Exceeds 4Q Revenue Expectations and Achieves

Over 5% Growth YoY

Diodes Incorporated (Diodes) (Nasdaq: DIOD) today reported its

financial results for the fourth quarter and year ended December

31, 2024.

Fourth Quarter Highlights

- Revenue was $339.3 million, compared to $350.1 million in the

prior quarter and $322.7 million in the fourth quarter 2023;

- GAAP gross profit was $110.9 million, compared to $118.0

million in the prior quarter and $112.5 million in the same quarter

a year ago;

- GAAP gross profit margin was 32.7 percent, compared to 33.7

percent in the prior quarter and 34.9 percent in the fourth quarter

of 2023;

- GAAP operating income was $11.9 million, or 3.5 percent of

revenue, compared to $21.9 million, or 6.3 percent of revenue, in

the prior quarter and compared to $20.7 million or 6.4 percent in

the fourth quarter of 2023;

- GAAP net income was $8.2 million, compared to the $13.7 million

last quarter and $25.3 million during the same quarter a year

ago;

- Non-GAAP adjusted net income was $12.5 million, compared to

$20.1 million in the prior quarter and $23.4 million in the same

quarter a year ago;

- GAAP EPS was $0.18 per diluted share, compared to $0.30 per

diluted share in the prior quarter and $0.55 per diluted share in

the fourth quarter of 2023;

- Non-GAAP EPS was $0.27 per diluted share, compared to $0.43 per

diluted share in the prior quarter and $0.51 per diluted share in

the same quarter a year ago;

- Excluding $5.3 million, net of tax, non-cash share-based

compensation expense, both GAAP net income and non-GAAP adjusted

net income would have increased by $0.11 per diluted share;

- EBITDA was $40.7 million, or 12.0 percent of revenue, compared

to $46.9 million, or 13.4 percent of revenue in the prior quarter

and $58.4 million, or 18.1 percent of revenue during the same

quarter last year; and

- Achieved $81.8 million cash flow from operations and $62.1

million of free cash flow, including $19.7 million of capital

expenditures. Net cash flow was a negative $2.4 million, which

includes the net pay-down of $3.8 million of total debt.

Commenting on the results, Gary Yu, President of Diodes, stated,

“Our above seasonal revenue results in the fourth quarter reflect

the improving momentum we have seen over the past few quarters as

the markets in Asia gradually improve, especially in China and the

Southeast Asia region. We achieved 5% growth over the fourth

quarter 2023, which marks a return to year-over-year growth

following the multi-year market slowdown. Even though the overall

global demand environment remains challenging, especially in Europe

and North America, we were able to maintain our automotive and

industrial mix percentage at 42% of total product revenue, which is

a testament to the progress we have made on our new product and

content expansion initiatives.

“Diodes enters the new year having strong POS in Asia for 2024,

improved levels of channel inventory and a solid balance sheet

combined with a committed focus on expanding growth in our target

markets, especially the automotive and industrial markets, and

capitalizing on new opportunities in AI-related applications. With

our product mix consistently above our target model, we are well

positioned for future growth and margin expansion as the market

recovery broadens across our end markets in 2025 and beyond.”

Fourth Quarter 2024

Revenue for fourth quarter 2024 was $339.3 million, compared to

$350.1 million in the third quarter 2024 and $322.7 million in the

fourth quarter 2023.

GAAP gross profit for the fourth quarter 2024 was $110.9

million, or 32.7 percent of revenue, compared to $118.0 million, or

33.7 percent of revenue, in the third quarter 2024 and $112.5

million, or 34.9 percent of revenue, in the fourth quarter of

2023.

GAAP operating expenses for fourth quarter 2024 were $99.0

million, or 29.2 percent of revenue, and on a non-GAAP basis were

$95.5 million, or 28.1 percent of revenue, which excludes $5.0

million amortization of acquisition-related intangible asset

expenses, $0.6 million in restructuring charges, $0.3 million in

acquisition-related costs and $2.3 million of insurance recovery.

GAAP operating expenses in the third quarter 2024 were $96.1

million, or 27.5 percent of revenue and in the fourth quarter 2023

were $91.8 million, or 28.4 percent of revenue.

