false000167672500016767252024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2024

IDEAYA Biosciences, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-38915 |

|

47-4268251 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification Number) |

7000 Shoreline Court, Suite 350

South San Francisco, California 94080

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (650) 443-6209

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, $0.0001 par value per share |

|

IDYA |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 7, 2024, IDEAYA Biosciences, Inc. (the “Company”) announced its financial results for the first quarter ended March 31, 2024. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 and the attached Exhibit 99.1 are being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall they be deemed to be incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

IDEAYA BIOSCIENCES, INC. |

|

|

|

Date: May 7, 2024 |

By: |

/s/ Yujiro Hata |

|

|

Yujiro Hata |

|

|

President and Chief Executive Officer |

IDEAYA Biosciences, Inc. Reports First Quarter 2024 Financial Results

and Provides Business Update

•ASCO 2024 oral presentation of darovasertib neoadjuvant UM Phase 2 investigator-sponsored trial on June 3rd, and targeting neoadjuvant UM update in over 30 patients from Phase 2 company-sponsored trial and regulatory guidance both in H2 2024

•Selected move-forward Phase 2 dose for IDE397 in MTAP squamous NSCLC, based on clinical efficacy observed in this indication, including multiple PRs by RECIST 1.1; and multiple PRs by RECIST 1.1 have also been observed in MTAP bladder cancer

•Enrollment is ongoing in the IDE397 and AMG 193 Phase 1 dose escalation and targeting development of joint Amgen / IDEAYA publication strategy in 2024

•First-patient-in (FPI) for Phase 1 trial of IDE397 in combination with Gilead’s Trodelvy® in MTAP bladder cancer targeted mid-year 2024

•Targeting initial Phase 2 expansion for IDE161 in HRD solid tumors and Phase 1 FPI for IDE161 in combination with Merck’s anti-PD-1 therapy KEYTRUDA® (pembrolizumab) in endometrial cancer both in H2 2024

•IND-enabling GLP toxicology studies completed and targeting Werner IND-filing with GSK in H2 2024, representing 5th potential first-in-class clinical program; and targeting MTAP development candidate in H2 2024 to enable wholly-owned IDE397 combination

•Strong balance sheet of $941.4 million of cash, cash equivalents and marketable securities as of March 31, 2024, anticipated to fund operations into 2028

South San Francisco, CA, May 7, 2024– IDEAYA Biosciences, Inc. (Nasdaq: IDYA), a precision medicine oncology company committed to the discovery and development of targeted therapeutics, provided a business update, and announced financial results for the first quarter ended March 31, 2024.

“This quarter we continued to execute on our strategic vision to build a leading precision medicine oncology company, with the broad advancement of 4 potential first-in-class clinical programs across multiple patient selection biomarker populations, including GNAQ/11, MTAP-deletion, and HRD solid tumors. Next, through our excellence in translational research, we have discovered and enabled what we believe are potential first-in-class rational combinations across our diverse clinical pipeline, including with Pfizer, Amgen, Gilead, GSK, and Merck. IDEAYA’s next generation programs have also made tremendous progress this past quarter, including the Werner Helicase program that is on-track for an IND-filing this year and our second MTAP-deletion program where we anticipate a development candidate in 2024 to enable a potential wholly-owned clinical combination with IDE397,” said Yujiro S. Hata, President and Chief Executive Officer, IDEAYA Biosciences.

“We are excited to provide a clinical data update from the ongoing investigator-sponsored Phase 2 neoadjuvant uveal melanoma trial as an oral presentation at ASCO 2024. In addition,

we are targeting to provide a clinical data update from our company-sponsored Phase 2 neoadjuvant UM trial and receive FDA regulatory guidance for a potential registrational path in the neoadjuvant uveal melanoma indication in the second half of 2024. In addition, our potential first-in-class clinical pipeline including programs in Phase 1/2 such as the MAT2A inhibitor IDE397 which targets MTAP-deleted solid tumors and PARG inhibitor IDE161 which targets HRD solid tumors, both continue to make important advancements. For IDE397, we have selected a move-forward Phase 2 monotherapy expansion dose in MTAP-deletion squamous non-small cell lung cancer. For the IDE161 program, we are targeting to initiate the Phase 2 monotherapy expansion in HRD solid tumors in the second half of 2024,” added Darrin Beaupre, M.D., Ph.D., Chief Medical Officer, IDEAYA Biosciences.

