false

0001585608

0001585608

2024-08-13

2024-08-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 13, 2024

JAGUAR HEALTH, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

001-36714 |

46-2956775 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

200 Pine Street, Suite 400

San Francisco, California |

94104 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (415) 371-8300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, Par Value $0.0001 Per Share |

JAGX |

The Nasdaq Capital Market |

Item 2.02 Results of Operations and Financial

Conditions.

On August 13, 2024, Jaguar Health, Inc. (the “Company”)

issued a press release announcing second quarter 2024 results. A copy of this press release is furnished as Exhibit 99.1 to this

report.

The information in Item 2.02 and the press release furnished as Exhibit 99.1

hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference into any of the Company’s

filings under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in any such filing.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

JAGUAR HEALTH, INC. |

| |

|

| |

By: |

/s/ Lisa A. Conte |

| |

|

Name: |

Lisa A. Conte |

| |

|

Title: |

President and Chief Executive Officer |

Date: August 13, 2024

Exhibit 99.1

Jaguar Health

Reports Second Quarter 2024 Financial Results

The combined net Q2 2024 revenue of approximately

$2.72 million for prescription and non-prescription products increased approximately 16% versus net Q1 2024 revenue of $2.35 million and

2.0% versus net Q2 2023 revenue of $2.67 million

Company to complete analysis of full data for

first and second 12-week periods of pivotal phase 3 OnTarget trial of crofelemer for prophylaxis of cancer therapy-related diarrhea

(CTD) in support of FDA discussion; Jaguar to explore possible approval pathway for crofelemer in breast and lung cancer based on phase

3 results

Jaguar planning to begin commercial launch

in October 2024 for Gelclair®, the company’s third prescription product

Import permit for crofelemer granted for independent,

investigator-initiated proof-of-concept trial in Abu Dhabi in pediatric patients for the rare and orphan disease indications of microvillus

inclusion disease (MVID) and short bowel syndrome (SBS) with intestinal failure

REMINDER: Jaguar to host investor

webcast Tuesday, August 13th at 8:30 a.m. Eastern regarding Q2 2024 financials and company updates; Click here

to register for webcast

SAN FRANCISCO,

CA / August 13, 2024 / Jaguar Health, Inc. (NASDAQ: JAGX) (“Jaguar” or the “Company”)

today reported its consolidated second-quarter 2024 financial results and provided Company updates.

The combined net revenue for the Company’s crofelemer prescription

products, Mytesi® and Canalevia®-CA1, and the Company’s non-prescription products,

was approximately $2.72 million in the second quarter of 2024, representing an increase of approximately 16% over the combined net revenue

in the first quarter of 2024, which totaled approximately $2.35 million, and 2.0% over the combined net revenue in the second quarter

of 2023, which totaled approximately $2.67 million.

Jaguar, with strong leadership and participation from Jaguar family

companies Napo Pharmaceuticals and Napo Therapeutics, is supporting investigator-initiated proof-of-concept (POC) studies

of crofelemer for the rare disease indications of microvillus inclusion disease (MVID) and short bowel syndrome (SBS) with intestinal

failure in the US, EU, and Middle East/North Africa (MENA) regions, with results expected by the end of 2024 and throughout 2025. The

import permit for crofelemer for Abu Dhabi for the POC study in pediatric patients with MVID or SBS with intestinal failure has been

granted. In accordance with the guidelines of specific EU countries, published data from clinical investigations in such rare diseases

could support early patient access to crofelemer for these debilitating conditions in those countries.

Lisa Conte,

Jaguar's president and CEO, said, “Our paramount near-term activities are our planned October 2024 commercial launch of the FDA-approved

oral mucositis prescription product Gelclair® in the U.S., progressing our rare disease development business, and our

ongoing analysis of full data for the first and second 12-week stages of our pivotal phase 3 OnTarget trial of crofelemer

for prophylaxis of cancer therapy-related diarrhea (CTD). As announced, we are collaborating with our clinical and scientific

advisers to evaluate the significance of the clinically meaningful results identified in patients with breast and lung cancer in the

initial data from OnTarget, as we plan to engage in discussions with the FDA to explore the possible pathway of approval to make crofelemer

available to breast and lung cancer patients for CTD.”

