frozen beverages, the transaction price is allocated

to that single performance obligation. |

| |

|

|

| |

5) |

Recognize

revenue when or as the Company satisfies a performance obligation |

| |

|

|

| |

|

The

Company recognizes revenue from the sale of frozen beverages when title and risk of loss

passes and the customer accepts the goods, which generally occurs at the time of delivery

to a customer warehouse. Customer sales incentives such as volume-based rebates or discounts

are treated as a reduction of sales at the time the sale is recognized. Shipping and handling

costs are treated as fulfilment costs and presented in distribution, selling and administrative

costs.

Payments

that are received before performance obligations are recorded are shown as current liabilities. |

| |

|

|

| |

|

The

Company evaluated the requirement to disaggregate revenue and concluded that substantially all of its revenue comes from a single

product, frozen beverages. |

Storage

and Shipping Costs

Storage

and outbound freight costs are included in selling, marketing and distribution expense. For the three months ending June 30, 2024 and

2023, storage and outbound freight totaled approximately $217,000 and $252,000, respectively. For the six months ended June 30, 2024

and 2023, storage and outbound freight totaled approximately $581,000 and $562,000, respectively.

Research

and Development

Expenditures

for research activities relating to product development and improvement are charged to expense as incurred. The Company incurred approximately

$17,000 and $35,000 in research and development expense for the three months ended June 30, 2024 and 2023, respectively, and $47,000

and $56,000 for the six months ended June 30, 2024 and 2023, respectively.

Loss

Per Share

For

the three and six months ended June 30, 2024 and 2023 common stock equivalents have not been included in the calculation of net loss

per share as their effect is anti-dilutive as a result of losses incurred.

Reclassifications

Certain

reclassifications have been made to the 2023 financial statements to conform to the 2024 presentation, namely stock-based compensation

paid to the Company’s directors has been reclassified from stock and options issued for services and shares repurchased for employee

tax withholding under the Company’s stock compensation program have been reclassified to financing activities in the consolidated

statement of cash flows, with corresponding changes reflected in the statement of stockholders’ equity for the six months ended

June 30, 2023.

Recent

Pronouncements

From

time to time, new accounting pronouncements are issued that we adopt as of the specified effective date. We have not determined if the

impact of recently issued standards that are not yet effective will have an impact on our results of operations and financial position.

Note

2. Inventory

Inventory

consists of the following:

Schedule of Inventory

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Raw materials | |

$ | 28,000 | | |

$ | 28,000 | |

| Finished goods | |

| 1,506,000 | | |

| 1,186,000 | |

| Inventory, net | |

$ | 1,534,000 | | |

$ | 1,214,000 | |

Note

3. Property Plant and Equipment

Property

and equipment, net consist of the following:

Schedule of Property and Equipment, Net

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Manufacturing equipment | |

$ | 1,546,000 | | |

$ | 1,546,000 | |

| Customer equipment | |

| 1,408,000 | | |

| 1,410,000 | |

| Property and equipment, gross | |

| 2,954,000 | | |

| 2,956,000 | |

| Less: accumulated depreciation | |

| (2,654,000 | ) | |

| (2,547,000 | ) |

| Property and equipment, net of depreciation | |

$ | 300,000 | | |

$ | 409,000 | |

Depreciation

expense related to these assets was approximately $56,000 and $87,000 for the three months ended June 30, 2024 and 2023, respectively,

and $113,000 and $174,000 for the six months ended June 30, 2024 and 2023, respectively. Depreciation expense in cost of revenue was

$6,000 and $5,000 for the three months ended June 30, 2024 and 2023, respectively, and $13,000 and $10,000 for the six months ended June

30, 2024 and 2023, respectively.

Note

4. Commitments and Contingencies

Lease

Commitments

The

Company leases office space under a non-cancellable operating lease which expired on March 31, 2023, and was extended in a series of

amendments through September 30, 2024. The Company’s periodic lease cost was approximately $20,000 for each of the three months

ended June 30, 2024 and 2023 and $40,000 for each of the six months ended June 30, 2024 and 2023.

Legal

Proceedings

Schreiber

Dispute

The

Company’s products are produced to its specifications through several contract manufacturers. One of the Company’s contract

manufacturers (the “Manufacturer”) provided approximately 52% and 42% of the Company’s products in the years ended

December 31, 2022 and 2021, respectively, under a Supply Agreement with an initial term through September 2025.

Over

the course of 2022, the Company experienced numerous quality issues with the case packaging utilized by the Manufacturer. In addition,

in July of 2022, the Company began receiving customer complaints about the texture of the Company’s smoothie products produced

by the Manufacturer. In response, the Company withdrew product from the market and destroyed on-hand inventory, withholding $499,000

in payments due to the Manufacturer.

