0001446847

false

0001446847

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to

Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

August 8, 2023

IRONWOOD PHARMACEUTICALS, INC.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-34620 |

|

04-3404176 |

| |

|

|

|

|

| (State

or other jurisdiction |

|

|

|

(I.R.S.

Employer |

| of incorporation) |

|

(Commission

File Number) |

|

Identification Number) |

| 100 Summer Street, Suite 2300 |

|

|

|

|

| Boston, Massachusetts |

|

|

|

02110 |

| |

|

|

|

|

| (Address of principal |

|

|

|

|

| executive offices) |

|

|

|

(Zip code) |

(617) 621-7722

(Registrant’s telephone number,

including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

| Class A common stock, $0.001 par value |

IRWD |

Nasdaq Global Select Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company o

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2023, Ironwood Pharmaceuticals, Inc.

issued a press release containing an update on its recent business activities as well as those for the quarter ended June 30, 2023. A

copy of the press release is furnished as Exhibit 99.1 and is incorporated herein by reference.

The press release is being furnished pursuant to

Item 2.02 of this Current Report on Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall

such document be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except

as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Ironwood Pharmaceuticals, Inc. |

| |

|

|

| Dated: August 8, 2023 |

By: |

/s/ Sravan K. Emany |

| |

|

Name: Sravan K. Emany |

| |

|

Title: Senior Vice President, Chief Financial Officer |

Exhibit 99.1

FOR

IMMEDIATE RELEASE

Ironwood Pharmaceuticals

Reports Second Quarter 2023 Results; Raises Full Year 2023 LINZESS® U.S. Net Sales and Ironwood Revenue Guidance

– LINZESS

(Iinaclotide) EUTRx prescription demand growth increased 9% year-over-year; LINZESS U.S. net sales of $270 million, an increase of 9%

year-over-year –

– Expands clinical utility of LINZESS

with FDA approval for pediatric patients ages 6-17 years-old suffering from functional constipation (FC) –

– Strengthens GI development portfolio

with acquisition of VectivBio Holding AG and its lead investigational asset, apraglutide, for the potential treatment of short bowel

syndrome with intestinal failure –

– Completes STARS Phase III clinical

trial enrollment; now expects topline data in March of 2024 –

BOSTON, Mass., August 8, 2023

— Ironwood Pharmaceuticals, Inc. (Nasdaq: IRWD), a GI-focused healthcare company, today reported its second

quarter 2023 results and updated its full year 2023 financial guidance.

“We made significant progress towards the goal of becoming the

leading GI healthcare company, as the second quarter was truly transformative for Ironwood,” said Tom McCourt, chief executive

officer of Ironwood. “LINZESS continued its strong momentum with another quarter of impressive performance. As a result, we are

raising our full-year 2023 U.S. net sales and Ironwood revenue guidance. Furthermore, we are thrilled that in June the FDA approved

LINZESS for the treatment of pediatric patients ages 6 to 17 years-old with functional constipation, expanding its clinical utility and

adding another potential growth driver for the brand. Also in the second quarter, we strengthened our GI portfolio with the acquisition

of VectivBio, including its lead investigational asset, apraglutide, which we believe is poised to become the new standard of care for

patients with short bowel syndrome with intestinal failure if successfully developed and approved, with the potential to achieve $1 billion

in peak net sales. Looking ahead, we are excited about continuing to maximize LINZESS, advance our clinical programs, strengthen our

financial position, and grow Ironwood’s leadership within GI.”

Second Quarter 2023 Financial Highlights1

(in thousands, except for per share amounts)

| | |

2Q 2023 | | |

2Q 2022 | |

| Total revenues | |

$ | 107,382 | | |

$ | 97,231 | |

| Total operating expenses2 | |

| 1,190,521 | | |

| 41,576 | |

| GAAP net income (loss)2 | |

| (1,089,478 | ) | |

| 37,080 | |

| GAAP net income (loss) attributable to Ironwood Pharmaceuticals, Inc.2 | |

| (1,062,187 | ) | |

| 37,080 | |

| GAAP net income (loss) attributable to Ironwood Pharmaceuticals, Inc. per share – basic | |

| (6.84 | ) | |

| 0.24 | |

| GAAP net income (loss) attributable to Ironwood Pharmaceuticals, Inc. per share –diluted | |

| (6.84 | ) | |

| 0.21 | |

| Adjusted EBITDA2 | |

| (1,034,182 | ) | |

| 56,015 | |

| Non-GAAP net income (loss)2 | |

| (1,041,325 | ) | |

| 37,761 | |

| Non-GAAP net income (loss) per share – basic | |

| (6.71 | ) | |

| 0.24 | |

| Non-GAAP net income (loss) per share – diluted | |

| (6.71 | ) | |

| 0.21 | |

| 1. | Refer to the Reconciliation of GAAP Results to Non-GAAP Financial Measures

table and to the Reconciliation of GAAP Net Income to Adjusted EBITDA table at the end of

this press release. Refer to Non-GAAP Financial Measures for additional information. |

| 2. | Includes a one-time charge of approximately $1.1 billion related to acquired

in-process research and development from the acquisition of VectivBio in the second quarter

of 2023. |

Second Quarter 2023 Corporate Highlights

U.S. LINZESS

| · | Prescription

Demand: Total LINZESS prescription demand in the second quarter of 2023 was 47 million

LINZESS capsules, a 9% increase compared to the second quarter of 2022, per IQVIA. |

| · | U.S.