According

to the World Health Organization, in 2022 breast cancer was the most common cancer in women in 157 countries out of 185, with 2.3 million

women diagnosed with breast cancer globally.1 Lung cancer is the most common cancer worldwide, with 2,480,675 new cases

of lung cancer in 2022. It is the most common cancer in men and the second most common in women.2

2024 SECOND QUARTER COMPANY FINANCIAL RESULTS:

| · | Net Mytesi Revenue: The combined net revenue for Mytesi was approximately $2.64 million in the second quarter of 2024, representing

an increase of approximately 15% over the combined net revenue in the first quarter of 2024, which totaled approximately $2.35 million,

and an increase of 1% over the combined net revenue for the second quarter of 2023, which totaled approximately $2.62 million. |

| · | Mytesi Prescription Volume: Mytesi prescription volume increased in

the second quarter of 2024 compared to the first quarter of 2024 by 5.2%. Prescriptions decreased by 0.4% in the second quarter of 2024

compared to the second quarter of 2023. Prescription volume differs from invoiced sales volume, which reflects, among other factors, varying

buying patterns among specialty pharmacies in the closed network as they manage their inventory levels. |

| · | Neonorm™:

Revenues for the non-prescription Neonorm products were minimal for the second quarters of

2024 and 2023. |

| | |

Three Months

Ended | | |

| | |

| |

| Financial Highlights | |

June

30, | | |

| | |

| |

| (in thousands, except per share amounts) | |

2024 | | |

2023 | | |

$

change | | |

%

change | |

| Net product revenue | |

$ | 2,720 | | |

$ | 2,676 | | |

| 44 | | |

| 2 | % |

| Loss from operations | |

$ | (7,198 | ) | |

$ | (8,102 | ) | |

| 904 | | |

| -13 | % |

| Net loss attributable to common

shareholders | |

$ | (9,492 | ) | |

$ | (12,150 | ) | |

| 2,658 | | |

| -28 | % |

| Net loss per share, basic and

diluted | |

$ | (4.04 | ) | |

$ | (41.35 | ) | |

| 37 | | |

| -924 | % |

| · | Cost of Product Revenue: Total cost of product revenue decreased by

approximately $70,000 from $0.50 million for the quarter ended June 30, 2023 compared to $0.43 million for the quarter ended June 30,

2024 |

| · | Research and Development: The R&D expense decreased by $0.6 million,

from $4.3 million for the quarter ended June 30, 2023 to $3.7 million during the same quarter in 2024, primarily due to the winding down

of activities related to the phase 3 OnTarget clinical trial, regulatory activities for the trial,

and the Company’s initiatives for rare disease product development. |

| · | Sales and Marketing: The Sales and Marketing expense decreased by

approximately $0.1 million, from $1.6 million for the quarter ended June 30, 2023 to $1.5 million during the same quarter in 2024. Direct

marketing fees and expenses decreased due to continued savings associated with the utilization of a more cost-effective patient support

services vendor, other Mytesi marketing initiatives, as well as decreased stock-based compensation, and commission expenses. |

| · | General and Administrative: The G&A expense decreased by $0.1

million, from $4.4 million for the quarter ended June 30, 2023, to $4.3 million during the same quarter in 2024, due to decreases in personnel

and benefits, rent and lease, stock-based compensation, travel and other expenses. However, this decrease is offset by an increase in

consulting, audit, tax and accounting services, and public company expenses. |

| · | Loss from Operations: Loss from operations decreased by $0.9 million,

from $8.1 million in the quarter ended June 30, 2023 to $7.2 million during the same period in 2024. |

| · | Net Loss: Net loss attributable to common shareholders decreased by

approximately $2.6 million, from $12.1 million in the quarter ended June 30, 2023 to $9.5 million in the same period in 2024. In addition

to the loss from operations: |

| o | Interest expense decreased by $3.3 million from ($0.11) million in the quarter

ended June 30, 2024 versus $3.5 million for the same period in 2023, primarily due to certain debt instruments being accounted for using

the fair value option. The lower interest expense was offset with a higher loss on change in fair value of debt instruments. |

| o | Change in fair value of financial instrument and hybrid instrument designated

at FVO increased by $1.0 million from a loss of $1.8 million in the three months ended June 30, 2024 compared to a loss of $0.8 million

for the same period in 2023 primarily due to fair value adjustments in liability classified warrants and notes payable designated at FVO. |

| · | Non-GAAP Recurring EBITDA: Non-GAAP recurring EBITDA for the second

quarter of 2024 and the second quarter of 2023 were a net loss of $8.8 million and $7.7 million, respectively. |

| | |

Three

Months Ending | |

| | |

June

30, | |

| (in

thousands) | |

2024 | | |

2023 | |

| | |

| | |

| |

| | |

(unaudited) | |

| Net

loss attributable to common shareholders: | |

$ | (9,492 | ) | |

$ | (12,150 | ) |

| Adjustments: | |

| | | |

| | |

| Interest

expense | |

| (108 | ) | |

| 3,453 | |

| Property

and equipment depreciation | |

| 17 | | |

| 20 | |

| Amortization

of intangible assets | |

| 430 | | |

| 484 | |

| Share-based

compensation expense | |

| 387 | | |

| 529 | |

| Non-GAAP

EBITDA | |

| (8,766 | ) | |

| (7,665 | ) |

| Non-GAAP

Recurring EBITDA | |

$ | (8,766 | ) | |

| (7,665 | ) |

Note Regarding Use of Non-GAAP Measures

The Company supplements its condensed consolidated financial

statements presented on a GAAP basis by providing non-GAAP EBITDA and non-GAAP recurring EBITDA, which are considered non-GAAP under

