FALSE000091577900009157792024-12-112024-12-110000915779us-gaap:CommonStockMember2024-12-112024-12-110000915779us-gaap:PreferredStockMember2024-12-112024-12-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 11, 2024

Daktronics, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

South Dakota | 001-38747 | 46-0306862 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

201 Daktronics Drive

Brookings, SD 57006

(Address of Principal Executive Offices Zip Code)

(605) 692-0200

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered or to be registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, No Par Value | DAKT | Nasdaq Global Select Market |

| Preferred Stock Purchase Rights | DAKT | Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 8 - Other Events

Item 8.01 Other Events

On December 11, 2024, Daktronics, Inc. (the “Registrant”) issued the press release filed herewith as Exhibit 99.1 and incorporated herein by reference.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits. The following exhibit is filed as part of this Current Report on Form 8-K:

104 Cover page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| DAKTRONICS, INC. |

| | |

| By: /s/ Sheila M. Anderson |

| | Sheila M. Anderson, Chief Financial Officer |

Date: December 11, 2024 | | (Principal Financial Officer and Principal Accounting Officer) |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover page Interactive Data File (embedded within the Inline XBRL document) |

Exhibit 99.1

Daktronics Comments on Presentation and Public Statements from Alta Fox

Highlights Alta Fox’s Self-Serving Campaign to Pressure the Daktronics Board into Taking Actions that Would Favor Alta Fox as a Creditor

BROOKINGS, S.D., Dec. 11, 2024 (GLOBE NEWSWIRE) -- Daktronics, Inc. (“Daktronics” or the “Company”) (NASDAQ-DAKT), the leading U.S.-based designer and manufacturer of best-in-class dynamic video communication displays and control systems for customers worldwide, today issued the following statement regarding the recent press release and public comments from Alta Fox Capital Management, LLC (together with its affiliates, “Alta Fox”):

In May 2023, after a competitive process with several potential financing providers, we sold $25 million of convertible debt to Alta Fox. At that time, Alta Fox stated on social media that Daktronics’ stock “could triple” to approximately $16.23 per share.1

Since then, we have engaged extensively and in good faith with Alta Fox, including recently regarding Alta Fox’s desire to accelerate the Company’s repayment of this twenty-month-old convertible debt. In its most recent proposal, Alta Fox demanded that the Company retire the convertible debt at a price more than three times its face value and nearly 50% above its fair value.2 On behalf of our shareholders and following consultation with its investment bankers, the Board rejected Alta Fox’s proposal as too costly to common shareholders, and it stands by that decision.

Alta Fox then tried to intimidate the Board by threatening to initiate specious litigation on three separate matters, call a special meeting of shareholders, and nominate candidates to replace directors at the Company’s 2025 annual meeting of shareholders if the Board did not accept Alta Fox’s buyout terms on the convertible note.

Recognizing that those threats would not convince the Board to repurchase Alta Fox’s debt at an unreasonable price, Alta Fox has now issued a press release and presentation rife with innuendo and misleading statements. Alta Fox’s public communications yesterday are also concerning because they fail to disclose that Alta

1 Alta Fox May 12, 2023, post on X

2 The convertible note is carried on Daktronics’ balance sheet at a fair value of $52.8 million as of October 26, 2024. See Daktronics Form 10-Q for period ended October 26, 2024, for additional details.

Fox has been seeking to secure an economic windfall for itself as a creditor of Daktronics at the expense of our common shareholders.

The Board recognizes and embraces its role as fiduciaries and will not be pressured into a transaction that is not in the best interests of the Company and its shareholders. The Company has made a counterproposal to Alta Fox that reflects the market value for Alta Fox’s convertible note and remains willing to assist Alta Fox in gaining the liquidity it desires at a price that is fair to both Alta Fox and our shareholders. At the same time, the Company will remain focused on its business transformation plan.

Notably, after significant transformation efforts and record financial performance in Fiscal Year 2024, Daktronics’ stock closed yesterday at a price of $19.24 per share, well above the price target Alta Fox itself set for the stock in May 2023.

About Daktronics

Daktronics has strong leadership positions in, and is the world's largest supplier of, large-screen video displays, electronic scoreboards, LED text and graphics displays, and related control systems. The Company excels in the control of display systems, including those that require integration of multiple complex displays showing real-time information, graphics, animation, and video. Daktronics designs, manufactures, markets and services display systems for customers around the world in four domestic business units: Live Events, Commercial, High School Park and Recreation, and Transportation, and one International business unit. For more information, visit the company's website at: www.daktronics.com.

Safe Harbor Statement

Cautionary Notice: In addition to statements of historical fact, this news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and is intended to enjoy the protection of that Act. These forward-looking statements reflect the Company's expectations or beliefs concerning future events. The Company cautions that these and similar statements involve risk and uncertainties which could cause actual results to differ materially from our expectations, including, but not limited to, changes in economic and market conditions, management of growth, timing and magnitude of future contracts and orders, fluctuations in margins, the introduction of new products and technology, the impact of adverse weather conditions, increased regulation, and other risks described in the company's SEC filings, including its Annual Report on Form 10-K for its 2024 fiscal year. Forward-looking statements are made in the context of information available as of the date stated. The Company undertakes no obligation to update or revise such statements to reflect new circumstances or unanticipated events as they occur.

For more information contact:

INVESTOR RELATIONS:

Sheila M. Anderson, Chief Financial Officer

Tel (605) 692-0200

Investor@daktronics.com

Alliance Advisors IR

Carolyn Capaccio / Jody Burfening

DAKTIRTeam@lhai.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

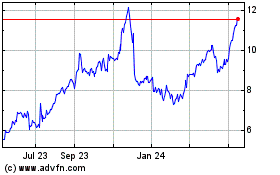

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Dec 2024 to Jan 2025

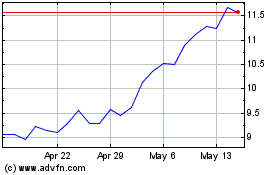

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Jan 2024 to Jan 2025