The

Company attempted to resolve the issues based on the contractual procedures described in the Supply Agreement. However, on November 4,

2022, in response to a formal proposal of alternate resolutions, the Company received notification from the Manufacturer that it was

denying any responsibility for the defective manufacture of the product. In response, on November 10, 2022, the Company filed a complaint

in the United States District Court for the Central District of California, Western Division (the “Complaint”), claiming

that the Manufacturer had not met its obligations under the Supply Agreement, and seeking economic damages. In response, the Manufacturer

terminated the Supply Agreement. On January 20, 2023, the Company filed a voluntary dismissal of the Complaint which allowed the parties

to reach a potential resolution outside of the court system. However, as the parties were once again unable to come to an agreement,

the Company re-filed the Complaint in California State Court in August 2023 and continues to progress through the court system.

In

May 2024, the Company entered into a non-recourse litigation financing arrangement which is expected to be adequate to pursue the Complaint

to conclusion.

Due

to the uncertainties surrounding the claim, the Company is not able to predict either the outcome or a range of reasonably possible recoveries

that could result from its actions against the Manufacturer, and no gain contingencies have been recorded. The disruption in its supply

resulting from the dispute has and will continue to adversely impact the Company’s results of operations and cash flow until a

suitable resolution is reached or new sources of reliable supply at sufficient volume can be identified and developed, the timing of

which is uncertain. The Company has mitigated the impact of the supply disruption with the introduction of its single-serve smoothie

cartons; however the product format has not been accepted by some customers or as a substitute for the bottle product in all use cases.

Other

legal matters

From

time to time, various lawsuits and legal proceedings may arise in the ordinary course of business. However, litigation is subject to

inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business. We are

currently the defendant in one legal proceeding for an amount less than $100,000. Our legal counsel and management believe the probability

of a material unfavorable outcome is remote.

Note

5. Convertible Notes

From

July 2023 to March 2024, the Company executed subscription agreements for substantially all of a $2,000,000 privately placed convertible

debt offering. The debt was available to be drawn in 25% increments, maturing on the anniversary of the draw, bearing interest at 10%

per annum for the term, regardless of earlier payment or conversion, and was mandatorily convertible as to principal and interest into

shares of the Company’s common stock at any time prior to maturity at the greater of $1.20 or 85% of the volume-weighted average

price of the common stock for the ten trading days immediately preceding the written notice of the conversion (the “Conversion

Price”). If the Company had not exercised the mandatory conversion, the holder of the debt had the option after six months and

on up to four occasions to convert all or any portion of the principal and interest into shares of the Company’s common stock at

the Conversion Price.

On

October 23, 2023, the Company drew down $1,390,000 in convertible debt and converted a total of $1,207,000 of principal into 820,160

shares of common stock. Additionally, on December 19, 2023, the Company drew down $470,000 in convertible debt and converted a total

of $653,000 of principal and $4,000 of accrued interest into 495,331 shares of common stock. Finally, on March 27 and 29, 2024 the Company

drew down $136,000 in convertible debt and converted the total drawn into 124,208 shares, settling all debt. Debt drawdowns included

the non-cash settlement of $30,000 and $71,000 in 2023 and 2024, respectively.

Note

6. Stockholders’ Equity

The

following are changes in stockholders’ equity for the six months ended June 30, 2023 and 2024:

Schedule of Changes in Stockholders' Equity

| |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

(Deficit) |

|

|

Total |

|

| |

|

|

|

|

Additional |

|

|

|

|

|

|

|

| |

|

Common Stock |

|

|

paid in |

|

|

Accumulated |

|

|

|

|

| |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

(Deficit) |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance December 31, 2022 |

|

|

12,934,741 |

|

|

$ |

- |

|

|

$ |

60,905,000 |

|

|

$ |

(57,972,000 |

) |

|

$ |

2,933,000 |

|

| Issuance of common stock for equity compensation, net of shares repurchased for income tax withholding |