Fourth quarter 2024 GAAP net income was $8.2 million, or $0.18

per diluted share, compared to GAAP net income in the third quarter

2024 of $13.7 million, or $0.30 per diluted share, and $25.3

million, or $0.55 per diluted share, of GAAP net income in the

fourth quarter 2023.

Fourth quarter 2024 non-GAAP adjusted net income was $12.5

million, or $0.27 per diluted share, which excluded, net of tax,

$4.1 million of acquisition-related intangible asset cost, $1.3

million non-cash mark-to-market investment value adjustment, $0.5

million in restructuring charges, $0.2 million in

acquisition-related costs and $1.9 million of insurance recovery.

This compares to non-GAAP adjusted net income of $20.1 million, or

$0.43 per diluted share, in the third quarter 2024 and $23.4

million, or $0.51 per diluted share, in the fourth quarter

2023.

The following is an unaudited summary reconciliation of GAAP net

income to non-GAAP adjusted net income and per share data, net of

tax (in thousands, except per share data):

Three Months Ended December 31, 2024 GAAP net

income

$

8,241

GAAP diluted earnings per share

$

0.18

Adjustments to reconcile net income to non-GAAP net

income: Amortization of acquisition-related

intangible assets

4,099

Acquisition related cost

232

Restructuring charge

458

Non-cash mark-to-market investment value adjustments

1,305

Insurance recovery for manufacturing facility

(1,870

)

Non-GAAP net income

$

12,465

Non-GAAP diluted earnings per share

$

0.27

Note: Throughout this release, we refer to “net income

attributable to common stockholders” as “net income.”

(See the reconciliation tables of GAAP net income to non-GAAP

adjusted net income near the end of this release for further

details.)

Included in fourth quarter 2024 GAAP net income and non-GAAP

adjusted net income was approximately $5.3 million, net of tax,

non-cash share-based compensation expense. Excluding share-based

compensation expense, GAAP earnings per share (“EPS”) and non-GAAP

adjusted EPS would have increased by $0.11 per share for the fourth

quarter 2024, compared to $0.13 for the third quarter 2024 and

$0.13 for both in the fourth quarter 2023.

EBITDA (a non-GAAP measure), which represents earnings before

net interest expense, income tax, depreciation and amortization, in

fourth quarter 2024 was $40.7 million, or 12.0 percent of revenue,

compared to $46.9 million, or 13.4 percent of revenue, in third

quarter 2024 and $58.4 million, or 18.1 percent of revenue, in

fourth quarter 2023. For a reconciliation of GAAP net income to

EBITDA, see the table near the end of this release for further

details.

For the fourth quarter 2024, net cash provided by operating

activities was $81.8 million. Net cash flow was negative $2.4

million, including the net pay-down of $3.8 million of total debt.

Free cash flow (a non-GAAP measure) was $62.1 million, which

includes $19.7 million of capital expenditures.

Balance Sheet

As of December 31, 2024, the Company had approximately $322

million in cash and cash equivalents, restricted cash, and

short-term investments. Total debt (including long-term and

short-term) amounted to approximately $52 million and working

capital was approximately $849 million.

The results announced today are preliminary and unaudited, as

they are subject to the Company finalizing its closing procedures

and completion of the quarterly review by its independent

registered public accounting firm. As such, these results are

subject to revision until the Company files its Form 10-K for the

year ending December 31, 2024.

Business Outlook

Gary Yu further commented, “For the first quarter of 2025, we

expect revenue to be approximately $323 million, plus or minus 3

percent, representing a 4.8% sequential decrease at the mid-point,

due to the Chinese New Year holiday but slightly better than

typical seasonality. Importantly, the mid-point of guidance

represents 7% year-over-year growth and extends our momentum in

support of our expectation for growth in 2025. GAAP gross margin is

expected to be 32.5 percent, plus or minus 1 percent. Non-GAAP

operating expenses, which are GAAP operating expenses adjusted for

amortization of acquisition-related intangible assets, are expected

to be approximately 30.0 percent of revenue, plus or minus 1

percent. We expect net interest income to be approximately $1.5

million. Our income tax rate is expected to be 18.5 percent, plus

or minus 3 percent, and shares used to calculate diluted EPS for

the first quarter are anticipated to be approximately 46.7

million.”