Summary of Recent Key Developments

•Interim data from the investigator-sponsored Phase 2 trial of darovasertib in neoadjuvant UM accepted for an oral presentation at the 2024 American Society of Clinical Oncology (ASCO) Annual Meeting.

•Selected move-forward Phase 2 expansion dose for IDE397 monotherapy in MTAP-deletion squamous NSCLC, based on adverse event profile and preliminary clinical efficacy observed, including multiple partial responses in squamous NSCLC by RECIST 1.1. In addition, multiple partial responses by RECIST 1.1 have also been observed in MTAP-deletion bladder cancer with IDE397 monotherapy and evaluation is ongoing for further potential Phase 2 expansion in this tumor type.

•Enrollment is ongoing in the IDE397 and AMG 193 combination Phase 1 dose escalation.

•IDE161 Phase 1/2 dose escalation is ongoing and targeting initial Phase 2 expansion in HRD solid tumors in H2 2024. Established clinical trial collaboration with MSD International Business GmbH, a subsidiary of Merck & Co., Inc. Rahway, NJ, USA, in March 2024 to evaluate IDE161 in combination with KEYTRUDA in endometrial cancer with a first patient dosing targeted in the second half of 2024.

•IND-enabling GLP toxicology studies have been completed for the Werner Helicase inhibitor development candidate, in collaboration with GSK, representing IDEAYA’s 5th potential first-in-class clinical program. Multiple development candidates targeted in H2 2024, including in MTAP-deletion to enable potential IDE397 clinical combination.

Clinical Programs Update and Upcoming Milestones

Darovasertib (IDE196) Program in Tumors with GNAQ or GNA11 Mutations

Darovasertib is a potent and selective protein kinase C (PKC) inhibitor being developed to broadly address primary and metastatic UM. Darovasertib is currently being evaluated in four ongoing clinical trials, three of which are in collaboration with Pfizer. The darovasertib + crizotinib combination in MUM has U.S. Food & Drug Administration (FDA) Fast Track designation:

•IDE196-002(NCT05987332) is a Phase 2/3 potentially registration-enabling clinical trial of darovasertib + crizotinib in first-line HLA-A2*02:01(-) MUM. Clinical program update(s) are anticipated in 2024.

•IDE196-001 (NCT03947385) is a Phase 1/2 clinical trial evaluating darovasertib + crizotinib in GNAQ/11 melanomas, including in MUM and metastatic cutaneous melanoma.

•Phase 2 trials of darovasertib as neoadjuvant / adjuvant therapy in primary UM:

oIDE196-009 (NCT05907954) is a company-sponsored Phase 2 trial evaluating darovasertib as neoadjuvant treatment of UM prior to primary interventional treatment of enucleation or radiation therapy, and as adjuvant therapy following the primary treatment. A clinical efficacy update on over 30 patients and an FDA regulatory guidance update are both targeted in the second half of 2024.

oNADOM (NCT05187884) is a Phase 2 neoadjuvant / adjuvant trial of darovasertib in ocular melanoma. This is an investigator-sponsored trial (IST) led by Anthony Joshua, MBBS, PhD, FRACP, Head Department of Medical Oncology, Kinghorn Cancer Centre, St. Vincent's Hospital in Sydney with additional participating sites in Melbourne, Australia. The interim results from the trial have been accepted for an oral presentation at the upcoming 2024 ASCO annual meeting on June 3, 2024.

