- Received approval for first Clinical Trial

Application to advance PBGENE-HBV into first-in-human trials for

treatment of chronic hepatitis B; additional global regulatory

applications pending approval

- Opened PBGENE-HBV phase 1 clinical program in

Moldova; patient screening underway with clinical data expected in

2025

- Strengthened infectious disease capabilities

with key clinical talent added to senior leadership team

- Expected cash runway into the second half of

2026 with sufficient capital to phase 1 clinical data for multiple

in vivo gene editing programs

- Company to host virtual investor event

highlighting final PBGENE-HBV preclinical safety data and Phase 1

trial plans on November 15, 2024, at 7:00am PST / 10:00am EST

Precision BioSciences, Inc. (Nasdaq: DTIL), a clinical stage

gene editing company utilizing its novel proprietary ARCUS®

platform to develop in vivo gene editing therapies for

sophisticated gene edits, today announced financial results for the

third quarter ended September 30, 2024, and provided a business

update.

“With the clearance of our first clinical trial application

(CTA) for our lead program, PBGENE-HBV, we have arrived at the next

phase of Precision’s journey as a single platform, clinical stage

in vivo gene editing company. Our team is moving quickly to dose

patients and in parallel is leveraging our robust regulatory

package to seek additional regulatory application approvals

globally with the aim of rapidly accelerating enrollment in the

PBGENE-HBV phase 1 trial,” said Michael Amoroso, Chief Executive

Officer at Precision BioSciences. “PBGENE-HBV represents the very

first clinical stage gene editing program for chronic hepatitis B

utilizing a differentiated dual modality targeting the elimination

of cccDNA and inactivation of integrated HBV genomes - the root

cause of viral persistence in chronic hepatitis B. We look forward

to sharing detail on our clinical plans for PBGENE-HBV on November

15 prior to AASLD.”

“Looking ahead, we expect to report phase 1 PBGENE-HBV data

throughout 2025 while continuing to work in parallel to submit an

investigational new drug (IND) and/or CTA for our second wholly

owned in vivo gene editing program, PBGENE-3243 for the potential

treatment of m.3243-associated mitochondrial disease,” added Mr.

Amoroso.

Wholly Owned Portfolio

PBGENE-HBV (Viral Elimination Program): PBGENE-HBV is

Precision’s wholly owned in vivo gene editing program under

investigation in a global first-in-human clinical trial, which is

designed to potentially cure chronic hepatitis B. Currently, it is

estimated that approximately 300 million people worldwide are

afflicted with chronic hepatitis B. PBGENE-HBV is the first and

only potentially curative gene editing program to enter clinic that

is specifically designed to eliminate cccDNA and inactivate

integrated HBV DNA.

In October 2024, Precision received CTA approval for PBGENE-HBV

in Moldova and is working towards dosing patients. Investigators

and clinical sites in Moldova, the first country to approve a CTA

for PBGENE-HBV, have extensive experience executing and enrolling

patients in early- and mid-stage hepatitis B clinical trials.

Precision has submitted additional regulatory applications globally

which are pending approval. The Company’s robust preclinical safety

package supports the ability of PBGENE-HBV to specifically target

and eliminate hepatitis B cccDNA and inactivate integrated HBV DNA

without impacting any genes in the human genome, including no

editing-associated translocations in HBV-infected primary human

hepatocytes. In addition, non-human primate data showed that

PBGENE-HBV was well-tolerated across multiple dose

administrations.

PBGENE-3243 (Mutant Mitochondrial DNA Elimination Program

previously known as PBGENE-PMM): PBGENE-3243 is a

first-of-its-kind potential treatment for m.3243-associated

mitochondrial diseases that is designed to target mutant

mitochondrial DNA. Mitochondrial diseases are the most common

hereditary metabolic disorder in the world. Precision has updated

the program’s nomenclature to more accurately describe its intended

target patient population – those who have m.3243 mutation and

muscle-related symptoms. In particular, the m.3243-associated

mitochondrial disease that PBGENE-3243 intends to address, affects

approximately 20,000 people in the US alone. The high specificity

of ARCUS nucleases enables editing and elimination of mutant

mitochondrial DNA while allowing wild-type (normal) mitochondrial

DNA to repopulate in the mitochondria, thus improving cellular

function. Unlike CRISPR/Cas, base editors, and prime editors that

require a guide RNA, ARCUS single-component nucleases do not

require a nucleic acid for targeting and are able to penetrate the

mitochondrial membranes.