Brand Collaboration: LINZESS U.S. net sales are provided to Ironwood by its U.S. partner,

AbbVie Inc. (“AbbVie”). LINZESS U.S. net sales were $269.7 million in the second

quarter of 2023, a 9% increase compared to $248.4 million in the second quarter of 2022. |

| § | Ironwood

and AbbVie share equally in U.S. brand collaboration profits. See the LINZESS U.S. Commercial

Collaboration table at the end of the press release. |

| – | LINZESS commercial margin

was 71% in the second quarter of 2023, compared to 69% in the second quarter of 2022. See

the U.S. LINZESS Full Brand Collaboration table below and at the end of this press release. |

| – | Net profit for the LINZESS

U.S. brand collaboration, net of commercial and research and development (“R&D”)

expenses, was $180.3 million in the second quarter of 2023, compared to $163.8 million in

the second quarter of 2022. See U.S. LINZESS Full Brand Collaboration table below and at

the end of this press release. |

| · | Collaboration

Revenue to Ironwood: Ironwood recorded $104.8 million in collaboration revenue in the

second quarter of 2023 related to sales of LINZESS in the U.S., an 11% increase compared

to $94.5 million for the second quarter of 2022. See U.S. LINZESS Commercial Collaboration

table at the end of the press release. |

U.S. LINZESS Full Brand Collaboration

(in thousands, except for percentages) | |

Three Months Ended

June 30, | |

| | |

2023 | | |

2022 | |

| LINZESS U.S. net sales as reported by AbbVie | |

$ | 269,686 | | |

$ | 248,351 | |

| AbbVie & Ironwood commercial costs, expenses and other discounts | |

| 78,998 | | |

| 76,363 | |

| Commercial margin | |

| 71 | % | |

| 69 | % |

| AbbVie & Ironwood R&D Expenses | |

| 10,356 | | |

| 8,214 | |

| Total net profit on sales of LINZESS | |

| 180,332 | | |

| 163,774 | |

| Full brand margin | |

| 67 | % | |

| 66 | % |

FDA Approval of New Indication for LINZESS

| · | In

June 2023, Ironwood announced that the U.S. Food and Drug Administration (“FDA”)

approved LINZESS as a once-daily treatment for pediatric patients ages 6-17 years-old suffering

from functional constipation. LINZESS is the first and only FDA-approved prescription therapy

for functional constipation in this patient population. |

Acquisition of VectivBio Holding AG (“VectivBio”)

| · | On

June 29, 2023, Ironwood completed a tender offer to purchase outstanding ordinary

shares of VectivBio (the “VectivBio Shares”) at a price per share of $17.00,

net to the shareholders of VectivBio in cash, without interest and subject to any applicable

withholding taxes. The aggregate consideration paid by Ironwood to acquire the shares accepted

for payment was approximately $1.2 billion. Ironwood financed the acquisition through proceeds

from the borrowings under a revolving credit facility entered into in connection with the

transaction, cash on hand, and cash of VectivBio. |

| · | As

of June 30, 2023, Ironwood holds 98% of the outstanding VectivBio Shares. Ironwood

intends to effect a squeeze-out merger under Swiss law to acquire the remaining outstanding

VectivBio Shares in the second half of 2023. The remaining outstanding VectivBio Shares are

expected to be settled by Ironwood in cash. |

Workforce Reductions and Restructuring

| · | In

April 2023, Ironwood reduced its workforce by approximately 10% of its headquarters-based

personnel in an effort to further strengthen the operational efficiency of the organization.

The workforce reduction was substantially completed during the second quarter of 2023. |

| · | In

June 2023, Ironwood commenced the elimination of certain positions in connection

with the VectivBio acquisition. The majority of the eliminations were initiated in June 2023

and the remaining eliminations are expected to be substantially completed during the third

quarter of 2023. |

Pipeline Updates

Apraglutide

| · | Ironwood

is advancing apraglutide, a next-generation, synthetic peptide glucagon-like peptide-2 (“GLP-2”)

analog which Ironwood is developing for short bowel syndrome with intestinal failure (“SBS-IF”),

a severe malabsorptive condition. Ironwood believes apraglutide has the potential to

be the new standard of care for the treatment of SBS-IF based on its potency and pharmacological

properties. Ironwood is conducting a Phase III clinical trial, STARS, designed

to evaluate clinical benefit for both SBS-IF stoma and colon-in-continuity patients with

unique convenience of weekly dosing. Enrollment is completed and topline results are now

expected in March of 2024. |

| · | Ironwood

is also conducting a Phase II proof-of-concept clinical trial, STARGAZE, to evaluate apraglutide

in patients with steroid-refractory gastrointestinal acute Graft versus Host Disease (aGvHD),

a life-threatening condition that occurs when immune cells from the donor attack a recipient’s

healthy cells after an allogeneic hematopoietic stem cell transplant. Ironwood expects data

for the STARGAZE Phase II clinical trial in the first quarter of 2024. |

CNP-104

| · | Ironwood

has a collaboration and license option agreement with COUR Pharmaceuticals Development Company, Inc.

(“COUR”). This agreement grants Ironwood an option to acquire an exclusive license

to research, develop, manufacture and commercialize, in the U.S., products containing CNP-104

(“CNP-104”), a tolerizing immune modifying nanoparticle, for the treatment of

primary biliary cholangitis (“PBC”), a rare autoimmune disease targeting the

liver. If successful, CNP-104 has the potential to be the first approved PBC disease modifying

therapy. |

| · | COUR

is currently conducting a clinical study for CNP-104 evaluating the safety, tolerability,

pharmacodynamic effects and efficacy of CNP-104 in PBC patients, with early data assessing

T-cell response from patients enrolled in the clinical study expected in the second half

of 2023, which Ironwood believes will inform timing of topline data. |

IW-3300

| · | Ironwood

is currently advancing IW-3300, a guanylate cyclase-C agonist being developed for the potential

treatment of visceral pain conditions, such as interstitial cystitis / bladder pain syndrome

