false

0001360214

0001360214

2023-11-13

2023-11-13

0001360214

HROW:CommonStock0.001ParValuePerShareMember

2023-11-13

2023-11-13

0001360214

HROW:Sec8.625SeniorNotesDue2026Member

2023-11-13

2023-11-13

0001360214

HROW:Sec11.875SeniorNotesDue2027Member

2023-11-13

2023-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 13, 2023

HARROW,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35814 |

|

45-0567010 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 102

Woodmont Blvd., Suite 610 |

|

|

| Nashville,

Tennessee |

|

37205 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (615) 733-4730

| Not

Applicable |

| (Former

Name or Former Address, if Changed Since Last Report) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

on exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

HROW |

|

The

Nasdaq Stock Market LLC |

| 8.625%

Senior Notes due 2026 |

|

HROWL |

|

The

Nasdaq Stock Market LLC |

| 11.875%

Senior Notes due 2027 |

|

HROWM |

|

The

Nasdaq Stock Market LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Act of 1934: Emerging growth company ☐

If

any emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

November 13, 2023, Harrow, Inc. (the “Company”) issued a press release and a letter to stockholders announcing its financial

results for the period ended September 30, 2023 and an update on recent corporate events. The press release and letter to stockholders

are being furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K.

The

information furnished under this Item 2.02 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed

to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that Section. The information in this Item 2.02, including Exhibits 99.1 and 99.2, shall not

be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the

extent it is specifically incorporated by reference but regardless of any general incorporation language in such filing.

The

information furnished under this Item 2.02 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed

to constitute an admission that such information or exhibit is required to be furnished pursuant to Regulation FD or that such information

or exhibit contains material information that is not otherwise publicly available. In addition, the Company does not assume any obligation

to update such information or exhibit in the future.

Item

9.01. Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

HARROW,

INC. |

| |

|

|

| Dated:

November 13, 2023 |

By: |

/s/

Andrew R. Boll |

| |

Name: |

Andrew

R. Boll |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

Harrow

Announces Third Quarter 2023 Financial Results

Third

Quarter 2023 and Recent Selected Highlights:

| |

● |

Record

revenues of $34.3 million, an increase of 50% over $22.8 million in the prior-year quarter and an increase of 2% over $33.5 million

in the sequential quarter. |

| |

● |

GAAP

net loss of $(4.4 million). |

| |

● |

Adjusted

EBITDA of $9.2 million, an increase of 270% over $2.5 million in the prior-year quarter. |

| |

● |

GAAP gross margin was flat at 71%, year-over-year. |

| |

● |

Core gross margin improved to 78% over the prior year’s

72%. |

| |

● |

Cash

and cash equivalents of $65.6 million as of September 30, 2023. |

| |

● |

Harrow Completes Transfer of NDAs and Launches FLAREX®,

NATACYN®, TOBRADEX® ST, VERKAZIA®, and ZERVIATE® in the U.S. |

NASHVILLE,

Tenn., November 13, 2023 – Harrow (Nasdaq: HROW), a leading U.S. eyecare pharmaceutical company, announced results for the third

quarter and nine months ended September 30, 2023. The Company also posted its third quarter Letter to Stockholders and corporate

presentation to the “Investors” section of its website, harrow.com. The Company encourages all Harrow stockholders

to review these documents, which provide additional details concerning the historical quarterly period as well as the future expectations

for the business.

Commenting

on Harrow’s third quarter results, Mark L. Baum, CEO of Harrow, said, “During the third quarter, we produced record revenues,

a 50% increase over prior-year revenues. However, operationally, the third quarter was a mixed bag, with some areas performing exceptionally

well, like our launch of IHEEZO, and some areas underperforming, such as our Fab Five products and our compounding business.

“The

50% year-over-year increase in revenues was primarily a result of increases in branded pharmaceutical products (BPPS), buoyed by performance

from IHEEZO® that exceeded our internal expectations. Strategic amendments to the IHEEZO launch led to a substantial ramp in unit

demand in September, a trend that continued into the fourth quarter. We are hearing from eyecare professionals that they are very happy

with IHEEZO’s clinical benefits, and we are seeing sizable orders and re-orders from high-volume users as well as many new accounts.

While it’s still early in the launch and we have a lot of additional work to do, we are bullish about what we see for IHEEZO in

2024 and beyond.

“During

the third quarter, we strategically focused our commercial team’s efforts on IHEEZO, delaying implementation of marketing and sales

detailing efforts for four of the “Fab Five” products we had acquired earlier in the year and for which the New Drug Applications

(NDAs) had recently transferred. We have now implemented those strategies and initial prescription data is encouraging. We estimate that

we are approximately three months behind our revenue forecasts for these products.

“Our

compounding business underperformed during the period as we made investments in compliance and operations. We are confident that the

solutions already implemented or planned for our

compounding business will prove effective and restore the business to its historical growth trajectory during the first quarter of 2024.

“Because

we are a few months behind our internal targets – for the aggregate business – we are adjusting our previously issued

2023 financial guidance to revenues of $129 million to $136 million and Adjusted EBITDA of $36 million to $41 million. In addition,

we are outlining our expectations for 2024, which include revenues of more than $180 million, excluding contributions from TRIESENCE. In summary, 2023, to date, has been a transformational year – and we believe that, because of the strategic actions

that we have taken in 2023, we are positioned well for another record-breaking year in 2024.”

-MORE-

Harrow Announces Third Quarter 2023 Financial Results Page 2 November 13, 2023 |

Third

quarter 2023 figures of merit:

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net revenues | |

$ | 34,265,000 | | |

$ | 22,823,000 | | |

$ | 93,838,000 | | |

$ | 68,266,000 | |

| Gross margin | |

| 71 | % | |

| 71 | % | |

| 70 | % | |

| 72 | % |

| Core gross margin(1) | |

| 78 | % | |

| 72 | % | |

| 77 | % | |

| 73 | % |

| Net loss | |

| (4,391,000 | ) | |

| (6,464,000 | ) | |

| (15,263,000 | ) | |

| (15,141,000 | ) |

| Core net loss(1) | |

| (2,960,000 | ) | |

| (1,531,000 | ) | |

| (4,519,000 | ) | |

| (564,000 | ) |

| Adjusted EBITDA(1) | |

| 9,209,000 | | |

| 2,483,000 | | |

| 25,556,000 | | |

| 11,928,000 | |

| Basic and diluted net loss per share | |

| (0.13 | ) | |

| (0.24 | ) | |

| (0.48 | ) | |

| (0.55 | ) |

| Core diluted net loss per share(1) | |

| (0.09 | ) | |

| (0.06 | ) | |

| (0.14 | ) | |

| (0.02 | ) |

| (1) |

Core gross

margin, core net loss, core diluted net loss per share (collectively, “Core Results”), and Adjusted EBITDA are non-GAAP

measures. For additional information, including a reconciliation of such Core Results and Adjusted EBITDA to the most directly comparable

measures presented in accordance with GAAP, see the explanation of non-GAAP measures and reconciliation tables in the financial tables

section. |

Conference

Call and Webcast

The

Company’s management team will host a conference call and live webcast today at 4:45 p.m. Eastern Time to discuss the third quarter

2023 results and provide a business update. To participate in the call, see details below:

| Conference

Call Details: |

|

| Date: |

Monday,

November 13, 2023 |

| Time: |

4:45

p.m. Eastern time |

| Participant

Dial-in: |

1-833-953-2434

(U.S.)

1-412-317-5763

(International) |

Replay

Dial-in (Passcode 7225453):

(telephonic

replay through November 20, 2023) |

1-877-344-7529

(U.S.)