Earlier this year, Precision presented additional data from the

PBGENE-3243 program at the UMDF Conference. The presentation

highlighted the ability of PBGENE-3243 to localize exclusively to

mitochondria, avoiding any detectable off-target editing in the

nuclear genome, while generating substantial shifts in heteroplasmy

and improvements in mitochondrial function. The Company expects to

submit an IND and/or CTA for this program in 2025.

Wholly Owned Portfolio – Under Assessment

In April 2024, Precision exercised its option to regain rights

for the three programs developed under its collaboration with

Prevail Therapeutics Inc. The Company is finalizing its portfolio

assessment for these returned programs for internal development

and/or development through new partners and expects to provide an

update as decisions are final. These programs include:

- PBGENE-DMD – novel gene excision approach for treatment

of Duchenne Muscular Dystrophy utilizing a pair of ARCUS nucleases,

delivered by a single adeno-associated virus (AAV), that are

designed to excise an approximately 500,000 base pair mutation “hot

spot” region from the dystrophin gene to generate a functionally

competent variant of the dystrophin protein.

- PBGENE-LIVER – liver target for gene insertion with data

demonstrating that ARCUS is capable of 40% to 45% high efficiency

gene insertion at 1- and 3-months in nondividing cells, the most

challenging context for gene insertion, in adult nonhuman

primates.

- PBGENE-CNS – gene editing program targeting neurons to

address a disease of the central nervous system.

Partnered Programs

iECURE-OTC (Gene Insertion Program): Led by iECURE,

ECUR-506 is an ARCUS-mediated in vivo gene editing program

currently in a first-in-human phase 1/2 trial (OTC-HOPE) evaluating

ECUR-506 as a potential treatment for neonatal onset ornithine

transcarbamylase (OTC) deficiency. iECURE expects initial data from

this trial to be available in 2025.

PBGENE-NVS (Gene Insertion Program): Precision continues

to advance its gene editing program with Novartis to develop a

custom ARCUS nuclease for patients with hemoglobinopathies, such as

sickle cell disease and beta thalassemia. The collaborative intent

is to insert, in vivo, a therapeutic transgene as a potential

one-time transformative treatment administered directly to the

patient to overcome disparities in patient access to treatment with

other therapeutic technologies, including those that are targeting

an ex vivo gene editing approach.

Corporate Updates & Upcoming

Events

PBGENE-HBV Investor Event: Precision will host a virtual

investor event on November 15, 2024, at 7:00am PST (10:00am EST) in

San Diego highlighting the complete preclinical safety data and

additional details regarding the phase 1 trial for PBGENE-HBV. The

live webcast of the event will be available on the Events &

Presentations section of the Precision BioSciences investor

website.

ESGCT presentation: The company presented a poster at the

European Society of Gene & Cell Therapy (ESGCT) 31st Annual

Congress held on October 24, 2024, in Rome, Italy. The poster

highlighted preclinical data demonstrating the ability of ARCUS to

achieve high-efficiency gene insertion, gene replacement, and base

correction via homology-directed repair (HDR). In the preclinical

work presented, the company showed that targeted gene insertion can

be achieved using ARCUS in greater than 85% of T cells and 39% of

non-dividing primary human hepatocytes. These high rates of gene

insertion were accomplished primarily through HDR which the

research demonstrated was dependent on homology arms in the repair

template and on the unique characteristic ARCUS 3’ overhang cut in

the direction of DNA replication.

