false

0001307579

0001307579

2025-01-27

2025-01-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 27, 2025

LiqTech International, Inc.

(Exact name of registrant as specified in charter)

|

Nevada

|

001-36210

|

20-1431677

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

Industriparken 22C, 2750 Ballerup,

Denmark

|

|

(Address of principal executive offices)

|

+45 3131 5941

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, $0.001 par value

|

|

LIQT

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of David Kowalczyk as Chief Financial Officer and Chief Operating Officer

On January 27, 2025, the board of directors (the “Board”) of Liqtech International, Inc. a Nevada corporation (the “Company”) appointed David Kowalczyk as Chief Financial Officer and Chief Operating Officer of the Company, effective March 1, 2025. Mr. Kowalczyk, age 47, served as an Equity Analyst at Nordea Securities (2000-2003) and an Auditor and Consultant at PricewaterhouseCoopers (2003-2007). Additionally, Mr. Kowalczyk served as Group Financial Planning Manager (2007-2009), Enzyme Business Finance Manager (2009-2011), Head of Biopharma Financial Planning and Analysis (2011-2013), Finance Senior Manager of Supply Operations Europe Middle East & Africa and HQ (2013) and Business Finance Director of Business Operations (2013-2016) of Novozymes, a global company that develops and provides biosolutions for various industries. He also served as Vice President and Member of Group Management at Flügger (2016-2018), Chief Financial Officer at Globus Wine (2018-2020), and as the Vice President of Business Finance and Systems at Hempel (2020-2024).

Mr. Kowalczyk holds a Bachelor of Science in Economics and Business Administration, a Master of Science in Accounting and Auditing, and a Master of Science in Finance and Investments from Copenhagen Business School. He is a seasoned finance leader with over two decades of professional experience across various industries and ownership structures. His educational background, combined with his extensive industry experience, particularly in technology/R&D-driven companies, positions him as a valuable asset to any organization.

In connection with his appointment as Chief Financial Officer and Chief Operating Officer, the Company (through its wholly owned Danish subsidiary) and Mr. Kowalczyk entered into a Service Agreement, effective March 1, 2025 (the “Service Agreement”), pursuant to which Mr. Kowalczyk will receive (i) an annual base salary of DKK 2,000,000 (approximately $280,000), subject to adjustment each February starting in February 2026; (ii) a discretionary annual performance bonus of up to 60% of his annual base salary; and (iii) a pension contribution by LiqTech Holding A/S of up to 10% of his annual base salary. Mr. Kowalczyk is entitled to participate in the Company’s RSU-based share program, under which he may receive restricted stock unit awards valued up to 60% of his annual base salary. Mr. Kowalczyk is also eligible to participate in the Company’s other benefit programs on the same basis as the Company’s officers, including up to six weeks paid time off per year.

The foregoing descriptions of the Service Agreement is not complete and is in summary form only and is qualified in their entirety by reference to the full text of the Service Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Mr. Kowalczyk does not have any family relationships with any of the Company’s other officers or directors and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Phillip Massie Price to Step Down as Interim Chief Financial Officer

On January 30, 2025, Phillip Massie Price and the Company mutually agreed that Mr. Price shall step down as Interim Chief Financial Officer of the Company, effective as of March 1, 2025, in connection with the appointment of Mr. Kowalczyk as Chief Financial Officer and Chief Operating Officer. Mr. Price will remain as principal financial officer until April 30, 2025, at which time Mr Price will separate from his service with the Company. The Company has agreed to provide Mr. Price as severance: (i) seven (7) months’ salary of DKK 700,000 (approximately $98,000); (ii) a retention bonus of $25,000 for the timely completion and submission of the Company’s Annual Report on Form 10-K; and (iii) the accelerated vesting of 8,019 unvested restricted stock units granted to Mr. Price under the Company’s Long-Term Incentive Program (“LTIP”) for 2024, which will now vest on May 1, 2025. Mr. Price will not participate in the LTIP or the Company’s Short-Term Incentive Program for 2025.

Mr. Price’s resignation is not a result of any disagreement between himself and the Company, its management, the Board or any committee of the Board. The Company appreciates Mr. Price’s diligent service as Interim Chief Financial Officer and wishes him success in any future endeavors.

Item 7.01. Regulation FD Disclosure.

