Denali Therapeutics Inc. (Nasdaq: DNLI), a biopharmaceutical

company developing a broad portfolio of product candidates

engineered to cross the blood-brain barrier (BBB) for the treatment

of neurodegenerative diseases and lysosomal storage diseases, today

reported financial results for the second quarter ended June 30,

2024, and provided business highlights.

"In the second quarter, our Enzyme Transport Vehicle franchise

gained additional momentum with continued engagement with the FDA

on an accelerated approval pathway for tividenofusp alfa (DNL310,

ETV:IDS) in MPS II and the FDA's selection of DNL126 (ETV:SGSH) in

MPS IIIA for the START program," said Ryan Watts, Ph.D., Chief

Executive Officer of Denali Therapeutics. “Today, we are also

pleased to share that we have regained the rights to our TfR-based

ATV:Abeta program from Biogen, thereby expanding our opportunities

for addressing Alzheimer's disease with a potential best-in-class

approach. We look forward to continuing to make significant

progress as leaders in the promising and growing field of

BBB-crossing therapeutics."

Second Quarter 2024 and Recent Program

Updates

Late-stage and mid-stage clinical programs

Tividenofusp alfa (DNL310): Enzyme

Transport Vehicle (ETV)-enabled, iduronate-2-sulfatase (IDS)

replacement therapy in development for MPS II (Hunter syndrome)

- In April, completed enrollment of 47 participants with MPS II

in the Phase 1/2 open-label study.

- COMPASS, the global Phase 2/3 study, is expected to complete

enrollment in 2024.

- In July, Molecular Genetics and Metabolism published a

review co-authored by Denali's Chief Medical Officer, Carole Ho,

M.D., titled, "Community consensus for heparan sulfate as a

biomarker to support accelerated approval in neuronopathic

mucopolysaccharidoses", which summarizes many of the presentations

at the Reagan-Udall Foundation workshop held in February 2024 and

provides a perspective on the path forward for neuronopathic MPS

disorders.

- Following the Reagan-Udall Foundation workshop, Denali received

written communication from the Center for Drug Evaluation and

Research (CDER) division of the FDA indicating openness to

discussing an accelerated approval pathway for tividenofusp alfa in

MPS II with cerebrospinal fluid heparan sulfate (CSF HS) as a

surrogate biomarker. Denali looks forward to continued engagement

with CDER regarding Denali’s intention to file for approval of

tividenofusp alfa using the accelerated approval pathway. Denali

will provide an update in 2H 2024.

DNL343: eIF2B activator in development for the

treatment of amyotrophic lateral sclerosis (ALS)

- In May, the Sean M. Healey & AMG Center for ALS at

Massachusetts General Hospital (MGH) in collaboration with the

Northeast ALS Consortium (NEALS) announced that enrollment is

complete in Regimen G (DNL343) of the Phase 2/3 HEALEY ALS Platform

Trial.

SAR443820/DNL788: CNS-penetrant RIPK1 inhibitor

in development for the treatment of multiple sclerosis (MS)

- Sanofi is evaluating SAR443820/DNL788 in a Phase 2 study in

participants with MS, which is fully enrolled.

BIIB122/DNL151: LRRK2 inhibitor in development

for the treatment of Parkinson’s disease (PD)

- Biogen is conducting the ongoing global Phase 2b LUMA study of

BIIB122 in participants with early-stage Parkinson’s disease.

- Denali plans to initiate a global Phase 2a study in 2024 to

evaluate safety and biomarkers associated with BIIB122 in

participants with Parkinson’s disease and confirmed pathogenic

variants of LRRK2. This study is being funded under the

Collaboration and Development Funding Agreement with a third

party.

Eclitasertib (SAR443122/DNL758): Peripheral

RIPK1 inhibitor in development for the treatment of ulcerative

colitis (UC)

- Sanofi is conducting the ongoing Phase 2 study of

SAR443122/DNL758 in participants with UC.