1-412-317-0088

(International) |

| Webcast:

(online replay through November 13, 2024) |

harrow.com |

About

Harrow

Harrow,

Inc. (Nasdaq: HROW) is a leading eyecare pharmaceutical company engaged in the discovery, development, and commercialization of innovative

ophthalmic pharmaceutical products for the U.S. market. Harrow helps U.S. eyecare professionals preserve the gift of sight by making

its comprehensive portfolio of prescription and non-prescription pharmaceutical products accessible and affordable to millions of Americans

each year. For more information about Harrow, please visit harrow.com.

-MORE-

Harrow Announces Third Quarter 2023 Financial Results Page 3 November 13, 2023 |

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act

of 1995. Any statements in this release that are not historical facts may be considered such “forward-looking statements.”

Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties which may

cause results to differ materially and adversely from the statements contained herein. Some of the potential risks and uncertainties

that could cause actual results to differ from those predicted include, among others, risks related to: liquidity or results of operations;

our ability to successfully implement our business plan, develop and commercialize our products, product candidates and proprietary formulations

in a timely manner or at all, identify and acquire additional products, manage our pharmacy operations, service our debt, obtain financing

necessary to operate our business, recruit and retain qualified personnel, manage any growth we may experience and successfully realize

the benefits of our previous acquisitions and any other acquisitions and collaborative arrangements we may pursue; competition from pharmaceutical

companies, outsourcing facilities and pharmacies; general economic and business conditions, including inflation and supply chain challenges;

regulatory and legal risks and uncertainties related to our pharmacy operations and the pharmacy and pharmaceutical business in general;

physician interest in and market acceptance of our current and any future formulations and compounding pharmacies generally. These and

additional risks and uncertainties are more fully described in Harrow’s filings with the Securities and Exchange Commission, including

its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Such documents may be read free of charge on the SEC’s web

site at sec.gov. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made.

Except as required by law, Harrow undertakes no obligation to update any forward-looking statements to reflect new information, events,

or circumstances after the date they are made, or to reflect the occurrence of unanticipated events.

Contact:

Jamie

Webb, Director of Communications and Investor Relations

jwebb@harrowinc.com

615-733-4737

-MORE-

Harrow Announces Third Quarter 2023 Financial Results Page 4 November 13, 2023 |

HARROW, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | |

| |

| Cash and cash equivalents | |

$ | 65,610,000 | | |

$ | 96,270,000 | |

| All other current assets | |

| 44,668,000 | | |

| 21,990,000 | |

| Total current assets | |

| 110,278,000 | | |

| 118,260,000 | |

| All other assets | |

| 175,787,000 | | |

| 39,118,000 | |

| TOTAL ASSETS | |

$ | 286,065,000 | | |

$ | 157,378,000 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

$ | 19,029,000 | | |

$ | 18,632,000 | |

| Loans payable, net of unamortized debt discount | |

| 182,186,000 | | |

| 104,174,000 | |

| All other liabilities | |

| 9,448,000 | | |

| 7,332,000 | |

| TOTAL LIABILITIES | |

| 210,663,000 | | |

| 130,138,000 | |

| TOTAL STOCKHOLDERS’ EQUITY | |

| 75,402,000 | | |

| 27,240,000 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 286,065,000 | | |

$ | 157,378,000 | |

HARROW, INC.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net revenues | |

$ | 34,265,000 | | |

$ | 22,823,000 | | |

$ | 93,838,000 | | |

$ | 68,266,000 | |

| Cost of sales | |

| 10,067,000 | | |

| 6,721,000 | | |

| 28,338,000 | | |

| 19,218,000 | |

| Gross profit | |

| 24,198,000 | | |

| 16,102,000 | | |

| 65,500,000 | | |

| 49,048,000 | |

| Selling, general and administrative | |

| 21,033,000 | | |

| 15,421,000 | | |

| 56,878,000 | | |

| 43,004,000 | |

| Research and development | |

| 1,421,000 | | |

| 775,000 | | |

| 3,316,000 | | |

| 2,347,000 | |

| Total operating expenses | |

| 22,454,000 | | |

| 16,196,000 | | |

| 60,194,000 | | |

| 45,351,000 | |

| Income (loss) from operations | |

| 1,744,000 | | |

| (94,000 | ) | |

| 5,306,000 | | |

| 3,697,000 | |

| Total other expense, net | |

| 4,596,000 | | |

| 6,335,000 | | |

| 19,333,000 | | |

| 18,763,000 | |

| Income tax expense | |

| 1,539,000 | | |

| 35,000 | | |

| 1,236,000 | | |

| 75,000 | |

| Net loss attributable to Harrow, Inc. | |

$ | (4,391,000 | ) | |

$ | (6,464,000 | ) | |

$ | (15,263,000 | ) | |

$ | (15,141,000 | ) |

| Net loss per share of common stock, basic and diluted | |

$ | (0.13 | ) | |

$ | (0.24 | ) | |

$ | (0.48 | ) | |

$ | (0.55 | ) |

HARROW, INC.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | |

For the Nine Months Ended | |

| | |

September 30, | |

| | |

2023 | | |

2022 | |

| Net cash (used in) provided by: | |

| | | |

| | |

| Operating activities | |

$ | (4,856,000 | ) | |

$ | 5,417,000 | |

| Investing activities | |

| (152,350,000 | ) | |

| (1,738,000 | ) |

| Financing activities | |

| 126,546,000 | | |

| (887,000 | ) |

| Net change in cash and cash equivalents | |

| (30,660,000 | ) | |

| 2,792,000 | |

| Cash and cash equivalents at beginning of the period | |

| 96,270,000 | | |

| 42,167,000 | |

| Cash and cash equivalents at end of the period | |

$ | 65,610,000 | | |

$ | 44,959,000 | |

-MORE-

Harrow Announces Third Quarter 2023 Financial Results Page 5 November 13, 2023 |

Non-GAAP

Financial Measures

In

addition to the Company’s results of operations determined in accordance with U.S. generally accepted accounting principles (GAAP),

which are presented and discussed above, management also utilizes Adjusted EBITDA and Core Results, unaudited financial measures that

are not calculated in accordance with GAAP, to evaluate the Company’s financial results and performance and to plan and forecast

future periods. Adjusted EBITDA and Core Results are considered “non-GAAP” financial measures within the meaning of Regulation

G promulgated by the SEC. Management believes that these non-GAAP financial measures reflect an additional way of viewing aspects of

the Company’s operations that, when viewed with GAAP results, provide a more complete understanding of the Company’s results

of operations and the factors and trends affecting its business. Management believes Adjusted EBITDA and Core Results provide meaningful

supplemental information regarding the Company’s performance because (i) they allow for greater transparency with respect to key

metrics used by management in its financial and operational decision-making; (ii) they exclude the impact of non-cash or, when specified,

non-recurring items that are not directly attributable to the Company’s core operating performance and that may obscure trends

in the Company’s core operating performance; and (iii) they are used by institutional investors and the analyst community to help

analyze the Company’s results. However, Adjusted EBITDA, Core Results, and any other non-GAAP financial measures should be considered

as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. Further,

non-GAAP financial measures used by the Company and the way they are calculated may differ from the non-GAAP financial measures or the

calculations of the same non-GAAP financial measures used by other companies, including the Company’s competitors.

Adjusted

EBITDA

The

Company defines Adjusted EBITDA as net loss, excluding the effects of stock-based compensation and expenses, interest, taxes, depreciation,

amortization, investment (income) loss, net, and, if any and when specified, other non-recurring income or expense items. Management

believes that the most directly comparable GAAP financial measure to Adjusted EBITDA is net loss. Adjusted EBITDA has limitations and

should not be considered as an alternative to gross profit or net loss as a measure of operating performance or to net cash provided

by (used in) operating, investing, or financing activities as a measure of ability to meet cash needs.