|

|

65,779 |

|

|

|

- |

|

|

|

(18,000 |

) |

|

|

- |

|

|

|

(18,000 |

) |

| Equity-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

211,000 |

|

|

|

- |

|

|

|

211,000 |

|

| Cash settlement of equity-based compensation |

|

|

- |

|

|

|

- |

|

|

|

(24,000 |

) |

|

|

- |

|

|

|

(24,000 |

) |

| Conversion of debt and interest (Note 5) | |

| 124,208 | | |

| | | |

| | | |

| | | |

| | |

| Issuance of stock for services |

|

|

2,083 |

|

|

|

- |

|

|

|

8,000 |

|

|

|

- |

|

|

|

8,000 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,647,000 |

) |

|

|

(1,647,000 |

) |

| Balance June 30, 2023 |

|

|

13,002,603 |

|

|

$ |

- |

|

|

$ |

61,082,000 |

|

|

$ |

(59,619,000 |

) |

|

$ |

1,463,000 |

|

| | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Common Stock | | |

paid in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

(Deficit) | | |

Total | |

| Balance December 31, 2023 | |

| 14,420,105 | | |

$ | - | | |

$ | 63,299,000 | | |

$ | (60,796,000 | ) | |

$ | 2,503,000 | |

| Balance | |

| 14,420,105 | | |

$ | - | | |

$ | 63,299,000 | | |

$ | (60,796,000 | ) | |

$ | 2,503,000 | |

| Issuance of common stock for equity compensation, net of shares repurchased for income tax withholding | |

| 179,593 | | |

| - | | |

| (20,000 | ) | |

| - | | |

| (20,000 | ) |

| Equity-based compensation expense | |

| - | | |

| - | | |

| 517,000 | | |

| - | | |

| 517,000 | |

| Conversion of debt and interest (Note 5) | |

| 124,208 | | |

| - | | |

| 136,000 | | |

| - | | |

| 136,000 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (1,460,000 | ) | |

| (1,460,000 | ) |

| Balance June 30, 2024 | |

| 14,723,906 | | |

$ | - | | |

$ | 63,932,000 | | |

$ | (62,256,000 | ) | |

$ | 1,676,000 | |

| Balance | |

| 14,723,906 | | |

$ | - | | |

$ | 63,932,000 | | |

$ | (62,256,000 | ) | |

$ | 1,676,000 | |

Warrants

During

the six months ended June 30, 2024, 122,739 warrants at a weighted average exercise price of $9.10 per share expired.

Equity

Incentive Plan

Through

2022, the Company issued equity awards under the 2015 Equity Incentive Plan (the “2015 Plan”) and outside the Plan. In June

2023, the Company’s stockholders adopted the 2023 Equity Incentive Plan (the “2023 Plan”), reserving 650,000 shares

for future issuance. The Board of Directors discontinued further grants under the 2015 Plan. In March 2024, the Board of Directors amended

the 2023 Plan to reserve an additional 650,000 shares for future issuance, bringing the total for the plan to 1,300,000, and to provide

an evergreen provision that reserves additional shares depending on future non-plan issuances of common stock.

As

of June 30, 2024, the Company has $797,000 of total unrecognized share-based compensation expense relative to unvested options, stock

awards and stock units, which is expected to be recognized over the remaining weighted average period of 2.5 years.

Stock

Options

The

following is a summary of stock option activity for the six months ended June 30, 2024:

Schedule of Stock Options Activity

| | |

Number of Options | | |

Weighted average exercise price per share | | |

Remaining term in years | |

| Outstanding on December 31, 2023 | |

| 587,091 | | |

$ | 6.50 | | |

| 3.6 | |

| Issued | |

| 229,849 | | |

$ | 1.97 | | |

| 8.0 | |

| Expired | |

| (71,930 | ) | |

$ | 7.95 | | |

| | |

| Outstanding on June 30, 2024 | |

| 745,010 | | |

$ | 4.96 | | |

| 5.5 | |

| | |

| | | |

| | | |

| | |

| Exercisable, June 30, 2024 | |

| 531,540 | | |

$ | 6.02 | | |

| 3.9 | |

The

fair value of the options issued was calculated using the Black-Scholes option pricing model, based on the following:

Schedule

of Fair Value of Options Using Black-Sholes Option Pricing Model

| | |

2024 | |

| Expected term (in years) | |

| 8.0 | |

| Expected volatility | |

| 93.5 | % |

| Risk-free interest rate | |

| 4.2 | % |

| Expected dividends | |

$ | - | |

| Weighted average grant date fair value per share | |

$ | 1.71 | |

Restricted

Stock

The

following is a summary of restricted stock award and restricted stock unit activity for the six months ended June 30, 2024:

Schedule of Restricted Stock Award and Restricted Stock Unit Activity

| | |

Number of shares | | |

Weighted average grant date fair value | |

| Unvested at January 1, 2024 | |

| 32,606 | | |

$ | 4.82 | |

| Granted | |

| 65,000 | | |

$ | 1.73 | |

| Vested | |

| (10,733 | ) | |

$ | 5.58 | |

| Unvested at June 30, 2024 | |

| 86,873 | | |

$ | 2.41 | |

Performance

Share Units

During

2023 and 2024, the Company issued performance share units (“PSUs”) that represented shares potentially issuable based upon

Company and individual performance in the years of issuance.