Early-stage clinical and preclinical

programs

DNL126: ETV-enabled N-sulfoglucosamine

sulfohydrolase (SGSH) replacement therapy in development for the

treatment of MPS IIIA (Sanfilippo syndrome Type A)

- In June, Denali announced that the CDER selected DNL126 for

participation in the FDA's Support for clinical Trials Advancing

Rare disease Therapeutics (START) Pilot Program to further

accelerate the development of novel drug and biological products

for rare diseases. Participation in START is expected to facilitate

and accelerate development of DNL126.

- Phase 1/2 biomarker and safety data are expected by the end of

2024.

TAK-594/DNL593: Protein Transport Vehicle

(PTV)-enabled progranulin (PGRN) replacement therapy in development

for the treatment of frontotemporal dementia-granulin (FTD-GRN)

- Denali has finalized the protocol amendment for the Phase 1/2

study and prescreening of participants for Cohort B2 is

ongoing.

Oligonucleotide Transport Vehicle (OTV)

platform

- Denali is advancing OTV:MAPT, targeting tau for Alzheimer’s

disease, and OTV:SNCA, targeting alpha-synuclein for Parkinson’s

disease, in the investigational new drug (IND)-enabling stage of

development.

Antibody Transport Vehicle Amyloid beta (ATV:Abeta)

program

- Today, Denali also announced that Biogen terminated its license

to the ATV:Abeta program enabled by Denali’s TfR-targeting

technology against amyloid beta for the potential treatment of

Alzheimer's disease and granted Denali rights to data generated

during the collaboration. As a result of the termination, all

rights to develop, manufacture, perform medical affairs activities,

and commercialize new TfR-targeting ATV:Abeta therapeutics reverted

to Denali. Biogen licensed Denali's TfR-targeting ATV:Abeta program

in April 2023 having exercised an option that was part of the 2020

collaboration agreement between the two companies. Biogen’s

decision was not related to any efficacy or safety concerns with

the Transport Vehicle platform.

- Denali is working to develop the next generation of

anti-amyloid beta therapeutics with ATV:Abeta, which is designed to

increase exposure of the therapeutic antibody and achieve broad

biodistribution in the brain with the potential for improved

efficacy and safety. Preclinical data demonstrated potential for a

wider therapeutic window compared to a standard antibody, with

superior plaque decoration and reduction and very low rates of

amyloid related imaging abnormalities (ARIA). These data are

included in a recent manuscript posted on bioRxiv.

- Denali plans to advance a TfR-targeting ATV:Abeta molecule as

well as a CD98hc-targeting ATV:Abeta molecule into development for

Alzheimer's disease.

Discovery programs

Denali applies its deep scientific expertise in

neurodegeneration biology and the BBB to discover and develop

medicines and platforms with the focus on programs enabled by the

TV technology and targeting neurodegenerative disease, including

Alzheimer’s and Parkinson’s, and lysosomal storage diseases.

- In July, Denali posted the manuscript

titled, "Fc-engineered large molecules targeting the blood-brain

barrier transferrin receptor and CD98hc have distinct central

nervous system and peripheral biodistribution compared to standard

antibodies" on bioRxiv. Using comprehensive and unbiased

approaches, Denali scientists reveal distinct biodistribution of

the TfR and CD98hc transport vehicle delivery platforms from the

brain single-cell level all the way to the whole body.

Participation in Upcoming Investor

Conferences

- BTIG Virtual Biotechnology Conference,

August 5-6

- 2024 Wedbush PacGrow Healthcare

Conference, August 13-14

- Morgan Stanley 22nd Annual Global

Healthcare Conference, September 4-6

- H.C. Wainwright 26th Annual Global

Investment Conference, September 9-11

- 2024 Cantor Global Healthcare

Conference, September 17-19

Second Quarter

2024 Financial Results

Net loss was $99.0 million for the quarter ended June 30, 2024,

compared to net income of $183.4 million for the quarter ended

June 30, 2023.