The

following is a reconciliation of Adjusted EBITDA, a non-GAAP measure, to the most comparable GAAP measure, net loss, for the three and

nine months ended September 30, 2023, and for the same periods in 2022:

HARROW, INC.

RECONCILIATION

OF NET LOSS TO ADJUSTED EBITDA

| |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP net loss | |

$ | (4,391,000 | ) | |

$ | (6,464,000 | ) | |

$ | (15,263,000 | ) | |

$ | (15,141,000 | ) |

| Stock-based compensation and expenses | |

| 4,476,000 | | |

| 1,932,000 | | |

| 11,521,000 | | |

| 5,941,000 | |

| Interest expense, net | |

| 5,749,000 | | |

| 1,800,000 | | |

| 16,200,000 | | |

| 5,386,000 | |

| Income tax expense | |

| 1,539,000 | | |

| 35,000 | | |

| 1,236,000 | | |

| 75,000 | |

| Depreciation | |

| 405,000 | | |

| 247,000 | | |

| 1,095,000 | | |

| 1,090,000 | |

| Amortization of intangible assets | |

| 2,584,000 | | |

| 398,000 | | |

| 7,634,000 | | |

| 1,200,000 | |

| Investment (income) loss, net | |

| (1,348,000 | ) | |

| 4,535,000 | | |

| (2,676,000 | ) | |

| 13,377,000 | |

| Other expense, net | |

| 195,000 | | |

| - | | |

| 5,809,000 (1) | | |

| - | |

| Adjusted EBITDA | |

$ | 9,209,000 | | |

$ | 2,483,000 | | |

$ | 25,556,000 | | |

$ | 11,928,000 | |

| (1) |

Includes $5,465,000 for the loss on extinguishment of debt. |

-MORE-

Harrow Announces Third Quarter 2023 Financial Results Page 6 November 13, 2023 |

Core

Results

Harrow

Core Results, including core gross margin, core net (loss) income, core operating income, core basic and diluted loss per share, and

core operating margin, exclude (1) all amortization and impairment charges of intangible assets, excluding software development costs,

(2) net gains and losses on investments and equity securities, including equity method gains and losses and equity valued at fair value

through profit and loss (“FVPL”), and preferred stock dividends, and (3) gains/losses on forgiveness of debt. In other periods,

Core Results may also exclude fair value adjustments of financial assets in the form of options to acquire a company carried at FVPL,

obligations related to product recalls, certain acquisition-related items, restructuring charges/releases and associated items, related

legal items, gains/losses on early extinguishment of debt or debt modifications, impairments of property, plant and equipment and software,

as well as income and expense items that management deems exceptional and that are or are expected to accumulate within the year to be

over a $100,000 threshold.

The

following is a reconciliation of Core Results, non-GAAP measures, to the most comparable GAAP measures for the three and nine months

ended September 30, 2023, and for the same periods in 2022:

| For the Three Months Ended September 30, 2023 |

| | |

| | |

Amortization | | |

| | |

| | |

| |

| | |

| | |

of Certain | | |

| | |

| | |

| |

| | |

GAAP | | |

Intangible | | |

Investment | | |

Other | | |

Results | |

| | |

Results | | |

Assets | | |

Gains | | |

Items | | |

Core | |

| Gross profit | |

$ | 24,198,000 | | |

$ | 2,480,000 | | |

$ | - | | |

$ | - | | |

$ | 26,678,000 | |

| Gross margin | |

| 71 | % | |

| | | |

| | | |

| | | |

| 78 | % |

| Operating income | |

| 1,744,000 | | |

| 2,584,000 | | |

| - | | |

| - | | |

| 4,328,000 | |

| (Loss) income before taxes | |

| (2,852,000 | ) | |

| 2,584,000 | | |

| (1,348,000 | ) | |

| 195,000 | | |

| (1,421,000 | ) |

| Tax expense | |

| (1,539,000 | ) | |

| - | | |

| - | | |

| - | | |

| (1,539,000 | ) |

| Net (loss) income | |

| (4,391,000 | ) | |

| 2,584,000 | | |

| (1,348,000 | ) | |

| 195,000 | | |

| (2,960,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.13 | ) | |

| | | |

| | | |

| | | |

| (0.09 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 34,255,197 | | |

| | | |

| | | |

| | | |

| 34,255,197 | |

| For the Nine Months Ended September 30, 2023 |

| | |

| | |

Amortization | | |

| | |

| | |

| |

| | |

| | |

of Certain | | |

| | |

| | |

| |

| | |

GAAP | | |

Intangible | | |

Investment | | |

Other | | |

Core | |

| | |

Results | | |

Assets | | |

Gains | | |

Items | | |

Results | |

| Gross profit | |

$ | 65,500,000 | | |

$ | 7,174,000 | | |

$ | - | | |

$ | - | | |

$ | 72,674,000 | |

| Gross margin | |

| 70 | % | |

| | | |

| | | |

| | | |

| 77 | % |

| Operating income | |

| 5,306,000 | | |

| 7,634,000 | | |

| - | | |

| - | | |

| 12,940,000 | |

| (Loss) income before taxes | |

| (14,027,000 | ) | |

| 7,634,000 | | |

| (2,676,000 | ) | |

| 5,786,000 | | |

| (3,283,000 | ) |

| Tax expense | |

| (1,236,000 | ) | |

| - | | |

| - | | |

| - | | |

| (1,236,000 | ) |

| Net (loss) income | |

| (15,263,000 | ) | |

| 7,634,000 | | |

| (2,676,000 | ) | |

| 5,786,000 | | |

| (4,519,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.48 | ) | |

| | | |

| | | |

| | | |

| (0.14 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 31,689,947 | | |

| | | |

| | | |

| | | |

| 31,689,947 | |

-MORE-

Harrow Announces Third Quarter 2023 Financial Results Page 7 November 13, 2023 |

| For the Three Months Ended September 30, 2022 |

| | |

| | |

Amortization | | |

| | |

| |

| | |

| | |

of Certain | | |

| | |

| |

| | |

GAAP | | |

Intangible | | |

Investment | | |

Core | |

| | |

Results | | |

Assets | | |

Losses | | |

Results | |

| Gross profit | |

$ | 16,102,000 | | |

$ | 341,000 | | |

$ | - | | |

$ | 16,443,000 | |

| Gross margin | |

| 71 | % | |

| | | |

| | | |

| 72 | % |

| Operating (loss) income | |

| (94,000 | ) | |

| 398,000 | | |

| - | | |

| 304,000 | |

| (Loss) income before taxes | |

| (6,429,000 | ) | |

| 398,000 | | |

| 4,535,000 | | |

| (1,496,000 | ) |

| Tax expense | |

| (35,000 | ) | |

| - | | |

| - | | |

| (35,000 | ) |

| Net (loss) income | |

| (6,464,000 | ) | |

| 398,000 | | |

| 4,535,000 | | |

| (1,531,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.24 | ) | |

| | | |

| | | |

| (0.06 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 27,349,642 | | |

| | | |

| | | |

| 27,349,642 | |

| For the Nine Months Ended September 30, 2022 |

| | |

| | |

Amortization | | |

| | |

| |

| | |

| | |

of Certain | | |

| | |

| |

| | |

GAAP | | |

Intangible | | |

Investment | | |

Core | |

| | |

Results | | |

Assets | | |

Losses | | |

Results | |

| Gross profit | |

$ | 49,048,000 | | |

$ | 1,023,000 | | |

$ | - | | |

$ | 50,071,000 | |

| Gross margin | |

| 72 | % | |

| | | |

| | | |

| 73 | % |

| Operating income | |

| 3,697,000 | | |

| 1,200,000 | | |

| - | | |

| 4,897,000 | |

| (Loss) Income before taxes | |

| (15,066,000 | ) | |

| 1,200,000 | | |

| 13,377,000 | | |

| (489,000 | ) |

| Tax expense | |

| (75,000 | ) | |

| - | | |

| - | | |

| (75,000 | ) |

| Net (loss) income | |

| (15,141,000 | ) | |

| 1,200,000 | | |

| 13,377,000 | | |

| (564,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.55 | ) | |

| | | |

| | | |

| (0.02 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 27,293,756 | | |

| | | |

| | | |

| 27,293,756 | |

| (1) |

Core basic and diluted loss per share is calculated using the

weighted-average number of shares of common stock outstanding during the period. Core basic and diluted loss per share also contemplates

dilutive shares associated with equity-based awards as described in Note 2 and elsewhere in the Condensed Consolidated Financial Statements

included in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. |

-END-

Exhibit

99.2

Letter

to Stockholders

November

13, 2023

Dear

Harrow Stockholders:

I

am pleased to report that Harrow produced record revenues during the third quarter of 2023 of $34.3 million, a 50% increase over quarterly

revenues for the prior-year period.