The

following table summarizes the activity for the Company’s unvested PSUs for the six months ended June 30, 2024:

Schedule of Performance Stock Unit Activity

| | |

Number of shares | | |

Weighted average grant date fair value | |

| Unvested at January 1, 2024 | |

| 63,888 | | |

$ | 1.70 | |

| Granted | |

| 429,844 | | |

$ | 1.22 | |

| Vested | |

| (55,217 | ) | |

$ | 1.15 | |

| Unvested and expected to vest at June 30, 2024 | |

| 438,515 | | |

$ | 1.20 | |

In

February 2023, the unvested awards issued and outstanding for individual performance under the 2022 PSU program were modified to cash-settle

the original grant-date fair value of approximately $80,000, resulting in incremental compensation of $56,000 after considering the $24,000

fair value of the vested shares at the date of the modification. Additionally, the Company performance targets were modified to allow

approximately 71,000 PSUs to vest, with an additional time-based vesting requirement for approximately 26,000 of the PSUs. Because the

awards did not vest based on the original terms, the modification was considered a new grant, resulting in $64,000 in compensation expense

in the six months ended June 30, 2023.

The

Company adopted a 2024 PSU program in March 2024, granting approximately 429,000 PSUs at target performance against company-wide and

individual performance metrics. The results for the three and six months ended June 30, 2024 include $85,000 and $210,000, respectively,

in expense for the 2024 PSU program. Estimates of expense associated with 2024 performance will be reassessed each quarter through the

performance period.

Note

7. Income Taxes

ASC

740 requires a valuation allowance to reduce the deferred tax assets reported if, based on the weight of evidence, it is more than likely

than not that some portion or all the deferred tax assets will not be recognized. Accordingly, at this time the Company has placed a

valuation allowance on all tax assets. As of June 30, 2024, the estimated effective tax rate for 2024 was zero.

There

are open statutes of limitations for taxing authorities in federal and state jurisdictions to audit our tax returns from 2018 through

the current period. Our policy is to account for income tax related interest and penalties in income tax expense in the statement of

operations.

For

the three and six months ended June 30, 2024 and 2023, the Company did not incur any interest and penalties associated with tax positions.

As of June 30, 2024, the Company did not have any significant unrecognized uncertain tax positions.

Note

8. Subsequent Event

In August 2024, the Company secured a $1,500,000

receivables financing facility which bears interest at prime plus 1.2%

per annum on amounts borrowed. The facility has a thirteen-month

term that renews annually and is secured by accounts receivable and inventory.

Note

9. Liquidity

During the six months ended June 30, 2024, the Company

used $1,549,000 in operations. As of June 30, 2024, the Company had $1,185,000 of working capital, including $383,000 in cash.

The Company has a history of negative cash flow and

operating losses, which were expected to improve with growth. As described more fully in Note 4, the dispute and subsequent contract

termination with the Manufacturer has resulted in limitations in our ability to procure certain products necessary to achieve our growth

projections and in elevated legal costs. To mitigate the impact, the Company has built inventory in anticipation of third quarter seasonal

requirements, contributing $320,000

to the cash used in operations in the first half of 2024. The Company expects that the seasonality in its cash flow will ease as additional

contracted capacity commences production in the third and fourth quarters of 2024. Additionally, in May 2024, the Company obtained non-recourse

litigation financing to allow vigorous pursuit of the complaint against the Manufacturer without further expense to the Company.

The financial position at June 30, 2024 and

historical results raise substantial doubt about the Company’s ability to continue as a going concern, which has been

alleviated. As described, the Company has taken and partially completed steps to mitigate the dispute related issues. Additionally,

in August 2024, the Company secured receivables financing of $1,500,000.

Management believes that other potential actions are feasible, including raising additional financing and reducing growth-related

expenditures. While management cannot predict with certainty whether additional actions would achieve the predicted outcome, the

availability of such options, along with the actions already taken, resulted in the alleviation of the substantial doubt about the

Company’s ability to continue as a going concern.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The

following discussion should be read in conjunction with the financial information included elsewhere in this Quarterly Report on Form

10-Q (this “Report”), including our unaudited condensed consolidated financial statements and the related notes and with

our audited consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December

31, 2023, as filed with the SEC on March 22, 2024, and other reports that we file with the SEC from time to time.

References

in this Quarterly Report on Form 10-Q to “us”, “we”, “our” and similar terms refer to Barfresh Food

Group Inc.

Cautionary

Note Regarding Forward-Looking Statements

This

discussion includes forward-looking statements, as that term is defined in the federal securities laws, based upon current expectations

that involve risks and uncertainties, such as plans, objectives, expectations, and intentions. Actual results and the timing of events

could differ materially from those anticipated in these forward-looking statements as a result of a number of factors. Words such as

“anticipate”, “estimate”, “plan”, “continuing”, “ongoing”, “expect”,

“believe”, “intend”, “may”, “will”, “should”, “could” and similar

expressions are used to identify forward-looking statements.