There was no collaboration revenue for the quarter ended June

30, 2024, compared to $294.1 million for the quarter ended

June 30, 2023. The decrease in collaboration revenue was primarily

due to $293.9 million of revenue recognized in the quarter

ended June 30, 2023 as a result of Biogen exercising their option

to license our ATV:Abeta program.

Total research and development expenses were $91.4 million for

the quarter ended June 30, 2024, compared to $97.5 million for

the quarter ended June 30, 2023. The decrease of approximately

$6.1 million for the quarter ended June 30, 2024 was primarily

attributable to a decrease in personnel and external expenses

associated with the divestiture of the Company's preclinical small

molecule programs. There were also decreases in external expenses

associated with the ATV:TREM2 and PTV:PGRN programs due to the

discontinuation of clinical development of TAK-920/DNL919

(ATV:TREM2) in Alzheimer’s disease and voluntary pause of Part B in

the TAK-594/DNL593 (PTV:PGRN) Phase 1/2 study, respectively.

Additionally, the Company commenced recognition of research funding

for the LRRK2 program from the Collaboration and Development

Funding Agreement executed in January 2024. These decreases were

partially offset by increases in costs in various clinical stage

programs, including eIF2B, ETV:SGSH and ETV:IDS reflecting the

continued progress of these programs in clinical trials.

General and administrative expenses were $25.2 million for the

quarter ended June 30, 2024, compared to $26.1 million for the

quarter ended June 30, 2023. The decrease of $0.9 million for the

quarter ended June 30, 2024 was primarily attributable to a

decrease in personnel-related expenses consisting of employee

compensation and stock-based compensation expense, partially offset

by combined increases of $0.2 million in professional

services, facilities and other corporate costs.

Cash, cash equivalents, and marketable securities were

approximately $1.35 billion as of June 30, 2024.

About Denali Therapeutics

Denali Therapeutics is a biopharmaceutical company developing a

broad portfolio of product candidates engineered to cross the

blood-brain barrier (BBB) for the treatment of neurodegenerative

diseases and lysosomal storage diseases. Denali pursues new

treatments by rigorously assessing genetically validated targets,

engineering delivery across the BBB, and guiding development

through biomarkers that demonstrate target and pathway engagement.

Denali is based in South San Francisco. For additional information,

please visit www.denalitherapeutics.com.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements expressed or implied in this press

