8-KCA000-3197777-05391257100 N. Financial Dr., Ste. 101FresnoCA93720559298-1775FALSE000112737100011273712023-07-202023-07-20

| | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM 8-K |

| CURRENT REPORT |

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 |

Date of Report: July 20, 2023

(Date of earliest event reported)

| | | | | | | | | | | | | | |

| Central Valley Community Bancorp |

| (Exact name of registrant as specified in its charter) |

|

CA (State or other jurisdiction of incorporation) | 000-31977 (Commission File Number) | 77-0539125 (IRS Employer Identification Number) |

|

7100 N. Financial Dr., Ste. 101, Fresno, CA (Address of principal executive offices) | | 93720 (Zip Code) |

559-298-1775 (Registrant’s telephone number, including area code) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Common Stock, no par value | | CVCY | | NASDAQ |

| (Title of Each Class) | | (Trading Symbol) | | (Name of Each Exchange on which Registered) |

| | | | |

Not Applicable (Former Name or Former Address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

Item 2.02. Results of Operations and Financial Condition

On July 20, 2023, Central Valley Community Bancorp issued a press release containing unaudited financial information and

accompanying discussion for the quarter and three months ended June 30, 2023. The press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 8.01. Other Events

On July 19, 2023 the Board of Directors of Central Valley Community Bancorp declared a $0.12 per share cash dividend

payable on August 18, 2023 to shareholders of record as of August 4, 2023.

The information in this Form 8-K filed on July 20, 2023 shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by

reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, regardless of any general

incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits

(a) Financial statements:

None

(b) Pro forma financial information:

None

(c) Shell company transactions:

None

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Dated: | July 20, 2023 | CENTRAL VALLEY COMMUNITY BANCORP

By: /s/ Shannon Avrett Shannon Avrett Executive Vice President and Chief Financial Officer (Principal Accounting Officer) |

| | | | | |

| Exhibit Index |

| Exhibit No. | Description |

| 99.1 | Press Release of Central Valley Community Bancorp dated |

| July 20, 2023 |

FOR IMMEDIATE RELEASE

CENTRAL VALLEY COMMUNITY BANCORP REPORTS EARNINGS RESULTS FOR THE PERIOD ENDED JUNE 30, 2023, AND QUARTERLY DIVIDEND

FRESNO, CALIFORNIA... July 20, 2023... The Board of Directors of Central Valley Community Bancorp (Company) (NASDAQ: CVCY), the parent company of Central Valley Community Bank (Bank), reported today unaudited consolidated net income of $6,282,000, and fully diluted earnings per common share of $0.54 for the quarter ended June 30, 2023, compared to $6,542,000 and $0.56 per fully diluted common share for the quarter ended June 30, 2022.

SECOND QUARTER FINANCIAL HIGHLIGHTS

•Net income for the second quarter of 2023 decreased to $6,282,000 or $0.54 per diluted common share, compared to $6,970,000 and $0.59, respectively, in the first quarter of 2023.

•Net loans decreased $5.3 million or 0.42%, and total assets increased $67.3 million or 2.78% at June 30, 2023 compared to December 31, 2022.

•Total deposits increased 4.79% to $2.20 billion at June 30, 2023 compared to December 31, 2022.

•Total cost of deposits increased to 0.88% for the quarter ended June 30, 2023 compared to 0.20% for the quarter ended March 31, 2023.

•Average non-interest bearing demand deposit accounts as a percentage of total average deposits was 43.53% and 43.92% for the quarters ended June 30, 2023 and 2022, respectively.

•Net interest margin decreased to 3.46% for the quarter ended June 30, 2023, from 3.81% for the quarter ended March 31, 2023.

•There were no non-performing assets for the quarter ended June 30, 2023. Additionally, net loan recoveries were $22,000 and loans delinquent more than 30 days were $252,000.

•Capital positions remain strong at June 30, 2023 with a 8.51% Tier 1 Leverage Ratio; a 12.39% Common Equity Tier 1 Ratio; a 12.68% Tier 1 Risk-Based Capital Ratio; and a 15.73% Total Risk-Based Capital Ratio.

•The Company declared a $0.12 per common share cash dividend, payable on August 18, 2023 to shareholders of record as of August 4, 2023.

“The challenging environment including rising cost of deposits and persistent inflation are impacting interest and operating expenses. The Company is not immune to these challenges, but our Company is well positioned to navigate it,” said James J. Kim, President and CEO.

Central Valley Community Bancorp -- page 2

“The strength of our Company has long been demonstrated by its 43-year track record of conservative business practices, its focus on relationships and stability in deposit base,” continued Kim. “To reinforce that strength, the Company will continue to invest in our team, facilities and technologies while maintaining our commitment to exceptional client service Bank-wide. Our team’s unfaltering focus on client success has been most gratifying, particularly during this past quarter.”

Results of Operations | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, | | March 31, | | June 30, | | |

| (In thousands, except share and per-share amounts) | | 2023 | | 2023 | | 2022 | | | | |

| Net interest income before provision for credit losses | | $ | 20,205 | | | $ | 21,581 | | | $ | 19,810 | | | | | |

| (Reversal of) provision for credit losses | | (343) | | | 633 | | | — | | | | | |

| Net interest income after provision for credit losses | | 20,548 | | | 20,948 | | | 19,810 | | | | | |

| Total non-interest income | | 1,594 | | | 1,575 | | | 770 | | | | | |

| Total non-interest expenses | | 13,805 | | | 13,205 | | | 12,083 | | | | | |

| Income before provision for income taxes | | 8,337 | | | 9,318 | | | 8,497 | | | | | |

| Provision for income taxes | | 2,055 | | | 2,348 | | | 1,955 | | | | | |

| Net income | | $ | 6,282 | | | $ | 6,970 | | | $ | 6,542 | | | | | |

For the quarter ended June 30, 2023, the Company reported unaudited consolidated net income of $6,282,000 and earnings per diluted common share of $0.54, compared to consolidated net income of $6,542,000 and $0.56 per diluted share for the same period in 2022. Net income for the period was impacted by an increase in total non-interest expenses of $1,722,000, primarily driven by the increase in costs for salaries and employee benefits and non-recurring one-time expenses in professional services, and an increase in the provision for income taxes of $100,000, partially offset by an increase in net interest income before provision for credit losses of $395,000 and an increase in non-interest income of $824,000. The effective tax rate increased to 24.65% from 23.01% for the quarters ended June 30, 2023 and June 30, 2022, respectively. Net income for the immediately trailing quarter ended March 31, 2023 was $6,970,000, or $0.59 per diluted common share.