(“IC/BPS”) and endometriosis. Ironwood is continuing the Phase II proof of concept

study in IC/BPS. |

Second Quarter 2023 Financial Results

| · | Total

Revenues. Total revenues in the second quarter of 2023 were $107.4 million, compared

to $97.2 million in the second quarter of 2022. |

| – | Total revenues in the second

quarter of 2023 consisted of $104.8 million associated with Ironwood’s share of the

net profits from the sales of LINZESS in the U.S. and $2.6 million in royalties and other

revenue. Total revenues in the second quarter of 2022 consisted of $94.5 million associated

with Ironwood’s share of the net profits from the sales of LINZESS in the U.S. and

$2.7 million in royalties and other revenue. |

| · | Operating

Expenses. Operating expenses in the second quarter of 2023 were $1,190.5 million, which

includes a one-time charge of $1,090.4 million of acquired IPR&D (“IPR&D”)

from the acquisition of VectivBio, compared to $41.6 million in the second quarter of 2022. |

| – | Operating expenses in the

second quarter of 2023 consisted of $52.5 million in selling, general and administrative

(“SG&A”) expenses, and $34.6 million in research and development (“R&D”)

expenses, $13.0 million in restructuring expenses and approximately $1.1 billion in acquired

in-process research and development. Operating expenses in the second quarter of 2022 consisted

of $30.1 million in SG&A expenses and $11.5 million in R&D expenses. |

| · | Interest

Expense and Other Financing Costs. Interest expense was $1.8 million in the second quarter

of 2023, in connection with Ironwood’s convertible senior notes and revolving credit

facility. Interest expense recorded in the second quarter of 2023 included $1.3 million in

cash expense and $0.5 million in non-cash expense. Interest expense was $2.2 million in the

second quarter of 2022, in connection with Ironwood’s convertible senior notes. Interest

expense recorded in the second quarter of 2022 included $1.7 million in cash expense and

$0.5 million in non-cash expense. |

| · | Interest

and Investment Income. Interest and investment income was $8.8 million in the second

quarter of 2023. Interest and investment income was $1.0 million in the second quarter of

2022. |

| · | Loss

on Derivatives. Ironwood recorded a loss on derivatives of $0.7 million in the second

quarter of 2022 as a result of the change in fair value of its convertible note hedges and

note hedge warrants. Ironwood’s note hedge warrants and convertible note hedges terminated

unexercised upon expiration in April 2023 and June 2022, respectively. |

| · | Income

Tax Expense. Ironwood recorded $13.3 million of income tax expense in the second quarter

of 2023, the majority of which was non-cash, as Ironwood continues to utilize net operating

losses to offset taxable income for federal purposes and in many states. Ironwood recorded

$16.7 million of income tax expense in the second quarter of 2022. |

| · | GAAP

Net Income (Loss) Attributable to Ironwood. GAAP net loss was ($1,062.2) million, or ($6.84) per share (basic

and diluted) in the second quarter of 2023, which includes a one-time charge of ($1,090.4)

million of acquired IPR&D from the acquisition of VectivBio, compared to GAAP net income

of $37.1 million, or $0.24 per share (basic) and $0.21 per share (diluted) in the second

quarter of 2022. |

| · | Non-GAAP

Net Income (Loss). Non-GAAP net loss was ($1,041.3) million, or ($6.71) per share (basic

and diluted) in the second quarter of 2023, which includes a one-time charge of ($1,090.4)

million of acquired IPR&D from the acquisition of VectivBio, compared to non-GAAP net

income of $37.8 million, or $0.24 per share (basic) and $0.21 (diluted) in the second quarter

of 2022. |

| – | Non-GAAP net income excludes

the impact of mark-to-market adjustments on the derivatives related to Ironwood’s 2022

Convertible Notes, amortization of acquired intangible assets, restructuring expenses and

acquisition-related costs, all net of tax effect. See Non-GAAP Financial Measures below. |

| · | Adjusted

EBITDA. Adjusted EBITDA was ($1,034.2) million in the second quarter of 2023, which includes

a one-time charge of ($1,090.4) million of acquired IPR&D from the acquisition of VectivBio,

compared to $56.0 million in the second quarter of 2022. |

| – | Adjusted EBITDA is calculated

by subtracting mark-to-market adjustments on derivatives related to Ironwood’s 2022

Convertible Notes, restructuring expenses, acquisition-related costs, net interest expense,

income taxes, depreciation and amortization, and acquisition-related costs, from GAAP net

income. See Non-GAAP Financial Measures below. |

| · | Cash

Flow Highlights. Ironwood ended the second quarter of 2023 with $175.3 million of cash

and cash equivalents, compared to $656.2 million of cash and cash equivalents at the end

of 2022. |

| – | Ironwood generated approximately $35.0 million in cash from operations in the second quarter of 2023, compared to $61.4 million

in cash from operations in the second quarter of 2022. |

| – | The acquisition of VectivBio

was funded through proceeds from a revolving credit agreement, cash on hand and cash of VectivBio. |

| · | Ironwood

2023 Financial Guidance. Ironwood is increasing its 2023 U.S. LINZESS net sales and total

revenue growth guidance and updating its adjusted EBITDA financial guidance. |

| |

Prior

2023 Guidance |

Updated

2023 Guidance |

| U.S.

LINZESS Net Sales Growth |

3%

to 5% |

6%

to 8% |

| Total

Revenue |

$420

to $435 million |

$435

to $450 million |

| Adjusted

EBITDA1 |

>$250 million

|

~ ($900) million2

Includes a one-time charge of approximately

$1.1 billion from acquisition of VectivBio |

1 Adjusted EBITDA is calculated by subtracting mark-to-market

adjustments on derivatives related to Ironwood’s 2022 Convertible Notes, restructuring expenses, net interest expense, income taxes,

depreciation and amortization, and acquisition-related costs from GAAP net income.