Amortization of acquisition-related intangible assets of $5.8

million, after tax, for previous acquisitions is not included in

these non-GAAP estimates.

Conference Call

Diodes will host a conference call on Tuesday, February 11, 2025

at 4:00 p.m. Central Time (5:00 p.m. Eastern Time) to discuss its

fourth quarter financial results. Investors and analysts may join

the conference call by dialing 1-833-634-2590, and

international callers may join the teleconference by dialing

+1-412-317-6038. A telephone replay of the call will be made

available approximately two hours after the call and will remain

available until February 18, 2025 at midnight Central Time. The

replay number is 1-877-344-7529 with an access code of 6215367

followed by the # key. International callers should dial

+1-412-317-0088 and enter the same pass code at the prompt followed

by the # key.

Additionally, this conference call will be broadcast live over

the Internet and can be accessed by all interested parties on the

Investor Relations section of the Company’s website. To listen to

the live call, please go to the investors’ section of Diodes’

website and click on the conference call link at least 15 minutes

prior to the start of the call to register, download and install

any necessary audio software. For those unable to participate

during the live broadcast, a replay will be available shortly after

the call on Diodes' website for approximately 90 days.

About Diodes Incorporated

Diodes Incorporated (Nasdaq: DIOD), a Standard and Poor’s

SmallCap 600 and Russell 3000 Index company, delivers high-quality

semiconductor products to the world’s leading companies in the

automotive, industrial, computing, consumer electronics, and

communications markets. We leverage our expanded product portfolio

of analog and discrete power solutions combined with leading-edge

packaging technology to meet customers’ needs. Our broad range of

application-specific products and solutions-focused sales, coupled

with global operations including engineering, testing,

manufacturing, and customer service, enable us to be a premier

provider for high-volume, high-growth markets. For more

information, visit www.diodes.com.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995: Any statements set forth above that are not

historical facts are forward-looking statements that involve risks

and uncertainties that could cause actual results to differ

materially from those in the forward-looking statements. Such

statements include statements containing forward-looking words such

as “expect,” “anticipate,” “aim,” “estimate,” and variations

thereof, including without limitation statements, whether direct or

implied, regarding expectations of that for the first quarter of

2025, we expect revenue to be approximately $323 million plus or

minus 3 percent; we expect GAAP gross margin to be 32.5 percent,

plus or minus 1 percent; non-GAAP operating expenses, which are

GAAP operating expenses adjusted for amortization of

acquisition-related intangible assets, are expected to be

approximately 30.0 percent of revenue, plus or minus 1 percent; we

expect non-GAAP net interest income to be approximately $1.5

million; we expect our income tax rate to be 18.5 percent, plus or

minus 3 percent; shares used to calculate diluted EPS for the first

quarter are anticipated to be approximately 46.7 million. Potential

risks and uncertainties include, but are not limited to, such

factors as: the risk that such expectations may not be met; the

risk that the expected benefits of acquisitions may not be realized

or that integration of acquired businesses may not continue as

rapidly as we anticipate; the risk that we may not be able to

maintain our current growth strategy or continue to maintain our

current performance, costs, and loadings in our manufacturing

facilities; the risk that we may not be able to increase our

automotive, industrial, or other revenue and market share; risks of

domestic and foreign operations, including excessive operating

costs, labor shortages, higher tax rates, and our joint venture

prospects; the risks of cyclical downturns in the semiconductor

industry and of changes in end-market demand or product mix that

may affect gross margin or render inventory obsolete; the risk of

unfavorable currency exchange rates; the risk that our future

outlook or guidance may be incorrect; the risks of global economic

weakness or instability in global financial markets; the risks of

trade restrictions, tariffs, or embargoes; the risk of breaches of

our information technology systems; and other information,

including the “Risk Factors” detailed from time to time in Diodes’

filings with the United States Securities and Exchange

Commission.