We

caution you that these statements are not guarantees of future performance or events and are subject to a number of uncertainties, risks

and other influences, many of which are beyond our control, which may influence the accuracy of the statements and the projections upon

which the statements are based. Any one or more of these uncertainties, risks and other influences could materially affect our results

of operations and whether forward-looking statements made by us ultimately prove to be accurate. Our actual results, performance and

achievements could differ materially from those expressed or implied in these forward-looking statements. We undertake no obligation

to publicly update or revise any forward-looking statements, whether from new information, future events or otherwise.

Critical

Accounting Policies

Our

consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States

of America (“GAAP”).

Results

of Operations

Results

of Operation for the Three Months Ended June 30, 2024 as Compared to the Three Months Ended June 30, 2023

Revenue

and cost of revenue

Revenue

decreased $47,000, or 3%, to $1,464,000 in 2024 as compared to $1,511,000 in 2023. Our revenue in 2024 benefited from continued acceptance

of our carton packaging format and improvements in bulk sales due to the reintroduction of our WHIRLZ 100% juice product in the fourth

quarter of 2023. Our revenues in 2023 were positively impacted by adjustments to estimated credits related to the dispute with the Manufacturer.

Excluding such adjustments, revenue increased by 6%.

While

the introduction of our carton packaging format has mitigated the loss of supply, the product offering has not been accepted by some

customers or as a substitute for the bottle product in all use cases. We have been able to expand our capacity on a limited basis at

our existing smoothie bottle manufacturer and in July 2024 contracted with an additional manufacturer. We expect expanded capacity to

become available in the third quarter of 2024, subject to the risks and uncertainties associated with pre-production activities.

Cost

of revenue decreased $82,000, or 8%, to $955,000 in 2024 as compared to $1,037,000 in 2023. Cost of revenue decreased at a higher rate

compared to revenue due to product mix and slight improvements in raw material and other input costs.

Our

gross profit was $509,000 (34.8%) and $474,000 (31.4%) for 2024 and 2023, respectively. The improvement in gross margin is a result of

favorable product mix, pricing actions, and a slight improvement in the cost of supply chain components.

Selling,

marketing and distribution expense

Our

operations were primarily directed towards increasing sales and expanding our distribution network.

| | |

Three months ended

June 30, | | |

Three months ended

June 30, | | |

| | |

| |

| | |

2024 | | |

2023 | | |

Change | | |

Percent | |

| Sales and marketing | |

$ | 366,000 | | |

$ | 373,000 | | |

$ | (7,000 | ) | |

| -2 | % |

| Storage and outbound freight | |

| 217,000 | | |

| 252,000 | | |

| (35,000 | ) | |

| -14 | % |

| | |

$ | 583,000 | | |

$ | 625,000 | | |

$ | (42,000 | ) | |

| -7 | % |

Selling,

marketing and distribution expense decreased approximately $42,000 (7%) from approximately $625,000 in 2023 to $583,000 in 2024.

Sales

and marketing expense decreased approximately $7,000 (5%) from approximately $373,000 in 2023 to $366,000 in 2024. The increase is a

result of a reduction in compensation expense, partially offset by higher broker commissions due to expansion of the broker network.

Storage

and outbound freight expense decreased approximately $35,000 (14%) from approximately $252,000 in 2023 to $217,000 in 2024, primarily

because of freight efficiencies, and lower storage and inventory management cost in 2024.

General

and administrative expense

| | |

Three months ended

June 30, | | |

Three months ended

June 30, | | |

| | |

| |

| | |

2024 | | |

2023 | | |

Change | | |

Percent | |

| Personnel costs | |

$ | 341,000 | | |

$ | 244,000 | | |

$ | 97,000 | | |

| 40 | % |

| Stock-based compensation | |

| 214,000 | | |

| (15,000 | ) | |

| 229,000 | | |

| -1527 | % |

| Legal, professional and consulting fees | |

| 59,000 | | |

| 59,000 | | |

| - | | |

| 0 | % |

| Director fees paid in cash | |

| - | | |

| 25,000 | | |

| (25,000 | ) | |

| -100 | % |

| Research and development | |

| 17,000 | | |

| 35,000 | | |

| (18,000 | ) | |

| -51 | % |

| Other general and administrative expenses | |

| 240,000 | | |

| 145,000 | | |

| 95,000 | | |

| 66 | % |

| | |

$ | 871,000 | | |

$ | 493,000 | | |

$ | 378,000 | | |

| 77 | % |

General

and administrative expenses increased approximately $378,000 (77%) from approximately $493,000 in 2023 to $871,000 in 2024.