IDE397 Program in Solid Tumors and Bladder Cancer with MTAP Deletion

IDE397 is a potent and selective small molecule inhibitor targeting methionine adenosyltransferase 2 alpha (MAT2A) in patients having solid tumors with methylthioadenosine phosphorylase (MTAP) deletion. The Company continues to focus on evaluating IDE397 in two trials in select monotherapy indications and in high conviction clinical combinations:

•IDE397-001 (NCT04794699) is a Phase 2 monotherapy expansion of IDE397 in MTAP-deletion NSCLC and bladder cancer.

oSelected a move-forward Phase 2 expansion dose for IDE397 monotherapy in MTAP-deletion squamous NSCLC, based on adverse event profile and preliminary clinical efficacy observed, including multiple partial responses by RECIST 1.1 in squamous NSCLC. MTAP-deletion squamous NSCLC is estimated to have a global annual incidence greater than 100,000 patients.

oMultiple partial responses by RECIST 1.1 have also been observed in MTAP-deletion bladder cancer with IDE397 monotherapy and evaluation is ongoing for further potential Phase 2 expansion in this tumor type.

•Phase 1/2 trial of IDE397 + AMG 193 in MTAP-Deletion NSCLC (Amgen-sponsored study, NCT05975073):

oEnrollment is ongoing in the dose escalation portion.

oJoint publication strategy on IDE397 and AMG 193 combination targeted in 2024

•Phase 1 trial of IDE397 + Trodelvy in MTAP-deletion bladder cancer (IDEAYA-sponsored, NCT04794699). Trial initiation activities for the IDE397 and Trodelvy clinical combination

are ongoing and the dosing of a first patient is anticipated in mid-year (second or third quarter) 2024.

IDE161 Program in Tumors with Homologous Recombination Deficiency

IDE161 is a potential first-in-class inhibitor of poly(ADP-ribose) glycohydrolase (PARG), a novel, mechanistically distinct target in the same clinically validated biological pathway as poly(ADP-ribose) polymerase (PARP). IDE161 received two FDA Fast Track designations in platinum-resistant advanced or metastatic ovarian cancer patients having tumors with BRCA1/2 mutations, and in pretreated advanced or metastatic HR+, Her2-, BRACA1/2 mutant breast cancer. IDE161 is currently being evaluated in IDE161-001 (NCT05787587), a Phase 1/2 trial of IDE161 in solid tumors with HRD.

Early clinical data from the dose escalation cohorts were reported and the Phase 1 dose optimization portion of the trial is ongoing with the goal to select an initial Phase 2 expansion dose. Solid tumor types of focus, include ER+ HER-breast, colorectal, endometrial, and prostate cancers. Selection of an initial Phase 2 monotherapy expansion dose in HRD solid tumors is targeted in the second half of 2024. The Company is currently validating IDE161 combination opportunities preclinically and targeting identification of additional combination(s) in 2024.

In March 2024, the Company entered into the Clinical Trial Collaboration and Supply Agreement with MSD International Business GmbH, a subsidiary of Merck & Co., Inc. Rahway, NJ, USA. The Company is planning to evaluate IDE161 in a combination study with KEYTRUDA in patients with MSI-high and MSS endometrial cancer. A first-patient-in for this study is targeted in the second half of 2024.

KEYTRUDA® is a registered trademark of Merck Sharp & Dohme LLC, a subsidiary of Merck & Co., Inc., Rahway, NJ, USA.

GSK-Partnered Programs

GSK101 (IDE705) Program in Tumors with HRD

GSK101 (IDE705) is a potential first-in-class small molecule inhibitor of Pol Theta Helicase being developed as a combination treatment with niraparib for advanced solid tumors with HRD. IND clearance was obtained from the FDA to enable the GSK-sponsored Phase 1/2 clinical trial to evaluate GSK101 in combination with niraparib, the GSK small molecule inhibitor of PARP, for patients having solid tumors with BRCA or other HR mutations, or with HRD. GSK is the sponsor of the Phase 1/2 clinical trial. GSK has dosed the first patient and enrollment is ongoing in the dose escalation portion of this study. Upon initiation of the Phase 1 dose expansion trial, IDEAYA will be eligible to receive a $10.0 million milestone payment, with the collaboration having a potential further aggregate later-stage development and regulatory milestones of up to $465.0 million. GSK is responsible for all research and development costs for the program. Upon commercialization, IDEAYA will be eligible to receive up to $475 million of commercial milestones, and tiered royalties on global net sales of GSK101 – ranging from high single-digit to sub-teen double-digit percentages, subject to certain customary reductions.