For the six months ended June 30, 2023, the Company reported unaudited consolidated net income of $13,252,000 and earnings per diluted common share of $1.13, compared to consolidated net income of $12,628,000 and $1.07 per diluted share for the same period in 2022. Net income for the period was impacted by an increase in net interest income before provision for credit losses of $4,379,000 and an increase in non-interest income of $565,000, partially offset by an increase in total non-interest expenses of $3,482,000 and an increase in the provision for income taxes of $548,000. The effective tax rate increased to 24.94% from 23.39% for the six months ended June 30, 2023 and June 30, 2022, respectively. Increases in non-interest expenses for the year-to-date period were impacted by increased salary expense, inflationary impacts of increased cost of services, and non-recurring professional expenses.

Central Valley Community Bancorp -- page 3

Annualized return on average equity (ROE) for the six months ended June 30, 2023 was 14.44%, compared to 12.35% for the same period of 2022. The increase in ROE reflects an increase in net income and a decrease in average shareholders’ equity compared to the prior year. The decrease in shareholders’ equity was primarily driven by the increase in accumulated other comprehensive losses and dividends paid, partially offset by the retention of earnings. Annualized return on average assets (ROA) was 1.08% for the six months ended June 30, 2023 compared to 1.03% for the same period in 2022. This increase was due to the increase in net income outpacing the increase in average assets.

The effective yield on average investment securities, including interest earning deposits in other banks and Federal funds sold, was 3.18% for the quarter ended June 30, 2023, compared to 2.58% for the quarter ended June 30, 2022 and 2.95% for the quarter ended March 31, 2023. The effective yield on average investment securities, including interest earning deposits in other banks and Federal funds sold, was 3.07% for the six months ended June 30, 2023, compared to 2.30% for the six months ended June 30, 2022.

Total average loans increased by $171,817,000 to $1,257,984,000 for the quarter ended June 30, 2023, from $1,086,167,000 for the quarter ended June 30, 2022 and decreased by $2,194,000 from $1,260,178,000 for the quarter ended March 31, 2023. The effective yield on average loans was 5.54% for the quarter ended June 30, 2023, compared to 4.76% and 5.31% for the quarters ended June 30, 2022 and March 31, 2023, respectively. Total average loans increased by $206,958,000 to $1,259,075,000 for the six months ended June 30, 2023, from $1,052,117,000 for the six months ended June 30, 2022. The effective yield on average loans was 5.47% for the six months ended June 30, 2023, compared to 4.80% for the six months ended June 30, 2022.

The Company’s net interest margin (fully tax equivalent basis) was 3.46% for the quarter ended June 30, 2023, compared to 3.48% for the quarter ended June 30, 2022. Net interest income, before provision for credit losses, increased $395,000, or 1.99%, to $20,205,000 for the second quarter of 2023, compared to $19,810,000 for the same period in 2022. The net interest margin period-to-period comparisons were impacted by the increase in the yield on total interest-bearing liabilities. Over the same periods, the cost of total deposits increased to 0.88% from 0.04%. The increase in the cost of deposits is primarily attributed to volume and rate increases in the money market and time deposit portfolios.

Central Valley Community Bancorp -- page 4

The Company’s net interest margin (fully tax equivalent basis) was 3.65% for the six months ended June 30, 2023, compared to 3.34% for the six months ended June 30, 2022. Net interest income, before provision for credit losses, increased $4,379,000, or 11.71%, to $41,786,000 for the six months ended June 30, 2023, compared to $37,407,000 for the same period in 2022. The accretion on loan marks of acquired loans increased interest income by $139,000 and $324,000 during the six months ended June 30, 2023 and 2022, respectively. Net interest income during the six months ended June 30, 2023 and 2022 benefited by approximately $42,000 and $470,000, respectively, from prepayment penalties and payoff of loans. The net interest margin period-to-period comparisons were impacted by the increase in the yield on total interest-bearing liabilities. Over the same periods, the cost of total deposits increased to 0.55% from 0.05%. The increase in the cost of deposits is primarily attributed to volume and rate increases in the money market and time deposit portfolios.

Non-Interest Income - The following tables present the key components of non-interest income for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | |

| (Dollars in thousands) | | June 30, 2023 | | June 30, 2022 | | $ Change | | % Change |

| Service charges | | $ | 367 | | | $ | 544 | | | $ | (177) | | | (32.5) | % |

| Appreciation in cash surrender value of bank owned life insurance | | 254 | | | 245 | | | 9 | | | 3.7 | % |

| Interchange fees | | 458 | | | 478 | | | (20) | | | (4.2) | % |

| Loan placement fees | | 172 | | | 268 | | | (96) | | | (35.8) | % |

| | | | | | | | |

| Net realized losses on sales and calls of investment securities | | (39) | | | (969) | | | 930 | | | (96.0) | % |

| Federal Home Loan Bank dividends | | 106 | | | 82 | | | 24 | | | 29.3 | % |

| Other income | | 276 | | | 122 | | | 154 | | | 126.2 | % |

| Total non-interest income | | $ | 1,594 | | | $ | 770 | | | $ | 824 | | | 107.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended | | | | |

| (Dollars in thousands) | | June 30, 2023 | | June 30, 2022 | | $ Change | | % Change |

| Service charges | | $ | 755 | | | $ | 1,083 | | | $ | (328) | | | (30.3) | % |

| Appreciation in cash surrender value of bank owned life insurance | | 503 | | | 487 | | | 16 | | | 3.3 | % |

| Interchange fees | | 903 | | | 920 | | | (17) | | | (1.8) | % |

| Loan placement fees | | 296 | | | 567 | | | (271) | | | (47.8) | % |

| | | | | | | | |

| Net realized losses on sales and calls of investment securities | | (257) | | | (763) | | | 506 | | | (66.3) | % |

| Federal Home Loan Bank dividends | | 215 | | | 167 | | | 48 | | | 28.7 | % |

| Other income | | 754 | | | 143 | | | 611 | | | 427.3 | % |

| Total non-interest income | | $ | 3,169 | | | $ | 2,604 | | | $ | 565 | | | 21.7 | % |

Central Valley Community Bancorp -- page 5

The increase in other income for the six months ended June 30, 2023 was primarily due to the change in equity investment gain (loss), which was zero for the six months ended June 30, 2023 compared to ($584,000) for the six months ended June 30, 2022. The decrease in service charges was the result of a reduction in the fess charged for non-sufficient funds.

