Inhibikase Therapeutics Reports Second Quarter Financial Results and Highlights Recent Period Activity

August 14 2024 - 3:25PM

Inhibikase Therapeutics, Inc. (Nasdaq: IKT) (Inhibikase or

Company), a clinical-stage pharmaceutical company developing

protein kinase inhibitor therapeutics to modify the course of

Parkinson's disease ("PD"), Parkinson's-related disorders and other

diseases of the Abelson Tyrosine Kinases, today reported financial

results for the second quarter ended June 30, 2024 and highlighted

recent developments.

“The first half of 2024 has showcased the

strength of our pipeline through the continued execution of key

milestones for both risvodetinib (risvo) and IkT-001Pro,” said Dr.

Milton H. Werner, President and Chief Executive Officer of

Inhibikase. “We completed enrollment of The 201 Trial evaluating

risvo in untreated Parkinson’s disease, and anticipate the last

patient exiting the study in September, 2024. We anticipate

reporting topline data in November, 2024. Additionally, 001Pro has

advanced as a potential treatment for Pulmonary Arterial

Hypertension (PAH). We have filed our IND and we intend to ramp up

the 702 trial following IND clearance. Finally, the manufacturing

requirements for 001Pro necessary for potential approval is

advancing with the on-going development of a scalable process.”

Recent Developments and Upcoming

Milestones:

- Completed enrollment of the

Phase 2 ‘201’ trial evaluating risvodetinib in untreated

Parkinson’s disease: On June 17, 2024, Inhibikase

announced that the final participant had been enrolled in The 201

Trial evaluating the safety and tolerability of risvodetinib as a

treatment in untreated Parkinson’s patients. The trial has enrolled

and randomized 126 patients total. The last patient will exit the

trial in September, 2024. As of July 29, 2024, 84 participants have

completed the 12-week dosing period. There have been 41 mild and 8

moderate adverse events observed that may be related to risvo

treatment. Six people withdrew from the trial without completing 12

weeks of treatment. Forty-six people have agreed to participate in

biomarker studies of the change in synuclein aggregate deposition

in the skin and seven have agreed to biomarker studies of the

status of synuclein aggregate in the spinal fluid.

- Expanded Pipeline with

advancement of IkT-001Pro as a therapy in Pulmonary Arterial

Hypertension: Following receipt of final meeting minutes

from Inhibikase’s pre-IND meeting with the FDA in May 2024, the

Company submitted its IND to the FDA and plans to begin ramp-up of

the Phase 2 702 trial to evaluate IkT-001Pro as a treatment for

PAH, subject to receipt of the Study May Proceed letter from the

FDA. In the final meeting minutes, the FDA stated that Inhibikase

had built a bridge between imatinib’s use in blood and

gastrointestinal cancers and PAH and that the Company’s Phase 2

design, to be known as the 702 trial, was reasonable. The Company

has completed the requested pre-clinical hERG safety study showing

that IkT-001Pro does not inhibit hERG and therefore is unlikely to

induce QTcF prolongation in treated patients. Imatinib has

previously been shown to induce QTcF prolongation in some

patients.The active ingredient in IkT-001Pro, imatinib, has

previously been shown to be disease-modifying for PAH. The Company

believes that 001Pro could have a more favorable safety and

tolerability profile compared to imatinib for this indication. If

approved, IkT-001Pro could be a branded product with all the value

drivers of a novel treatment for an indication with high unmet need

valued at $7.66 billion in 2023 according to global sales data from

Evaluate Pharma.

- Scaled manufacturing of

IkT-001Pro: Following the Company’s pre-NDA meeting with

the U.S. FDA in January 2024, Inhibikase scaled its process

development efforts for IkT-001Pro to support late-stage clinical

development and NDA batch requirements. Ongoing activities include

development of new dosage forms, a more efficient production

process and a high throughput tableting process that will lead to

dosage forms for 001Pro tablets that are differentiated from

generic imatinib mesylate in alignment with FDA feedback.

- Successfully raised $4.0

Million in a registered direct offering and concurrent private

placement: In May 2024, Inhibikase raised $4 million in

aggregate gross proceeds from its registered direct offering and

concurrent private placement. The Company is using the net proceeds

from the offering to progress risvodetinib towards its planned

Phase 3 trials in 2025 and completed pre-clinical studies requested

by the FDA that enabled the IND filing for 001Pro in PAH.

Second Quarter Financial

Results

Net Loss: Net loss for the quarter ended June

30, 2024, was $5.0 million, or $0.66 per share, compared to a net

loss of $5.8 million, or $0.94 per share in the quarter ended June

30, 2023. The net loss per share for the three and six months ended

June 30, 2023, was adjusted to show an improvement from ($1.11) to

($0.94) and from ($2.09) to ($1.74), respectively.