The Diodes logo is a registered trademark of Diodes Incorporated

in the United States and other countries.

© 2025 Diodes Incorporated. All Rights Reserved.

DIODES INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED CONDENSED

STATEMENTS OF OPERATIONS

(in thousands, except per share

data)

(unaudited)

Three Months Ended Twelve Months Ended

December 31, December 31,

2024

2023

2024

2023

Net sales

$

339,298

$

322,699

$

1,311,120

$

1,661,739

Cost of goods sold

228,414

210,223

875,258

1,003,557

Gross profit

110,884

112,476

435,862

658,182

Operating expenses Selling, general and

administrative

62,323

56,484

233,913

257,939

Research and development

33,207

32,957

134,051

134,868

Amortization of acquisition-related intangible assets

5,002

3,806

16,499

15,282

(Gain)loss on disposal of fixed assets

(2,116

)

(489

)

(7,641

)

(2,045

)

Restructuring charge

552

(983

)

8,591

1,583

Other operating (income) expense

(1

)

(2

)

(1

)

(16

)

Total operating expense

98,967

91,773

385,412

407,611

Income from operations

11,917

20,703

50,450

250,571

Other (expense) income Interest income

4,920

4,835

18,303

13,338

Interest expense

(494

)

(481

)

(2,334

)

(5,700

)

Foreign currency gain(loss), net

(3,656

)

(2,468

)

(6,308

)

(5,264

)

Unrealized gain(loss) on investments

(1,631

)

1,805

(321

)

18,267

Other income

1,214

3,484

2,892

6,721

Total other income (expense)

353

7,175

12,232

27,362

Income before income taxes and noncontrolling

interest

12,270

27,878

62,682

277,933

Income tax provision

2,041

2,771

11,840

47,285

Net income

10,229

25,107

50,842

230,648

Less net (income) attributable to noncontrolling interest

(1,988

)

185

(6,818

)

(3,466

)

Net income attributable to common stockholders

$

8,241

$

25,292

$

44,024

$

227,182

Earnings per share attributable to common

stockholders: Basic

$

0.18

$

0.55

$

0.95

$

4.96

Diluted

$

0.18

$

0.55

0.95

$

4.91

Number of shares used in earnings per share computation:

Basic

46,333

45,938

46,208

45,803

Diluted

46,397

46,245

46,408

46,311

Note: Throughout this release, we refer to “net

income attributable to common stockholders” as “net income.”

DIODES INCORPORATED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

TO ADJUSTED NET INCOME

(in thousands, except per share

data)

(unaudited)

For the three months

ended December 31, 2024:

Operating Expenses Other (Income) Expense Income

Tax Provision Net Income Per-GAAP

$

8,241

Diluted earnings per share (per-GAAP)

$

0.18

Adjustments to reconcile net income to non-GAAP net income:

Amortization of acquisition-related intangible assets

5,002

(903

)

4,099

Acquisition related cost

294

(62

)

232

Restructuring charge

552

(94

)

458

Non-cash mark-to-market investment value adjustments

1,631

(326

)

1,305

Insurance recovery for manufacturing facility

(2,338

)

468

(1,870

)

Non-GAAP

$

12,465

Diluted shares used in computing earnings per share

46,397

Non-GAAP diluted earnings per share

$

0.27

Note: Included in GAAP and non-GAAP adjusted net income was

approximately $5.3 million, net of tax, non-cash share-based

compensation expense. Excluding share-based compensation expense,

both GAAP and non-GAAP adjusted diluted earnings per share would

have improved by $0.11 per share.

DIODES INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED RECONCILIATION OF

NET INCOME TO ADJUSTED NET INCOME – Cont.