Non-Interest Expense - The following table presents the key components of non-interest expense for the periods indicated: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | |

| (Dollars in thousands) | | June 30, 2023 | | June 30, 2022 | | $ Change | | % Change |

| Salaries and employee benefits | | $ | 7,976 | | | $ | 7,057 | | | $ | 919 | | | 13.0 | % |

| Occupancy and equipment | | 1,264 | | | 1,344 | | | (80) | | | (6.0) | % |

| Information technology | | 935 | | | 828 | | | 107 | | | 12.9 | % |

| Regulatory assessments | | 356 | | | 194 | | | 162 | | | 83.5 | % |

| Data processing expense | | 618 | | | 548 | | | 70 | | | 12.8 | % |

| Professional services | | 883 | | | 464 | | | 419 | | | 90.3 | % |

| ATM/Debit card expenses | | 193 | | | 217 | | | (24) | | | (11.1) | % |

| Internet banking expense | | 47 | | | 48 | | | (1) | | | (2.1) | % |

| Advertising | | 124 | | | 138 | | | (14) | | | (10.1) | % |

| Directors’ expenses | | 151 | | | 48 | | | 103 | | | 214.6 | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Amortization of core deposit intangibles | | 34 | | | 140 | | | (106) | | | (75.7) | % |

| Loan related expenses | | 51 | | | 68 | | | (17) | | | (25.0) | % |

| Personnel other | | 63 | | | 59 | | | 4 | | | 6.8 | % |

| | | | | | | | |

| Other expense | | 1,110 | | | 930 | | | 180 | | | 19.4 | % |

| Total non-interest expenses | | $ | 13,805 | | | $ | 12,083 | | | $ | 1,722 | | | 14.3 | % |

| | | | | | | | |

| | | | | | | | |

The increase in salaries and benefits and director expenses was due to expense recorded in the current quarter for post-retirement benefits compared to credits recorded in the prior year, which were a result of changes in the discount rate. In addition, salary and employee benefits increased in the current quarter compared to the prior year quarter due to salary adjustments related to market conditions. The increase in regulatory assessments was the result of FDIC adjustment in their rate and assessment multiplier. The increase in professional services was the result of non-recurring one-time expenses recorded during the period.

Central Valley Community Bancorp -- page 6

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended | | | | |

| (Dollars in thousands) | | June 30, 2023 | | June 30, 2022 | | $ Change | | % Change |

| Salaries and employee benefits | | $ | 16,010 | | | $ | 14,001 | | | $ | 2,009 | | | 14.3 | % |

| Occupancy and equipment | | 2,521 | | | 2,506 | | | 15 | | | 0.6 | % |

| Information technology | | 1,782 | | | 1,586 | | | 196 | | | 12.4 | % |

| Regulatory assessments | | 566 | | | 416 | | | 150 | | | 36.1 | % |

| Data processing expense | | 1,269 | | | 1,089 | | | 180 | | | 16.5 | % |

| Professional services | | 1,235 | | | 838 | | | 397 | | | 47.4 | % |

| ATM/Debit card expenses | | 377 | | | 412 | | | (35) | | | (8.5) | % |

| Internet banking expense | | 82 | | | 69 | | | 13 | | | 18.8 | % |

| Advertising | | 249 | | | 278 | | | (29) | | | (10.4) | % |

| Directors’ expenses | | 314 | | | 93 | | | 221 | | | 237.6 | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Amortization of core deposit intangibles | | 68 | | | 280 | | | (212) | | | (75.7) | % |

| Loan related expenses | | 198 | | | 139 | | | 59 | | | 42.4 | % |

| Personnel other | | 323 | | | 162 | | | 161 | | | 99.4 | % |

| | | | | | | | |

| Other expense | | 2,016 | | | 1,659 | | | 357 | | | 21.5 | % |

| Total non-interest expenses | | $ | 27,010 | | | $ | 23,528 | | | $ | 3,482 | | | 14.8 | % |

| | | | | | | | |

| | | | | | | | |

The increase in salaries and benefits and director expenses was primarily due to credits in post-retirement costs recorded in the prior year, a result of changes in the discount rate compared to expense in the current period. Additionally, increases in salaries and benefits were a reflection of salary adjustments due to market conditions. The increase in personnel other was primarily the result of employee placement fees.

Balance Sheet Summary

Total assets for the period ended June 30, 2023 increased $67,288,000 or 2.78% compared to the period ended December 31, 2022, and $25,914,000 or 1.07% compared to the first quarter of 2023. Asset growth during the six months ended June 30, 2023 was driven by increases in cash and cash equivalents. Total average assets for the quarter ended June 30, 2023 were $2,501,524,000 compared to $2,441,962,000 for the quarter ended June 30, 2022 and $2,415,640,000 for the quarter ended March 31, 2023, a increase of $59,562,000 or 2.44% and a increase of $85,884,000 or 3.52%, respectively.

For the quarter ended June 30, 2023, the Company’s average investment securities decreased by $197,499,000, or 16.20%, compared to the quarter ended June 30, 2022, and decreased by $19,462,000, or 1.87%, compared to the quarter ended March 31, 2023. For the six months ended June 30, 2023, the Company’s average investment securities, decreased by $147,335,000, or 12.50%, compared to the six months ended June 30, 2022. These decreases for both periods were the result of sales, maturities, and the change in the unrealized loss position on available for sale securities.

Central Valley Community Bancorp -- page 7

In comparing the quarter ended June 30, 2023 to the quarter ended March 31, 2023, and the quarter ended June 30, 2022, total average gross loans decreased by $2,194,000 or 0.17% and increased $171,817,000 or 15.82%, respectively. Year-to-date average gross loans increased $206,958,000 or 19.67% when compared to the six months ended June 30, 2022.

The following table shows the Company’s outstanding loan portfolio composition as of June 30, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loan Type (dollars in thousands) | | June 30, 2023 | | % of Total

Loans | | December 31, 2022 | | % of Total

Loans |

| Commercial: | | | | | | | | |

| Commercial and industrial | | $ | 103,490 | | | 8.2 | % | | $ | 141,197 | | | 11.2 | % |

| Agricultural production | | 36,283 | | | 2.9 | % | | 37,007 | | | 2.9 | % |

| Total commercial | | 139,773 | | | 11.1 | % | | 178,204 | | | 14.1 | % |

| Real estate: | | | | | | | | |

| Construction & other land loans | | 77,865 | | | 6.2 | % | | 109,175 | | | 8.7 | % |

| Commercial real estate - owner occupied | | 195,348 | | | 15.6 | % | | 194,663 | | | 15.5 | % |

| Commercial real estate - non-owner occupied | | 502,814 | | | 40.1 | % | | 464,809 | | | 37.2 | % |

| Farmland | | 118,616 | | | 9.4 | % | | 119,648 | | | 9.5 | % |

| Multi-family residential | | 53,432 | | | 4.3 | % | | 24,586 | | | 2.0 | % |

| 1-4 family - close-ended | | 90,064 | | | 7.2 | % | | 93,510 | | | 7.4 | % |

| 1-4 family - revolving | | 28,625 | | | 2.3 | % | | 30,071 | | | 2.4 | % |

| Total real estate | | 1,066,764 | | | 85.1 | % | | 1,036,462 | | | 82.7 | % |

| Consumer: | | 47,597 | | | 3.8 | % | | 40,252 | | | 3.2 | % |

| Net deferred origination fees | | 1,524 | | | | | 1,386 | | | |

| Total gross loans | | 1,255,658 | | | 100.0 | % | | 1,256,304 | | | 100.0 | % |

| Allowance for credit losses | | (15,463) | | | | | (10,848) | | | |

| Total loans | | $ | 1,240,195 | | | | | $ | 1,245,456 | | | |

Total average deposits increased $54,852,000, or 2.54%, to $2,212,592,000 for the quarter ended June 30, 2023, compared to $2,157,740,000 for the quarter ended June 30, 2022, and increased $131,334,000, or 6.31%, compared to $2,081,258,000 for the quarter ended March 31, 2023. The Company’s ratio of average non-interest bearing deposits to total deposits was 43.53% for the quarter ended June 30, 2023, compared to 43.92% and 48.92% for the quarters ended June 30, 2022 and March 31, 2023, respectively.