2 Updated 2023 adjusted EBITDA guidance includes a one-time

charge of approximately $1.1 billion related to acquired in-process research and development from the acquisition of VectivBio in the

second quarter of 2023. For purposes of this guidance, Ironwood has assumed that it will not incur material expenses related to

additional business development activities in 2023.

Non-GAAP Financial Measures

Ironwood presents non-GAAP net income and non-GAAP net income per

share to exclude the impact, net of tax effects, of net gains and losses on derivatives related to Ironwood’s 2022 Convertible

Notes that are required to be marked-to-market, restructuring expenses, and acquisition-related costs. Non-GAAP adjustments are further

detailed below:

| · | The

gains and losses on the derivatives related to Ironwood’s 2022 Convertible Notes were

highly variable, difficult to predict and of a size that could have a substantial impact

on the company’s reported results of operations in any given period. |

| · | Restructuring

expenses are considered to be a non-recurring event as they are associated with distinct

operational decisions. Included in restructuring expenses are costs associated with exit

and disposal activities. |

| · | Acquisition-related

costs in connection with the acquisition of VectivBio are considered to be non-recurring

and include direct and incremental costs associated with the acquisition and integration

of VectivBio to the extent such costs were not classified as capitalizable transaction costs

attributed to the cost of net assets acquired through acquisition accounting. |

Ironwood also presents adjusted EBITDA, a non-GAAP measure, as well

as guidance on adjusted EBITDA. Adjusted EBITDA is calculated by subtracting mark-to-market adjustments on derivatives related to Ironwood’s

2022 Convertible Notes, restructuring expenses, net interest expense, income taxes, depreciation and amortization, and acquisition-related

costs from GAAP net income. The adjustments are made on a similar basis as described above related to non-GAAP net income, as applicable.

Management believes this non-GAAP information is useful for investors,

taken in conjunction with Ironwood’s GAAP financial statements, because it provides greater transparency and period-over-period

comparability with respect to Ironwood’s operating performance. These measures are also used by management to assess the performance

of the business. Investors should consider these non-GAAP measures only as a supplement to, not as a substitute for or as superior to,

measures of financial performance prepared in accordance with GAAP. In addition, these non-GAAP financial measures are unlikely to be

comparable with non-GAAP information provided by other companies. For a reconciliation of non-GAAP net income and non-GAAP net income

per share to GAAP net income and GAAP net income per share, respectively, and for a reconciliation of adjusted EBITDA to GAAP net income,

please refer to the tables at the end of this press release.

Ironwood does not provide guidance on GAAP net income or a reconciliation

of expected adjusted EBITDA to expected GAAP net income because, without unreasonable efforts, it is unable to predict with reasonable

certainty the non-GAAP adjustments used to calculate adjusted EBITDA. These adjustments are uncertain, depend on various factors

and could have a material impact on GAAP net income for the guidance period.

Conference Call Information

Ironwood will host a conference call

and webcast at 8:30 a.m. Eastern Time on Tuesday, August 8, 2023 to discuss its second quarter 2023 results and recent business

activities. Individuals interested in participating in the call should dial (888) 330-2384 (U.S. and Canada) or (240) 789-2701 (international)

using conference ID number and event passcode 4671230. To access the webcast, please visit the Investors section of Ironwood’s

website at www.ironwoodpharma.com at least 15 minutes prior to the start of the call to ensure adequate time for any software downloads

that may be required. The call will be available for replay via telephone starting at approximately 11:30 a.m. Eastern Time on August 8,

2023, running through 11:59 p.m. Eastern Time on August 22, 2023. To listen to the replay, dial (800) 770-2030 (U.S.

and Canada) or (647) 362-9199 (international) using conference ID number 4671230. The archived webcast will be available on Ironwood’s

website for 14 days beginning approximately one hour after the call has completed.

About Ironwood Pharmaceuticals

Ironwood Pharmaceuticals (Nasdaq: IRWD), an S&P

SmallCap 600® company, is a leading global gastrointestinal (GI) healthcare company on a mission to advance the treatment of GI diseases

and redefine the standard of care for GI patients. We are pioneers in the development of LINZESS® (linaclotide), the U.S. branded

prescription market leader for adults with irritable bowel syndrome with constipation (IBS-C) or chronic idiopathic constipation (CIC).

LINZESS is also approved for the treatment of functional constipation in pediatric patients ages 6-17 years-old. Ironwood is also advancing

apraglutide, a next-generation, long-acting synthetic GLP-2 analog being developed for rare gastrointestinal diseases, including short

bowel syndrome with intestinal failure (SBS-IF) as well as several earlier stage assets. Building upon our history of GI innovation,

we keep patients at the heart of our R&D and commercialization efforts to reduce the burden of GI diseases and address significant

unmet needs.

Founded in 1998, Ironwood Pharmaceuticals

is headquartered in Boston, Massachusetts, and has additional operations in Basel, Switzerland.

We

routinely post information that may be important to investors on our website at www.ironwoodpharma.com.

In addition, follow us on Twitter and

on LinkedIn.

About LINZESS (linaclotide)

LINZESS® is the #1 prescribed brand in the U.S. for the treatment

of adult patients with irritable bowel syndrome with constipation (“IBS-C”) or chronic idiopathic constipation (“CIC”),

based on IQVIA data.

LINZESS is a once-daily capsule that helps relieve the abdominal pain,

constipation, and overall abdominal symptoms of bloating, discomfort and pain associated with IBS-C, as well as the constipation, infrequent

stools, hard stools, straining, and incomplete evacuation associated with CIC. LINZESS relieves constipation in children and adolescents

aged 6 to 17 years with functional constipation. The recommended dose is 290 mcg for IBS-C patients and 145 mcg for CIC patients, with

a 72 mcg dose approved for use in CIC depending on individual patient presentation or tolerability. In children with functional constipation

aged 6 to 17 years, the recommended dose is 72 mcg.