Werner Helicase Inhibitor in Tumors with High Microsatellite Instability

IDEAYA and GSK are on track for an IND filing later in 2024 for the selected Werner Helicase inhibitor announced in December 2023. The IND-enabling GLP toxicology studies have been completed for the Werner Helicase inhibitor development candidate. IDEAYA has the potential to earn up to an additional $17.0 million in aggregate milestones through early Phase 1, including $7.0 million upon IND clearance, and is entitled to receive up to $465.0 million in further later-stage development and regulatory milestones. GSK is responsible for 80% of global research and development costs and IDEAYA is responsible for 20% of such costs. Upon commercialization, IDEAYA will be eligible to receive up to $475 million of commercial milestones, 50% of U.S. net profits and tiered royalties on global non-U.S. net sales of the Werner Helicase Inhibitor DC – ranging from high single-digit to sub-teen double-digit percentages, subject to certain customary reductions.

Next-Generation Precision Medicine Pipeline Programs

Early preclinical research programs focused on pharmacological inhibition of several new targets for patients with solid tumors characterized by defined biomarkers based on genetic mutations and/or molecular signatures are ongoing. These programs have the potential for discovery and development of first-in-class or best-in-class therapeutics with multiple wholly owned development candidate nominations targeted in the second half of 2024, including in MTAP-deletion solid tumors indications to enable potential wholly-owned clinical combination with IDE397.

Financial Results

As of March 31, 2024, IDEAYA had cash, cash equivalents and marketable securities totaling $941.4 million. This compared to cash, cash equivalents and marketable securities of $632.6 million as of December 31, 2023. The increase was primarily attributable to net proceeds of $343.5 million from the sale of shares of its common stock through ATM offerings during the period from January 1, 2024 to March 31, 2024, offset by net cash used in operations.

Subsequent to March 31, 2024, the Company raised gross proceeds of approximately $37.2 million, before deducting underwriting discounts and commissions and other offering expenses, from the sale of shares of its common stock through ATM offerings in April 2024, generating net proceeds of approximately $36.5 million, after deducting underwriting discounts and commissions and other estimated offering expenses.

There was no collaboration revenue recognized for the three months ended March 31, 2024 compared to $3.9 million for the three months ended December 31, 2023. We completed all performance obligations related to the upfront payment under the GSK collaboration agreement as of December 31, 2023. Future collaboration revenue recognized under the GSK collaboration agreement will be related to future milestone payments as they are earned.

Research and development (R&D) expenses for the three months ended March 31, 2024 totaled $42.8 million compared to $38.8 million for the three months ended December 31, 2023. The increase was primarily due to higher clinical trial and personnel-related expenses.

General and administrative (G&A) expenses for the three months ended March 31, 2024 totaled $8.2 million compared to $7.1 million for the three months ended December 31, 2023. The increase was primarily due to higher personnel-related expenses to support our growth.

The net loss for the three months ended March 31, 2024 was $39.6 million compared to the net loss of $34.0 million for the three months ended December 31, 2023. Total stock compensation expense for the three months ended March 31, 2024 was $6.3 million compared to $4.8 million for the three months ended December 31, 2023.

About IDEAYA Biosciences

IDEAYA is a precision medicine oncology company committed to the discovery and development of targeted therapeutics for patient populations selected using molecular diagnostics. IDEAYA’s approach integrates capabilities in identifying and validating translational biomarkers with drug discovery to select patient populations most likely to benefit from its targeted therapies. IDEAYA is applying its research and drug discovery capabilities to synthetic lethality – which represents an emerging class of precision medicine targets.