Buoyed

by demand for IHEEZO®, which is tracking ahead of internal forecasts since its May launch, revenues from Harrow’s branded products

were $14.5 million during the third quarter and $33.9 million for the nine months ended September 30, 2023. Revenues from the “Fab

Five” products we acquired earlier this year and our compounded products were lower than expected. I will discuss these subjects

and others in greater detail in this Letter to Stockholders.

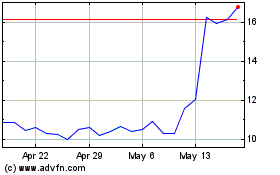

During

the third quarter, unit demand for IHEEZO began to increase markedly, a result of several successful launch strategy amendments since

its launch. Specifically, IHEEZO unit volumes and revenues ramped significantly during September (see graph below), and encouragingly,

IHEEZO’s commercial momentum has continued in the fourth quarter.

| * | Customer

Unit Demand reflects the number of units purchased by surgery centers, clinic/group practices,

and physicians from Harrow’s distributors. It is not representative of net sales or

revenues on a GAAP basis. |

Third

Quarter 2023 Financial Overview

See

Link to Selected GAAP Operating Results before reviewing non-GAAP results.

See

Link to Selected Core Results (non-GAAP measures).

Record

revenues of $34.3 million for the third quarter of 2023 represent a 50% increase over the prior-year's third-quarter revenues of $22.8

million and a 2% increase over the sequential second quarter of 2023.

Adjusted

EBITDA increased to $9.2 million for the third quarter of 2023 compared with Adjusted EBITDA of $2.5 million during the same period last

year, primarily due to increased revenues of our branded products, especially IHEEZO. Core net loss was $(3.0 million) for the third

quarter of 2023 compared with core net loss of $(1.5 million) for the third quarter of 2022.

We

had $65.6 million in cash and cash equivalents at the end of the third quarter.

Shortly

after the close of the third quarter, Harrow completed the transfer of new drug applications (NDAs) for FLAREX®, NATACYN®,

TOBRADEX® ST, VERKAZIA®, and ZERVIATE®, products that we purchased in July of 2023. Before the transfer of these NDAs,

Harrow had been receiving profit transfers on these products; however, as each of these NDAs was transferred and launched under the Harrow

name, we began implementing commercial strategies to increase brand awareness and sales for these products.

Core

gross margin improved 600 basis points to 78% in the third quarter of 2023 compared with core gross margin of 72% in the third quarter

of 2022.

Selling,

general, and administrative (SG&A) expenses for the third quarter of 2023 increased to $21.0 million compared with $15.4 million

during the same period last year. The year-over-year increase is due in large part to an increase in stock-based compensation along with

transition costs from the Santen and VEVYE product acquisitions and further expansion of our general operating and sales infrastructure

to support our branded product acquisitions and launches in 2023 and beyond. We are adding new sales and commercial positions to support

our sales growth and expect that trend to continue in 2024.

Research

and development (R&D) costs were $1.4 million in the third quarter of 2023, compared with $775,000 during the same period last year.

Throughout the remainder of 2023 and next year, R&D costs should continue to increase as we further build out our medical and clinical

affairs teams and finalize tech transfer manufacturing processes for our recent product acquisitions.

GAAP

operating income was $1.7 million for the third quarter of 2023, compared with a GAAP operating loss of $(94,000) during the same period

last year.

Core

diluted net loss per share for the third quarter of 2023 was $(0.09) compared with $(0.06) during the same period last year.

A

reconciliation of all non-GAAP financial measures in this letter begins on page 9.

GAAP

Operating Results

Selected

financial highlights regarding GAAP operating results for the three and nine months ended September 30, 2023, and for the same periods

in 2022 are as follows:

| | |

For the Three Months Ended September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net revenues | |

$ | 34,265,000 | | |

$ | 22,823,000 | | |

$ | 93,838,000 | | |

$ | 68,266,000 | |

| Cost of sales | |

| 10,067,000 | | |

| 6,721,000 | | |

| 28,338,000 | | |

| 19,218,000 | |

| Gross profit | |

| 24,198,000 | | |

| 16,102,000 | | |

| 65,500,000 | | |

| 49,048,000 | |

| Selling, general and administrative | |

| 21,033,000 | | |

| 15,421,000 | | |

| 56,878,000 | | |

| 43,004,000 | |

| Research and development | |

| 1,421,000 | | |

| 775,000 | | |

| 3,316,000 | | |

| 2,347,000 | |

| Total operating expenses | |

| 22,454,000 | | |

| 16,196,000 | | |

| 60,194,000 | | |

| 45,351,000 | |

| Income (loss) from operations | |

| 1,744,000 | | |

| (94,000 | ) | |

| 5,306,000 | | |

| 3,697,000 | |

| Total other expense, net | |

| 4,596,000 | | |

| 6,335,000 | | |

| 19,333,000 | | |

| 18,763,000 | |

| Income tax expense | |

| (1,539,000 | ) | |

| (35,000 | ) | |

| (1,236,000 | ) | |

| (75,000 | ) |

| Net loss attributable to Harrow, Inc. | |

$ | (4,391,000 | ) | |

$ | (6,464,000 | ) | |

$ | (15,263,000 | ) | |

$ | (15,141,000 | ) |

| Net loss per share of common stock, basic and diluted | |

$ | (0.13 | ) | |

$ | (0.24 | ) | |

$ | (0.48 | ) | |

$ | (0.55 | ) |

Core

Results (Non-GAAP Measures)

Core

Results (non-GAAP measures), which we define as the after-tax earnings and other operational and financial metrics generated from our

principal business, for the three and nine months ended September 30, 2023, and for the same periods in 2022 are as follows:

| | |

For the Three Months Ended September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net revenues | |

$ | 34,265,000 | | |

$ | 22,823,000 | | |

$ | 93,838,000 | | |

$ | 68,266,000 | |

| Gross margin | |

| 71 | % | |

| 71 | % | |

| 70 | % | |

| 72 | % |

| Core gross margin(1) | |

| 78 | % | |

| 72 | % | |

| 77 | % | |

| 73 | % |

| Net loss | |

| (4,391,000 | ) | |

| (6,464,000 | ) | |

| (15,263,000 | ) | |

| (15,141,000 | ) |

| Core net loss(1) | |

| (2,960,000 | ) | |

| (1,531,000 | ) | |

| (4,519,000 | ) | |

| (564,000 | ) |

| Adjusted EBITDA(1) | |

| 9,209,000 | | |

| 2,483,000 | | |

| 25,556,000 | | |

| 11,928,000 | |

| Basic and diluted net loss per share | |

| (0.13 | ) | |

| (0.24 | ) | |

| (0.48 | ) | |

| (0.55 | ) |

| Core diluted net loss per share(1) | |

| (0.09 | ) | |

| (0.06 | ) | |

| (0.14 | ) | |

| (0.02 | ) |

| (1) | Core

gross margin, core net loss, core diluted net loss per share (collectively, “Core Results”),

and Adjusted EBITDA are non-GAAP measures. For additional information, including a reconciliation

of such Core Results and Adjusted EBITDA to the most directly comparable measures presented

in accordance with GAAP, see the explanation of non-GAAP measures and reconciliation tables

at the end of this Letter to Stockholders |

IHEEZO

Commentary

We

have continued to execute our launch plan for IHEEZO since its debut in May 2023. We focused on raising IHEEZO awareness among our targeted

audience (i.e., long-standing Harrow customers), collecting and incorporating user feedback, optimizing our market access strategies,

pursuing high-revenue potential IHEEZO prescribers, and capitalizing on the success indicators we observed in the first stages of the

launch, including those related to reimbursement.