LINZESS is not a laxative; it is the first medicine approved by the

FDA in a class called GC-C agonists. LINZESS contains a peptide called linaclotide that activates the GC-C receptor in the intestine.

Activation of GC-C is thought to result in increased intestinal fluid secretion and accelerated transit and a decrease in the activity

of pain-sensing nerves in the intestine. The clinical relevance of the effect on pain fibers, which is based on nonclinical studies,

has not been established.

In the United States, Ironwood and AbbVie co-develop and co-commercialize

LINZESS for the treatment of adults with IBS-C or CIC. In Europe, AbbVie markets linaclotide under the brand name CONSTELLA® for

the treatment of adults with moderate to severe IBS-C. In Japan, Ironwood's partner, Astellas, markets linaclotide under the brand

name LINZESS for the treatment of adults with IBS-C or CIC. Ironwood also has partnered with AstraZeneca for development and commercialization

of LINZESS in China, and with AbbVie for development and commercialization of linaclotide in all other territories worldwide.

LINZESS Important Safety Information

INDICATIONS AND USAGE

LINZESS® (linaclotide) is indicated for the treatment of both

irritable bowel syndrome with constipation (IBS-C) and chronic idiopathic constipation (CIC) in adults and functional constipation (FC)

in children and adolescents 6 to 17 years of age. It is not known if LINZESS is safe and effective in children with FC less than 6 years

of age or in children with IBS-C less than 18 years of age.

IMPORTANT SAFETY INFORMATION

WARNING: RISK OF SERIOUS DEHYDRATION IN PEDIATRIC PATIENTS

LESS THAN 2 YEARS OF AGE

LINZESS is contraindicated in patients less than 2 years of

age. In nonclinical studies in neonatal mice, administration of a single, clinically relevant adult oral dose of linaclotide caused

deaths due to dehydration. |

Contraindications

| · | LINZESS

is contraindicated in patients less than 2 years of age due to the risk of serious dehydration. |

| · | LINZESS

is contraindicated in patients with known or suspected mechanical gastrointestinal obstruction. |

Warnings and Precautions

| · | LINZESS

is contraindicated in patients less than 2 years of age. In neonatal mice, linaclotide increased

fluid secretion as a consequence of age-dependent elevated guanylate cyclase (GC-C) agonism,

which was associated with increased mortality within the first 24 hours due to dehydration.

There was no age dependent trend in GC-C intestinal expression in a clinical study of children

2 to less than 18 years of age; however, there are insufficient data available on GC-C intestinal

expression in children less than 2 years of age to assess the risk of developing diarrhea

and its potentially serious consequences in these patients. |

Diarrhea

| · | In

adults, diarrhea was the most common adverse reaction in LINZESS-treated patients in the

pooled IBS-C and CIC double-blind placebo-controlled trials. The incidence of diarrhea was

similar in the IBS-C and CIC populations. Severe diarrhea was reported in 2% of 145 mcg and

290 mcg LINZESS-treated patients and in <1% of 72 mcg LINZESS-treated CIC patients. |

| · | In

children and adolescents 6 to 17 years of age, diarrhea was the most common adverse reaction

in 72 mcg LINZESS-treated patients in the FC double-blind placebo-controlled trial. Severe

diarrhea was reported in <1% of 72 mcg LINZESS treated patients. If severe diarrhea occurs,

dosing should be suspended and the patient rehydrated. |

Common Adverse Reactions (incidence

≥2% and greater than placebo)

| · | In

IBS-C or CIC adult patients: diarrhea, abdominal pain, flatulence, and abdominal distension. |

| · | In

FC pediatric patients: diarrhea. |

Please see full Prescribing Information

including Boxed Warning: http://www.allergan.com/assets/pdf/linzess_pi

LINZESS® and CONSTELLA® are registered trademarks of Ironwood

Pharmaceuticals, Inc. Any other trademarks referred to in this press release are the property of their respective owners. All rights

reserved.

Forward-Looking Statements

This press release contains forward-looking statements. Investors

are cautioned not to place undue reliance on these forward-looking statements, including statements about Ironwood’s ability to

execute on its mission; Ironwood’s strategy, business, financial position and operations; Ironwood’s ability to drive growth

and profitability; the demand, development, commercial availability and commercial potential of linaclotide, including pursuing highly

differentiated GI assets to add to our portfolio, and the drivers, timing, impact and results thereof; the potential indications for,

and benefits of, linaclotide; our financial performance and results, and guidance and expectations related thereto; LINZESS prescription

demand growth, LINZESS U.S. net sales growth, total revenue and adjusted EBITDA in 2023; our ability to develop apraglutide and the expected

timing of receiving data from the apraglutide clinical trials; the commercial potential of apraglutide, including potential peak net

sales, and the potential of apraglutide to become the standard of care for patients with SBS-IF; the potential of CNP-104 to be the first

PBC disease modifying therapy and the expected timing of receiving data from the clinical study for CNP-104 in PBC patients and the results

thereof, and the belief that this will inform timing of topline data; our plan to advance IW-3300 including the timing and results thereof;

our plans for completing statutory squeeze-out merger, and the expected timing thereof. These forward-looking statements speak only as

of the date of this press release, and Ironwood undertakes no obligation to update these forward-looking statements. Each forward-looking

statement is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied

in such statement. Applicable risks and uncertainties include those related to the effectiveness of development and commercialization

efforts by us and our partners; preclinical and clinical development, manufacturing and formulation development of linaclotide, apraglutide,