On January 31, 2025, the Company issued a press release announcing the foregoing, which is attached to this Current Report on Form 8-K as Exhibit 99.1 and incorporated herein by reference.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and it shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

Exhibit No.

|

|

Description

|

| |

|

|

|

10.1

|

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

LIQTECH INTERNATIONAL, INC.

|

Date: January 31, 2025

|

/s/Fei Chen

|

| |

Fei Chen

|

| |

Chief Executive Officer

|

Exhibit 10.1

Exhibit 99.1

LiqTech Announces Appointment of David Kowalczyk as Chief Financial and Operating Officer

BALLERUP, Denmark, January 31, 2025 – LiqTech International, Inc. (NASDAQ: LIQT), a clean technology company specializing in highly advanced filtration products and systems, today announced the appointment of David Kowalczyk as Chief Financial and Chief Operating Officer, effective March 1, 2025.

David Kowalczyk brings over 20 years of leadership experience and a proven track record in global industrial companies. His expertise spans finance, strategy, equity analysis, audit, and operational management. Specifically, he has held senior roles including:

| |

●

|

Vice President, Business Finance and Systems at Hempel A/S

|

| |

●

|

Chief Financial Officer at Globus Wine

|

| |

●

|

Vice President and Group Management Member at Flügger

|

| |

●

|

Business Finance Director for Business Operations at Novozymes

|

| |

●

|

Auditor and Consultant at PricewaterhouseCoopers

|

| |

●

|

Equity Analyst at Nordea Securities

|

“David brings to LiqTech a wealth of expertise in financial planning & analysis, business systems, and operational finance,” said Fei Chen, President and CEO of LiqTech. “I look forward to working closely with him as we continue to position LiqTech for profitable growth.”

A native of Denmark, David holds dual master’s degrees in Auditing and Accounting as well as Finance and Investments from Copenhagen Business School.

Kowalczyk commented, “I am honored to join LiqTech at this pivotal moment in its journey, and am eager to contribute to its growth and profitability. I look forward to leveraging my experience and collaborating with the talented team at LiqTech, customers and suppliers, to achieve our shared objectives.”

Phillip Massie Price, who has served as Interim CFO since March 2024, will step down from the role upon David Kowalczyk’s arrival, but he will remain with the company until April 30, 2025, to ensure for a seamless transition. The company expresses its sincere gratitude to Phillip for his exceptional service and contribution during his tenure with the company.

About LiqTech International, Inc.

LiqTech International, Inc., a Nevada corporation, is a high-tech filtration technology company that provides state-of-the-art ceramic silicon carbide filtration technologies for gas and liquid purification. LiqTech's silicon carbide membranes are designed for the most challenging purification applications, and its filters are used to control diesel exhaust soot emissions. Utilizing nanotechnology, LiqTech develops products with its proprietary silicon carbide technology, resulting in a wide range of component membranes, membrane systems, and filters for both microfiltration and ultrafiltration applications. By integrating LiqTech's SiC liquid membrane technology with the company's extensive systems design experience, LiqTech offers unique, modular filtration solutions for the most difficult water purification challenges.

For more information, please visit: www.liqtech.com

Follow LiqTech on LinkedIn: LiqTech International

Follow LiqTech on Twitter: @LiqTech

Forward-Looking Statements

This press release contains "forward-looking statements." Although the forward-looking statements in this release reflect the good faith judgment of management, they are inherently subject to known and unknown risks and uncertainties that may cause actual results to differ materially from those discussed in these forward-looking statements. Readers are urged to carefully review and consider the various disclosures made by us in the reports filed with the Securities and Exchange Commission, including the risk factors that attempt to advise interested parties of the risks that may affect performance.

LiqTech Investor Contact

Robert Blum

Lytham Partners, LLC

Phone: 602-889-9700

liqt@lythampartners.com

v3.24.4

Document And Entity Information

|

Jan. 27, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

LiqTech International, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 27, 2025

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-36210

|

| Entity, Tax Identification Number |

20-1431677

|

| Entity, Address, Address Line One |

Industriparken 22C

|

| Entity, Address, Postal Zip Code |

2750

|

| Entity, Address, City or Town |

Ballerup

|

| Entity, Address, Country |

DK

|

| City Area Code |

45

|

| Local Phone Number |

3131 5941

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

LIQT

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001307579

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

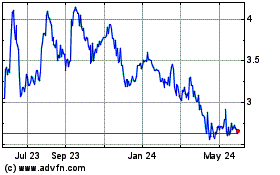

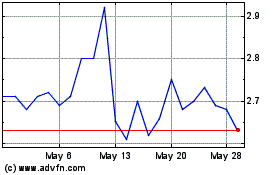

LiqTech (NASDAQ:LIQT)

Historical Stock Chart

From Feb 2025 to Mar 2025

LiqTech (NASDAQ:LIQT)

Historical Stock Chart

From Mar 2024 to Mar 2025