FALSE000178542400017854242024-02-012024-02-010001785424us-gaap:CommonStockMember2024-02-012024-02-010001785424kplt:RedeemableWarrantMember2024-02-012024-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 1, 2024

| | |

| KATAPULT HOLDINGS, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-39116 | | 81-4424170 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

5360 Legacy Drive, Building 2

Plano, TX | | 75024 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

(833) 528-2785 |

(Registrant’s telephone number, including area code:) |

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on

Which Registered |

| Common Stock, par value $0.0001 per share | | KPLT | | The Nasdaq Stock Market LLC |

| Redeemable Warrants | | KPLTW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 1, 2024, Katapult Holdings, Inc., a Delaware corporation ("Katapult"), issued a press release regarding certain preliminary results for the fourth quarter ended December 31, 2023 A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

The information in this Current Report, including Exhibits 99.1 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Exhibit |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| Date: | February 1, 2024 | | | /s/ Orlando Zayas | |

| | | | Name: | Orlando Zayas |

| | | | Title: | Chief Executive Officer |

| | | | | |

Katapult Announces Double-Digit Preliminary Gross Originations and Revenue Growth for Fourth Quarter 2023

Gross Originations Increase 13% and Revenue Increases ~19% Year-Over-Year

Results Exceed Company Outlook

PLANO, Texas, February 01, 2024 (GLOBE NEWSWIRE) -- Katapult Holdings, Inc. (NASDAQ: KPLT), an e-commerce-focused financial technology company, today announced preliminary gross originations and revenue for the fourth quarter ended December 31, 2023.

Based on preliminary unaudited results, Katapult expects to report gross originations of approximately $67.5 million for the fourth quarter, an increase of 13.0% year-over-year and above the 3-5% growth outlook the company provided on November 8, 2023. This is expected to be the fifth consecutive quarter of year-over-year gross originations growth and the second highest level of gross originations volume in the company’s history. Katapult also expects to report approximately $58.0 million in revenue for the fourth quarter, an increase of 18.7% year-over-year, which exceeds the 13-15% growth outlook the company provided on November 8, 2023. Fourth quarter revenue is expected to be the highest since the first quarter of 2022.

“We ended 2023 on a high note, with gross originations and revenue well above our previous outlook,” said Orlando Zayas, CEO of Katapult. “Heading into the fourth quarter, we were cautious about our outlook given the uncertain macroeconomic backdrop consumers were facing and the impact this could have on the holiday shopping season. Despite these potential headwinds, we delivered strong double-digit preliminary gross originations and revenue growth, driven by the power of our direct merchant integrations and Katapult Pay™. Specific to Katapult Pay, we also successfully launched a new major retailer earlier than expected, which contributed to strong performance during the quarter. We are excited about the year ahead and look forward to discussing our full financial results in early March.”

Katapult’s financial close procedures for the quarter and year ended December 2023 are not yet complete. This release includes preliminary financial results for gross originations and revenue for the quarter ended December 31, 2023 that are based on information available at this time. These preliminary financial results have also not been audited or reviewed by Katapult’s independent registered public accounting firm. Katapult intends to report its finalized financial results for the fourth quarter and fiscal year ended December 31, 2023 in early March 2024. Until that time, the preliminary gross originations and revenue results described in this press release are estimates only and are subject to revisions that could differ materially.

About Katapult

Katapult is a technology driven lease-to-own platform that integrates with omnichannel retailers and e-commerce platforms to power the purchasing of everyday durable goods for underserved U.S. non-prime consumers. Through our point-of-sale (POS) integrations and innovative mobile app featuring Katapult Pay™, consumers who may be unable to access traditional financing can shop a growing network of merchant partners. Our process is simple, fast, and transparent. We believe that seeing the good in people is good for business, humanizing the way underserved consumers get the things they need with payment solutions based on fairness and dignity.

For more information, visit www.katapult.com.

Contact:

Jennifer Kull

VP of Investor Relations

ir@katapult.com

Forward-Looking Statements

Certain statements included in this Press Release that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding our fourth quarter 2023 results, our 2024 business outlook, our ability to weather the macroeconomic headwinds and our ability to drive growth. These statements are based on various assumptions, whether or not identified in this Press Release, and on the current expectations of Katapult’s management and are not predictions of actual performance.