Personnel

cost represents the cost of employees including salaries, bonuses, employee benefits and employment taxes. Personnel cost increased by

approximately $97,000 (40%) from approximately $244,000 in 2023 to $341,000 in 2024. The increase in personnel cost resulted from the

non-recurrence of the recognition of a COVID-19 related Employee Retention Tax Credit in 2023.

Stock-based

compensation increased by approximately $229,000 from ($15,000) in 2023 to $214,000 in 2024 as a result of the Company adopting an equity-only

structure for management incentives Board of Directors compensation, implemented to conserve cash and to achieve compliance with NASDAQ

listing regulations.

Other

general and administrative expenses increased by approximately $95,000 (66%) due to recruiting fees incurred to broaden the capabilities

of our management team.

Net

loss

We

had net losses of approximately $1,011,000 and $742,000 for the three-month periods ended June 30, 2024 and 2023, respectively. The increase

in net loss of approximately $269,000, was primarily the result of a shift to stock-based compensation and the non-recurrence of recognizing

ERTC benefits in 2023.

Results

of Operation for the Six Months Ended June 30, 2024 as Compared to the Six Months Ended June 30, 2023

Revenue

and cost of revenue

Revenue

increased $691,000, or 19%, to $4,293,000 in 2024 as compared to $3,602,000 in 2023. Our revenue in 2024 benefited from continued acceptance

of our carton packaging format and improvements in bulk sales due to the reintroduction of our WHIRLZ 100% juice product in the fourth

quarter of 2023.

Cost

of revenue increased $341,000, or 15%, to $2,614,000 in 2024 as compared to $2,273,000 in 2023. Cost of revenue increased at a lower

rate compared to revenue due to product mix and slight improvements in raw material and other input costs.

Our

gross profit was $1,679,000 (39.1%) and $1,329,000 (36.9%) for 2024 and 2023, respectively. The improvement in gross margin is a result

of favorable product mix, pricing actions, and a slight improvement in the cost of supply chain components.

Selling,

marketing and distribution expense

| | |

Six months ended

June 30, | | |

Six months ended

June 30, | | |

| | |

| |

| | |

2024 | | |

2023 | | |

Change | | |

Percent | |

| Sales and marketing | |

$ | 696,000 | | |

$ | 731,000 | | |

$ | (35,000 | ) | |

| -5 | % |

| Storage and outbound freight | |

| 581,000 | | |

| 562,000 | | |

| 19,000 | | |

| 3 | % |

| | |

$ | 1,277,000 | | |

$ | 1,293,000 | | |

$ | (16,000 | ) | |

| -1 | % |

Selling,

marketing and distribution expense decreased approximately $16,000 (1%) from approximately $1,293,000 in 2023 to $1,277,000 in 2024.

Sales

and marketing expense decreased approximately $35,000 (5%) from approximately $731,000 in 2023 to $696,000 in 2024. The decrease is a

result of a reduction in compensation expense. Advertising and sample expense were lower as a result of non-recurring costs in 2023 associated

with the launch of our smoothie carton format offering. These cost reductions were partially offset by higher broker commissions due

to expansion of the broker network.

Storage

and outbound freight expense increased approximately $19,000 (3%) from approximately $562,000 in 2023 to $581,000 in 2024, primarily

because of the 19% increase in revenue over the same period, partially offset by freight efficiencies, and lower storage and inventory

management cost in 2024.

General

and administrative expense

| | |

Six months ended

June 30, | | |

Six months ended

June 30, | | |

| | |

| |

| | |

2024 | | |

2023 | | |

Change | | |

Percent | |

| Personnel costs | |

$ | 603,000 | | |

$ | 733,000 | | |

$ | (130,000 | ) | |

| -18 | % |

| Stock based compensation | |

| 517,000 | | |

| 191,000 | | |

| 326,000 | | |

| 171 | % |

| Legal, professional and consulting fees | |

| 215,000 | | |

| 173,000 | | |

| 42,000 | | |

| 24 | % |

| Director fees paid in cash | |

| - | | |

| 50,000 | | |

| (50,000 | ) | |

| -100 | % |

| Research and development | |

| 47,000 | | |

| 56,000 | | |

| (9,000 | ) | |

| -16 | % |

| Other general and administrative expenses | |

| 347,000 | | |

| 284,000 | | |

| 63,000 | | |

| 22 | % |

| | |

$ | 1,729,000 | | |

$ | 1,487,000 | | |

$ | 242,000 | | |

| 16 | % |

General

and administrative expenses increased approximately $242,000 (16%) from approximately $1,487,000 in 2023 to $1,729,000 in 2024.