CNP-104, IW-3300, and our product candidates; the risk that clinical programs and studies, including for the linaclotide pediatric

program, apraglutide, IW-3300 and CNP-104, may not progress or develop as anticipated, including that studies are delayed or discontinued

for any reason, such as safety, tolerability, enrollment, manufacturing, economic or other reasons; the risk that findings from our completed

nonclinical and clinical studies may not be replicated in later studies; the risk that we or our partners are unable to obtain, maintain

or manufacture sufficient LINZESS or our product candidates, or otherwise experience difficulties with respect to supply or manufacturing;

the efficacy, safety and tolerability of linaclotide and our product candidates; the risk that the commercial and therapeutic opportunities

for LINZESS or our product candidates are not as we expect; decisions by regulatory and judicial authorities; the risk we may never get

additional patent protection for linaclotide and other product candidates, that patents for linaclotide or other products may not provide

adequate protection from competition, or that we are not able to successfully protect such patents; the risk that we are unable to manage

our expenses or cash use, or are unable to commercialize our products as expected; the risk that the development of any of our linaclotide

pediatric programs, apraglutide, CNP-104 and/or IW-3300 are not successful or that any of our product candidates is not successfully

commercialized; outcomes in legal proceedings to protect or enforce the patents relating to our products and product candidates, including

abbreviated new drug application litigation; the risk that financial and operating results may differ from our projections; developments

in the intellectual property landscape; challenges from and rights of competitors or potential competitors; the risk that our planned

investments do not have the anticipated effect on our company revenues; developments in accounting guidance or practice; Ironwood’s

or AbbVie’s accounting practices, including reporting and settlement practices as between Ironwood and AbbVie; the risk that we

are unable to manage our expenses or cash use, or are unable to commercialize our products as expected; the impact of the COVID-19 pandemic;

and the risks listed under the heading “Risk Factors” and elsewhere in Ironwood's Annual Report on Form 10-K for the

year ended December 31, 2022, and in our subsequent Securities and Exchange Commission filings.

Investors:

Greg Martini, 617-374-5230

gmartini@ironwoodpharma.com

Matt Roache, 617-621-8395

mroache@ironwoodpharma.com

Media:

Beth Calitri, 978-417-2031

bcalitri@ironwoodpharma.com

Condensed Consolidated

Balance Sheets

(In thousands)

(unaudited)

| | |

June 30,

2023 | | |

December 31,

2022 | |

| Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 175,321 | | |

$ | 656,203 | |

| Accounts receivable, net | |

| 118,990 | | |

| 115,458 | |

| Prepaid expenses and other current assets | |

| 22,500 | | |

| 7,715 | |

| Restricted cash | |

| 788 | | |

| 1,250 | |

| Total current assets | |

| 317,599 | | |

| 780,626 | |

| Restricted cash, net of current portion | |

| 510 | | |

| 485 | |

| Accounts receivable, net of current portion | |

| - | | |

| 14,589 | |

| Property and equipment, net | |

| 5,876 | | |

| 6,288 | |

| Operating lease right-of-use assets | |

| 13,319 | | |

| 14,023 | |

| Intangible assets, net | |

| 4,096 | | |

| - | |

| Deferred tax assets | |

| 257,900 | | |

| 283,661 | |

| Other assets | |

| 3,920 | | |

| 847 | |

| Total assets | |

$ | 603,220 | | |

$ | 1,100,519 | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Accounts payable | |

$ | 3,505 | | |

$ | 483 | |

| Accrued research and development costs | |

| 20,122 | | |

| 5,258 | |

| Accrued expenses and other current liabilities | |

| 79,585 | | |

| 16,700 | |

| Current portion of operating lease liabilities | |

| 3,095 | | |

| 3,065 | |

| Current portion on convertible senior notes | |

| 199,083 | | |

| - | |

| Note hedge warrants | |

| - | | |

| 19 | |

| Total current liabilities | |

| 305,390 | | |

| 25,525 | |

| Operating lease liabilities, net of current portion | |

| 15,598 | | |

| 16,599 | |

| Convertible senior notes, net of current portion | |

| 197,974 | | |

| 396,251 | |

| Revolving credit facility | |

| 400,000 | | |

| - | |

| Other liabilities | |

| 31,035 | | |

| 9,766 | |

| Total stockholders’ equity (deficit) | |

| (346,777 | ) | |

| 652,378 | |

| Total liabilities and stockholders’ equity (deficit) | |

$ | 603,220 | | |

$ | 1,100,519 | |

Condensed Consolidated Statements of Income

(In thousands, except per share amounts)

(unaudited)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| Collaborative arrangements revenue | |

$ | 107,382 | | |

$ | 97,231 | | |

$ | 211,443 | | |

$ | 194,760 | |

| Total revenues | |

| 107,382 | | |

| 97,231 | | |

| 211,443 | | |

| 194,760 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 34,577 | | |

| 11,452 | | |

| 47,424 | | |

| 22,274 | |

| Selling, general and administrative | |

| 52,484 | | |

| 30,124 | | |

| 83,601 | | |

| 58,985 | |

| Restructuring expenses | |

| 13,011 | | |

| - | | |

| 13,011 | | |

| - | |

| Acquired in-process research and development | |

| 1,090,449 | | |

| - | | |

| 1,090,449 | | |

| - | |

| Total operating expenses | |

| 1,190,521 | | |

| 41,576 | | |

| 1,234,485 | | |

| 81,259 | |

| Income (loss) from operations | |

| (1,083,139 | ) | |

| 55,655 | | |

| (1,023,042 | ) | |

| 113,501 | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense and other financing costs | |