release include, but are not limited to, statements regarding

expectations regarding Denali’s TV technology platform; statements

made by Denali’s Chief Executive Officer; plans, timelines, and

expectations regarding DNL310 and the ongoing Phase 2/3 COMPASS and

Phase 1/2 studies, the timing and likelihood of accelerated

approval, and the timing and availability of program updates; plans

and timelines regarding DNL343, including in Regimen G of the Phase

2/3 HEALEY ALS Platform Trial; plans, timelines, and expectations

of both Denali and Sanofi regarding DNL788, including the Phase 2

study in MS; plans, timelines, and expectations regarding DNL151,

including with respect to the ongoing LUMA study as well as

enrollment and timing of the proposed Phase 2a study in PD patients

with LRRK2 mutations; expectations regarding DNL758, including the

ongoing Phase 2 study in patients with UC; plans, timelines, and

expectations related to DNL126, including the timing and

availability of data in the ongoing Phase 1/2 study and the impact

on development of participation in START; plans, timelines, and

expectations of both Denali and Takeda regarding DNL593 and the

ongoing Phase 1/2 study; plans, timelines, and expectations

regarding the advancement of OTV:MAPT and OTV:SNCA towards clinical

development; plans, timelines, and expectations regarding the

ATV:Abeta program, including its therapeutic potential and the

clinical advancement of ATV:Abeta molecules; plans and expectations

for Denali's preclinical programs; Denali's future operating

expenses and anticipated cash runway; Denali's PIPE financing and

its anticipated proceeds; and Denali's participation in upcoming

investor conferences. Actual results are subject to risks and

uncertainties and may differ materially from those indicated by

these forward-looking statements as a result of these risks and

uncertainties, including but not limited to, risks related to: any

and all risks to Denali’s business and operations caused by adverse

economic conditions; risk of the occurrence of any event, change,

or other circumstance that could give rise to the termination of

Denali’s agreements with Sanofi, Takeda, or Biogen, or any of

Denali’s other collaboration agreements; Denali’s transition to a

late-stage clinical drug development company; Denali’s and its

collaborators’ ability to complete the development and, if

approved, commercialization of its product candidates; Denali’s and

its collaborators’ ability to enroll patients in its ongoing and

future clinical trials; Denali’s reliance on third parties for the

manufacture and supply of its product candidates for clinical

trials; Denali’s dependence on successful development of its

blood-brain barrier platform technology and its programs and

product candidates; Denali’s and its collaborators' ability to

conduct or complete clinical trials on expected timelines; the risk

that preclinical profiles of Denali’s product candidates may not

translate in clinical trials; the potential for clinical trials to

differ from preclinical, early clinical, preliminary or expected

results; the risk of significant adverse events, toxicities or

other undesirable side effects; the uncertainty that product

candidates will receive regulatory approval necessary to be

commercialized; Denali’s ability to continue to create a pipeline

of product candidates or develop commercially successful products;

developments relating to Denali's competitors and its industry,

including competing product candidates and therapies; Denali’s

ability to obtain, maintain, or protect intellectual property

rights related to its product candidates; implementation of

Denali’s strategic plans for its business, product candidates, and

blood-brain barrier platform technology; Denali's ability to obtain

additional capital to finance its operations, as needed; Denali's

ability to accurately forecast future financial results in the

current environment; and other risks and uncertainties, including

those described in Denali's most recent Annual and Quarterly

Reports on Forms 10-K and 10-Q filed with the Securities and

Exchange Commission (SEC) on February 28, 2024 and May 7, 2024,

respectively, and Denali’s future reports to be filed with the SEC.

Denali does not undertake any obligation to update or revise any

forward-looking statements, to conform these statements to actual

results, or to make changes in Denali’s expectations, except as

required by law.

Denali Therapeutics Inc.Condensed

Consolidated Statements of

Operations(Unaudited)(In thousands,

except share and per share amounts)