Our

nimble commercial approach enabled us to amend our plans, making strategic tweaks in the middle of the quarter that yielded immediate

positive results and contributed to a notable increase in IHEEZO unit demand and revenues for September – surpassing our internal

targets for 2023. We are now seeing sizable orders and re-orders from high-volume users, along with many new accounts, both large and

small, which we expect will start to utilize IHEEZO in the fourth quarter and beyond.

We

are also investing in clinical research to demonstrate IHEEZO’s unique capabilities. An example is a recent in-vivo (in human)

study that we sponsored to compare the effect of IHEEZO on the bacterial action of povidone-iodine (PVI) with the effect of a low-viscosity

tetracaine ophthalmic solution on PVI. To our knowledge, this was the most robust, prospective study evaluating the effects of PVI with

anesthetics in an in-vivo setting to date. We executed this study because every ophthalmic surgical intervention requires an antiseptic

application (e.g., PVI) to prevent potentially blinding conditions such as endophthalmitis, and previous studies have shown that high

viscosity gel vehicles act as a “barrier” to the bactericidal properties of PVI and may increase the risk of endophthalmitis

following ophthalmic procedures. The problem is that other commonly used non-gel anesthetics, such as tetracaine, have poor ocular surface

residence time on the eye, causing an unpredictable onset and duration of anesthetic effect, and contain preservatives known to cause

endothelial cell damage. IHEEZO offers numerous benefits, including reliable anesthetic onset and duration, but to improve IHEEZO adoption,

we needed to alleviate any clinical concerns regarding the potential barrier effect of IHEEZO.

I

am happy to report that data from this barrier-effect study, which we expect to be published in the coming months, clearly demonstrated

similar barrier risks between IHEEZO and solution-based topical anesthetics – meaning that IHEEZO provides the benefits

of a gel without the known risks. Therefore, IHEEZO low-viscosity gel, used as a monotherapy, uniquely provides patient comfort,

predictable onset, and duration of anesthesia, with a single dose, and the option to re-dose as needed, without the need for any

supplemental intervention, including the need for opioids. This study was a fantastic outcome for IHEEZO given ophthalmologists’

concerns about “barrier-issues” with gel-based anesthetics. We look forward to the public availability of this study and

its accompanying data supporting our belief that IHEEZO’s clinical benefits are truly unique from anything currently available.

Finally,

we are also working to ensure continued access to the Medicare market for the ambulatory surgery center (ASC) and hospital and outpatient

department (HOPD) market segments and the in-office use of IHEEZO. In this regard, we are designing and intend to execute during the

first half of 2024, clinical studies to build data sets that could be presented to the Centers for Medicare & Medicaid Services (CMS)

to eventually extend our temporary pass-through period for IHEEZO in ASCs and HOPDs. We have also requested to meet with CMS to clarify

a billing policy that has historically not allowed for the separate billing of anesthesia services in a physician’s office. Our

request to CMS is to clarify that J-Code 2403, IHEEZO’s permanent J-Code, may be billed for the anesthesia itself (i.e., IHEEZO

under J-2403), not the provision of anesthesia services, in a physician’s office setting. We will continue to update our stockholders

as we make progress on these efforts.

Fab

Five Commentary

As

readers of these Letters to Stockholders are aware, earlier this year, Harrow acquired the U.S. commercial rights to five products –

MAXIDEX®, ILEVRO®, NEVANAC®, VIGAMOX®, and TRIESENCE (the first four of these products are commercially available –

see TRIESENCE Commentary below). Harrow’s strategy with these products, which had not been supported by marketing or sales

detailing for many years, was first to stem the downward decline in unit demand and second, to begin to grow sales, in particular, from

our nepafenac franchise, represented by ILEVRO and NEVANAC. As a part of the acquisition, the NDAs for these products were to be transferred

to Harrow during a transition period after the closing, at which time they would be fully integrated into Harrow’s commercial platform

and begin executing our strategy. While NDAs for MAXIDEX, ILEVRO, and NEVANAC were transferred in May 2023 and VIGAMOX in late July 2023,

we made the strategic decision to focus our commercial team’s efforts on IHEEZO, delaying implementation of marketing and sales

detailing efforts for these products. Therefore, we are about three months behind our revenue forecast for these products.

On

the positive side, once we began implementing our awareness campaign, demand for ILEVRO and NEVANAC began to build, as evidenced by recent

positive prescription data. Preliminarily, it appears that our belief that reminding prescribers of the availability of products they

know and trust, which have strong reimbursement support from third-party payers (see an example below of a reimbursement tool for ILEVRO

highlighting the significant coverage levels in Texas), is what was needed to regain interest in these fantastic products. We remain

excited about this acquisition, and while we are a bit behind with our plans, we believe that the economic and strategic potential from

the Fab Five remains intact.

Compounded

Pharmaceuticals Commentary

Our

compounding business has recently underperformed as we’ve invested in improving efficiencies and compliance related to manufacturing,

quality systems, the makeup of our sales team, our analytical testing capabilities, and our customer care infrastructure. Additionally,

some authoritative agencies have added complexities to state-specific compounding regulatory constructs. While these investments have

been modest from a cash investment perspective, they have affected (i) our productivity, (ii) our ability to meet the growing demand

for our products, and (iii) our ability to provide customer experiences at the levels our customers deserve. I am highly confident this

is a temporary situation, and these enhancements and compliance investments are necessary to preserve and expand our market leadership

position over the longer term.

Harrow

stockholders who have followed our company for many years know we have occasionally encountered growing pains like this in our compounding

business. Frankly, it’s just the nature of the compounding business when you operate at the scale we do. We have had to invest

in efficiency and compliance in the past, and importantly, we have a 100% success record of overcoming these challenges and returning

to growth. Investing in the required systems, processes, and protocols to reliably serve a national market requires adherence to a standard

and a level of complexity that few competitors can achieve. Although we have never been perfect, our commitment to compliance with the

strictest of regulations has been a “superpower” for us as we’ve built our compounding business. Based on what has

been successfully implemented and other solutions planned in the coming weeks, I am confident that our compounding business will resume

our historical growth – likely in the first quarter of 2024.

VEVYE

Commentary

Harrow's

largest future annual market opportunity is VEVYE, the recently FDA-approved patented semi-fluorinated alkane plus 0.1% cyclosporine

product – which we are launching in a few weeks. VEVYE, a “water-free” topical prescription medication, is FDA-approved

to treat both the signs and symptoms of dry eye disease (DED). We believe eyecare professionals (ECPs) have long awaited a product like

VEVYE – a DED product that can deliver effective, fast, and sustained clinical results for patients without the negative

adverse event profiles associated with current DED pharmaceutical product choices.