Total average deposits decreased $6,505,000, or 0.30%, to $2,147,287,000 for the six months ended June 30, 2023, compared to $2,153,792,000 for the six months ended June 30, 2022. The Company’s ratio of average non-interest bearing deposits to total deposits increased to 46.13% for the six months ended June 30, 2023 compared to 43.85% for the six months ended June 30, 2022.

Central Valley Community Bancorp -- page 8

The composition of deposits at June 30, 2023 and December 31, 2022 is summarized in the table below: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | June 30, 2023 | | % of

Total

Deposits | | | December 31, 2022 | | % of

Total

Deposits |

| NOW accounts | | $ | 272,419 | | | 12.4 | % | | | $ | 324,089 | | | 15.4 | % |

| MMA accounts | | 569,807 | | | 25.9 | % | | | 435,783 | | | 20.8 | % |

| Time deposits | | 208,864 | | | 9.5 | % | | | 67,923 | | | 3.2 | % |

| Savings deposits | | 192,116 | | | 8.7 | % | | | 215,287 | | | 10.3 | % |

| Total interest-bearing | | 1,243,206 | | | 56.5 | % | | | 1,043,082 | | | 49.7 | % |

| Non-interest bearing | | 957,088 | | | 43.5 | % | | | 1,056,567 | | | 50.3 | % |

| Total deposits | | $ | 2,200,294 | | | 100.0 | % | | | $ | 2,099,649 | | | 100.0 | % |

The Company has significant liquidity, both on and off-balance sheet, to meet customer demand. During the year-to-date period, the Company’s cash and cash equivalents increased $97,488,000 to $128,658,000 compared to $31,170,000 at December 31, 2022. The Company had no short-term borrowings at June 30, 2023 compared to $46,000,000 at December 31, 2022. At June 30, 2023 and December 31, 2022, the Company had the following sources of primary and secondary liquidity:

| | | | | | | | | | | | | | | |

| Liquidity Sources (in thousands) | | June 30, 2023 | | December 31, 2022 | |

| Cash and cash equivalents | | $ | 128,658 | | | $ | 31,170 | | |

| Unpledged investment securities | | 684,113 | | | 758,389 | | |

| Excess pledged securities | | 117,988 | | | 81,527 | | |

| FHLB borrowing availability | | 347,510 | | | 319,309 | | |

| FRB Bank Term Funding Program (BTFP) availability | | 37,968 | | | — | | |

| Unsecured lines of credit | | 110,000 | | | 110,000 | | |

| Funds available through FRB discount window | | 4,583 | | | 4,702 | | |

| Total | | $ | 1,430,820 | | | $ | 1,305,097 | | |

Credit Quality

During the second quarter of 2023, the Company recorded net loan recoveries of $22,000 compared to $9,000 for the same period in 2022. The net charge-off (recovery) ratio, which reflects annualized net charge-offs (recoveries) to average loans, was (0.01)% for the quarter ended June 30, 2023 compared to 0.00% for the quarter ended June 30, 2022. During the quarter ended June 30, 2023, the Company recorded a provision of $184,000 for credit losses on loans, compared to no provision for the quarter ended June 30, 2022. Offsetting this provision of credit losses on loans were credits to the provision for losses on held-to-maturity securities and unfunded loan commitments totaling $527,000.

Central Valley Community Bancorp -- page 9

The following table shows the Company’s loan portfolio allocated by management’s internal risk ratings: | | | | | | | | | | | | | | | | | | | | |

| Loan Risk Rating (In thousands) | | June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| Pass | | $ | 1,212,129 | | | $ | 1,225,913 | | | $ | 1,089,423 | |

| Special mention | | 18,094 | | | 29,061 | | | 34,509 | |

| Substandard | | 25,435 | | | 30,580 | | | 10,756 | |

| Doubtful | | — | | | — | | | — | |

| Total | | $ | 1,255,658 | | | $ | 1,285,554 | | | $ | 1,134,688 | |

At June 30, 2023, the allowance for credit losses was $15,463,000, compared to $10,848,000 at December 31, 2022, a net increase of $4,615,000 reflecting a CECL implementation Day 1 adjustment of $3,910,000, a provision of $702,000 and net recoveries during the period. The allowance for credit losses as a percentage of total loans was 1.23% and 0.86% as of June 30, 2023 and December 31, 2022, respectively. The Company believes the allowance for credit losses is adequate to provide for expected credit losses within the loan portfolio at June 30, 2023.

Cash Dividend Declared

On July 19, 2023, the Board of Directors of the Company declared a regular quarterly cash dividend of $0.12 per share on the Company’s common stock. The dividend is payable on August 18, 2023 to shareholders of record as of August 4, 2023. The Company continues to be well capitalized and expects to maintain adequate capital levels.

Company Overview

Central Valley Community Bancorp trades on the NASDAQ stock exchange under the symbol CVCY. Central Valley Community Bank (CVCB), headquartered in Fresno, California, was founded in 1979 and is the sole subsidiary of Central Valley Community Bancorp. CVCB operates full-service Banking Centers throughout California’s San Joaquin Valley and Greater Sacramento region, in addition to CVCB maintaining Commercial, Real Estate, and Agribusiness Lending, as well as Private Business Banking and Cash Management Departments.

Members of Central Valley Community Bancorp’s and CVCB’s Board of Directors are: Daniel J. Doyle (Chairman), Daniel N. Cunningham (Vice Chairman), F. T. “Tommy” Elliott, IV, Robert J. Flautt, Gary D. Gall, James J. Kim, Andriana D. Majarian, Steven D. McDonald, Louis C. McMurray, Karen A. Musson, Dorothea D. Silva and William S. Smittcamp.

More information about Central Valley Community Bancorp and Central Valley Community Bank can be found at www.cvcb.com. Also, visit Central Valley Community Bank on Twitter, Facebook and LinkedIn.