IDEAYA’s updated corporate presentation is available on its website, at its Investor Relations page: https://ir.ideayabio.com/.

Forward-Looking Statements

This press release contains forward-looking statements, including, but not limited to, statements related to (i) the timing, content and venue of clinical program updates, (ii) the timing for the development of a joint Amgen/IDEAYA publication strategy, (iii) the timing of a first-patient-in in the IDE397 and Trodelvy combination study, (iv) the timing of initial Phase 2 expansion for IDE161 in HRD solid tumors, (v) the timing of a first-patient-in in the IDE161 and KEYTRUDA combination study, (vi) the timing of IND submission for the Werner Helicase inhibitor DC, (vii) the timing of designation of next generation development candidates, (viii) the extent to which IDEAYA’s existing cash, cash equivalents, and marketable securities will fund its planned operations, (ix) the estimate of patient populations, (x) additional clinical combinations, and (xi) the receipt of development and regulatory milestones. Such forward-looking statements involve substantial risks and uncertainties that could cause IDEAYA’s preclinical and clinical development programs, future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, the uncertainties inherent in the drug development process, including IDEAYA’s programs’ early stage of development, the process of designing and conducting preclinical and clinical trials, the regulatory approval processes, the timing of regulatory filings, the challenges associated with manufacturing drug products, IDEAYA’s ability to successfully establish, protect and defend its intellectual property, and other matters that could affect the sufficiency of existing cash to fund operations. IDEAYA undertakes no obligation to update or revise any forward-looking statements. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of IDEAYA in general, see IDEAYA’s Annual Report on Form 10-K dated February 20, 2024 and any current and periodic reports filed with the U.S. Securities and Exchange Commission.

Investor and Media Contact

IDEAYA Biosciences

Andres Ruiz Briseno

SVP, Head of Finance and Investor Relations

investor@ideayabio.com

IDEAYA Biosciences, Inc.

Condensed Statements of Operations and Comprehensive Loss

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|

(Unaudited) |

|

Collaboration revenue |

|

$ |

- |

|

|

$ |

3,923 |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

|

42,805 |

|

|

|

38,770 |

|

General and administrative |

|

|

8,212 |

|

|

|

7,068 |

|

Total operating expenses |

|

|

51,017 |

|

|

|

45,838 |

|

Loss from operations |

|

|

(51,017 |

) |

|

|

(41,915 |

) |

Interest income and other income, net |

|

|

11,445 |

|

|

|

7,960 |

|

Net loss |

|

|

(39,572 |

) |

|

|

(33,955 |

) |

Unrealized (losses) gains on marketable securities |

|

|

(1,485 |

) |

|

|

1,312 |

|

Comprehensive loss |

|

$ |

(41,057 |

) |

|

$ |

(32,643 |

) |

Net loss per share

attributable to common

stockholders, basic and diluted |

|

$ |

(0.53 |

) |

|

$ |

(0.52 |

) |

Weighted-average number of shares

outstanding, basic and diluted |

|

|

75,108,484 |

|

|

|

65,246,361 |

|

IDEAYA Biosciences, Inc.

Condensed Balance Sheet Data

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

Cash and cash equivalents and short-term and

long-term marketable securities |

|

$ |

941,408 |

|

|

$ |

632,606 |

|

Total assets |

|

|

961,527 |

|

|

|

649,316 |

|

Total liabilities |

|

|

26,216 |

|

|

|

28,226 |

|

Total liabilities and stockholders' equity |

|

|

961,527 |

|

|

|

649,316 |

|

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

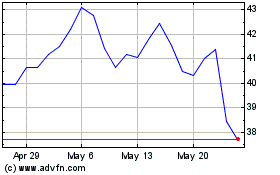

IDEAYA Biosciences (NASDAQ:IDYA)

Historical Stock Chart

From Dec 2024 to Jan 2025

IDEAYA Biosciences (NASDAQ:IDYA)

Historical Stock Chart

From Jan 2024 to Jan 2025