Strengthened Senior Leadership Team: In September 2024,

Precision announced the appointment of Dr. Murray Abramson, MD, MPH

as Senior Vice President, Head of Clinical Development, and John

Fry as Strategic Clinical Advisor, Hepatitis, significantly

strengthening the Company’s infectious disease and hepatitis

capabilities to support its transition into the clinic and execute

its Phase 1 PBGENE-HBV trial. Precision also announced the

retirement of Alan List, MD who has assumed a role on Precision’s

Scientific Advisory Board as a Clinical Consultant.

Amended Banc of California Loan and Security Agreement:

On July 31, 2024, the Company entered into an amended and restated

loan and security agreement (the 2024 Loan and Security Agreement)

with Banc of California (formerly known as Pacific Western Bank)

pursuant to which Banc of California provided the Company with a

term loan with a principal amount of $22.5 million secured by

restricted cash. The maturity date under the 2024 Loan and Security

Agreement is June 30, 2027.

Quarter Ended September 30, 2024

Financial Results:

Cash, Cash Equivalents, and Restricted Cash: As of

September 30, 2024, Precision had approximately $121.3 million in

cash, cash equivalents, and restricted cash. The Company expects

that existing cash and cash equivalents, upfront and potential

near-term cash from CAR T transactions, along with expected

operational receipts, continued fiscal and operating discipline,

and availability of Precision’s at-the-market (ATM) facility are

expected to extend Precision’s cash runway into the second half of

2026. Based on its expected cash runway, Precision believes it is

sufficiently capitalized to propel two wholly owned programs

through Phase 1 data readouts in 2025 and 2026.

Revenues: Total revenues for the quarter ended September

30, 2024, were $0.6 million, as compared to $13.1 million for the

same period in 2023. The decrease of $12.5 million in revenue

during the quarter ended September 30, 2024, was primarily the

result of a $7.0 million decrease in revenue recognized under the

Novartis Agreement as Precision nears completion of its

pre-clinical workplan compared to the three months ended September

30, 2023. In addition, there was a $5.5 million decrease in revenue

recognized under the Prevail Agreement during the three months

ended September 30, 2024, following conclusion of the collaboration

in April 2024.

Research and Development Expenses: Research and

development expenses were $13.1 million for the quarter ended

September 30, 2024, as compared to $15.9 million for the same

period in 2023. The decrease of $2.8 million was primarily due to a

$2.7 million decrease in PBGENE-HBV external development costs

primarily from nonclinical studies and a $2.0 million decrease in

outsourced R&D costs, lab supplies and services, and share

based compensation, offset by a $2.4 million increase in

PBGENE-3243 program external development costs as the program

continues to advance toward an IND and/or CTA in 2025.

General and Administrative Expenses: General and

administrative expenses were $8.8 million for the quarter ended

September 30, 2024, as compared to $9.6 million for the same period

in 2023. The decrease of $0.8 million was primarily due to a

decrease in consulting fees in addition to decreases in tax and

insurance expenses.

Net Loss from Continuing Operations: Net loss from

continuing operations was $16.4 million for the quarter ended

September 30, 2024, as compared to a net loss from continuing

operations of $12.1 million for the same period in 2023. The

increase in net loss was primarily related to decreases in revenue

under the Novartis and Prevail Agreements.

Net Loss: Net loss was $16.4 million, or $(2.25) per

share (basic and diluted), for the quarter ended September 30,

2024, as compared to a net loss of $8.1 million, or $(2.10) per

share (basic and diluted), for the same period in 2023.

Shares: Basic and diluted weighted-average common shares

outstanding for the third quarter of 2024 were 7,287,173 compared

to 3,838,900 for the same period in 2023. Precision BioSciences had

7,480,521 shares outstanding as of September 30, 2024.

About Precision BioSciences, Inc.

Precision BioSciences, Inc. is a clinical stage gene editing

company dedicated to improving life (DTIL) with its novel and

proprietary ARCUS® genome editing platform that differs from other

technologies in the way it cuts, its smaller size, and its simpler

structure. Key capabilities and differentiating characteristics may

enable ARCUS nucleases to drive more intended, defined therapeutic

outcomes. Using ARCUS, the Company’s pipeline is comprised of in

vivo gene editing candidates designed to deliver lasting cures for

the broadest range of genetic and infectious diseases where no

adequate treatments exist. For more information about Precision

BioSciences, please visit www.precisionbiosciences.com.