These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Katapult. These forward-looking statements are subject to a number of risks and uncertainties, including execution of Katapult’s business strategy, launching new product offerings, new brands and expanding information and technology capabilities; Katapult’s market opportunity and its ability to acquire new customers and retain existing customers; the timing and impact of our growth initiatives on our future financial performance and the impact of our new executive hires and brand strategy; anticipated occurrence and timing of prime lending tightening and impact on our results of operations; adoption and success of our new mobile application featuring, Katapult Pay™, general economic conditions in the markets where Katapult operates, the cyclical nature of consumer spending, and seasonal sales and spending patterns of customers; risks relating to factors affecting consumer spending that are not under Katapult’s control, including, among others, levels of employment, disposable consumer income, inflation, prevailing interest rates, consumer debt and availability of credit, pandemics (such as COVID-19), consumer confidence in future economic conditions and political conditions, and consumer perceptions of personal well-being and security; risks relating to uncertainty of Katapult’s estimates of market opportunity and forecasts of market growth; risks related to the concentration of a significant portion of our transaction volume with a single merchant partner, or type of merchant or industry; the effects of competition on Katapult’s future business; unstable market and economic conditions, including as a result of the conflict involving Russia and Ukraine and the Israel-Hamas conflict; reliability of Katapult’s platform and effectiveness of its risk model; protection of confidential, proprietary or sensitive information, including confidential information about consumers, and privacy or data breaches, including by cyber-attacks or similar disruptions; ability to attract and retain employees, executive officers or directors; meeting future liquidity

requirements and complying with restrictive covenants related to long-term indebtedness; effectively respond to general economic and business conditions; obtain additional capital, including equity or debt financing; ability to service our indebtedness; anticipate rapid technological changes; comply with laws and regulations applicable to Katapult’s business, including laws and regulations related to rental purchase transactions; stay abreast of modified or new laws and regulations applying to Katapult’s business, including rental purchase transactions and privacy regulations; maintain relationships with merchant partners; respond to uncertainties associated with product and service developments and market acceptance; anticipate the impact of new U.S. federal income tax law; that Katapult has identified material weaknesses in its internal control over financial reporting which, if not remediated, could affect the reliability of its consolidated financial statements; successfully defend litigation; litigation, regulatory matters, complaints, adverse publicity and/or misconduct by employees, vendors and/or service providers; and other events or factors, including those resulting from civil unrest, war, foreign invasions (including the conflict involving Russia and Ukraine), terrorism, or public health crises, or responses to such events; and those factors discussed in greater detail in the section entitled “Risk Factors” in Katapult’s periodic reports filed with the Securities and Exchange Commission (“SEC”), including Katapult’s Annual Report on Form 10-K for the year ended December 31, 2022 and the Quarterly Report on Form 10-Q for the quarter ended September 30, 2023.

If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Katapult does not presently know or that Katapult currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Undue reliance should not be placed on the forward-looking statements in this Press Release. All forward-looking statements contained herein are based on information available to Katapult as of the date hereof, and Katapult does not assume any obligation to update these statements as a result of new information or future events, except as required by law.

v3.24.0.1

Cover

|

Feb. 01, 2024 |

| Entity Listings [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 01, 2024

|

| Entity Registrant Name |

KATAPULT HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39116

|

| Entity Tax Identification Number |

81-4424170

|

| Entity Address, Address Line One |

5360 Legacy Drive

|

| Entity Address, Address Line Two |

Building 2

|

| Entity Address, City or Town |

Plano

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75024

|

| City Area Code |

833

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001785424

|

| Local Phone Number |

528-2785

|

| Common Stock |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

KPLT

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrant |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Redeemable Warrants

|

| Trading Symbol |

KPLTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kplt_RedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

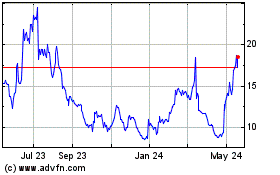

Katapult (NASDAQ:KPLT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Katapult (NASDAQ:KPLT)

Historical Stock Chart

From Dec 2023 to Dec 2024