R&D Expenses: Research and development

expenses were $3.1 million for the quarter ended June 30, 2024

compared to $4.5 million in the quarter ended June 30, 2023. The

$1.5 million decrease in research and development expenses was due

to a decrease of $1.4 million in IkT-001Pro expenses due to the

completion of the three-part dose finding/dose equivalence study in

2023 and a net decrease of $0.1 million in other research and

development expenses.

SG&A Expenses: Selling, general and

administrative expenses for the quarter ended June 30, 2024 were

$2.0 million compared to $1.8 million for the quarter ended June

30, 2023. The $0.2 million increase was primarily driven by a $0.4

million increase legal and consulting fees partially offset by a

$0.1 million decrease in D&O insurance and a $0.1 million net

decrease in all other normal selling, general and administrative

expenses.

Cash Position: Cash, cash

equivalents and marketable securities were $7.9 million as of June

30, 2024. The Company expects that existing cash and cash

equivalents will be sufficient to fund operations into December,

2024.

Conference Call InformationThe

conference call is scheduled to begin at 8:00am ET on August 15,

2024. Participants should dial 1-877-407-0789 (United States) or

1-201-689-8562 (International). A live webcast may be accessed

using the link HERE or by visiting the investors section of the

Company's website at www.inhibikase.com. After the live webcast,

the event will be archived on Inhibikase's website for

approximately 90 days after the call.

About Inhibikase

(www.inhibikase.com)

Inhibikase Therapeutics, Inc. (Nasdaq: IKT) is a clinical-stage

pharmaceutical company developing therapeutics for Parkinson's

disease and related disorders. Inhibikase's multi-therapeutic

pipeline has a primary focus on neurodegeneration and its lead

program Risvodetinib, an Abelson Tyrosine Kinase (c-Abl) inhibitor,

targets the treatment of Parkinson's disease inside and outside the

brain as well as other diseases that arise from Abelson Tyrosine

Kinases. Its multi-therapeutic pipeline is pursuing

Parkinson's-related disorders of the brain and GI tract, orphan

indications related to Parkinson's disease such as Multiple System

Atrophy, and drug delivery technologies for kinase inhibitors such

as IkT-001Pro, a prodrug of the anticancer agent imatinib mesylate

that the Company believes will provide a better patient experience

with fewer on-dosing side-effects for the treatment of certain

hematological or gastrointestinal cancers and in cardiopulmonary

disease. The Company's RAMP™ medicinal chemistry program has

identified several follow-on compounds to Risvodetinib that could

potentially be applied to other cognitive and motor function

diseases of the brain. Inhibikase is headquartered in Atlanta,

Georgia with offices in Lexington, Massachusetts.

Social Media

DisclaimerInvestors and others should note that the

Company announces material financial information to investors using

its investor relations website, press releases, SEC filings and

public conference calls and webcasts. The Company intends to also

use X, Facebook, LinkedIn and YouTube as a

means of disclosing information about the Company, its services and

other matters and for complying with its disclosure obligations

under Regulation FD.

Forward-Looking StatementsThis

press release contains "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking terminology such as "believes," "expects," "may,"

"will," "should," "anticipates," "plans," or similar expressions or

the negative of these terms and similar expressions are intended to

identify forward-looking statements. These forward-looking

statements are based on Inhibikase's current expectations and

assumptions. Such statements are subject to certain risks and

uncertainties, which could cause Inhibikase's actual results to

differ materially from those anticipated by the forward-looking

statements. Important factors that could cause actual results to

differ materially from those in the forward-looking statements

include our ability to enroll and complete the 201 Trial evaluating

Risvodetinib in untreated Parkinson’s disease, to successfully

apply for and obtain FDA approval for IkT-001Pro in blood and

stomach cancers or other indications, to successfully conduct

clinical trials that are statistically significant and whether

results from our animal studies may be replicated in humans, as

well as such other factors that are included in our periodic

reports on Form 10-K and Form 10-Q that we file with the U.S.

Securities and Exchange Commission. Any forward-looking statement

in this release speaks only as of the date of this release.

Inhibikase undertakes no obligation to publicly update or revise

any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by any applicable securities laws.