| (1,840 | ) | |

| (2,207 | ) | |

| (3,367 | ) | |

| (4,548 | ) |

| Interest and investment income | |

| 8,757 | | |

| 1,018 | | |

| 16,029 | | |

| 1,248 | |

| Gain (loss) on derivatives | |

| - | | |

| (681 | ) | |

| 19 | | |

| 49 | |

| Other income (expense), net | |

| 6,917 | | |

| (1,870 | ) | |

| 12,681 | | |

| (3,251 | ) |

| Income (loss) before income taxes | |

| (1,076,222 | ) | |

| 53,785 | | |

| (1,010,361 | ) | |

| 110,250 | |

| Income tax expense | |

| (13,256 | ) | |

| (16,705 | ) | |

| (33,403 | ) | |

| (34,369 | ) |

| GAAP net income (loss) | |

| (1,089,478 | ) | |

| 37,080 | | |

| (1,043,764 | ) | |

| 75,881 | |

| Less: GAAP net income (loss) attributable to noncontrolling interests | |

| (27,291 | ) | |

| - | | |

| (27,291 | ) | |

| - | |

| GAAP net income (loss) attributable to Ironwood Pharmaceuticals, Inc. | |

$ | (1,062,187 | ) | |

$ | 37,080 | | |

$ | (1,016,473 | ) | |

$ | 75,881 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP net income (loss) attributable to Ironwood

Pharmaceuticals, Inc. per share—basic | |

$ | (6.84 | ) | |

$ | 0.24 | | |

$ | (6.56 | ) | |

$ | 0.49 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP net income (loss) attributable to Ironwood

Pharmaceuticals, Inc. per share—diluted | |

$ | (6.84 | ) | |

$ | 0.21 | | |

$ | (6.56 | ) | |

$ | 0.42 | |

Reconciliation of GAAP Results to Non-GAAP

Financial Measures

(In thousands, except per share amounts) (unaudited)

A reconciliation between net income on a GAAP basis and on a non-GAAP

basis is as follows:

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP net income (loss)1 | |

$ | (1,089,478 | ) | |

$ | 37,080 | | |

$ | (1,043,764 | ) | |

$ | 75,881 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Mark-to-market adjustments on the derivatives related to convertible notes, net | |

| 0 | | |

| 681 | | |

| (19 | ) | |

| (49 | ) |

| Amortization of acquired intangible assets | |

| 4 | | |

| - | | |

| 4 | | |

| - | |

| Restructuring expenses | |

| 13,011 | | |

| - | | |

| 13,011 | | |

| - | |

| Acquisition-related costs | |

| 35,681 | | |

| - | | |

| 35,681 | | |

| - | |

| Tax effect of adjustments | |

| (543 | ) | |

| - | | |

| (543 | ) | |

| - | |

| Non-GAAP net income (loss)1 | |

$ | (1,041,325 | ) | |

$ | 37,761 | | |

$ | (995,630 | ) | |

$ | 75,832 | |

A reconciliation between basic net income per share on a GAAP basis

and on a non-GAAP basis is as follows:

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP net income (loss) attributable to Ironwood Pharmaceuticals, Inc. per share –basic | |

$ | (6.84 | ) | |

$ | 0.24 | | |

$ | (6.56 | ) | |

$ | 0.49 | |

| Plus: GAAP net

income (loss) attributable to noncontrolling interests – basic | |

$ | (0.18 | ) | |

| - | | |

$ | (0.18 | ) | |

| - | |

| Adjustments to GAAP net income (loss) per share (as detailed above) | |

| 0.31 | | |

| - | | |

| 0.31 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP net income per share (loss) –basic | |

$ | (6.71 | ) | |

$ | 0.24 | | |

$ | (6.43 | ) | |

$ | 0.49 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares used to calculate net income per share — basic | |

| 155,367 | | |

| 153,304 | | |

| 154,912 | | |

| 155,550 | |

A reconciliation between diluted net income per share on a GAAP basis

and on a non-GAAP basis is as follows:

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP net income (loss) attributable to Ironwood Pharmaceuticals, Inc. per share – diluted | |

$ | (6.84 | ) | |

$ | 0.24 | | |

$ | (6.56 | ) | |

$ | 0.49 | |

| Plus: GAAP net

income (loss) attributable to noncontrolling interests – diluted | |

$ | (0.18 | ) | |

| - | | |

$ | (0.18 | ) | |

| - | |

| Adjustments to GAAP net income per share (loss) (as detailed above) | |

| 0.31 | | |

| - | | |

| 0.31 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP net income per share (loss) – diluted | |

$ | (6.71 | ) | |

$ | 0.21 | | |

$ | (6.43 | ) | |

$ | 0.42 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares used to calculate net income per share — diluted | |

| 155,367 | | |

| 184,876 | | |

| 154,912 | | |

| 187,315 | |

1

GAAP and non-GAAP net loss for three months ended June 30, 2023 and for six months ended June 30, 2023 include a one-time charge of approximately

$1.1 billion related to acquired in-process research and development from the acquisition of VectivBio in the second quarter of 2023

Reconciliation of GAAP Net Income to Adjusted

EBITDA

(In

thousands)

(unaudited)

A reconciliation of GAAP net income to adjusted EBITDA:

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP net income (loss)1 | |

$ | (1,089,478 | ) | |

$ | 37,080 | | |

$ | (1,043,764 | ) | |

$ | 75,881 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Mark-to-market adjustments on the derivatives related to convertible notes, net | |

| 0 | | |

| 681 | | |

| (19 | ) | |

| (49 | ) |

| Restructuring expenses | |

| 13,011 | | |

| - | | |

| 13,011 | | |

| - | |

| Interest expense | |

| 1,840 | | |

| 2,207 | | |

| 3,367 | | |

| 4,548 | |

| Interest and investment income | |

| (8,757 | ) | |

| (1,018 | ) | |

| (16,029 | ) | |

| (1,248 | ) |

| Income tax expense | |

| 13,256 | | |

| 16,705 | | |

| 33,403 | | |

| 34,369 | |

| Depreciation and amortization | |

| 265 | | |

| 360 | | |

| 551 | | |

| 715 | |

| Acquisition-related costs | |

| 35,681 | | |

| - | | |

| 35,681 | | |

| - | |

| Adjusted EBITDA1 | |

$ | (1,034,182 | ) | |

$ | 56,015 | | |

$ | (973,799 | ) | |

$ | 114,216 | |

1

GAAP net loss and adjusted EBITDA for three months ended June 30, 2023 and for six months ended June 30, 2023 includes a one-time charge

of approximately $1.1 billion related to acquired in-process research and development from the acquisition of VectivBio in the second

quarter of 2023.