(in thousands, except per share

data)

(unaudited)

For the three months

ended December 31, 2023:

Operating Expenses Other (Income) Expense Income

Tax Provision Net Income Per-GAAP

$

25,292

Diluted earnings per share (per-GAAP)

$

0.55

Adjustments to reconcile net income to non-GAAP net income:

Amortization of acquisition-related intangible assets

3,806

(698

)

3,108

Non-cash mark-to-market investment value adjustments

(1,805

)

361

(1,444

)

Investment gain

(2,794

)

(2,794

)

Restructuring Cost

(984

)

246

(738

)

Non-GAAP

$

23,424

Diluted shares used in computing earnings per share

46,245

Non-GAAP diluted earnings per share

$

0.51

Note: Included in GAAP and non-GAAP adjusted net income was

approximately $5.9 million, net of tax, non-cash share-based

compensation expense. Excluding share-based compensation expense,

both GAAP and non-GAAP adjusted diluted earnings per share would

have improved by $0.13 per share.

DIODES INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED RECONCILIATION OF

NET INCOME TO ADJUSTED NET INCOME – Cont.

(in thousands, except per share

data)

(unaudited)

For the twelve

months ended December 31, 2024:

Operating Expenses Other (Income) Expense Income

Tax Provision Net Income Per-GAAP

$

44,024

Diluted earnings per share (per-GAAP)

$

0.95

Adjustments to reconcile net income to non-GAAP net income:

Amortization of acquisition-related intangible assets

16,499

(3,012

)

13,487

Officer retirement

644

(135

)

509

Acquisition related cost

1,059

(222

)

837

Restructuring charge

8,591

789

(1,835

)

7,545

Non-cash mark-to-market investment value adjustments

321

(64

)

257

Insurance recovery for manufacturing facility

(7,142

)

1,428

(5,714

)

Non-GAAP

$

60,945

Diluted shares used in computing earnings per share

46,408

Non-GAAP diluted earnings per share

$

1.31

Note: Included in GAAP and non-GAAP income was approximately $18

million and $17.4 million respectively, net of tax, non-cash

share-based compensation expense. Excluding share-based

compensation expense, GAAP diluted earnings per share would have

improved by $0.40 per share and non-GAAP diluted earnings per share

would have improved by $0.39 per share.

DIODES INCORPORATED AND

SUBSIDIARIES

CONSOLIDATED RECONCILIATION OF

NET INCOME TO ADJUSTED NET INCOME – Cont.

(in thousands, except per share

data)

(unaudited)

For the twelve

months ended December 31, 2023:

Operating Expenses Other (Income) Expense Income

Tax Provision Net Income Per-GAAP

$

227,182

Diluted earnings per share (per-GAAP)

$

4.91

Adjustments to reconcile net income to non-GAAP net income:

Amortization of acquisition-related intangible assets

15,282

(2,803

)

12,479

Officer retirement

2,788

(571

)

2,217

Non-cash mark-to-market investment value adjustments

(18,267

)

1,690

(16,577

)

Investment gain

(3,931

)

227

(3,704

)

Restructuring Cost

1,583

(396

)

1,187

Non-GAAP

$

222,784

Diluted shares used in computing earnings per share

46,311

Non-GAAP diluted earnings per share

$

4.81

Note: Included in GAAP and non-GAAP adjusted net income was

approximately $24.4 million, net of tax, non-cash share-based

compensation expense. Excluding share-based compensation expense,

both GAAP and non-GAAP adjusted diluted earnings per share would

have improved by $0.53 per share.

ADJUSTED NET INCOME

AND ADJUSTED EARNINGS PER SHARE

The Company’s financial statements present net income and

earnings per share that are calculated using accounting principles

generally accepted in the United States (“GAAP”). The Company’s

management makes adjustments to the GAAP measures that it feels are

necessary to allow investors and other readers of the Company’s

financial releases to view the Company’s operating results as

viewed by the Company’s management, board of directors and research

analysts in the semiconductor industry. These non-GAAP measures are

not prepared in accordance with, and should not be considered

alternatives or necessarily superior to, GAAP financial data and

may be different from non-GAAP measures used by other companies.