The ARCUS® platform is being used to develop in vivo gene

editing therapies for sophisticated gene edits, including gene

insertion (inserting DNA into gene to cause expression/add

function), elimination (removing a genome e.g. viral DNA or mutant

mitochondrial DNA), and excision (removing a large portion of a

defective gene by delivering two ARCUS nucleases in a single

AAV).

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including, without limitation,

statements regarding the clinical development and expected safety,

efficacy and benefit of our and our partners’ and licensees’

product candidates and gene editing approaches including editing

efficiency, and the suitability of ARCUS nucleases for gene

insertion, gene elimination and gene excision and differentiation

from other gene editing approaches; the expected timing of

regulatory processes and clinical operations (including filings,

studies, enrollment and clinical data for PBGENE-HBV, PBGENE-PMM

and iECURE OTC); the design of PBGENE-HBV to directly eliminate

cccDNA and inactivate integrated HBV DNA with high specificity,

potentially leading to functional cures; the ability of ARCUS

single-component nucleases to penetrate the mitochondrial

membranes; expectations about our and our partners’ operational

initiatives, strategies, and further development of our programs;

expectations and updates around our partnerships and collaborations

and our ability to enter into new collaborations, license

agreements or other arrangements; our expected cash runway and

available credit; the sufficiency of our cash runway extending into

the second half of 2026 and realizing Phase 1 clinical data for

multiple in vivo gene editing programs; expectations about

achievement of key milestones and receipt of any milestone,

royalty, or other payments; expectations regarding our liquidity

and capital resources; and anticipated timing of clinical data . In

some cases, you can identify forward-looking statements by terms

such as “aim,” “anticipate,” “approach,” “believe,” “contemplate,”

“could,” “designed,” “estimate,” “expect,” “goal,” “intend,”

“look,” “may,” “mission,” “plan,” “possible,” “potential,”

“predict,” “project,” “pursue,” “should,” “strive,” “target,”

“will,” “would,” or the negative thereof and similar words and

expressions.

Forward-looking statements are based on management’s current

expectations, beliefs and assumptions and on information currently

available to us. These statements are neither promises nor

guarantees, and involve a number of known and unknown risks,

uncertainties and assumptions, and actual results may differ

materially from those expressed or implied in the forward-looking

statements due to various important factors, including, but not

limited to, our ability to become profitable; our ability to

procure sufficient funding to advance our programs; risks

associated with our capital requirements, anticipated cash runway,

requirements under our current debt instruments and effects of

restrictions thereunder, including our ability to raise additional

capital due to market conditions and/or our market capitalization;

our operating expenses and our ability to predict what those

expenses will be; our limited operating history; the progression

and success of our programs and product candidates in which we

expend our resources; our limited ability or inability to assess

the safety and efficacy of our product candidates; the risk that

other genome-editing technologies may provide significant

advantages over our ARCUS technology; our dependence on our ARCUS

technology; the initiation, cost, timing, progress, achievement of

milestones and results of research and development activities and

preclinical and clinical studies, including clinical trial and

investigational new drug applications; public perception about

genome editing technology and its applications; competition in the

genome editing, biopharmaceutical, and biotechnology fields; our or

our collaborators’ or other licensees’ ability to identify, develop

and commercialize product candidates; pending and potential product

liability lawsuits and penalties against us or our collaborators or

other licensees related to our technology and our product

candidates; the U.S. and foreign regulatory landscape applicable to

our and our collaborators’ or other licensees’ development of

product candidates; our or our collaborators’ or other licensees’

ability to advance product candidates into, and successfully

design, implement and complete, clinical trials; potential

manufacturing problems associated with the development or

commercialization of any of our product candidates; delays or

difficulties in our and our collaborators’ and other licensees’