U.S. LINZESS Commercial Collaboration1

Revenue/Expense Calculation

(In thousands)

(unaudited)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| LINZESS U.S. net sales as reported by AbbVie2 | |

$ | 269,686 | | |

$ | 248,351 | | |

$ | 519,900 | | |

$ | 480,685 | |

| AbbVie & Ironwood commercial costs, expenses and other discounts3 | |

| 78,998 | | |

| 76,363 | | |

| 145,406 | | |

| 137,379 | |

| Commercial profit on sales of LINZESS | |

$ | 190,688 | | |

$ | 171,988 | | |

$ | 374,494 | | |

$ | 343,306 | |

| Commercial Margin4 | |

| 71 | % | |

| 69 | % | |

| 72 | % | |

| 71 | % |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Ironwood’s share of net profit | |

| 95,344 | | |

| 85,994 | | |

| 187,247 | | |

| 171,653 | |

| Reimbursement for Ironwood’s commercial expenses | |

| 9,407 | | |

| 8,458 | | |

| 19,135 | | |

| 17,118 | |

| Ironwood’s collaborative arrangement revenue | |

$ | 104,751 | | |

$ | 94,452 | | |

$ | 206,382 | | |

$ | 188,771 | |

1

Ironwood collaborates with AbbVie on the development and commercialization of linaclotide in North America. Under the terms of the collaboration

agreement, Ironwood receives 50% of the net profits and bears 50% of the net losses from the commercial sale of LINZESS in the U.S. The

purpose of this table is to present calculations of Ironwood’s share of net profit (loss) generated from the sales of LINZESS in

the U.S. and Ironwood’s collaboration revenue/expense; however, the table does not present the research and development expenses

related to LINZESS in the U.S. that are shared equally between the parties under the collaboration agreement. Please refer to the table

at the end of this press release for net profit for the U.S. LINZESS brand collaboration with AbbVie.

2

LINZESS net sales are recognized using AbbVie’s revenue recognition accounting policies and reporting conventions. As a result,

certain rebates and discounts are classified as LINZESS U.S. commercial costs, expenses and other discounts within Ironwood’s calculation

of collaborative arrangements revenue.

3 Includes certain discounts recognized and cost of goods sold incurred

by AbbVie; also includes commercial costs incurred by AbbVie and Ironwood that are attributable to the cost-sharing arrangement between

the parties.

4

Commercial margin is defined as commercial profit on sales of LINZESS as a percent of total LINZESS U.S. net sales.

US LINZESS Full Brand Collaboration1

Revenue/Expense Calculation

(In thousands)

(unaudited)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| LINZESS U.S. net sales as reported by AbbVie2 | |

$ | 269,686 | | |

$ | 248,351 | | |

$ | 519,900 | | |

$ | 480,685 | |

| AbbVie & Ironwood commercial costs, expenses and other discounts3 | |

| 78,998 | | |

| 76,363 | | |

| 145,406 | | |

| 137,379 | |

| AbbVie & Ironwood R&D Expenses4 | |

| 10,356 | | |

| 8,214 | | |

| 19,006 | | |

| 16,380 | |

| Total net profit on sales of LINZESS | |

$ | 180,332 | | |

$ | 163,774 | | |

$ | 355,488 | | |

$ | 326,926 | |

1 Ironwood collaborates with AbbVie on the development

and commercialization of linaclotide in North America. Under the terms of the collaboration agreement, Ironwood receives 50% of the net

profits and bears 50% of the net losses from the commercial sale of LINZESS in the U.S. The purpose of this table is to present calculations

of the total net profit (loss) generated from the sales of LINZESS in the U.S., including the commercial costs and expenses and the research

and development expenses related to LINZESS in the U.S. that are shared equally between the parties under the collaboration agreement.

2

LINZESS net sales are recognized using AbbVie’s revenue recognition accounting policies and reporting conventions. As a result,

certain rebates and discounts are classified as LINZESS U.S. commercial costs, expenses and other discounts within Ironwood’s calculation

of collaborative arrangements revenue.

3

Includes certain discounts recognized and cost of goods sold incurred by AbbVie; also includes commercial costs incurred by AbbVie and

Ironwood that are attributable to the cost-sharing arrangement between the parties.

4

R&D expenses related to LINZESS in the U.S. are shared equally between Ironwood and AbbVie under the collaboration agreement.

v3.23.2

Cover

|

Aug. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity File Number |

001-34620

|

| Entity Registrant Name |

IRONWOOD PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0001446847

|

| Entity Tax Identification Number |

04-3404176

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

100 Summer Street

|

| Entity Address, Address Line Two |

Suite 2300

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02110

|

| City Area Code |

617

|

| Local Phone Number |

621-7722

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.001 par value

|

| Trading Symbol |

IRWD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

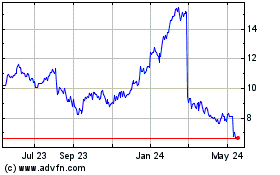

Ironwood Pharmaceuticals (NASDAQ:IRWD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ironwood Pharmaceuticals (NASDAQ:IRWD)

Historical Stock Chart

From Mar 2024 to Mar 2025