Contacts:

Company Contact:Milton H. Werner, PhDPresident &

CEO678-392-3419info@inhibikase.com

Investor Relations:Alex LoboPrecision

AQAlex.lobo@precisionaq.com

|

Inhibikase Therapeutics, Inc.Condensed Consolidated Balance

Sheets(Unaudited) |

|

|

|

June 30,2024 |

|

|

December 31,2023 |

|

|

|

(unaudited) |

|

|

|

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,086,455 |

|

|

$ |

9,165,179 |

|

Marketable securities |

|

|

4,853,559 |

|

|

|

4,086,873 |

|

Prepaid research and development |

|

|

306,300 |

|

|

|

219,817 |

|

Prepaid expenses and other current assets |

|

|

356,487 |

|

|

|

739,179 |

|

Total current assets |

|

|

8,602,801 |

|

|

|

14,211,048 |

|

Equipment and improvements, net |

|

|

60,235 |

|

|

|

73,372 |

|

Right-of-use asset |

|

|

163,762 |

|

|

|

222,227 |

|

Total assets |

|

$ |

8,826,798 |

|

|

$ |

14,506,647 |

| Liabilities and

stockholders’ equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,340,538 |

|

|

$ |

646,767 |

|

Lease obligation, current |

|

|

152,224 |

|

|

|

150,095 |

|

Accrued expenses and other current liabilities |

|

|

2,034,525 |

|

|

|

2,259,955 |

|

Insurance premium financing payable |

|

|

177,256 |

|

|

|

381,784 |

|

Total current liabilities |

|

|

3,704,543 |

|

|

|

3,438,601 |

|

Lease obligation, net of current portion |

|

|

25,606 |

|

|

|

90,124 |

|

Total liabilities |

|

|

3,730,149 |

|

|

|

3,528,725 |

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

| Preferred stock, $0.001 par

value; 10,000,000 shares authorized; 0 shares issued and

outstanding at June 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

| Common stock, $0.001 par value;

100,000,000 shares authorized; 7,216,145 and 6,186,280 shares

issued and outstanding at June 30, 2024 and December 31, 2023 |

|

|

7,216 |

|

|

|

6,186 |

| Additional paid-in capital |

|

|

81,600,425 |

|

|

|

77,871,584 |

| Accumulated other comprehensive

(loss) income |

|

|

(1,024 |

) |

|

|

877 |

| Accumulated deficit |

|

|

(76,509,968 |

) |

|

|

(66,900,725 |

|

Total stockholders' equity |

|

|

5,096,649 |

|

|

|

10,977,922 |

|

Total liabilities and stockholders’ equity |

|

$ |

8,826,798 |

|

|

$ |

14,506,647 |

| |

|

|

|

|

|

|

Inhibikase Therapeutics, Inc.Condensed Consolidated

Statements of Operations and Comprehensive

Loss(Unaudited) |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

Grant revenue |

$ |

— |

|

$ |

116,410 |

|

$ |

— |

|

$ |

180,931 |

|

| Total revenue |

|

— |

|

|

|

116,410 |

|

|

|

— |

|

|

|

180,931 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

3,075,830 |

|

|

4,535,698 |

|

|

5,827,109 |

|

|

7,389,817 |

|

|

Selling, general and administrative |

|

1,974,705 |

|

|

|

1,783,113 |

|

|

|

4,005,786 |

|

|

|

3,708,464 |

|

| Total costs and expenses |

|

5,050,535 |

|

|

|

6,318,811 |

|

|

|

9,832,895 |

|

|

|

11,098,281 |

|

| Loss from operations |

|

(5,050,535 |

) |

|

|

(6,202,401 |

) |

|

|

(9,832,895 |

) |

|

|

(10,917,350 |

) |

| Interest income (expense) |

|

90,927 |

|

|

|

424,435 |

|

|

|

223,652 |

|

|

|

661,606 |

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

(4,959,608 |

) |

|

|

(5,777,966 |

) |

|

|

(9,609,243 |

) |

|

|

(10,255,744 |

) |

| Other comprehensive income,

net of tax |

|

|

|

|

|

|

|

|

Unrealized (loss) gains on marketable securities |

|

776 |

|

|

|

(167,536 |

) |

|

|

(1,901 |

) |

|

|

(106,432 |

) |

| Comprehensive Loss |

$ |

(4,958,832 |

) |

|

$ |

(5,945,502 |

) |

|

$ |

(9,611,144 |

) |

|

$ |

(10,362,176 |

) |

| Net loss per share – basic and

diluted |

$ |

(0.66 |

) |

|

$ |

(0.94 |

) |

|

$ |

(1.38 |

) |

|

$ |

(1.74 |

) |

| Weighted-average number of

common shares – basic and diluted |

|

7,535,667 |

|

|

|

6,162,280 |

|

|

|

6,939,779 |

|

|

|

5,883,895 |

|

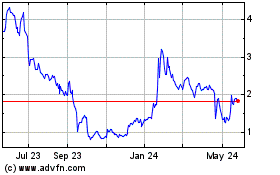

Inhibikase Therapeutics (NASDAQ:IKT)

Historical Stock Chart

From Nov 2024 to Dec 2024

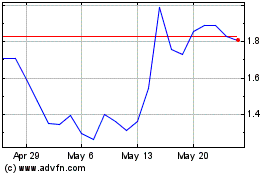

Inhibikase Therapeutics (NASDAQ:IKT)

Historical Stock Chart

From Dec 2023 to Dec 2024