In

preparing for the upcoming launch of VEVYE, it has become evident that most ophthalmologists and optometrists believe strongly in the

clinical power of cyclosporine – as a therapeutic agent. This should not be surprising given the tens of millions of U.S.

patients prescribed cyclosporine during the past 20 years. However, VEVYE is very different from the currently available cyclosporine-based

products, not only because of the comfort and many benefits of its patented delivery vehicle – only the second “water-free”

product in the U.S. market – but also because it offers the highest available concentration of cyclosporine. This puts VEVYE

in a class of its own. I can’t wait to get VEVYE in the hands of Harrow’s existing prescribers and those we believe will

become prescribers of Harrow products during the VEVYE launch.

One

final comment on VEVYE:

I

recently returned from my first visit to the American Academy of Optometry (AAOpt) annual meeting, which was held in New Orleans. There,

we had a medical advisory board (MAB) meeting that included the “who’s who” in U.S. optometry. (As an FYI, data shows

that optometrists are responsible for writing about 50% of the U.S. prescriptions for dry eye medications.) I didn’t know what

to expect from such an esteemed group as they listened to the scientific presentation of the VEVYE data and discussed potential “holes”

in VEVYE’s value proposition and clinical benefits.

Based

on what I heard at AAOpt and the recent American Academy of Ophthalmology (AAO) meeting in San Francisco, I have a strong conviction

that VEVYE is a winner! This slide from the VEVYE scientific materials, which describes consistent improvement in both signs and symptoms

for DED patients – over an entire year, says it all:

| * | Data

was presented by David Wirta, MD, in a paper entitled “Long-Term Safety and Efficacy

of a Water-Free Cyclosporine Ophthalmic Solution for the Treatment of Dry-Eye Disease: Essence-2-OLE

Study,” during the American Society of Cataract and Refractive Surgery (ASCRS)

annual meeting in San Diego in May 2023. |

During

the AAOpt advisory board meeting, one Key Opinion Leader (KOL) observing this slide reflected, “I’d show my colleagues this

slide and be done – it’s the best data I’ve ever seen in my career.”

We

expect to begin to record our first VEVYE revenues by the end of 2023 and deploy additional resources in January at the 2024 Royal Hawaiian

Eye Meeting as we more fully launch VEVYE in the U.S. market.

TRIESENCE

Commentary

The

“diamond” of the Fab Five transaction was TRIESENCE, a high utility J-Coded buy-and-bill triamcinolone acetonide suspension

that has been on the FDA’s drug shortage list for most of the past five years. For Harrow, bringing TRIESENCE back to the U.S.

market is a strategic imperative – and we will succeed.

In

last quarter’s Letter to Stockholders, we reported that demo batches of TRIESENCE were completed, and we were awaiting results

from the first of three process performance qualification (PPQ) batches. While we were not naïve about the fact that TRIESENCE is

a tricky product to manufacture, contributing to its out-of-stock status for most of the last five years, we are nevertheless disappointed

to report that our first PPQ batch did not meet all specifications.

Based

on the investigation into the potential cause of the out-of-specification TRIESENCE PPQ batch, we remain committed to getting TRIESENCE

back in stock and available to physicians during 2024. Once TRIESENCE is available to sell to our wholesaler partners, Harrow could begin

to record TRIESENCE revenues. We continue to work diligently with our contracted manufacturing partner to resolve manufacturing challenges,

achieve inventory build, and be able to supply TRIESENCE to U.S. ECPs, who we are highly confident are eager to purchase TRIESENCE once

it is again available.

On

a positive note, as we focus on finalizing manufacturing inventory for TRIESENCE, we also continue to make good progress in getting the

NDA for TRIESENCE transferred to Harrow, which will allow us to reasonably adjust the price of TRIESENCE for the first time in 12 years.

This price increase will be vital in ensuring that we can manufacture and build an inventory of TRIESENCE, thus keeping it in stock and

available for the 600,000 internally estimated annual use cases for TRIESENCE. As of today, we expect that the NDA transfer will be completed

before a TRIESENCE re-launch and that the agreed upon acquisition purchase price will continue to be due when inventory is made commercially

available for sale.

Investments

and Royalties

Harrow

has non-controlling equity positions in three companies founded as Harrow subsidiaries before being deconsolidated into independent and

separately managed companies: (1) Melt Pharmaceuticals, (2) Eton Pharmaceuticals, and (3) Surface Ophthalmics.

Founded

by Harrow in 2018, Melt Pharmaceuticals is developing a non-IV and non-opioid sedation platform for ophthalmic surgical procedures such

as cataract surgery and the more than 100 million annual medical procedures requiring sedation. The Melt team has been raising the balance

of the capital required to complete its Phase 3 program for its lead drug candidate, MELT-300. I am pleased to report that as of today,

Melt has raised nearly $20 million in new capital at a $70 million pre-money valuation, a significant increase from the Series A valuation.

Melt is in the final stages of closing on the last bit of capital of its Series B financing to complete the MELT-300 program through

the NDA stage.

Harrow

(i) owns 36% of Melt’s equity interests, (ii) holds a $13.5 million principal amount secured note receivable, and (iii) is entitled

to a 5% royalty interest in MELT-300.

We

also continue to be excited about being a shareholder of both Eton Pharmaceuticals and Surface Ophthalmics, and we look forward to continuing

to follow their growth in the future.

2023

Guidance

Because

the aggregate progress of our business is about 60 days behind, we are adjusting our 2023 revenue guidance from a range of $135 million

to $143 million to a range of $129 million to $136 million. If we continue to be successful in the execution of a few open 2023 objectives,

including IHEEZO sales growing outside the bounds we anticipated at this stage of the launch, and the timing of future milestones unfolds

in our favor, we could land toward the higher end of the range. Regardless, our business remains solidly in a growth mode for the balance

of our five-year planning cycle, which includes 2024 and continues through 2027.

We

are also adjusting our previously issued 2023 Adjusted EBITDA guidance from a range of $44 million to $50 million to a range of $36 million

to $41 million, primarily because of lower revenue estimates coupled with increased costs associated with recent acquisitions, needed

investments in preparation for the launch of VEVYE®, and one-time integration costs of the recently acquired Santen products.

Preliminary

2024 Financial Guidance

Many

of our stockholders know that Andrew and I have been hesitant to make public financial guidance statements for many years. However, we

appreciate that our stockholders deserve some reasonable level of visibility into what we are seeing and expecting, as a financial base

case, in prospective periods. Therefore, below are a few items that reflect our current view on the coming annual period:

| ● | Excluding

any contribution from TRIESENCE®,

we expect our 2024 revenues to be over $180 million. |

| ● | The

magnitude of revenue growth beyond $180 million will depend on many factors, including when

we restore TRIESENCE inventory, accelerate IHEEZO sales, and generate new revenues from VEVYE.

|

| ● | Beginning

in the first quarter of 2024, we expect (i) moderate revenue growth from our recently acquired

FDA-approved products (the Fab Five and those we acquired from Santen) and (ii) the recovery

of our compounding business to historical growth levels. |

| ● | From

a cost structure perspective, we expect our operating costs to increase incrementally as

we scale our business to grow revenues and invest in the VEVYE launch. |

| ● | We

expect to continue investing in our commercial infrastructure while maintaining our leverage

ratio (debt/Adjusted EBITDA) below five times. |

| ● | We

expect to close 2024 with a strong balance sheet, with cash increasing during the year. |

| ● | We

remain confident in meeting our obligations to Harrow’s creditors. |

| ● | During

2024, we expect to focus on operations, specifically on leveraging Harrow’s branded

portfolio, which is one of the most comprehensive in the U.S. market. |

Closing

Being

the CEO of Harrow allows me plenty of credit when things go well, as things have for most of the past decade. On the other hand, when

things disappoint, I must be willing to take the upbraiding. While I am proud of the work we accomplished in the third quarter –

including achieving record revenues that represent a 50% year-over-year increase – I wish we had made the strategic amendments

to the IHEEZO plan earlier in the period, that we could have started our Fab Five commercial efforts sooner, and that we didn’t

experience the recent temporary disruptions to our compounding business. This is not just wishful thinking; it reflects how we could

have extracted better performance from our business during this last quarter and, in turn, drive more potential for the year.