###

Central Valley Community Bancorp -- page 10

Forward-looking Statements- Certain matters discussed in this press release constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are forward-looking in nature and involve a number of risks and uncertainties. Such risks and uncertainties include, but are not limited to (1) significant increases in competitive pressure in the banking industry; (2) the impact of changes in interest rates; (3) a decline in economic conditions in the Central Valley and the Greater Sacramento Region, including the impact of inflation; (4) the Company’s ability to continue its internal growth at historical rates; (5) the Company’s ability to maintain its net interest margin; (6) the decline in quality of the Company’s earning assets; (7) a decline in credit quality; (8) changes in the regulatory environment; (9) fluctuations in the real estate market; (10) changes in business conditions and inflation; (11) changes in securities markets (12) risks associated with acquisitions, relating to difficulty in integrating combined operations and related negative impact on earnings, and incurrence of substantial expenses; (13) political developments, uncertainties or instability, catastrophic events, acts of war or terrorism, or natural disasters, such as earthquakes, drought, pandemic diseases or extreme weather events, any of which may affect services we use or affect our customers, employees or third parties with which we conduct business; and (14) the other risks set forth in the Company’s reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2022. Therefore, the information set forth in such forward-looking statements should be carefully considered when evaluating the business prospects of the Company.

Central Valley Community Bancorp -- page 11

CENTRAL VALLEY COMMUNITY BANCORP

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | June 30, | | December 31, | | June 30, |

| (In thousands, except share amounts) | | 2023 | | 2022 | | 2022 |

| | | | | | |

| ASSETS | | | | | | |

| Cash and due from banks | | $ | 28,325 | | | $ | 25,485 | | | $ | 26,579 | |

| Interest-earning deposits in other banks | | 100,333 | | | 5,685 | | | 654 | |

| | | | | | |

| Total cash and cash equivalents | | 128,658 | | | 31,170 | | | 27,233 | |

| Available-for-sale debt securities | | 619,759 | | | 648,825 | | | 710,481 | |

| Held-to-maturity debt securities | | 303,876 | | | 305,107 | | | 305,902 | |

| Equity securities | | 6,558 | | | 6,558 | | | 6,832 | |

| Loans, less allowance for credit losses of $15,463, $10,848, and $9,873 at June 30, 2023, December 31, 2022, and June 30, 2022, respectively | | 1,240,195 | | | 1,245,456 | | | 1,126,091 | |

| Bank premises and equipment, net | | 10,939 | | | 7,987 | | | 8,060 | |

| | | | | | |

| Bank owned life insurance | | 41,041 | | | 40,537 | | | 40,040 | |

| Federal Home Loan Bank stock | | 7,136 | | | 6,169 | | | 6,169 | |

| Goodwill | | 53,777 | | | 53,777 | | | 53,777 | |

| | | | | | |

| Accrued interest receivable and other assets | | 77,868 | | | 76,933 | | | 69,007 | |

| Total assets | | $ | 2,489,807 | | | $ | 2,422,519 | | | $ | 2,353,592 | |

| | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | |

| Deposits: | | | | | | |

| Non-interest bearing | | $ | 957,088 | | | $ | 1,056,567 | | | $ | 931,157 | |

| Interest bearing | | 1,243,206 | | | 1,043,082 | | | 1,174,840 | |

| Total deposits | | 2,200,294 | | | 2,099,649 | | | 2,105,997 | |

| Short-term borrowings | | — | | | 46,000 | | | 9,324 | |

| | | | | | |

| Senior debt and subordinated debentures | | 69,671 | | | 69,599 | | | 39,526 | |

| Accrued interest payable and other liabilities | | 32,482 | | | 32,611 | | | 28,492 | |

| Total liabilities | | 2,302,447 | | | 2,247,859 | | | 2,183,339 | |

| Shareholders’ equity: | | | | | | |

Preferred stock, no par value; 10,000,000 shares authorized, none issued and outstanding | | — | | | — | | | — | |

| Common stock, no par value; 80,000,000 shares authorized; issued and outstanding: 11,812,425, 11,735,291, and 11,717,146, at June 30, 2023, December 31, 2022, and June 30, 2022, respectively | | 62,128 | | | 61,487 | | | 60,975 | |

| | | | | | |

| Retained earnings | | 201,100 | | | 194,400 | | | 183,197 | |

| Accumulated other comprehensive loss, net of tax | | (75,868) | | | (81,227) | | | (73,919) | |

| Total shareholders’ equity | | 187,360 | | | 174,660 | | | 170,253 | |

| Total liabilities and shareholders’ equity | | $ | 2,489,807 | | | $ | 2,422,519 | | | $ | 2,353,592 | |

Central Valley Community Bancorp -- page 12

CENTRAL VALLEY COMMUNITY BANCORP

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended | | For the Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, |

| (In thousands, except share and per-share amounts) | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | |

| INTEREST INCOME: | | | | | | | | | | |

| Interest and fees on loans | | $ | 17,382 | | | $ | 16,777 | | | $ | 12,883 | | | $ | 34,159 | | | $ | 25,044 | |

| Interest on deposits in other banks | | 1,374 | | | 75 | | | 52 | | | 1,449 | | | 109 | |

| | | | | | | | | | |

| Interest and dividends on investment securities: | | | | | | | | | | |

| Taxable | | 5,826 | | | 5,886 | | | 5,651 | | | 11,712 | | | 10,175 | |

| Exempt from Federal income taxes | | 1,405 | | | 1,405 | | | 1,879 | | | 2,810 | | | 3,319 | |

| Total interest income | | 25,987 | | | 24,143 | | | 20,465 | | | 50,130 | | | 38,647 | |

| INTEREST EXPENSE: | | | | | | | | | | |

| Interest on deposits | | 4,871 | | | 1,004 | | | 231 | | | 5,876 | | | 483 | |

| Interest on short-term borrowings | | — | | | 661 | | | 91 | | | 661 | | | 91 | |

| Interest on senior debt and subordinated debentures | | 911 | | | 897 | | | 333 | | | 1,807 | | | 666 | |

| | | | | | | | | | |

| Total interest expense | | 5,782 | | | 2,562 | | | 655 | | | 8,344 | | | 1,240 | |

| Net interest income before (credit) provision for credit losses | | 20,205 | | | 21,581 | | | 19,810 | | | 41,786 | | | 37,407 | |

| (CREDIT) PROVISION FOR CREDIT LOSSES | | (343) | | | 633 | | | — | | | 290 | | | — | |

| Net interest income after (credit) provision for credit losses | | 20,548 | | | 20,948 | | | 19,810 | | | 41,496 | | | 37,407 | |

| NON-INTEREST INCOME: | | | | | | | | | | |

| Service charges | | 367 | | | 387 | | | 544 | | | 755 | | | 1,083 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net realized losses on sales and calls of investment securities | | (39) | | | (219) | | | (969) | | | (257) | | | (763) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other income | | 1,266 | | | 1,407 | | | 1,195 | | | 2,671 | | | 2,284 | |

| Total non-interest income | | 1,594 | | | 1,575 | | | 770 | | | 3,169 | | | 2,604 | |