Personnel

cost decreased by approximately $130,000 (18%) from approximately $733,000 in 2023 to $603,000 in 2024. The decrease in personnel cost

resulted from a reduction in headcount and cash bonus expense as a result of adopting an equity-only incentive structure in mid-2023,

partially offset by the non-recurrence of the recognition of a COVID-19 related Employee Retention Tax Credit in 2023.

Stock-based

compensation increased by approximately $326,000 from $191,000 in 2023 to $517,000 in 2024 as a result of the Company adopting an equity-only

structure for management incentives Board of Directors compensation, implemented to conserve cash and to achieve compliance with NASDAQ

listing regulations.

Other

general and administrative expenses increased by approximately $63,000 (22%) due to recruiting fees incurred to broaden the capabilities

of our management team, partially offset by a decrease in patent fees due to targeted renewals in 2024.

Net

loss

We

had net losses of approximately $1,460,000 and $1,647,000 for the six-month periods ended June 30, 2024 and 2023, respectively. The decrease

in net loss of approximately $187,000, was primarily the result an increase in gross profit of approximately $350,000, partially offset

by increased operating expense of $163,000 due to the shift to stock-based compensation and the non-recurrence of recognizing ERTC benefits

in 2023.

Liquidity

and Capital Resources

On

June 1, 2021, we completed a private placement of 1,282,051 shares of our common stock at $4.68 per share, resulting in gross proceeds

of $6,000,000. In addition, holders of debt converted a total of $399,000 in principal and $234,000 in interest into 133,991 shares of

common stock and debt in the amount of $840,000 was retired, leaving the Company with no debt.

From

July 2023 to March 2024, we executed subscription agreements for substantially all of a $2,000,000 privately placed convertible debt

offering. The debt was available to be drawn in 25% increments, maturing on the anniversary of the draw, bearing interest at 10% per

annum for the term, regardless of earlier payment or conversion, and was mandatorily convertible as to principal and interest into shares

of our common stock at any time prior to maturity at the greater of $1.20 or 85% of the volume-weighted average price of the common stock

for the ten trading days immediately preceding the written notice of the conversion (the “Conversion Price”). If we had not

exercised the mandatory conversion, the holder of the debt had the option after six months and on up to four occasions to convert all

or any portion of the principal and interest into shares of our common stock at the Conversion Price. On October 23, 2023, we issued

$1,390,000 of convertible notes pursuant to the subscription agreements, and immediately converted $1,207,000 of principal and interest

into approximately 820,000 shares of common stock. Additionally, on December 19, 2023, we drew down $470,000 in convertible debt and

converted a total of $653,000 of principal and $4,000 of accrued interest into 495,331 shares of common stock. Finally, on March 27 and

29, 2024, we drew down $136,000 in convertible debt and converted the total drawn into 124,208 shares, settling all debt.

During

the six months ended June 30, 2024, we used $1,549,000 in operations. Our net loss adjusted for non-cash operating expenses was a loss

of $799,000, while changes in non-cash current assets and liabilities consumed $750,000 primarily as a result of increased inventory

built at our Twist & Go bottle manufacturer in advance of orders for the 2024/25 academic year to alleviate capacity constraints

while we bring up additional locations contracted in the third quarter of 2024. Additionally, our accounts payable decreased with other

manufacturing locations as we slowed purchases in anticipation of the summer recess in the education channel.

As

of June 30, 2024, we had working capital of $1,185,000 compared with $1,846,000 at December 31, 2023. The decrease in working capital

is primarily due to losses incurred in the six months ended June 30, 2024, partially offset by capital raised in the six months ended

June 30, 2024 through the sale convertible notes and the conversion of those notes and other current liabilities to equity.

Our

liquidity needs will depend on how quickly we are able to profitably ramp up sales, as well as our ability to control and reduce variable

operating expenses, and to continue to control fixed overhead expense. Our current dispute with the Manufacturer and the resulting loss

of product supply and legal expense continue to negatively impact our financial position, results of operations and cash flow. While

the introduction of our carton packaging format has mitigated the loss of supply, the product offering has not been accepted by some

customers or as a substitute for the bottle product in all use cases. We have contracted with a co-manufacturer for additional smoothie

bottle manufacturing capacity. We expect expanded capacity to become available in 2024, subject to the risks and uncertainties associated

with pre-production activities. Additionally, we have taken other measures to reduce our liquidity requirements, including compensating

our directors and employees with equity to reduce cash compensation requirements, obtaining non-recourse litigation financing, and securing

receivables financing in the third quarter of 2024.