Because non-GAAP financial measures are not standardized, it may

not be possible to compare these financial measures with other

companies’ non-GAAP financial measures, even if they have similar

names. The explanation of the adjustments made in the table above,

are set forth below:

Detail of non-GAAP adjustments

Amortization of acquisition-related

intangible assets – The Company excluded this item,

including amortization of developed technologies and customer

relationships. The fair value of the acquisition-related intangible

assets is amortized using straight-line methods which approximate

the proportion of future cash flows estimated to be generated each

period over the estimated useful life of the applicable assets. The

Company believes that exclusion of this item is appropriate because

a significant portion of the purchase price for its acquisitions

was allocated to the intangible assets that have short lives and

exclusion of the amortization expense allows comparisons of

operating results that are consistent over time for both the

Company’s newly acquired and long-held businesses. In addition, the

Company excluded this item because there is significant variability

and unpredictability among companies with respect to this

expense.

Officer retirement – The

Company excluded costs related to the retirement of two executives.

These costs represent cash payments and the accelerated vesting of

previously issued stock awards. The Company feels it is appropriate

to exclude these costs since they don’t represent ongoing operating

expenses and will present investors with a more accurate indication

of our continuing operations.

Acquisition related costs –

The Company excluded expenses associated with previous acquisitions

of that typically consist of advisory, legal and other professional

and consulting fees. These costs were expensed as they were

incurred and as services were received, and in which the

corresponding tax adjustments were made for the non-deductible

portions of these expenses. The Company believes the exclusion of

the acquisition related costs provides investors with a more

accurate reflection of costs likely to be incurred in the absence

of an unusual event such as an acquisition and facilitates

comparisons with the results of other periods that may not reflect

such costs.

Insurance recovery for manufacturing

facility – The Company recorded gains related to

insurance recovery for a manufacturing facility in Asia. The

Company believes the exclusion of the insurance recovery provides

investors with a more accurate reflection of the continuing

operations of the Company and facilitates comparisons with the

results of other periods which may not reflect such gains.

Non-cash mark-to-market investment

adjustments – The Company excluded mark-to-market

adjustments on various equity related investments. The Company

believes this is not reflective of the ongoing operations and

exclusion of this provides investors an enhanced view of the

Company’s operating results.

Restructuring charge – The

Company recorded restructuring charges related to various

locations. These restructuring charges are excluded from

management’s assessment of the Company’s operating performance. The

Company believes the exclusion of the restructuring charges

provides investors an enhanced view of the cost structure of the

Company’s operations and facilitates comparisons with the results

of other periods that may not reflect such charges or may reflect

different levels of such charges.

Investment gain – The

Company excluded the gain realized on the sale of an equity

investment. The Company believes this is not reflective of the

ongoing operations and exclusion of this item provides investors an

enhanced view of the Company’s operating results.

CASH FLOW

ITEMS

Free cash flow (FCF)

(Non-GAAP)

FCF for the fourth quarter of 2024 is a non-GAAP financial

measure, which is calculated by subtracting capital expenditures

from cash flow from operations. For the fourth quarter of 2024, FCF

was $62.1 million, which represents the cash and cash equivalents

that we are able to generate after taking into account cash outlays

required to maintain or expand property, plant and equipment. FCF

is important because it allows us to pursue opportunities to

develop new products, make acquisitions and reduce debt.

CONSOLIDATED

RECONCILIATION OF NET INCOME TO EBITDA

EBITDA represents earnings before net interest expense, income

tax provision, depreciation and amortization. Management believes

EBITDA is useful to investors because it is frequently used by

securities analysts, investors and other interested parties, such

as financial institutions in extending credit, in evaluating

companies in our industry and provides further clarity on our

profitability. In addition, management uses EBITDA, along with

other GAAP and non-GAAP measures, in evaluating our operating

performance compared to that of other companies in our industry.

The calculation of EBITDA generally eliminates the effects of

financing, operating in different income tax jurisdictions, and

accounting effects of capital spending, including the impact of our

asset base, which can differ depending on the book value of assets

and the accounting methods used to compute depreciation and

amortization expense. EBITDA is not a recognized measurement under

GAAP, and when analyzing our operating performance, investors

should use EBITDA in addition to, and not as an alternative for,

income from operations and net income, each as determined in

accordance with GAAP. Because not all companies use identical

calculations, our presentation of EBITDA may not be comparable to

similarly titled measures used by other companies. For example, our

EBITDA takes into account all net interest expense, income tax

provision, depreciation and amortization without taking into

account any amounts attributable to noncontrolling interest.