applicable SEC rules. Jaguar believes that the disclosure items of these non-GAAP measures provide investors with additional information

that reflects the basis upon which Company management assesses and operates the business. These non-GAAP financial measures are not in

accordance with GAAP and should not be viewed in isolation or as substitutes for GAAP net sales and GAAP net loss and are not substitutes

for, or superior to, measures of financial performance in conformity with GAAP.

The Company defines non-GAAP EBITDA as net loss before interest expense

and other expense, depreciation of property and equipment, amortization of intangible assets, share-based compensation expense and provision

for or benefit from income taxes. The Company defines non-GAAP Recurring EBITDA as non-GAAP EBITDA adjusted for certain non-recurring

revenues and expenses. Company management believes that non-GAAP EBITDA and non-GAAP Recurring EBITDA are meaningful indicators of Jaguar’s

performance and provide useful information to investors regarding the Company’s results of operations and financial condition.

Participation Instructions for Webcast

When: Tuesday, August 13, 2024, at 8:30 AM Eastern

Time

Participant

Registration & Access Link: Click Here

Replay Instructions for Webcast

Replay of the webcast on the investor relations

section of Jaguar’s website: (click here)

About Crofelemer

Crofelemer

is the only oral FDA-approved prescription drug under botanical guidance. It is plant-based, extracted and purified from the red bark

sap of the Croton lechleri tree in the Amazon Rainforest. Napo Pharmaceuticals, a Jaguar family company, has established

a sustainable harvesting program, under fair trade practices, for crofelemer to ensure a high degree of quality, ecological integrity,

and support for Indigenous communities.

About the Jaguar Health Family of Companies

Jaguar Health, Inc. (Jaguar) is a commercial stage pharmaceuticals

company focused on developing novel proprietary prescription medicines sustainably derived from plants from rainforest areas for people

and animals with gastrointestinal distress, specifically associated with overactive bowel, which includes symptoms such as chronic debilitating

diarrhea, urgency, bowel incontinence, and cramping pain. Jaguar family company Napo Pharmaceuticals (Napo) focuses on developing and

commercializing human prescription pharmaceuticals for essential supportive care and management of neglected gastrointestinal symptoms

across multiple complicated disease states. Napo’s crofelemer is FDA-approved under the brand name Mytesi® for the

symptomatic relief of noninfectious diarrhea in adults with HIV/AIDS on antiretroviral therapy. Jaguar family company Napo Therapeutics

is an Italian corporation Jaguar established in Milan, Italy in 2021 focused on expanding crofelemer access in Europe and specifically

for orphan and/or rare diseases. Jaguar Animal Health is a Jaguar tradename. Magdalena Biosciences, a joint venture formed by Jaguar

and Filament Health Corp. that emerged from Jaguar’s Entheogen Therapeutics Initiative (ETI), is focused on developing novel prescription

medicines derived from plants for mental health indications.

For more information about:

Jaguar Health, visit https://jaguar.health

Napo Pharmaceuticals, visit www.napopharma.com

Napo Therapeutics, visit napotherapeutics.com

Magdalena Biosciences, visit magdalenabiosciences.com

Visit the Make Cancer Less Shitty patient advocacy program

at makecancerlessshitty.com and on X, Facebook & Instagram

About Mytesi®

Mytesi (crofelemer) is an antidiarrheal indicated for the symptomatic

relief of noninfectious diarrhea in adult patients with HIV/AIDS on antiretroviral therapy (ART). Mytesi is not indicated for the treatment

of infectious diarrhea. Rule out infectious etiologies of diarrhea before starting Mytesi. If infectious etiologies are not considered,

there is a risk that patients with infectious etiologies will not receive the appropriate therapy and their disease may worsen. In clinical

studies, the most common adverse reactions occurring at a rate greater than placebo were upper respiratory tract infection (5.7%), bronchitis

(3.9%), cough (3.5%), flatulence (3.1%), and increased bilirubin (3.1%).

See full Prescribing Information at Mytesi.com. Crofelemer,

the active ingredient in Mytesi, is a botanical (plant-based) drug extracted and purified from the red bark sap of the medicinal Croton

lechleri tree in the Amazon rainforest. Napo has established a sustainable harvesting program for crofelemer to ensure a high degree

of quality and ecological integrity.