Our

operations to date have been financed by the sale of securities, the issuance of convertible debt and the issuance of short-term debt,

including related party advances. If we are unable to generate sufficient cash flow from operations with the capital raised we will be

required to raise additional funds either in the form of equity or in the form of debt. There are no assurances that we will be able

to generate the necessary capital to carry out our current plan of operations.

Off-Balance

Sheet Arrangements

We

have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition,

changes in financial condition, revenues or expense, results of operations, liquidity, capital expenditures or capital resources that

are material to stockholders.

Item

3. Quantitative and Qualitative Disclosures About Market Risk.

Not

required because we are a smaller reporting company.

Item

4. Controls and Procedures.

Evaluation

of Disclosure Controls and Procedures

Under

the supervision and with the participation of our management, including our Chief Executive Officer and our Chief Financial Officer,

we conducted an evaluation of our disclosure controls and procedures, as such term is defined under Securities and Exchange Act of 1934

Rule 13(a)-15(e). Disclosure controls and procedures are designed to provide reasonable assurance that the information required to be

disclosed in the reports that we file or submit under the Exchange Act has been appropriately recorded, processed, summarized, and reported

on a timely basis and are effective in ensuring that such information is accumulated and communicated to the Company’s management,

as appropriate to allow timely decisions regarding required disclosure. Based on the evaluation of our disclosure controls and procedures

as of June 30, 2024, our Chief Executive Officer and Chief Financial Officer concluded that, as of such date, our disclosure controls

and procedures were effective at the reasonable assurance level.

Changes

in Internal Control over Financial Reporting

Through

2023, we had previously disclosed a material weakness in our internal control over financial reporting related to the control environment,

which was impacted by inadequate segregation of duties, including information technology control activities.

We

took actions to remediate the material weakness relating to our internal control over financial reporting, as described below. The controls

and processes we implemented to remediate the identified material weakness included:

| |

● |

Implemented

procedures to mitigate the lack of segregation of duties |

| |

● |

Retained

additional information technology resources which bolstered control over data access and changes to operating systems |

As

a result of the remediation activities and controls in place as of June 30, 2024 described above, we have remediated this previously disclosed

material weakness. However, completion of remediation does not provide assurance that our remediated controls will continue to operate

properly or that our financial statements will be free from error.

There

were no additional changes in our internal control over financial reporting that occurred during the period covered by this Quarterly

Report on Form 10-Q that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART

II- OTHER INFORMATION

Item

1. Legal Proceedings.

As

described in Note 4, the Company has an on-going dispute with the Manufacturer, the outcome of which cannot be predicted at this time.

From

time to time, various lawsuits and legal proceedings may arise in the ordinary course of business. However, litigation is subject to

inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business. We are

currently the defendant in one legal proceeding for an amount less than $100,000. Our legal counsel and management believe a material

unfavorable outcome to be remote.

Item

1A. Risk Factors.

Not

required because we are a smaller reporting company.

Item

2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item

3. Defaults Upon Senior Securities.

None.

Item

4. Mine Safety Disclosures.

Not

applicable.

Item

5. Other Information.

None.

Item

6. Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

BARFRESH

FOOD GROUP INC. |

| |

|

|

| Date:

August 14, 2024 |

By: |

/s/

Riccardo Delle Coste |

| |

|

Riccardo

Delle Coste |

| |

|

Chief

Executive Officer |

| |

|

(Principal

Executive Officer) |

| |

|

|

| Date:

August 14, 2024 |

By: |

/s/

Lisa Roger |

| |

|

Chief

Financial Officer |

| |

|

(Principal

Financial Officer) |

Exhibit

31.1

RULE

13a-14(a) CERTIFICATION

I,

Riccardo Delle Coste, certify that:

1.

I have reviewed this quarterly report on Form 10-Q of Barfresh Food Group Inc., a Delaware corporation;

2.

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the

period covered by this report;

3.

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report;

4.

The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures

(as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act

Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision,

to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others

within those entities, particularly during the period in which this report is being prepared;

(b)

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under

our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles;

(c)

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions

about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation;

and

(d)

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s

most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected,

or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.

The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over

financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons

performing the equivalent functions):

(a)

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are

reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information;

and

(b)

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s

internal control over financial reporting.

August

14, 2024

| By: |

/s/

Riccardo Delle Coste |

|

| Name:

|

Riccardo

Delle Coste |

|

| Title: |

Principal

Executive Officer |

|

Exhibit

31.2

RULE

13a-14(a) CERTIFICATION

I,

Lisa Roger, certify that:

1.

I have reviewed this quarterly report on Form 10-Q of Barfresh Food Group Inc., a Delaware corporation;

2.

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the

period covered by this report;

3.

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report;

4.

The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures

(as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act