Regardless

of my self-criticism, I feel inspired by slide #5 of our corporate presentation. This slide illustrates our remarkable financial journey,

with revenues of $49 million in 2020, $72 million in 2021, and $89 million in 2022. As we set our sights on achieving, and hopefully

surpassing, our revenue projections for 2023, targeting a minimum of $129 million, and for 2024, aiming for a minimum of $180 million,

we are on track to nearly quadruple our revenue in just four years. We also have plenty of cash and should have an even larger

pile of cash at the end of next year. Every member of the Harrow Family and each Harrow stockholder should be proud of our extraordinary

growth.

We

appreciate your trust and patience as we meet the moment and opportunity. I look forward to updating you again in my next Letter to

Stockholders in March of 2024.

Sincerely,

Mark

L. Baum

Founder,

Chairman of the Board, and Chief Executive Officer

Nashville,

Tennessee

Harrow’s

current Corporate Presentation

Index

to Previous Letters to Stockholders

| 2023 | |

2022 | | |

2021 | | |

2020 | | |

2019 | |

| | |

4Q 2022 | | |

4Q 2021 | | |

4Q 2020 | | |

4Q 2019 | |

| | |

3Q 2022 | | |

3Q 2021 | | |

3Q 2020 | | |

3Q 2019

| |

| 2Q23 | |

2Q 2022 | | |

2Q 2021 | | |

2Q 2020 | | |

| |

| 1Q23 | |

1Q 2022 | | |

1Q 2021 | | |

1Q 2020 | | |

| |

FORWARD-LOOKING

STATEMENTS

Management’s

remarks in this stockholder letter include forward-looking statements within the meaning of federal securities laws. Forward-looking

statements are subject to numerous risks and uncertainties, many of which are beyond Harrow’s control, including risks and uncertainties

described from time to time in its SEC filings, such as the risks and uncertainties related to the Company’s ability to make commercially

available its FDA-approved products and compounded formulations and technologies, and FDA approval of certain drug candidates in a timely

manner or at all.

For

a list and description of those risks and uncertainties, please see the “Risk Factors” section of the Company’s Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the SEC.

Harrow’s

results may differ materially from those projected. Harrow disclaims any intention or obligation to update or revise any financial projections

or forward-looking statements whether because of new information, future events or otherwise. This stockholder letter contains time-sensitive

information and is accurate only as of today.

Additionally,

Harrow refers to non-GAAP financial measures, specifically Adjusted EBITDA, adjusted earnings, core gross margin, core net loss, and

core diluted net loss per share. A reconciliation of non-GAAP measures with the most directly comparable GAAP measures is included in

this letter.

No

compounded formulation is FDA-approved. All compounded formulations are customizable. Other than drugs compounded at a registered outsourcing

facility, all compounded formulations require a prescription for an individually identified patient consistent with federal and state

laws.

All

trademarks, service marks, and trade names included or referenced in this publication are the property of their respective owners.

Non-GAAP

Financial Measures

In

addition to the Company’s results of operations determined in accordance with U.S. generally accepted accounting principles (GAAP),

which are presented and discussed above, management also utilizes Adjusted EBITDA and Core Results, unaudited financial measures that

are not calculated in accordance with GAAP, to evaluate the Company’s financial results and performance and to plan and forecast

future periods. Adjusted EBITDA and Core Results are considered “non-GAAP” financial measures within the meaning of Regulation

G promulgated by the SEC. Management believes that these non-GAAP financial measures reflect an additional way of viewing aspects of

the Company’s operations that, when viewed with GAAP results, provide a more complete understanding of the Company’s results

of operations and the factors and trends affecting its business. Management believes Adjusted EBITDA and Core Results provide meaningful

supplemental information regarding the Company’s performance because (i) they allow for greater transparency with respect to key

metrics used by management in its financial and operational decision-making; (ii) they exclude the impact of non-cash or, when specified,

non-recurring items that are not directly attributable to the Company’s core operating performance and that may obscure trends

in the Company’s core operating performance; and (iii) they are used by institutional investors and the analyst community to help

analyze the Company’s results. However, Adjusted EBITDA, Core Results, and any other non-GAAP financial measures should be considered

as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. Further,

non-GAAP financial measures used by the Company and the way they are calculated may differ from the non-GAAP financial measures or the

calculations of the same non-GAAP financial measures used by other companies, including the Company’s competitors.

Adjusted

EBITDA

The

Company defines Adjusted EBITDA as net loss, excluding the effects of stock-based compensation and expenses, interest, taxes, depreciation,

amortization, investment (income) loss, net, and, if any and when specified, other non-recurring income or expense items. Management

believes that the most directly comparable GAAP financial measure to Adjusted EBITDA is net loss. Adjusted EBITDA has limitations and

should not be considered as an alternative to gross profit or net loss as a measure of operating performance or to net cash provided

by (used in) operating, investing, or financing activities as a measure of ability to meet cash needs.

The

following is a reconciliation of Adjusted EBITDA, a non-GAAP measure, to the most comparable GAAP measure, net loss, for the three and

nine months ended September 30, 2023, and for the same periods in 2022:

| | |

For the Three Months Ended September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP net loss | |

$ | (4,391,000 | ) | |

$ | (6,464,000 | ) | |

$ | (15,263,000 | ) | |

$ | (15,141,000 | ) |

| Stock-based compensation and expenses | |

| 4,476,000 | | |

| 1,932,000 | | |

| 11,521,000 | | |

| 5,941,000 | |

| Interest expense, net | |

| 5,749,000 | | |

| 1,800,000 | | |

| 16,200,000 | | |

| 5,386,000 | |

| Income tax expense | |

| 1,539,000 | | |

| 35,000 | | |

| 1,236,000 | | |

| 75,000 | |

| Depreciation | |

| 405,000 | | |

| 247,000 | | |

| 1,095,000 | | |

| 1,090,000 | |

| Amortization of intangible assets | |

| 2,584,000 | | |

| 398,000 | | |

| 7,634,000 | | |

| 1,200,000 | |

| Investment (income) loss, net | |

| (1,348,000 | ) | |

| 4,535,000 | | |

| (2,676,000 | ) | |

| 13,377,000 | |

| Other expense, net | |

| 195,000 | | |

| - | | |

| 5,809,000 (1) | | |

| - | |

| Adjusted EBITDA | |

$ | 9,209,000 | | |

$ | 2,483,000 | | |

$ | 25,556,000 | | |

$ | 11,928,000 | |

| (1) | Includes

$5,465,000 for the loss on extinguishment of debt. |

Core

Results

Harrow

Core Results, including core gross margin, core net (loss) income, core operating income, core basic and diluted loss per share, and

core operating margin, exclude (1) all amortization and impairment charges of intangible assets, excluding software development costs,

(2) net gains and losses on investments and equity securities, including equity method gains and losses and equity valued at fair value

through profit and loss (“FVPL”), and preferred stock dividends, and (3) gains/losses on forgiveness of debt. In other periods,

Core Results may also exclude fair value adjustments of financial assets in the form of options to acquire a company carried at FVPL,

obligations related to product recalls, certain acquisition-related items, restructuring charges/releases and associated items, related

legal items, gains/losses on early extinguishment of debt or debt modifications, impairments of property, plant and equipment and software,

as well as income and expense items that management deems exceptional and that are or are expected to accumulate within the year to be

over a $100,000 threshold.