About Gelclair®

INDICATIONS

GELCLAIR® has a mechanical action indicated for the

management of pain and relief of pain by adhering to the mucosal surface of the mouth, soothing oral lesions of various etiologies, including

oral mucositis/stomatitis (may be caused by chemotherapy or radiation therapy), irritation due to oral surgery, traumatic ulcers caused

by braces or ill-fitting dentures, or disease. Also, indicated for diffuse aphthous ulcers.

IMPORTANT SAFETY INFORMATION

| · | Do not use GELCLAIR if there is a known or suspected hypersensitivity to

any of its ingredients. |

| · | No adverse effects have been reported in clinical trials, although postmarketing

reports have included infrequent complaints of burning sensation in the mouth. |

| · | If GELCLAIR is swallowed accidentally, no adverse effects are anticipated. |

| · | If no improvement is seen within 7 days, a physician should be consulted. |

You are encouraged to report negative side effects of prescription

medical products to the FDA.

Visit www.fda.gov/safety/medwatch, call 1-855-273-0468 or fill-in

the form at this link.

Please see full Prescribing Information at:

https://gelclair.com/assets/Gelclair_PI_Decemeber_2021.pdf

Important Safety Information About Canalevia®-CA1

For oral use in dogs only. Not for use in humans. Keep Canalevia-CA1

(crofelemer delayed-release tablets) in a secure location out of reach of children and other animals. Consult a physician in case of accidental

ingestion by humans. Do not use in dogs that have a known hypersensitivity to crofelemer. Prior to using Canalevia-CA1, rule out infectious

etiologies of diarrhea. Canalevia-CA1 is a conditionally approved drug indicated for the treatment of chemotherapy-induced diarrhea in

dogs. The most common adverse reactions included decreased appetite, decreased activity, dehydration, abdominal pain, and vomiting.

Caution: Federal law restricts this drug to use by or on the

order of a licensed veterinarian. Use only as directed. It is a violation of Federal law to use this product other than as directed

in the labeling. Conditionally approved by FDA pending a full demonstration of effectiveness under application number 141-552.

See full Prescribing Information at Canalevia.com.

Forward-Looking Statements

Certain statements in this press release constitute “forward-looking

statements.” These include statements regarding Jaguar’s expectation that it will host an investor webcast on August 13, 2024,

the Company’s expectation that it will begin the commercial launch in October 2024 for Gelclair, Jaguar’s expectation that

the Company may engage in discussions with the FDA after evaluating the significance of the clinical outcome signals from the OnTarget

trial, Jaguar’s expectation that an approval pathway may exist to make crofelemer available to breast and lung cancer patients for

CTD, the Company’s expectation that results from investigator-initiated and IND proof-of-concept studies of crofelemer for MVID

and SBS with intestinal failure will be available by the end of 2024 and throughout 2025, and the Company’s expectation, that in

accordance with the guidelines of specific EU countries, published data from clinical investigations of crofelemer in MVID and SBS could

support early patient access to crofelemer for these conditions in those countries. In some cases, you can identify forward-looking statements

by terms such as “may,” “will,” “should,” “expect,” “plan,” “aim,”

“anticipate,” “could,” “intend,” “target,” “project,” “contemplate,”

“believe,” “estimate,” “predict,” “potential” or “continue” or the negative

of these terms or other similar expressions. The forward-looking statements in this release are only predictions. Jaguar has based these

forward-looking statements largely on its current expectations and projections about future events. These forward-looking statements speak

only as of the date of this release and are subject to several risks, uncertainties, and assumptions, some of which cannot be predicted

or quantified and some of which are beyond Jaguar’s control. Except as required by applicable law, Jaguar does not plan to publicly

update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances

or otherwise.

1 https://www.who.int/news-room/fact-sheets/detail/breast-cancer

2 https://www.wcrf.org/cancer-trends/lung-cancer-statistics/

Source: Jaguar Health, Inc.

Contact:

hello@jaguar.health

Jaguar-JAGX

v3.24.2.u1

Cover

|

Aug. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 13, 2024

|

| Entity File Number |

001-36714

|

| Entity Registrant Name |

JAGUAR HEALTH, INC.

|

| Entity Central Index Key |

0001585608

|

| Entity Tax Identification Number |

46-2956775

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

200 Pine Street

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94104

|

| City Area Code |

415

|

| Local Phone Number |

371-8300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.0001 Per Share

|

| Trading Symbol |

JAGX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

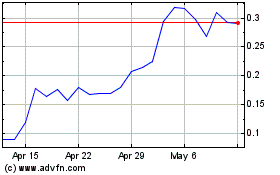

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Jan 2024 to Jan 2025