ability to enroll patients; changes in interim “top-line” and

initial data that we announce or publish; if our product candidates

do not work as intended or cause undesirable side effects; risks

associated with applicable healthcare, data protection, privacy and

security regulations and our compliance therewith; our or our

licensees’ ability to obtain orphan drug designation or fast track

designation for our product candidates or to realize the expected

benefits of these designations; our or our collaborators’ or other

licensees’ ability to obtain and maintain regulatory approval of

our product candidates, and any related restrictions, limitations

and/or warnings in the label of an approved product candidate; the

rate and degree of market acceptance of any of our product

candidates; our ability to effectively manage the growth of our

operations; our ability to attract, retain, and motivate executives

and personnel; effects of system failures and security breaches;

insurance expenses and exposure to uninsured liabilities; effects

of tax rules; effects of any pandemic, epidemic, or outbreak of an

infectious disease; the success of our existing collaboration and

other license agreements, and our ability to enter into new

collaboration arrangements; our current and future relationships

with and reliance on third parties including suppliers and

manufacturers; our ability to obtain and maintain intellectual

property protection for our technology and any of our product

candidates; potential litigation relating to infringement or

misappropriation of intellectual property rights; effects of

natural and manmade disasters, public health emergencies and other

natural catastrophic events; effects of sustained inflation, supply

chain disruptions and major central bank policy actions; market and

economic conditions; risks related to ownership of our common

stock, including fluctuations in our stock price; our ability to

meet the requirements of and maintain listing of our common stock

on Nasdaq or other public stock exchanges; and other important

factors discussed under the caption “Risk Factors” in our Quarterly

Report on Form 10-Q for the quarterly period ended September 30,

2024, as any such factors may be updated from time to time in our

other filings with the SEC, which are accessible on the SEC’s

website at www.sec.gov and the Investors page of our website under

SEC Filings at investor.precisionbiosciences.com.

All forward-looking statements speak only as of the date of this

press release and, except as required by applicable law, we have no

obligation to update or revise any forward-looking statements

contained herein, whether as a result of any new information,

future events, changed circumstances or otherwise.

Precision Biosciences, Inc. Condensed Statements

of Operations (In thousands, except share and per share

amounts) (Unaudited)

For the Three Months Ended September

30,

2024

2023

Revenue

$

576

$

13,120

Operating expenses Research and development

13,084

15,850

General and administrative

8,767

9,633

Total operating expenses

21,851

25,483

Operating loss

(21,275

)

(12,363

)

Other income (expense), net: Loss from equity method investment

(875

)

(1,350

)

Gain on change in fair value

571

311

Gain on change in fair value of warrant liability

3,647

—

Interest expense

(256

)

(576

)

Interest income

1,763

1,870

Loss on disposal of assets

—

(2

)

Total other income

4,850

253

Loss from continuing operations

$

(16,425

)

$

(12,110

)

Income from discontinued operations

—

$

4,031

Net loss

$

(16,425

)

$

(8,079

)

Net loss per share Basic

$

(2.25

)

$

(2.10

)

Diluted

$

(2.25

)

$

(2.10

)

Weighted-average shares of common stock outstanding Basic

7,287,173

3,838,900

Diluted

7,287,173

3,838,900

Precision Biosciences, Inc. Condensed Balance

Sheets Data (In thousands, except share amounts) (Unaudited)

September 30, 2024 December 31, 2023 Cash,

cash equivalents, restricted cash

$

121,328

$

116,678

Working capital

98,541

86,372

Total assets

153,258

159,781

Total liabilities

88,392

140,920

Total stockholders' equity

64,866

18,861

Common stock outstanding

7,480,521

4,164,038

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104349480/en/

Investor and Media Contact: Naresh Tanna Vice President,

Investor Relations Naresh.Tanna@precisionbiosciences.com

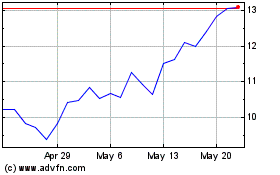

Precision BioSciences (NASDAQ:DTIL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Precision BioSciences (NASDAQ:DTIL)

Historical Stock Chart

From Nov 2023 to Nov 2024