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Collaboration revenue: |

|

|

|

|

|

|

|

|

Collaboration revenue from customers(1) |

$ |

— |

|

|

$ |

294,123 |

|

|

$ |

— |

|

|

$ |

329,264 |

|

|

Total collaboration revenue |

|

— |

|

|

|

294,123 |

|

|

|

— |

|

|

|

329,264 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development(2) |

|

91,399 |

|

|

|

97,520 |

|

|

|

198,415 |

|

|

|

226,336 |

|

|

General and administrative |

|

25,194 |

|

|

|

26,120 |

|

|

|

50,430 |

|

|

|

53,260 |

|

|

Total operating expenses |

|

116,593 |

|

|

|

123,640 |

|

|

|

248,845 |

|

|

|

279,596 |

|

| Gain from divestiture of small

molecule programs |

|

— |

|

|

|

— |

|

|

|

14,537 |

|

|

|

— |

|

| Income (loss) from

operations |

|

(116,593 |

) |

|

|

170,483 |

|

|

|

(234,308 |

) |

|

|

49,668 |

|

| Interest and other income,

net |

|

17,567 |

|

|

|

12,900 |

|

|

|

33,480 |

|

|

|

23,934 |

|

| Net income (loss) |

$ |

(99,026 |

) |

|

$ |

183,383 |

|

|

$ |

(200,828 |

) |

|

$ |

73,602 |

|

| Net income (loss) per

share: |

|

|

|

|

|

|

|

| Net income (loss) per share,

basic |

$ |

(0.59 |

) |

|

$ |

1.34 |

|

|

$ |

(1.26 |

) |

|

$ |

0.54 |

|

| Net income (loss) per share,

diluted |

$ |

(0.59 |

) |

|

$ |

1.30 |

|

|

$ |

(1.26 |

) |

|

$ |

0.52 |

|

| Weighted-average shares used

in calculating: |

|

|

|

|

|

|

|

| Net income (loss) per share,

diluted |

|

168,831,329 |

|

|

|

137,047,227 |

|

|

|

159,117,759 |

|

|

|

136,787,321 |

|

| Weighted average number of

shares outstanding, basic and diluted |

|

168,831,329 |

|

|

|

140,930,625 |

|

|

|

159,117,759 |

|

|

|

140,550,226 |

|

|

__________________________________________________ |

| (1) |

|

Includes

related-party collaboration revenue from customers of

$294.1 million and $294.3 million for the three and six

months ended June 30, 2023, respectively. |

| (2) |

|

Includes expenses for cost sharing payments due to a related

party of $7.0 million and $11.1 million for the three and

six months ended June 30, 2023, respectively. |

| |

Denali Therapeutics Inc.Condensed

Consolidated Balance Sheets(Unaudited)(In

thousands)

| |

June 30, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

74,679 |

|

|

$ |

127,106 |

|

|

Short-term marketable securities |

|

821,365 |

|

|

|

907,405 |

|

|

Prepaid expenses and other current assets |

|

32,339 |

|

|

|

29,626 |

|

|

Total current assets |

|

928,383 |

|

|

|

1,064,137 |

|

| Long-term marketable

securities |

|

450,994 |

|

|

|

— |

|

| Property and equipment,

net |

|

48,077 |

|

|

|

45,589 |

|

| Operating lease right-of-use

asset |

|

24,533 |

|

|

|

26,048 |

|

| Other non-current assets |

|

50,578 |

|

|

|

18,143 |

|

| Total assets |

$ |

1,502,565 |

|

|

$ |

1,153,917 |

|

| Liabilities and

stockholders' equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

13,936 |

|

|

$ |

9,483 |

|

|

Accrued clinical and other research & development costs |

|

19,915 |

|

|

|

19,035 |

|

|

Accrued manufacturing costs |

|

7,111 |

|

|

|

15,462 |

|

|

Other accrued costs and current liabilities |

|

6,013 |

|

|

|

5,152 |

|

|

Accrued compensation |

|

9,555 |

|

|

|

21,590 |

|

|

Operating lease liability, current |

|

7,771 |

|

|

|

7,260 |

|

|

Deferred research funding liability |

|

10,232 |

|

|

|

— |

|

|

Total current liabilities |

|

74,533 |

|

|

|

77,982 |

|

| Operating lease liability,

less current portion |

|

40,981 |

|

|

|

44,981 |

|

| Total liabilities |

|

115,514 |

|

|

|

122,963 |

|

| Total stockholders'

equity |

|

1,387,051 |

|

|

|

1,030,954 |

|

| Total liabilities and

stockholders’ equity |

$ |

1,502,565 |

|

|

$ |

1,153,917 |

|

| |

Investor and Media Contact:

Laura Hansen, Ph.D.Vice President, Investor Relations(650)

452-2747hansen@dnli.com

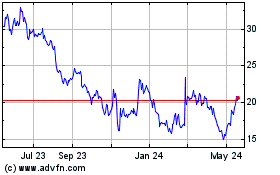

Denali Therapeutics (NASDAQ:DNLI)

Historical Stock Chart

From Oct 2024 to Nov 2024

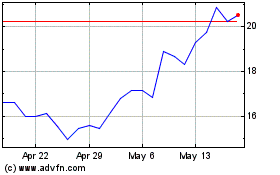

Denali Therapeutics (NASDAQ:DNLI)

Historical Stock Chart

From Nov 2023 to Nov 2024