Furthermore, EBITDA is not intended to be a measure of free cash

flow for management’s discretionary use, as it does not consider

certain cash requirements such as tax and debt service

payments.

The following table provides a reconciliation of net income to

EBITDA (in thousands, unaudited):

Three Months Ended Twelve Months Ended December

31, December 31,

2024

2023

2024

2023

Net income (per-GAAP)

$

8,241

$

25,292

$

44,024

$

227,182

Plus: Interest expense, net

(4,426

)

(4,354

)

(15,969

)

(7,638

)

Income tax provision

2,041

2,771

11,840

47,285

Depreciation and amortization

34,890

34,644

137,189

137,367

EBITDA (non-GAAP)

$

40,746

$

58,353

$

177,084

$

404,196

DIODES INCORPORATED AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited) (In thousands, except

share and per share data)

December 31, December 31,

2024

2023

Assets Current assets: Cash and cash equivalents

$

308,671

$

315,457

Restricted Cash

6,053

3,026

Short-term investments

7,464

10,174

Accounts receivable, net of allowances of $7,799 and $5,641 at

December 31, 2024 and December 31, 2023, respectively

325,517

371,930

Inventories

474,948

389,774

Prepaid expenses and other

101,500

97,024

Total current assets

1,224,153

1,187,385

Property, plant and equipment, net

684,259

746,169

Deferred income tax

51,974

51,620

Goodwill

181,555

146,558

Intangible assets, net

67,397

63,937

Other long-term assets

176,943

171,990

Total assets

$

2,386,281

$

2,367,659

Liabilities Current liabilities: Line of credit

$

31,429

$

40,685

Accounts payable

133,765

158,261

Accrued liabilities

186,576

179,674

Income tax payable

22,730

10,459

Current portion of long-term debt

1,096

4,419

Total current liabilities

375,596

393,498

Long-term debt, net of current portion

19,563

16,979

Deferred tax liabilities

6,953

13,662

Unrecognized tax benefits

24,646

34,035

Other long-term liabilities

90,576

99,808

Total liabilities

517,334

557,982

Commitments and contingencies

Stockholders'

equity

-

Preferred stock - par value $1.00 per share; 1,000,000 shares

authorized; no shares issued or outstanding

-

-

Common stock - par value $0.66 2/3 per share; 70,000,000 shares

authorized; 46,332,891 and 45,938,382, issued and outstanding at

December 31, 2024 and December 31, 2023, respectively

37,083

36,819

Additional paid-in capital

523,744

509,861

Retained earnings

1,719,298

1,675,274

Treasury stock, at cost, 9,288,420 and 9,286,862 shares held at

December 31, 2024 and December 31, 2023

(338,100

)

(337,986

)

Accumulated other comprehensive loss

(146,724

)

(143,227

)

Total stockholders' equity

1,795,301

1,740,741

Noncontrolling interest

73,646

68,936

Total equity

1,868,947

1,809,677

Total liabilities and stockholders' equity

$

2,386,281

$

2,367,659

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211482829/en/

Company Contact: Diodes Incorporated Gurmeet Dhaliwal

Director, IR & Corporate Marketing P: 408-232-9003 E:

Gurmeet_Dhaliwal@diodes.com

Investor Relations Contact: Shelton Group Leanne Sievers

President, Investor Relations P: 949-224-3874 E:

lsievers@sheltongroup.com

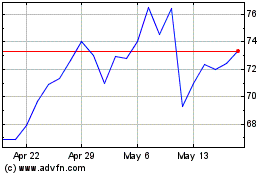

Diodes (NASDAQ:DIOD)

Historical Stock Chart

From Jan 2025 to Feb 2025

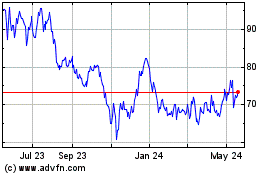

Diodes (NASDAQ:DIOD)

Historical Stock Chart

From Feb 2024 to Feb 2025