| NON-INTEREST EXPENSES: | | | | | | | | | | |

| Salaries and employee benefits | | 7,976 | | | 8,034 | | | 7,057 | | | 16,010 | | | 14,001 | |

| Occupancy and equipment | | 1,264 | | | 1,258 | | | 1,344 | | | 2,521 | | | 2,506 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other expense | | 4,565 | | | 3,913 | | | 3,682 | | | 8,479 | | | 7,021 | |

| Total non-interest expenses | | 13,805 | | | 13,205 | | | 12,083 | | | 27,010 | | | 23,528 | |

| Income before provision for income taxes | | 8,337 | | | 9,318 | | | 8,497 | | | 17,655 | | | 16,483 | |

| PROVISION FOR INCOME TAXES | | 2,055 | | | 2,348 | | | 1,955 | | | 4,403 | | | 3,855 | |

| Net income | | $ | 6,282 | | | $ | 6,970 | | | $ | 6,542 | | | $ | 13,252 | | | $ | 12,628 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net income per common share: | | | | | | | | | | |

| Basic earnings per common share | | $ | 0.54 | | | $ | 0.60 | | | $ | 0.56 | | | $ | 1.13 | | | $ | 1.08 | |

| Weighted average common shares used in basic computation | | 11,723,127 | | | 11,703,813 | | | 11,665,074 | | | 11,713,524 | | | 11,746,795 | |

| Diluted earnings per common share | | $ | 0.54 | | | $ | 0.59 | | | $ | 0.56 | | | $ | 1.13 | | | $ | 1.07 | |

| Weighted average common shares used in diluted computation | | 11,740,390 | | | 11,731,135 | | | 11,685,850 | | | 11,738,037 | | | 11,778,127 | |

| Cash dividends per common share | | $ | 0.12 | | | $ | 0.12 | | | $ | 0.12 | | | $ | 0.24 | | | $ | 0.24 | |

Central Valley Community Bancorp -- page 13

CENTRAL VALLEY COMMUNITY BANCORP

CONDENSED CONSOLIDATED INCOME STATEMENTS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June. 30, | | Mar. 31, | | Dec. 31, | | Sept. 30, | | Jun. 30, |

| For the three months ended | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| (In thousands, except share and per share amounts) | | | | | | | | | | |

| Net interest income | | $ | 20,205 | | | $ | 21,581 | | | $ | 21,993 | | | $ | 20,164 | | | $ | 19,810 | |

| (Credit) provision for credit losses | | (343) | | | 518 | | | 500 | | | 500 | | | — | |

| Net interest income after (credit) provision for credit losses | | 20,548 | | | 20,948 | | | 21,493 | | | 19,664 | | | 19,810 | |

| Total non-interest income | | 1,594 | | | 1,575 | | | 970 | | | 1,480 | | | 770 | |

| Total non-interest expense | | 13,805 | | | 13,205 | | | 12,152 | | | 12,798 | | | 12,083 | |

| Provision for income taxes | | 2,055 | | | 2,348 | | | 2,678 | | | 1,962 | | | 1,955 | |

| Net income | | $ | 6,282 | | | $ | 6,970 | | | $ | 7,633 | | | $ | 6,384 | | | $ | 6,542 | |

| | | | | | | | | | |

| Basic earnings per common share | | $ | 0.54 | | | $ | 0.60 | | | $ | 0.65 | | | $ | 0.55 | | | $ | 0.56 | |

| Weighted average common shares used in basic computation | | 11,723,127 | | | 11,703,813 | | | 11,690,410 | | | 11,678,532 | | | 11,665,074 | |

| Diluted earnings per common share | | $ | 0.54 | | | $ | 0.59 | | | $ | 0.65 | | | $ | 0.55 | | | $ | 0.56 | |

| Weighted average common shares used in diluted computation | | 11,740,390 | | | 11,731,135 | | | 11,708,753 | | | 11,689,323 | | | 11,685,850 | |

CENTRAL VALLEY COMMUNITY BANCORP

SELECTED RATIOS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Jun. 30, | | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, |

| As of and for the three months ended | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| (Dollars in thousands, except per share amounts) | | | | | | | | | | |

| Allowance for credit losses to total loans | | 1.23 | % | | 1.19 | % | | 0.86 | % | | 0.85 | % | | 0.87 | % |

| Non-performing assets to total assets | | — | % | | — | % | | — | % | | 0.01 | % | | 0.01 | % |

| Total non-performing assets | | $ | — | | | $ | — | | | $ | — | | | $ | 251 | | | $ | 271 | |

| Total nonaccrual loans | | $ | — | | | $ | — | | | $ | — | | | $ | 251 | | | $ | 271 | |

| Total substandard loans | | $ | 25,435 | | | $ | 30,580 | | | $ | 27,785 | | | $ | 22,657 | | | $ | 10,756 | |

| Total special mention loans | | $ | 18,094 | | | $ | 29,061 | | | $ | 31,023 | | | $ | 30,894 | | | $ | 34,509 | |

| Net loan charge-offs (recoveries) | | $ | (22) | | | $ | 19 | | | $ | 18 | | | $ | 7 | | | $ | (9) | |

| Net (recoveries) charge-offs to average loans (annualized) | | (0.01) | % | | 0.01 | % | | 0.01 | % | | — | % | | — | % |

| Book value per share | | $ | 15.86 | | | $ | 15.49 | | | $ | 14.88 | | | $ | 13.54 | | | $ | 13.90 | |

| Tangible book value per share (1) | | $ | 11.31 | | | $ | 10.91 | | | $ | 10.30 | | | $ | 8.94 | | | $ | 9.29 | |

| Tangible common equity (1) | | $ | 133,583 | | | $ | 128,240 | | | $ | 120,814 | | | $ | 104,935 | | | $ | 108,863 | |

| Cost of total deposits | | 0.88 | % | | 0.20 | % | | 0.09 | % | | 0.04 | % | | 0.04 | % |

| Interest and dividends on investment securities exempt from Federal income taxes | | $ | 1,405 | | | $ | 1,405 | | | $ | 1,534 | | | $ | 1,825 | | | $ | 1,879 | |

| Net interest margin (calculated on a fully tax equivalent basis) (2) | | 3.46 | % | | 3.81 | % | | 3.80 | % | | 3.57 | % | | 3.48 | % |

| Return on average assets (3) | | 1.00 | % | | 1.15 | % | | 1.25 | % | | 1.06 | % | | 1.07 | % |

| Return on average equity (3) | | 13.60 | % | | 15.64 | % | | 18.79 | % | | 14.42 | % | | 14.73 | % |

| Loan to deposit ratio | | 57.07 | % | | 59.09 | % | | 59.83 | % | | 57.28 | % | | 53.94 | % |

| Efficiency ratio | | 65.24 | % | | 55.46 | % | | 49.85 | % | | 57.20 | % | | 54.20 | % |

| Tier 1 leverage - Bancorp | | 8.51 | % | | 8.58 | % | | 8.37 | % | | 8.26 | % | | 7.89 | % |

| Tier 1 leverage - Bank | | 11.04 | % | | 11.19 | % | | 10.86 | % | | 10.73 | % | | 9.10 | % |

| Common equity tier 1 - Bancorp | | 12.39 | % | | 11.80 | % | | 11.92 | % | | 11.56 | % | | 11.94 | % |

| Common equity tier 1 - Bank | | 16.46 | % | | 15.77 | % | | 15.87 | % | | 15.41 | % | | 14.15 | % |

| Tier 1 risk-based capital - Bancorp | | 12.68 | % | | 12.09 | % | | 12.22 | % | | 11.86 | % | | 12.26 | % |

| Tier 1 risk-based capital - Bank | | 16.46 | % | | 15.77 | % | | 15.87 | % | | 15.41 | % | | 14.15 | % |

| Total risk-based capital - Bancorp | | 15.73 | % | | 15.08 | % | | 14.92 | % | | 14.54 | % | | 15.07 | % |

| Total risk based capital - Bank | | 17.44 | % | | 16.75 | % | | 16.53 | % | | 16.03 | % | | 14.78 | % |

(1) Non-GAAP measure. Tangible common equity equals totals shareholder’s equity minus goodwill and core deposit intangible.

(2) Net Interest Margin is computed by dividing annualized quarterly net interest income by quarterly average interest-bearing assets.

(3) Computed by annualizing quarterly net income.

Central Valley Community Bancorp -- page 14

CENTRAL VALLEY COMMUNITY BANCORP

SCHEDULE OF AVERAGE BALANCES AND AVERAGE YIELDS AND RATES

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended

June 30, 2023 | | For the Three Months Ended

March 31, 2023 | | For the Three Months Ended

June 30, 2022 |

| (Dollars in thousands) | | Average

Balance | | Interest

Income/

Expense | | Average

Interest

Rate | | Average

Balance | | Interest

Income/

Expense | | Average

Interest

Rate | | Average

Balance | | Interest

Income/

Expense | | Average

Interest

Rate |

| ASSETS | | | | | | | | | | | | | | | | | | |

| Interest-earning deposits in other banks | | $ | 107,134 | | | $ | 1,373 | | | 5.13 | % | | $ | 6,882 | | | $ | 75 | | | 4.36 | % | | $ | 33,067 | | | $ | 53 | | | 0.64 | % |

| Securities | | | | | | | | | | | | | | | | | | |

| Taxable securities | | 765,304 | | | 5,826 | | | 3.05 | % | | 783,938 | | | 5,886 | | | 3.00 | % | | 945,210 | | | 5,651 | | | 2.39 | % |

| Non-taxable securities (1) | | 256,624 | | | 1,779 | | | 2.77 | % | | 257,452 | | | 1,778 | | | 2.76 | % | | 274,217 | | | 2,378 | | | 3.47 | % |

| Total investment securities | | 1,021,928 | | | 7,605 | | | 2.98 | % | | 1,041,390 | | | 7,664 | | | 2.94 | % | | 1,219,427 | | | 8,029 | | | 2.63 | % |

| | | | | | | | | | | | | | | | | | |

| Total securities and interest-earning deposits | | 1,129,062 | | | 8,978 | | | 3.18 | % | | 1,048,272 | | | 7,739 | | | 2.95 | % | | 1,252,494 | | | 8,082 | | | 2.58 | % |

| Loans (2) (3) | | 1,257,984 | | | 17,382 | | | 5.54 | % | | 1,260,178 | | | 16,508 | | | 5.31 | % | | 1,085,887 | | | 12,883 | | | 4.76 | % |

| | | | | | | | | | | | | | | | | | |

| Total interest-earning assets | | 2,387,046 | | | $ | 26,360 | | | 4.43 | % | | 2,308,450 | | | $ | 24,247 | | | 4.26 | % | | 2,338,381 | | | $ | 20,965 | | | 3.60 | % |

| Allowance for credit losses | | (15,317) | | | | | | | (14,759) | | | | | | | (9,870) | | | | | |

| Non-accrual loans | | — | | | | | | | — | | | | | | | 280 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Cash and due from banks | | 26,467 | | | | | | | 27,574 | | | | | | | 33,050 | | | | | |

| Bank premises and equipment | | 9,392 | | | | | | | 8,072 | | | | | | | 8,132 | | | | | |

| Other assets | | 93,936 | | | | | | | 86,303 | | | | | | | 71,989 | | | | | |

| Total average assets | | $ | 2,501,524 | | | | | | | $ | 2,415,640 | | | | | | | $ | 2,441,962 | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | |

| Savings and NOW accounts | | $ | 476,398 | | | $ | 158 | | | 0.13 | % | | $ | 526,232 | | | $ | 92 | | | 0.07 | % | | $ | 600,685 | | | $ | 34 | | | 0.02 | % |

| Money market accounts | | 547,452 | | | 2,423 | | | 1.78 | % | | 468,166 | | | 837 | | | 0.73 | % | | 520,224 | | | 164 | | | 0.13 | % |

| Time certificates of deposit | | 225,638 | | | 2,292 | | | 4.07 | % | | 68,650 | | | 75 | | | 0.44 | % | | 89,107 | | | 33 | | | 0.15 | % |

| | | | | | | | | | | | | | | | | | |

| Total interest-bearing deposits | | 1,249,488 | | | 4,873 | | | 1.56 | % | | 1,063,048 | | | 1,004 | | | 0.38 | % | | 1,210,016 | | | 231 | | | 0.08 | % |

| Other borrowed funds | | 69,653 | | | 911 | | | 5.23 | % | | 124,480 | | | 1,558 | | | 5.01 | % | | 78,435 | | | 424 | | | 2.16 | % |

| Total interest-bearing liabilities | | 1,319,141 | | | $ | 5,784 | | | 1.76 | % | | 1,187,528 | | | $ | 2,562 | | | 0.87 | % | | 1,288,451 | | | $ | 655 | | | 0.20 | % |

| Non-interest bearing demand deposits | | 963,104 | | | | | | | 1,018,210 | | | | | | | 947,724 | | | | | |

| Other liabilities | | 34,492 | | | | | | | 31,591 | | | | | | | 28,091 | | | | | |

| Shareholders’ equity | | 184,787 | | | | | | | 178,311 | | | | | | | 177,696 | | | | | |

| Total average liabilities and shareholders’ equity | | $ | 2,501,524 | | | | | | | $ | 2,415,640 | | | | | | | $ | 2,441,962 | | | | | |

| Interest income and rate earned on average earning assets | | | | $ | 26,360 | | | 4.43 | % | | | | $ | 24,247 | | | 4.26 | % | | | | $ | 20,965 | | | 3.60 | % |

| Interest expense and interest cost related to average interest-bearing liabilities | | | | 5,784 | | | 1.76 | % | | | | 2,562 | | | 0.87 | % | | | | 655 | | | 0.20 | % |

| Net interest income and net interest margin (4) | | | | $ | 20,576 | | | 3.46 | % | | | | $ | 21,685 | | | 3.81 | % | | | | $ | 20,310 | | | 3.48 | % |

(1) Calculated on a fully tax equivalent basis, which includes Federal tax benefits relating to income earned on municipal bonds totaling $374, $373, and $499 at June 30, 2023, March 31, 2023, and June 30, 2022, respectively.

(2) Loan interest income includes loan fees of $26 and $226 at June 30, 2023 and June 30, 2022, respectively, and loan costs of $260 at March 31, 2023.

(3) Average loans do not include non-accrual loans but do include interest income recovered from previously charged off loans.

(4) Net interest margin is computed by dividing net interest income by total average interest-earning assets.

Central Valley Community Bancorp -- page 15

CENTRAL VALLEY COMMUNITY BANCORP

SCHEDULE OF AVERAGE BALANCES AND AVERAGE YIELDS AND RATES

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Six Months Ended

June 30, 2023 | | | | For the Six Months Ended

June 30, 2022 |

| (Dollars in thousands) | | Average

Balance | | Interest

Income/

Expense | | Average

Interest

Rate | | | | | | | | Average

Balance | | Interest

Income/

Expense | | Average

Interest

Rate |

| ASSETS | | | | | | | | | | | | | | | | | | |

| Interest-earning deposits in other banks | | $ | 57,285 | | | $ | 1,449 | | | 5.06 | % | | | | | | | | $ | 81,204 | | | $ | 109 | | | 0.27 | % |

| Securities | | | | | | | | | | | | | | | | | | |

| Taxable securities | | 774,569 | | | 11,712 | | | 3.02 | % | | | | | | | | 913,481 | | | 10,176 | | | 2.23 | % |

| Non-taxable securities (1) | | 257,036 | | | 3,557 | | | 2.77 | % | | | | | | | | 265,459 | | | 4,201 | | | 3.17 | % |

| Total investment securities | | 1,031,605 | | | 15,269 | | | 2.96 | % | | | | | | | | 1,178,940 | | | 14,377 | | | 2.44 | % |

| | | | | | | | | | | | | | | | | | |

| Total securities and interest-earning deposits | | 1,088,890 | | | 16,718 | | | 3.07 | % | | | | | | | | 1,260,144 | | | 14,486 | | | 2.30 | % |

| Loans (2) (3) | | 1,259,075 | | | 34,159 | | | 5.47 | % | | | | | | | | 1,051,772 | | | 25,044 | | | 4.80 | % |

| | | | | | | | | | | | | | | | | | |

| Total interest-earning assets | | 2,347,965 | | | $ | 50,877 | | | 4.37 | % | | | | | | | | 2,311,916 | | | $ | 39,530 | | | 3.45 | % |

| Allowance for credit losses | | (13,117) | | | | | | | | | | | | | (9,851) | | | | | |

| Non-accrual loans | | — | | | | | | | | | | | | | 345 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Cash and due from banks | | 27,017 | | | | | | | | | | | | | 42,713 | | | | | |

| Bank premises and equipment | | 8,735 | | | | | | | | | | | | | 8,218 | | | | | |

| Other assets | | 90,142 | | | | | | | | | | | | | 97,603 | | | | | |

| Total average assets | | $ | 2,460,742 | | | | | | | | | | | | | $ | 2,450,944 | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | |

| Savings and NOW accounts | | $ | 501,177 | | | $ | 252 | | | 0.10 | % | | | | | | | | $ | 589,785 | | | $ | 68 | | | 0.02 | % |

| Money market accounts | | 508,028 | | | 3,259 | | | 1.29 | % | | | | | | | | 531,383 | | | 347 | | | 0.13 | % |

| Time certificates of deposit | | 147,577 | | | 2,365 | | | 3.23 | % | | | | | | | | 88,262 | | | 68 | | | 0.16 | % |

| | | | | | | | | | | | | | | | | | |

| Total interest-bearing deposits | | 1,156,782 | | | 5,876 | | | 1.02 | % | | | | | | | | 1,209,430 | | | 483 | | | 0.08 | % |

| Other borrowed funds | | 96,915 | | | 2,468 | | | 5.09 | % | | | | | | | | 59,062 | | | 757 | | | 2.56 | % |

| Total interest-bearing liabilities | | 1,253,697 | | | $ | 8,344 | | | 1.34 | % | | | | | | | | 1,268,492 | | | $ | 1,240 | | | 0.20 | % |

| Non-interest bearing demand deposits | | 990,505 | | | | | | | | | | | | | 944,362 | | | | | |

| Other liabilities | | 33,050 | | | | | | | | | | | | | 33,538 | | | | | |

| Shareholders’ equity | | 183,490 | | | | | | | | | | | | | 204,552 | | | | | |

| Total average liabilities and shareholders’ equity | | $ | 2,460,742 | | | | | | | | | | | | | $ | 2,450,944 | | | | | |

| Interest income and rate earned on average earning assets | | | | $ | 50,877 | | | 4.37 | % | | | | | | | | | | $ | 39,530 | | | 3.45 | % |

| Interest expense and interest cost related to average interest-bearing liabilities | | | | 8,344 | | | 1.34 | % | | | | | | | | | | 1,240 | | | 0.20 | % |

| Net interest income and net interest margin (4) | | | | $ | 42,533 | | | 3.65 | % | | | | | | | | | | $ | 38,290 | | | 3.34 | % |

(1) Calculated on a fully tax equivalent basis, which includes Federal tax benefits relating to income earned on municipal bonds totaling $747 and $882 at June 30, 2023 and June 30, 2022, respectively.

(2) Loan interest income includes loan fees of $36 and $490 at June 30, 2023 and June 30, 2022, respectively.

(3) Average loans do not include non-accrual loans but do include interest income recovered from previously charged off loans.

(4) Net interest margin is computed by dividing net interest income by total average interest-earning assets.

CONTACTS: Investor Contact: Media Contact:

Shannon Avrett Debbie Nalchajian-Cohen

Executive Vice President, Chief Financial Officer Marketing Director

Central Valley Community Bancorp Central Valley Community Bancorp

916-235-4617 559-222-1322

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

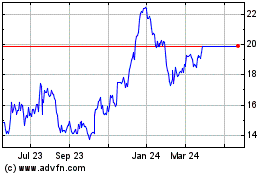

Central Valley Community... (NASDAQ:CVCY)

Historical Stock Chart

From Apr 2024 to May 2024

Central Valley Community... (NASDAQ:CVCY)

Historical Stock Chart

From May 2023 to May 2024