The

following is a reconciliation of Core Results, non-GAAP measures, to the most comparable GAAP measures for the three and nine months

ended September 30, 2023, and for the same periods in 2022:

| For the Three Months Ended September 30, 2023 |

| | |

GAAP Results | | |

Amortization of Certain Intangible Assets | | |

Investment Gains | | |

Other Items | | |

Core Results | |

| Gross profit | |

$ | 24,198,000 | | |

$ | 2,480,000 | | |

$ | - | | |

$ | - | | |

$ | 26,678,000 | |

| Gross margin | |

| 71 | % | |

| | | |

| | | |

| | | |

| 78 | % |

| Operating income | |

| 1,744,000 | | |

| 2,584,000 | | |

| - | | |

| - | | |

| 4,328,000 | |

| (Loss) income before taxes | |

| (2,852,000 | ) | |

| 2,584,000 | | |

| (1,348,000 | ) | |

| 195,000 | | |

| (1,421,000 | ) |

| Tax expense | |

| (1,539,000 | ) | |

| - | | |

| - | | |

| - | | |

| (1,539,000 | ) |

| Net (loss) income | |

| (4,391,000 | ) | |

| 2,584,000 | | |

| (1,348,000 | ) | |

| 195,000 | | |

| (2,960,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.13 | ) | |

| | | |

| | | |

| | | |

| (0.09 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 34,255,197 | | |

| | | |

| | | |

| | | |

| 34,255,197 | |

| For the Nine Months Ended September 30, 2023 |

| | |

GAAP Results | | |

Amortization

of Certain Intangible Assets | | |

Investment Gains | | |

Other Items | | |

Core Results | |

| Gross profit | |

$ | 65,500,000 | | |

$ | 7,174,000 | | |

$ | - | | |

$ | - | | |

$ | 72,674,000 | |

| Gross margin | |

| 70 | % | |

| | | |

| | | |

| | | |

| 77 | % |

| Operating income | |

| 5,306,000 | | |

| 7,634,000 | | |

| - | | |

| - | | |

| 12,940,000 | |

| (Loss) income before taxes | |

| (14,027,000 | ) | |

| 7,634,000 | | |

| (2,676,000 | ) | |

| 5,786,000 | | |

| (3,283,000 | ) |

| Tax expense | |

| (1,236,000 | ) | |

| - | | |

| - | | |

| - | | |

| (1,236,000 | ) |

| Net (loss) income | |

| (15,263,000 | ) | |

| 7,634,000 | | |

| (2,676,000 | ) | |

| 5,786,000 | | |

| (4,519,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.48 | ) | |

| | | |

| | | |

| | | |

| (0.14 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 31,689,947 | | |

| | | |

| | | |

| | | |

| 31,689,947 | |

| For the Three Months Ended September 30, 2022 |

| | |

GAAP Results | | |

Amortization

of Certain Intangible Assets | | |

Investment Losses | | |

Core Results | |

| Gross profit | |

$ | 16,102,000 | | |

$ | 341,000 | | |

$ | - | | |

$ | 16,443,000 | |

| Gross margin | |

| 71 | % | |

| | | |

| | | |

| 72 | % |

| Operating (loss) income | |

| (94,000 | ) | |

| 398,000 | | |

| - | | |

| 304,000 | |

| (Loss) income before taxes | |

| (6,429,000 | ) | |

| 398,000 | | |

| 4,535,000 | | |

| (1,496,000 | ) |

| Tax expense | |

| (35,000 | ) | |

| - | | |

| - | | |

| (35,000 | ) |

| Net (loss) income | |

| (6,464,000 | ) | |

| 398,000 | | |

| 4,535,000 | | |

| (1,531,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.24 | ) | |

| | | |

| | | |

| (0.06 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 27,349,642 | | |

| | | |

| | | |

| 27,349,642 | |

| For the Nine Months Ended September 30, 2022 |

| | |

GAAP Results | | |

Amortization

of Certain Intangible Assets | | |

Investment Losses | | |

Core Results | |

| Gross profit | |

$ | 49,048,000 | | |

$ | 1,023,000 | | |

$ | - | | |

$ | 50,071,000 | |

| Gross margin | |

| 72 | % | |

| | | |

| | | |

| 73 | % |

| Operating income | |

| 3,697,000 | | |

| 1,200,000 | | |

| - | | |

| 4,897,000 | |

| (Loss) Income before taxes | |

| (15,066,000 | ) | |

| 1,200,000 | | |

| 13,377,000 | | |

| (489,000 | ) |

| Tax expense | |

| (75,000 | ) | |

| - | | |

| - | | |

| (75,000 | ) |

| Net (loss) income | |

| (15,141,000 | ) | |

| 1,200,000 | | |

| 13,377,000 | | |

| (564,000 | ) |

| Basic and diluted loss per share ($)(1) | |

| (0.55 | ) | |

| | | |

| | | |

| (0.02 | ) |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 27,293,756 | | |

| | | |

| | | |

| 27,293,756 | |

| (1) | Core

basic and diluted loss per share is calculated using the weighted-average number of shares

of common stock outstanding during the period. Core basic and diluted loss per share also

contemplates dilutive shares associated with equity-based awards as described in Note 2 and

elsewhere in the Condensed Consolidated Financial Statements included in the Company’s

Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. |

Investment

Portfolio

(includes

Non-GAAP Values)

| | |

At September 30, 2023 | |

| Company | |

Number of

Shares of

Common Stock | | |

Management Estimated Value | |

| Eton Pharmaceuticals | |

| 1,982,000 | | |

$ | 8,265,000 | |

| Surface Ophthalmics | |

| 3,500,000 | | |

| 15,750,000 | (1) |

| Melt Pharmaceuticals | |

| 3,500,000 | | |

| 29,750,000 | (2) |

| Melt Pharmaceuticals – Secured Loan + PIK | |

| - | | |

| 17,765,000 | (3) |

| Estimated Total Value | |

| | | |

$ | 71,530,000 | |

| (1) | Represents

a non-GAAP value, calculated as the purchase and conversion price $(4.50) of the Series A-1

Preferred Stock (the most recent equity offering) multiplied by the number of common shares

owned by Harrow at September 30, 2023. |

| (2) | Represents

a non-GAAP value, calculated as the purchase and conversion price $(8.50) of the Series B

Preferred Stock (the most recent equity offering) multiplied by the number of common shares

owned by Harrow at September 30, 2023. |

| (3) | Represents

the principal balance owed under the loan agreement, including interest paid in kind (or

PIK). In accordance with ASC 323, Harrow’s presentation of this loan receivable on

its consolidated balance sheet is presented at its carry value less reductions in the carrying

value related to Harrow’s share of Melt equity losses. |

v3.23.3

Cover

|

Nov. 13, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 13, 2023

|

| Entity File Number |

001-35814

|

| Entity Registrant Name |

HARROW,

INC.

|

| Entity Central Index Key |

0001360214

|

| Entity Tax Identification Number |

45-0567010

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

102

Woodmont Blvd.

|

| Entity Address, Address Line Two |

Suite 610

|

| Entity Address, City or Town |

Nashville

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37205

|

| City Area Code |

(615)

|

| Local Phone Number |

733-4730

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| Common Stock, $0.001 par value per share |

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

HROW

|

| Security Exchange Name |

NASDAQ

|

| 8.625% Senior Notes due 2026 |

|

| Title of 12(b) Security |

8.625%

Senior Notes due 2026

|

| Trading Symbol |

HROWL

|

| Security Exchange Name |

NASDAQ

|

| 11.875% Senior Notes due 2027 |

|

| Title of 12(b) Security |

11.875%

Senior Notes due 2027

|

| Trading Symbol |

HROWM

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |