falseMARRIOTT INTERNATIONAL INC /MD/000104828600010482862024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 8-K

_______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024

_______________________________________

MARRIOTT INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

_______________________________________

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Delaware | | 1-13881 | | 52-2055918 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | |

| 7750 Wisconsin Avenue | Bethesda | Maryland | | | | 20814 |

(Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (301) 380-3000

_______________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

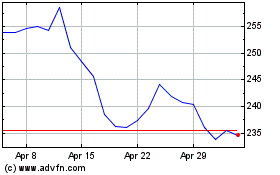

| Class A Common Stock, $0.01 par value | | MAR | | Nasdaq Global Select Market |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter) |

| | | | | | | | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐

|

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

Financial Results for the Quarter Ended June 30, 2024

Marriott International, Inc. (“Marriott”) issued a press release reporting financial results for the quarter ended June 30, 2024.

A copy of Marriott’s press release is attached as Exhibit 99 and incorporated by reference.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are furnished with this report: |

| | | | | |

| 99 | |

| |

| 104 | The cover page to this Current Report on Form 8-K, formatted in inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | MARRIOTT INTERNATIONAL, INC. |

| | | | |

Date: July 31, 2024 | | | | | | By: | | /s/ Felitia O. Lee |

| | | | | | | | Felitia O. Lee |

| | | | | | | | Controller and Chief Accounting Officer |

NEWS

Marriott International Reports Second Quarter 2024 Results

•Second quarter 2024 comparable systemwide constant dollar RevPAR increased 4.9 percent worldwide, 3.9 percent in the U.S. & Canada, and 7.4 percent in international markets, compared to the 2023 second quarter;

•Second quarter reported diluted EPS totaled $2.69, compared to reported diluted EPS of $2.38 in the year-ago quarter. Second quarter adjusted diluted EPS totaled $2.50, compared to second quarter 2023 adjusted diluted EPS of $2.26;

•Second quarter reported net income totaled $772 million, compared to reported net income of $726 million in the year-ago quarter. Second quarter adjusted net income totaled $716 million, compared to second quarter 2023 adjusted net income of $690 million;

•Adjusted EBITDA totaled $1,324 million in the 2024 second quarter, compared to second quarter 2023 adjusted EBITDA of $1,219 million;

•The company added roughly 15,500 net rooms during the quarter;

•At the end of the quarter, Marriott’s worldwide development pipeline totaled approximately 3,500 properties and more than 559,000 rooms, including roughly 33,000 pipeline rooms approved, but not yet subject to signed contracts. Over 209,000 rooms in the pipeline were under construction as of the end of the second quarter;

•Marriott repurchased 4.1 million shares of common stock for $1.0 billion in the second quarter. Year to date through July 29, the company has returned $2.8 billion to shareholders through dividends and share repurchases.

For a summary of second quarter highlights, please visit: https://news.marriott.com/static-assets/component-resources/newscenter/earnings/2024/20240731-q2-2024-infographic.pdf.

BETHESDA, MD – July 31, 2024 - Marriott International, Inc. (Nasdaq: MAR) today reported second quarter 2024 results.

Anthony Capuano, President and Chief Executive Officer, said, “Marriott reported strong second quarter results, with net rooms up 6 percent year over year and worldwide RevPAR1 growth of nearly 5 percent, as consumers continued to prioritize travel. International RevPAR increased more than 7 percent,

1All occupancy, Average Daily Rate (ADR) and Revenue Per Available Room (RevPAR) statistics and estimates are systemwide constant dollar. Unless otherwise stated, all changes refer to year-over-year changes for the comparable period. Occupancy, ADR and RevPAR comparisons between 2024 and 2023 reflect properties that are comparable in both years.

with Asia Pacific excluding China leading the way, posting an impressive 13 percent RevPAR increase from the year-ago quarter.

“In the U.S. & Canada, second quarter RevPAR grew nearly 4 percent, with all customer segments growing versus the prior year quarter. Group RevPAR rose nearly 10 percent year over year, with both rate and occupancy increasing in the mid-single digits.

“With a membership base of over 210 million members and growing, Marriott Bonvoy is a key competitive advantage. We remain focused on enhancing the loyalty program’s benefits and finding new ways to engage with our members both on and off property. In June, we announced a collaboration with Starbucks. The number of members who have linked their accounts is already well exceeding our expectations.

“Owner preference for our brands remains strong. We signed nearly 31,000 rooms in the quarter, 75 percent of which were in international markets. Our momentum around conversions continued, accounting for 37 percent of room additions in the quarter. We continue to expand our industry leading global portfolio, and our expectation for net rooms growth remains at 5.5 to 6 percent for full year 2024.

“With our solid financial results and strong cash generation, we have already returned $2.8 billion to shareholders year-to-date through July 29. We expect to return approximately $4.3 billion to our shareholders in 2024 through share repurchases and dividends.”

Second Quarter 2024 Results

Base management and franchise fees totaled $1,148 million in the 2024 second quarter, a 9 percent increase compared to base management and franchise fees of $1,057 million in the year-ago quarter. The increase is primarily attributable to RevPAR increases and unit growth. Non-RevPAR-related franchise fees in the 2024 second quarter totaled $234 million, compared to $206 million in the year-ago quarter. The increase was largely driven by a 10 percent increase in co-branded credit card fees, as well as $13 million of higher residential branding fees.

Incentive management fees totaled $195 million in the 2024 second quarter, compared to $193 million in the 2023 second quarter, and were impacted by weaker results in Greater China, as well as unfavorable foreign exchange. Managed hotels in international markets contributed more than 60 percent of the incentive fees earned in the quarter.

Owned, leased, and other revenue, net of direct expenses, totaled $99 million in the 2024 second quarter, compared to $103 million in the year-ago quarter.

General, administrative, and other expenses for the 2024 second quarter totaled $248 million, compared to $240 million in the year-ago quarter.

Interest expense, net, totaled $164 million in the 2024 second quarter, compared to $141 million in the year-ago quarter. The increase was largely due to higher interest expense associated with higher debt balances.

Marriott’s reported operating income totaled $1,195 million in the 2024 second quarter, compared to 2023 second quarter reported operating income of $1,096 million. Reported net income totaled $772 million in the 2024 second quarter, compared to 2023 second quarter reported net income of $726 million. Reported diluted earnings per share (EPS) totaled $2.69 in the quarter, compared to reported diluted EPS of $2.38 in the year-ago quarter.

Adjusted operating income in the 2024 second quarter totaled $1,120 million, compared to 2023 second quarter adjusted operating income of $1,043 million. Second quarter 2024 adjusted net income totaled $716 million, compared to 2023 second quarter adjusted net income of $690 million. Adjusted diluted EPS in the 2024 second quarter totaled $2.50, compared to adjusted diluted EPS of $2.26 in the year-ago quarter.

Adjusted results excluded cost reimbursement revenue, reimbursed expenses and merger-related charges and other expenses. See page A-3 and page A-11 of the press release schedules for the calculation of adjusted results and the manner in which the adjusted measures are determined in this press release.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) totaled $1,324 million in the 2024 second quarter, compared to second quarter 2023 adjusted EBITDA of $1,219 million. See page A-11 of the press release schedules for the adjusted EBITDA calculation.

Selected Performance Information

The company added roughly 15,500 net rooms during the quarter.

At the end of the quarter, Marriott’s global system totaled nearly 9,000 properties, with roughly 1,659,000 rooms.

At the end of the quarter, the company’s worldwide development pipeline totaled 3,509 properties with more than 559,000 rooms, including 208 properties with roughly 33,000 rooms approved for development, but not yet subject to signed contracts. The quarter-end pipeline included 1,127 properties with over 209,000 rooms under construction. Fifty-seven percent of rooms in the quarter-end pipeline are in international markets.

In the 2024 second quarter, worldwide RevPAR increased 4.9 percent (a 4.0 percent increase using actual dollars) compared to the 2023 second quarter. RevPAR in the U.S. & Canada increased 3.9 percent (a 3.9 percent increase using actual dollars), and RevPAR in international markets increased 7.4 percent (a 4.2 percent increase using actual dollars).

Balance Sheet & Common Stock

At the end of the quarter, Marriott’s total debt was $13.1 billion and cash and equivalents totaled $0.3 billion, compared to $11.9 billion in debt and $0.3 billion of cash and equivalents at year-end 2023.

Year to date through July 29, the company has repurchased 10.4 million shares for $2.5 billion.

Company Outlook

The company’s updated outlook includes a narrowing of the RevPAR growth range for full year 2024, primarily as a result of a weaker operating environment in Greater China, as well as marginally softer expectations in the U.S. & Canada.

| | | | | | | | |

| Third Quarter 2024 vs Third Quarter 2023 | Full Year 2024 vs Full Year 2023 |

Comparable systemwide constant $

RevPAR growth | | |

| Worldwide | 3% to 4% | 3% to 4% |

| | |

| | |

| | | | | | | | |

| | Year-End 2024 vs Year-End 2023 |

Net rooms growth | | 5.5% to 6% |

| | |

| | |

| | | | | | | | |

| ($ in millions, except EPS) | Third Quarter 2024 | Full Year 2024 |

| Gross fee revenues | $1,275 to $1,290 | $5,130 to $5,180 |

| Owned, leased, and other revenue, net of direct expenses | Approx. $75 | $345 to $350 |

| General, administrative, and other expenses | $250 to $240 | $1,030 to $1,020 |

Adjusted EBITDA1,2 | $1,225 to $1,250 | $4,950 to $5,015 |

Adjusted EPS – diluted2,3 | $2.27 to $2.33 | $9.23 to $9.40 |

Investment spending4 | | $1,000 to $1,200 |

Capital return to shareholders5 | | Approx. $4,300 |

1See page A-12 and page A-13 of the press release schedules for the adjusted EBITDA calculations.

2Adjusted EBITDA and Adjusted EPS – diluted for third quarter and full year 2024 do not include cost reimbursement revenue, reimbursed expenses, merger-related charges and other expenses, or any asset sales that may occur during the year, each of which the company cannot forecast with sufficient accuracy and without unreasonable efforts, and which may be significant.

3Assumes the level of capital return to shareholders noted above.

4Includes capital and technology expenditures, loan advances, contract acquisition costs, and other investing activities.

5Factors in the purchase of the Sheraton Grand Chicago and underlying land for $500 million, $200 million of which is included in investment spending. Assumes the level of investment spending noted above and that no asset sales occur during the year.

Marriott International, Inc. (Nasdaq: MAR) will conduct its quarterly earnings review for the investment community and news media on Wednesday, July 31, 2024, at 8:30 a.m. Eastern Time (ET). The conference call will be webcast simultaneously via Marriott’s investor relations website at http://www.marriott.com/investor, click on “Events & Presentations” and click on the quarterly conference call link. A replay will be available at that same website until July 31, 2025.

The telephone dial-in number for the conference call is US Toll Free: 800-274-8461, or Global: +1 203-518-9843. The conference ID is MAR2Q24. A telephone replay of the conference call will be available from 1:00 p.m. ET, Wednesday, July 31, 2024, until 8:00 p.m. ET, Wednesday, August 7, 2024. To access the replay, call US Toll Free: 800-695-1564 or Global: +1 402-530-9025.

Note on forward-looking statements: All statements in this press release and the accompanying schedules are made as of July 31, 2024. We undertake no obligation to publicly update or revise these statements, whether as a result of new information, future events or otherwise. This press release and the accompanying schedules contain "forward-looking statements" within the meaning of federal securities laws, including statements related to our RevPAR, rooms growth and other financial metric estimates, outlook and assumptions; shareholder returns; our Marriott Bonvoy program; our development pipeline; owner preference for our brands; and similar statements concerning anticipated future events and expectations that are not historical facts. We caution you that these statements are not guarantees of future performance and are subject to numerous evolving risks and uncertainties that we may not be able to accurately predict or assess, including the risk factors that we describe in our Securities and Exchange Commission filings, including our most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q. Any of these factors could cause actual results to differ materially from the expectations we express or imply in this press release.

Marriott International, Inc. (Nasdaq: MAR) is based in Bethesda, Maryland, USA, and encompasses a portfolio of nearly 9,000 properties across more than 30 leading brands in 141 countries and territories. Marriott operates and franchises hotels and licenses vacation ownership resorts all around the world. The company offers Marriott Bonvoy®, its highly awarded travel program. For more information, please visit our website at www.marriott.com, and for the latest company news, visit www.marriottnewscenter.com. In addition, connect with us on Facebook and @MarriottIntl on X and Instagram.

Marriott encourages investors, the media, and others interested in the company to review and subscribe to the information Marriott posts on its investor relations website at www.marriott.com/investor or Marriott's news center website at www.marriottnewscenter.com, which may be material. The contents of these websites are not incorporated by reference into this press release or any report or document Marriott files with the SEC, and any references to the websites are intended to be inactive textual references only.

| | |

MEDIA & INVESTOR RELATIONS CONTACTS: |

| Melissa Froehlich Flood |

Senior Vice President, Global Corporate Communications & Public Policy |

Marriott International |

| newsroom@marriott.com |

|

| Jackie Burka McConagha |

Senior Vice President, Investor Relations |

Marriott International |

| jackie.mcconagha@marriott.com |

|

| Betsy Dahm |

Vice President, Investor Relations |

Marriott International |

| betsy.dahm@marriott.com |

IRPR#1

Tables follow

| | | | | |

| MARRIOTT INTERNATIONAL, INC. |

| PRESS RELEASE SCHEDULES |

| TABLE OF CONTENTS |

QUARTER 2, 2024 |

| |

| Consolidated Statements of Income - As Reported | |

| Non-GAAP Financial Measures | |

| Total Lodging Products by Ownership Type | |

| Total Lodging Products by Tier | |

| Key Lodging Statistics | |

| Adjusted EBITDA | |

| Adjusted EBITDA Forecast - Third Quarter 2024 | |

| Adjusted EBITDA Forecast - Full Year 2024 | |

| Explanation of Non-GAAP Financial and Performance Measures | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| MARRIOTT INTERNATIONAL, INC. |

| CONSOLIDATED STATEMENTS OF INCOME - AS REPORTED |

| SECOND QUARTER 2024 AND 2023 |

| ($ in millions except per share amounts, unaudited) |

| | | | | |

| As Reported | | As Reported | | Percent |

| Three Months Ended | | Three Months Ended | | Better/(Worse) |

| June 30, 2024 | | June 30, 2023 | | Reported 2024 vs. 2023 |

| REVENUES | | | | | |

| Base management fees | $ | 330 | | | $ | 318 | | | 4 | |

Franchise fees1 | 818 | | | 739 | | | 11 | |

| Incentive management fees | 195 | | | 193 | | | 1 | |

| Gross Fee Revenues | 1,343 | | | 1,250 | | | 7 | |

Contract investment amortization2 | (27) | | | (22) | | | (23) | |

| Net Fee Revenues | 1,316 | | | 1,228 | | | 7 | |

Owned, leased, and other revenue3 | 395 | | | 390 | | | 1 | |

Cost reimbursement revenue4 | 4,728 | | | 4,457 | | | 6 | |

| Total Revenues | 6,439 | | | 6,075 | | | 6 | |

| | | | | |

| OPERATING COSTS AND EXPENSES | | | | |

Owned, leased, and other - direct5 | 296 | | | 287 | | | (3) | |

Depreciation, amortization, and other6 | 47 | | | 48 | | | 2 | |

General, administrative, and other7 | 248 | | | 240 | | | (3) | |

| Merger-related charges and other | 8 | | | 38 | | | 79 | |

Reimbursed expenses4 | 4,645 | | | 4,366 | | | (6) | |

| Total Expenses | 5,244 | | | 4,979 | | | (5) | |

| | | | | |

| OPERATING INCOME | 1,195 | | | 1,096 | | | 9 | |

| | | | | |

Gains and other income, net8 | 4 | | | 2 | | | 100 | |

| Interest expense | (173) | | | (140) | | | (24) | |

| Interest income | 9 | | | (1) | | | * |

Equity in earnings9 | 5 | | | 7 | | | (29) | |

| | | | | |

| INCOME BEFORE INCOME TAXES | 1,040 | | | 964 | | | 8 | |

| | | | | |

| Provision for income taxes | (268) | | | (238) | | | (13) | |

| | | | | |

| NET INCOME | $ | 772 | | | $ | 726 | | | 6 | |

| | | | | |

| EARNINGS PER SHARE | | | | | |

| Earnings per share - basic | $ | 2.70 | | | $ | 2.39 | | | 13 | |

| Earnings per share - diluted | $ | 2.69 | | | $ | 2.38 | | | 13 | |

| | | | | |

| Basic Shares | 285.8 | | | 303.6 | | | |

| Diluted Shares | 286.7 | | | 305.0 | | | |

| | | | | |

* Calculated percentage is not meaningful. |

1 Franchise fees include fees from our franchise and license agreements, application and relicensing fees, timeshare and yacht fees, co-branded credit card fees, and residential branding fees. |

2 Contract investment amortization includes amortization of capitalized costs to obtain management, franchise, and license contracts and any related impairments. |

3 Owned, leased, and other revenue includes revenue from the properties we own or lease, termination fees, and other revenue. |

4 Cost reimbursement revenue includes reimbursements from properties for property-level and centralized programs and services that we operate for the benefit of our property owners. Reimbursed expenses include costs incurred by Marriott for certain property-level operating expenses and centralized programs and services. |

5 Owned, leased, and other - direct expenses include operating expenses related to our owned or leased hotels, including lease payments and pre-opening expenses. |

6 Depreciation, amortization, and other expenses include depreciation for fixed assets, amortization of capitalized costs incurred to acquire management, franchise, and license agreements, and any related impairments, accelerations, or write-offs. |

7 General, administrative, and other expenses include our corporate and business segments overhead costs and general expenses. |

8 Gains and other income, net includes gains and losses on the sale of real estate, the sale of joint venture interests and other investments, and adjustments from other equity investments. |

9 Equity in earnings include our equity in earnings or losses of unconsolidated equity method investments. |

| | | | | | | | | | | | | | | | | |

| MARRIOTT INTERNATIONAL, INC. |

| CONSOLIDATED STATEMENTS OF INCOME - AS REPORTED |

| SECOND QUARTER YEAR-TO-DATE 2024 AND 2023 |

| ($ in millions except per share amounts, unaudited) |

| | | | | |

| As Reported | | As Reported | | Percent |

| Six Months Ended | | Six Months Ended | | Better/(Worse) |

| June 30, 2024 | | June 30, 2023 | | Reported 2024 vs. 2023 |

| REVENUES | | | | | |

| Base management fees | $ | 643 | | | $ | 611 | | | 5 | |

Franchise fees1 | 1,506 | | | 1,378 | | | 9 | |

| Incentive management fees | 404 | | | 394 | | | 3 | |

| Gross Fee Revenues | 2,553 | | | 2,383 | | | 7 | |

Contract investment amortization2 | (50) | | | (43) | | | (16) | |

| Net Fee Revenues | 2,503 | | | 2,340 | | | 7 | |

Owned, leased, and other revenue3 | 752 | | | 746 | | | 1 | |

Cost reimbursement revenue4 | 9,161 | | | 8,604 | | | 6 | |

| Total Revenues | 12,416 | | | 11,690 | | | 6 | |

| | | | | |

| OPERATING COSTS AND EXPENSES | | | | | |

Owned, leased, and other - direct5 | 582 | | | 568 | | | (2) | |

Depreciation, amortization, and other6 | 92 | | | 92 | | | — | |

General, administrative, and other7 | 509 | | | 442 | | | (15) | |

| Merger-related charges and other | 16 | | | 39 | | | 59 | |

Reimbursed expenses4 | 9,146 | | | 8,502 | | | (8) | |

| Total Expenses | 10,345 | | | 9,643 | | | (7) | |

| | | | | |

| OPERATING INCOME | 2,071 | | | 2,047 | | | 1 | |

| | | | | |

Gains and other income, net8 | 8 | | | 5 | | | 60 | |

| | | | | |

| Interest expense | (336) | | | (266) | | | (26) | |

| Interest income | 19 | | | 14 | | | 36 | |

Equity in earnings9 | 5 | | | 8 | | | (38) | |

| | | | | |

| INCOME BEFORE INCOME TAXES | 1,767 | | | 1,808 | | | (2) | |

| | | | | |

| Provision for income taxes | (431) | | | (325) | | | (33) | |

| | | | | |

| NET INCOME | $ | 1,336 | | | $ | 1,483 | | | (10) | |

| | | | | |

| EARNINGS PER SHARE | | | | | |

| Earnings per share - basic | $ | 4.64 | | | $ | 4.84 | | | (4) | |

| Earnings per share - diluted | $ | 4.62 | | | $ | 4.81 | | | (4) | |

| | | | | |

| Basic Shares | 288.1 | | | 306.6 | | | |

| Diluted Shares | 289.1 | | | 308.0 | | | |

| | | | | |

1 Franchise fees include fees from our franchise and license agreements, application and relicensing fees, timeshare and yacht fees, co-branded credit card fees, and residential branding fees. |

2 Contract investment amortization includes amortization of capitalized costs to obtain management, franchise, and license contracts and any related impairments. |

3 Owned, leased, and other revenue includes revenue from the properties we own or lease, termination fees, and other revenue. |

4 Cost reimbursement revenue includes reimbursements from properties for property-level and centralized programs and services that we operate for the benefit of our property owners. Reimbursed expenses include costs incurred by Marriott for certain property-level operating expenses and centralized programs and services. |

5 Owned, leased, and other - direct expenses include operating expenses related to our owned or leased hotels, including lease payments and pre-opening expenses. |

6 Depreciation, amortization, and other expenses include depreciation for fixed assets, amortization of capitalized costs incurred to acquire management, franchise, and license agreements, and any related impairments, accelerations, or write-offs. |

7 General, administrative, and other expenses include our corporate and business segments overhead costs and general expenses. |

8 Gains and other income, net includes gains and losses on the sale of real estate, the sale of joint venture interests and other investments, and adjustments from other equity investments. |

9 Equity in earnings include our equity in earnings or losses of unconsolidated equity method investments. |

.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MARRIOTT INTERNATIONAL, INC. |

| NON-GAAP FINANCIAL MEASURES |

| ($ in millions except per share amounts) |

| | | | | | | | | | | |

| The following table presents our reconciliations of Adjusted operating income, Adjusted operating income margin, Adjusted net income, and Adjusted diluted earnings per share, to the most directly comparable GAAP measure. Adjusted total revenues is used in the determination of Adjusted operating income margin. |

| | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| | | | | Percent | | | | | | Percent |

| June 30, | | June 30, | | Better/ | | June 30, | | June 30, | | Better/ |

| 2024 | | 2023 | | (Worse) | | 2024 | | 2023 | | (Worse) |

| Total revenues, as reported | $ | 6,439 | | | $ | 6,075 | | | | | $ | 12,416 | | | $ | 11,690 | | | |

| Less: Cost reimbursement revenue | (4,728) | | | (4,457) | | | | | (9,161) | | | (8,604) | | | |

| | | | | | | | | | | |

Adjusted total revenues† | 1,711 | | | 1,618 | | | | | 3,255 | | | 3,086 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Operating income, as reported | 1,195 | | | 1,096 | | | | | 2,071 | | | 2,047 | | | |

| Less: Cost reimbursement revenue | (4,728) | | | (4,457) | | | | | (9,161) | | | (8,604) | | | |

| Add: Reimbursed expenses | 4,645 | | | 4,366 | | | | | 9,146 | | | 8,502 | | | |

| Add: Merger-related charges and other | 8 | | | 38 | | | | | 16 | | | 39 | | | |

| | | | | | | | | | | |

Adjusted operating income† | 1,120 | | | 1,043 | | | 7% | | 2,072 | | | 1,984 | | | 4% |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Operating income margin | 19 | % | | 18 | % | | | | 17 | % | | 18 | % | | |

Adjusted operating income margin† | 65 | % | | 64 | % | | | | 64 | % | | 64 | % | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income, as reported | 772 | | | 726 | | | | | 1,336 | | | 1,483 | | | |

| Less: Cost reimbursement revenue | (4,728) | | | (4,457) | | | | | (9,161) | | | (8,604) | | | |

| Add: Reimbursed expenses | 4,645 | | | 4,366 | | | | | 9,146 | | | 8,502 | | | |

| Add: Merger-related charges and other | 8 | | | 38 | | | | | 16 | | | 39 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Income tax effect of above adjustments | 19 | | | 17 | | | | | (1) | | | 18 | | | |

| Less: Income tax special items | — | | | — | | | | | — | | | (100) | | | |

Adjusted net income† | $ | 716 | | | $ | 690 | | | 4% | | $ | 1,336 | | | $ | 1,338 | | | —% |

| | | | | | | | | | | |

| Diluted earnings per share, as reported | $ | 2.69 | | | $ | 2.38 | | | | | $ | 4.62 | | | $ | 4.81 | | | |

Adjusted diluted earnings per share† | $ | 2.50 | | | $ | 2.26 | | | 11% | | $ | 4.62 | | | $ | 4.35 | | | 6% |

| | | | | | | | | | | |

† Denotes non-GAAP financial measures. Please see pages A-14 and A-15 for information about our reasons for providing these alternative financial measures and the limitations on their use. |

|

|

|

|

|

|

| | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | |

MARRIOTT INTERNATIONAL, INC. |

| TOTAL LODGING PRODUCTS BY OWNERSHIP TYPE |

| As of June 30, 2024 |

| | | | | | |

| US & Canada | Total International1 | Total Worldwide |

| Properties | Rooms | Properties | Rooms | Properties | Rooms |

| Managed | 617 | | 213,712 | | 1,363 | | 354,789 | | 1,980 | | 568,501 | |

| Marriott Hotels | 101 | | 56,736 | | 186 | | 58,147 | | 287 | | 114,883 | |

| Sheraton | 26 | | 20,869 | | 182 | | 61,494 | | 208 | | 82,363 | |

| Courtyard | 156 | | 25,372 | | 128 | | 27,744 | | 284 | | 53,116 | |

| Westin | 40 | | 22,344 | | 78 | | 23,608 | | 118 | | 45,952 | |

| JW Marriott | 23 | | 13,189 | | 74 | | 26,496 | | 97 | | 39,685 | |

| The Ritz-Carlton | 41 | | 12,354 | | 77 | | 18,047 | | 118 | | 30,401 | |

| Renaissance | 21 | | 9,065 | | 53 | | 16,542 | | 74 | | 25,607 | |

| Four Points | 1 | | 134 | | 87 | | 24,339 | | 88 | | 24,473 | |

| Le Méridien | 1 | | 100 | | 71 | | 19,861 | | 72 | | 19,961 | |

| W Hotels | 23 | | 6,516 | | 42 | | 11,805 | | 65 | | 18,321 | |

| Residence Inn | 73 | | 12,002 | | 9 | | 1,116 | | 82 | | 13,118 | |

| St. Regis | 11 | | 2,169 | | 47 | | 10,285 | | 58 | | 12,454 | |

| Delta Hotels by Marriott | 25 | | 6,770 | | 26 | | 4,924 | | 51 | | 11,694 | |

| Fairfield by Marriott | 6 | | 1,431 | | 78 | | 9,848 | | 84 | | 11,279 | |

| Gaylord Hotels | 6 | | 10,220 | | — | | — | | 6 | | 10,220 | |

| Aloft | 2 | | 505 | | 44 | | 9,696 | | 46 | | 10,201 | |

| The Luxury Collection | 6 | | 2,296 | | 39 | | 7,737 | | 45 | | 10,033 | |

| Autograph Collection | 9 | | 2,862 | | 15 | | 3,021 | | 24 | | 5,883 | |

| Marriott Executive Apartments | — | | — | | 35 | | 5,011 | | 35 | | 5,011 | |

| EDITION | 5 | | 1,379 | | 15 | | 2,844 | | 20 | | 4,223 | |

| SpringHill Suites | 23 | | 3,872 | | — | | — | | 23 | | 3,872 | |

| Element | 3 | | 810 | | 14 | | 2,803 | | 17 | | 3,613 | |

| AC Hotels by Marriott | 8 | | 1,512 | | 11 | | 1,892 | | 19 | | 3,404 | |

| Moxy | 1 | | 380 | | 12 | | 2,771 | | 13 | | 3,151 | |

| Protea Hotels | — | | — | | 23 | | 2,824 | | 23 | | 2,824 | |

| Tribute Portfolio | — | | — | | 10 | | 1,284 | | 10 | | 1,284 | |

| TownePlace Suites | 6 | | 825 | | — | | — | | 6 | | 825 | |

| Bulgari | — | | — | | 7 | | 650 | | 7 | | 650 | |

| Owned/Leased | 13 | | 4,335 | | 37 | | 8,775 | | 50 | | 13,110 | |

| Marriott Hotels | 2 | | 1,304 | | 5 | | 1,631 | | 7 | | 2,935 | |

| Courtyard | 7 | | 987 | | 4 | | 894 | | 11 | | 1,881 | |

| Sheraton | — | | — | | 4 | | 1,830 | | 4 | | 1,830 | |

| W Hotels | 2 | | 779 | | 2 | | 665 | | 4 | | 1,444 | |

| Westin | 1 | | 1,073 | | — | | — | | 1 | | 1,073 | |

| Protea Hotels | — | | — | | 5 | | 912 | | 5 | | 912 | |

| The Ritz-Carlton | — | | — | | 2 | | 550 | | 2 | | 550 | |

| Renaissance | — | | — | | 2 | | 505 | | 2 | | 505 | |

| JW Marriott | — | | — | | 1 | | 496 | | 1 | | 496 | |

| The Luxury Collection | — | | — | | 3 | | 383 | | 3 | | 383 | |

| Autograph Collection | — | | — | | 5 | | 360 | | 5 | | 360 | |

| Residence Inn | 1 | | 192 | | 1 | | 140 | | 2 | | 332 | |

| Tribute Portfolio | — | | — | | 2 | | 249 | | 2 | | 249 | |

| St. Regis | — | | — | | 1 | | 160 | | 1 | | 160 | |

| | | | | | | | | | | | | | | | | | | | |

MARRIOTT INTERNATIONAL, INC. |

| TOTAL LODGING PRODUCTS BY OWNERSHIP TYPE |

| As of June 30, 2024 |

| | | | | | |

| US & Canada | Total International1 | Total Worldwide |

| Properties | Rooms | Properties | Rooms | Properties | Rooms |

| Franchised, Licensed, and Other | 5,425 | | 818,512 | | 1,384 | | 244,237 | | 6,809 | | 1,062,749 | |

| Courtyard | 910 | | 121,873 | | 126 | | 23,197 | | 1,036 | | 145,070 | |

| Fairfield by Marriott | 1,159 | | 109,225 | | 68 | | 11,574 | | 1,227 | | 120,799 | |

| Residence Inn | 794 | | 94,604 | | 36 | | 4,670 | | 830 | | 99,274 | |

| Marriott Hotels | 230 | | 73,263 | | 67 | | 19,385 | | 297 | | 92,648 | |

| Sheraton | 140 | | 43,453 | | 80 | | 22,834 | | 220 | | 66,287 | |

| SpringHill Suites | 534 | | 62,100 | | — | | — | | 534 | | 62,100 | |

| Autograph Collection | 150 | | 33,810 | | 141 | | 28,245 | | 291 | | 62,055 | |

| TownePlace Suites | 511 | | 51,664 | | — | | — | | 511 | | 51,664 | |

| Westin | 94 | | 31,759 | | 31 | | 9,774 | | 125 | | 41,533 | |

| Four Points | 150 | | 22,503 | | 77 | | 13,609 | | 227 | | 36,112 | |

| AC Hotels by Marriott | 113 | | 18,471 | | 107 | | 15,707 | | 220 | | 34,178 | |

| Aloft | 162 | | 23,224 | | 27 | | 5,060 | | 189 | | 28,284 | |

| Renaissance | 68 | | 19,060 | | 31 | | 8,044 | | 99 | | 27,104 | |

| MGM Collection with Marriott Bonvoy** | 12 | | 26,210 | | — | | — | | 12 | | 26,210 | |

| Moxy | 39 | | 6,899 | | 97 | | 18,372 | | 136 | | 25,271 | |

| Timeshare* | 72 | | 18,839 | | 21 | | 3,906 | | 93 | | 22,745 | |

| Tribute Portfolio | 71 | | 14,016 | | 42 | | 5,670 | | 113 | | 19,686 | |

| Delta Hotels by Marriott | 67 | | 15,002 | | 20 | | 4,496 | | 87 | | 19,498 | |

| The Luxury Collection | 13 | | 7,607 | | 57 | | 10,414 | | 70 | | 18,021 | |

| City Express by Marriott | — | | — | | 151 | | 17,571 | | 151 | | 17,571 | |

| Element | 83 | | 11,136 | | 3 | | 397 | | 86 | | 11,533 | |

| Le Méridien | 24 | | 5,389 | | 22 | | 5,746 | | 46 | | 11,135 | |

| Design Hotels* | 16 | | 1,904 | | 120 | | 8,266 | | 136 | | 10,170 | |

| JW Marriott | 12 | | 6,072 | | 15 | | 3,272 | | 27 | | 9,344 | |

| Protea Hotels | — | | — | | 35 | | 3,035 | | 35 | | 3,035 | |

| The Ritz-Carlton | 1 | | 429 | | — | | — | | 1 | | 429 | |

| Marriott Executive Apartments | — | | — | | 3 | | 242 | | 3 | | 242 | |

| W Hotels | — | | — | | 1 | | 226 | | 1 | | 226 | |

| Bulgari | — | | — | | 2 | | 161 | | 2 | | 161 | |

| The Ritz-Carlton Yacht Collection* | — | | — | | 1 | | 149 | | 1 | | 149 | |

| Four Points Express | — | | — | | 2 | | 108 | | 2 | | 108 | |

| Apartments by Marriott Bonvoy | — | | — | | 1 | | 107 | | 1 | | 107 | |

| Residences | 71 | | 7,631 | | 59 | | 6,668 | | 130 | | 14,299 | |

| The Ritz-Carlton Residences | 43 | | 4,790 | | 19 | | 1,756 | | 62 | | 6,546 | |

| St. Regis Residences | 10 | | 1,198 | | 13 | | 1,785 | | 23 | | 2,983 | |

| W Residences | 10 | | 1,092 | | 7 | | 549 | | 17 | | 1,641 | |

| Marriott Hotels Residences | — | | — | | 4 | | 981 | | 4 | | 981 | |

| Westin Residences | 3 | | 266 | | 2 | | 353 | | 5 | | 619 | |

| Bulgari Residences | — | | — | | 5 | | 519 | | 5 | | 519 | |

| Sheraton Residences | — | | — | | 3 | | 472 | | 3 | | 472 | |

| The Luxury Collection Residences | 1 | | 91 | | 3 | | 115 | | 4 | | 206 | |

| Renaissance Residences | 1 | | 112 | | — | | — | | 1 | | 112 | |

| EDITION Residences | 3 | | 82 | | — | | — | | 3 | | 82 | |

| JW Marriott Residences | — | | — | | 1 | | 62 | | 1 | | 62 | |

| Le Méridien Residences | — | | — | | 1 | | 62 | | 1 | | 62 | |

| Autograph Collection Residences | — | | — | | 1 | | 14 | | 1 | | 14 | |

| Grand Total | 6,126 | | 1,044,190 | | 2,843 | | 614,469 | | 8,969 | | 1,658,659 | |

| | | | | | |

1 "International" refers to: (i) Europe, Middle East & Africa, (ii) Greater China, (iii) Asia Pacific excluding China, and (iv) Caribbean & Latin America. |

| * Timeshare, Design Hotels, and The Ritz-Carlton Yacht Collection counts are included in this table by geographical location. For external reporting purposes, these offerings are captured within “Unallocated corporate and other.” |

| ** Excludes four MGM Collection with Marriott Bonvoy properties (two Autograph Collection, one Tribute Portfolio, and one The Luxury Collection) which are presented in "Franchised, Licensed and Other" within their respective brands. |

In the above table, under “Owned/Leased,” The Luxury Collection, Autograph Collection and Tribute Portfolio include seven total properties that we acquired when we purchased Elegant Hotels Group plc in December 2019, which we currently intend to re-brand under such brands after the completion of planned renovations. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MARRIOTT INTERNATIONAL, INC. | | | | | | | | | | | | | | | | | | | |

| TOTAL LODGING PRODUCTS BY TIER | | | | | | | | | | | | | | | | | | | |

| As of June 30, 2024 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| US & Canada | Total International1 | Total Worldwide | | | | | | | | | | | | | | | | | | | |

| Total Systemwide | Properties | Rooms | Properties | Rooms | Properties | Rooms | | | | | | | | | | | | | | | | | | | |

| Luxury | 204 | | 60,043 | | 434 | | 99,126 | | 638 | | 159,169 | | | | | | | | | | | | | | | | | | | | |

| JW Marriott | 35 | | 19,261 | | 90 | | 30,264 | | 125 | | 49,525 | | | | | | | | | | | | | | | | | | | | |

| JW Marriott Residences | — | | — | | 1 | | 62 | | 1 | | 62 | | | | | | | | | | | | | | | | | | | | |

| The Ritz-Carlton | 42 | | 12,783 | | 79 | | 18,597 | | 121 | | 31,380 | | | | | | | | | | | | | | | | | | | | |

| The Ritz-Carlton Residences | 43 | | 4,790 | | 19 | | 1,756 | | 62 | | 6,546 | | | | | | | | | | | | | | | | | | | | |

| The Ritz-Carlton Yacht Collection* | — | | — | | 1 | | 149 | | 1 | | 149 | | | | | | | | | | | | | | | | | | | | |

| The Luxury Collection | 19 | | 9,903 | | 99 | | 18,534 | | 118 | | 28,437 | | | | | | | | | | | | | | | | | | | | |

| The Luxury Collection Residences | 1 | | 91 | | 3 | | 115 | | 4 | | 206 | | | | | | | | | | | | | | | | | | | | |

| W Hotels | 25 | | 7,295 | | 45 | | 12,696 | | 70 | | 19,991 | | | | | | | | | | | | | | | | | | | | |

| W Residences | 10 | | 1,092 | | 7 | | 549 | | 17 | | 1,641 | | | | | | | | | | | | | | | | | | | | |

| St. Regis | 11 | | 2,169 | | 48 | | 10,445 | | 59 | | 12,614 | | | | | | | | | | | | | | | | | | | | |

| St. Regis Residences | 10 | | 1,198 | | 13 | | 1,785 | | 23 | | 2,983 | | | | | | | | | | | | | | | | | | | | |

| EDITION | 5 | | 1,379 | | 15 | | 2,844 | | 20 | | 4,223 | | | | | | | | | | | | | | | | | | | | |

| EDITION Residences | 3 | | 82 | | — | | — | | 3 | | 82 | | | | | | | | | | | | | | | | | | | | |

| Bulgari | — | | — | | 9 | | 811 | | 9 | | 811 | | | | | | | | | | | | | | | | | | | | |

| Bulgari Residences | — | | — | | 5 | | 519 | | 5 | | 519 | | | | | | | | | | | | | | | | | | | | |

| Premium | 1,108 | | 395,587 | | 1,243 | | 313,158 | | 2,351 | | 708,745 | | | | | | | | | | | | | | | | | | | | |

| Marriott Hotels | 333 | | 131,303 | | 258 | | 79,163 | | 591 | | 210,466 | | | | | | | | | | | | | | | | | | | | |

| Marriott Hotels Residences | — | | — | | 4 | | 981 | | 4 | | 981 | | | | | | | | | | | | | | | | | | | | |

| Sheraton | 166 | | 64,322 | | 266 | | 86,158 | | 432 | | 150,480 | | | | | | | | | | | | | | | | | | | | |

| Sheraton Residences | — | | — | | 3 | | 472 | | 3 | | 472 | | | | | | | | | | | | | | | | | | | | |

| Westin | 135 | | 55,176 | | 109 | | 33,382 | | 244 | | 88,558 | | | | | | | | | | | | | | | | | | | | |

| Westin Residences | 3 | | 266 | | 2 | | 353 | | 5 | | 619 | | | | | | | | | | | | | | | | | | | | |

| Autograph Collection | 159 | | 36,672 | | 161 | | 31,626 | | 320 | | 68,298 | | | | | | | | | | | | | | | | | | | | |

| Autograph Collection Residences | — | | — | | 1 | | 14 | | 1 | | 14 | | | | | | | | | | | | | | | | | | | | |

| Renaissance | 89 | | 28,125 | | 86 | | 25,091 | | 175 | | 53,216 | | | | | | | | | | | | | | | | | | | | |

| Renaissance Residences | 1 | | 112 | | — | | — | | 1 | | 112 | | | | | | | | | | | | | | | | | | | | |

| Delta Hotels by Marriott | 92 | | 21,772 | | 46 | | 9,420 | | 138 | | 31,192 | | | | | | | | | | | | | | | | | | | | |

| Le Méridien | 25 | | 5,489 | | 93 | | 25,607 | | 118 | | 31,096 | | | | | | | | | | | | | | | | | | | | |

| Le Méridien Residences | — | | — | | 1 | | 62 | | 1 | | 62 | | | | | | | | | | | | | | | | | | | | |

| MGM Collection with Marriott Bonvoy** | 12 | | 26,210 | | — | | — | | 12 | | 26,210 | | | | | | | | | | | | | | | | | | | | |

| Tribute Portfolio | 71 | | 14,016 | | 54 | | 7,203 | | 125 | | 21,219 | | | | | | | | | | | | | | | | | | | | |

| Gaylord Hotels | 6 | | 10,220 | | — | | — | | 6 | | 10,220 | | | | | | | | | | | | | | | | | | | | |

| Design Hotels* | 16 | | 1,904 | | 120 | | 8,266 | | 136 | | 10,170 | | | | | | | | | | | | | | | | | | | | |

| Marriott Executive Apartments | — | | — | | 38 | | 5,253 | | 38 | | 5,253 | | | | | | | | | | | | | | | | | | | | |

| Apartments by Marriott Bonvoy | — | | — | | 1 | | 107 | | 1 | | 107 | | | | | | | | | | | | | | | | | | | | |

| Select | 4,742 | | 569,721 | | 992 | | 180,600 | | 5,734 | | 750,321 | | | | | | | | | | | | | | | | | | | | |

| Courtyard | 1,073 | | 148,232 | | 258 | | 51,835 | | 1,331 | | 200,067 | | | | | | | | | | | | | | | | | | | | |

| Fairfield by Marriott | 1,165 | | 110,656 | | 146 | | 21,422 | | 1,311 | | 132,078 | | | | | | | | | | | | | | | | | | | | |

| Residence Inn | 868 | | 106,798 | | 46 | | 5,926 | | 914 | | 112,724 | | | | | | | | | | | | | | | | | | | | |

| SpringHill Suites | 557 | | 65,972 | | — | | — | | 557 | | 65,972 | | | | | | | | | | | | | | | | | | | | |

| Four Points | 151 | | 22,637 | | 164 | | 37,948 | | 315 | | 60,585 | | | | | | | | | | | | | | | | | | | | |

| TownePlace Suites | 517 | | 52,489 | | — | | — | | 517 | | 52,489 | | | | | | | | | | | | | | | | | | | | |

| Aloft | 164 | | 23,729 | | 71 | | 14,756 | | 235 | | 38,485 | | | | | | | | | | | | | | | | | | | | |

| AC Hotels by Marriott | 121 | | 19,983 | | 118 | | 17,599 | | 239 | | 37,582 | | | | | | | | | | | | | | | | | | | | |

| Moxy | 40 | | 7,279 | | 109 | | 21,143 | | 149 | | 28,422 | | | | | | | | | | | | | | | | | | | | |

| Element | 86 | | 11,946 | | 17 | | 3,200 | | 103 | | 15,146 | | | | | | | | | | | | | | | | | | | | |

| Protea Hotels | — | | — | | 63 | | 6,771 | | 63 | | 6,771 | | | | | | | | | | | | | | | | | | | | |

| Midscale | — | | — | | 153 | | 17,679 | | 153 | | 17,679 | | | | | | | | | | | | | | | | | | | | |

| City Express by Marriott | — | | — | | 151 | | 17,571 | | 151 | | 17,571 | | | | | | | | | | | | | | | | | | | | |

| Four Points Express | — | | — | | 2 | | 108 | | 2 | | 108 | | | | | | | | | | | | | | | | | | | | |

| Timeshare* | 72 | | 18,839 | | 21 | | 3,906 | | 93 | | 22,745 | | | | | | | | | | | | | | | | | | | | |

| Grand Total | 6,126 | | 1,044,190 | | 2,843 | | 614,469 | | 8,969 | | 1,658,659 | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

1 "International" refers to: (i) Europe, Middle East & Africa, (ii) Greater China, (iii) Asia Pacific excluding China, and (iv) Caribbean & Latin America. | | | | | | | | | | | | | | | | | | | |

| * Timeshare, Design Hotels, and The Ritz-Carlton Yacht Collection counts are included in this table by geographical location. For external reporting purposes, these offerings are captured within “Unallocated corporate and other.” | | | | | | | | | | | | | | | | | | | |

** Excludes four MGM Collection with Marriott Bonvoy properties (two Autograph Collection, one Tribute Portfolio, and one The Luxury Collection) which are presented within their respective brands. | | | | | | | | | | | | | | | | | | | |

In the above table, The Luxury Collection, Autograph Collection and Tribute Portfolio include seven total properties that we acquired when we purchased Elegant Hotels Group plc in December 2019, which we currently intend to re-brand under such brands after the completion of planned renovations. | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MARRIOTT INTERNATIONAL, INC. |

| KEY LODGING STATISTICS |

| In Constant $ |

| | | | | | | | | | | | | |

| Comparable Company-Operated US & Canada Properties |

| | Three Months Ended June 30, 2024 and June 30, 2023 |

| | REVPAR | | Occupancy | | Average Daily Rate |

| Brand | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 |

| JW Marriott | | $ | 249.86 | | | 1.6 | % | | 73.3 | % | | -0.6 | % | pts. | | $ | 340.96 | | | 2.4 | % |

| The Ritz-Carlton | | $ | 352.94 | | | 3.3 | % | | 69.2 | % | | 1.8 | % | pts. | | $ | 510.38 | | | 0.6 | % |

| W Hotels | | $ | 231.58 | | | 1.8 | % | | 70.9 | % | | 0.9 | % | pts. | | $ | 326.44 | | | 0.5 | % |

Composite US & Canada Luxury1 | | $ | 298.56 | | | 1.5 | % | | 71.2 | % | | 0.6 | % | pts. | | $ | 419.44 | | | 0.6 | % |

| Marriott Hotels | | $ | 184.03 | | | 4.0 | % | | 74.4 | % | | 0.3 | % | pts. | | $ | 247.21 | | | 3.6 | % |

| Sheraton | | $ | 172.59 | | | 8.9 | % | | 72.9 | % | | 3.0 | % | pts. | | $ | 236.76 | | | 4.4 | % |

| Westin | | $ | 191.97 | | | 5.5 | % | | 75.2 | % | | 2.1 | % | pts. | | $ | 255.20 | | | 2.6 | % |

Composite US & Canada Premium2 | | $ | 180.87 | | | 5.2 | % | | 73.8 | % | | 1.0 | % | pts. | | $ | 244.97 | | | 3.7 | % |

US & Canada Full-Service3 | | $ | 205.80 | | | 4.0 | % | | 73.3 | % | | 1.0 | % | pts. | | $ | 280.87 | | | 2.6 | % |

| Courtyard | | $ | 124.52 | | | 3.1 | % | | 72.4 | % | | 1.0 | % | pts. | | $ | 172.10 | | | 1.6 | % |

| Residence Inn | | $ | 158.73 | | | 1.2 | % | | 79.1 | % | | -0.7 | % | pts. | | $ | 200.75 | | | 2.1 | % |

Composite US & Canada Select4 | | $ | 136.01 | | | 2.3 | % | | 74.8 | % | | 0.6 | % | pts. | | $ | 181.96 | | | 1.4 | % |

US & Canada - All5 | | $ | 189.01 | | | 3.7 | % | | 73.6 | % | | 0.9 | % | pts. | | $ | 256.72 | | | 2.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Comparable Systemwide US & Canada Properties |

| | Three Months Ended June 30, 2024 and June 30, 2023 |

| | REVPAR | | Occupancy | | Average Daily Rate |

| Brand | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 |

| JW Marriott | | $ | 243.31 | | | 3.7 | % | | 75.1 | % | | 0.9 | % | pts. | | $ | 324.17 | | | 2.4 | % |

| The Ritz-Carlton | | $ | 352.42 | | | 3.5 | % | | 69.7 | % | | 1.9 | % | pts. | | $ | 505.31 | | | 0.7 | % |

| W Hotels | | $ | 231.58 | | | 1.8 | % | | 70.9 | % | | 0.9 | % | pts. | | $ | 326.44 | | | 0.5 | % |

Composite US & Canada Luxury1 | | $ | 284.64 | | | 2.4 | % | | 72.5 | % | | 1.1 | % | pts. | | $ | 392.58 | | | 0.7 | % |

| Marriott Hotels | | $ | 155.93 | | | 5.2 | % | | 72.9 | % | | 1.3 | % | pts. | | $ | 213.88 | | | 3.3 | % |

| Sheraton | | $ | 139.57 | | | 7.5 | % | | 72.0 | % | | 2.4 | % | pts. | | $ | 193.83 | | | 3.9 | % |

| Westin | | $ | 173.59 | | | 4.5 | % | | 74.7 | % | | 1.6 | % | pts. | | $ | 232.28 | | | 2.2 | % |

Composite US & Canada Premium2 | | $ | 157.64 | | | 5.5 | % | | 72.8 | % | | 1.7 | % | pts. | | $ | 216.61 | | | 3.0 | % |

US & Canada Full-Service3 | | $ | 171.82 | | | 4.9 | % | | 72.7 | % | | 1.7 | % | pts. | | $ | 236.19 | | | 2.5 | % |

| Courtyard | | $ | 123.46 | | | 2.5 | % | | 73.9 | % | | 0.4 | % | pts. | | $ | 167.06 | | | 1.9 | % |

| Residence Inn | | $ | 140.03 | | | 3.1 | % | | 80.2 | % | | 0.8 | % | pts. | | $ | 174.52 | | | 2.1 | % |

| Fairfield by Marriott | | $ | 102.55 | | | 2.5 | % | | 74.2 | % | | 0.5 | % | pts. | | $ | 138.25 | | | 1.8 | % |

Composite US & Canada Select4 | | $ | 121.99 | | | 3.1 | % | | 76.1 | % | | 0.7 | % | pts. | | $ | 160.40 | | | 2.1 | % |

US & Canada - All5 | | $ | 142.20 | | | 3.9 | % | | 74.7 | % | | 1.1 | % | pts. | | $ | 190.33 | | | 2.4 | % |

| | | | | | | | | | | | | |

1 Includes JW Marriott, The Ritz-Carlton, W Hotels, The Luxury Collection, St. Regis, and EDITION. |

2 Includes Marriott Hotels, Sheraton, Westin, Renaissance, Autograph Collection, Delta Hotels by Marriott, and Gaylord Hotels. Systemwide also includes Le Méridien and Tribute Portfolio. |

3 Includes Composite US & Canada Luxury and Composite US & Canada Premium. |

4 Includes Courtyard, Residence Inn, Fairfield by Marriott, SpringHill Suites, TownePlace Suites, Four Points, Aloft, Element, and AC Hotels by Marriott. Systemwide also includes Moxy. |

5 Includes US & Canada Full-Service and Composite US & Canada Select. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MARRIOTT INTERNATIONAL, INC. |

| KEY LODGING STATISTICS |

| In Constant $ |

| | | | | | | | | | | | | |

| Comparable Company-Operated US & Canada Properties |

| | Six Months Ended June 30, 2024 and June 30, 2023 |

| | REVPAR | | Occupancy | | Average Daily Rate |

| Brand | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 |

| JW Marriott | | $ | 255.92 | | | 2.5 | % | | 72.2 | % | | 0.0 | % | pts. | | $ | 354.38 | | | 2.5 | % |

| The Ritz-Carlton | | $ | 351.79 | | | 2.3 | % | | 67.1 | % | | 0.9 | % | pts. | | $ | 524.52 | | | 1.0 | % |

| W Hotels | | $ | 209.99 | | | 0.5 | % | | 64.8 | % | | 1.0 | % | pts. | | $ | 324.30 | | | -1.0 | % |

Composite US & Canada Luxury1 | | $ | 306.08 | | | 1.3 | % | | 69.3 | % | | 0.6 | % | pts. | | $ | 441.67 | | | 0.4 | % |

| Marriott Hotels | | $ | 170.40 | | | 4.2 | % | | 70.4 | % | | 0.6 | % | pts. | | $ | 242.10 | | | 3.2 | % |

| Sheraton | | $ | 163.33 | | | 9.9 | % | | 69.5 | % | | 3.4 | % | pts. | | $ | 235.05 | | | 4.5 | % |

| Westin | | $ | 173.17 | | | 4.5 | % | | 69.6 | % | | 1.1 | % | pts. | | $ | 248.68 | | | 2.8 | % |

Composite US & Canada Premium2 | | $ | 167.57 | | | 4.6 | % | | 69.7 | % | | 0.8 | % | pts. | | $ | 240.28 | | | 3.4 | % |

US & Canada Full-Service3 | | $ | 196.92 | | | 3.5 | % | | 69.6 | % | | 0.8 | % | pts. | | $ | 282.73 | | | 2.3 | % |

| Courtyard | | $ | 112.86 | | | 1.6 | % | | 67.2 | % | | 0.2 | % | pts. | | $ | 168.05 | | | 1.2 | % |

| Residence Inn | | $ | 151.06 | | | 0.5 | % | | 75.9 | % | | -1.4 | % | pts. | | $ | 199.03 | | | 2.3 | % |

Composite US & Canada Select4 | | $ | 126.13 | | | 1.3 | % | | 70.3 | % | | -0.2 | % | pts. | | $ | 179.48 | | | 1.6 | % |

US & Canada - All5 | | $ | 179.89 | | | 3.1 | % | | 69.8 | % | | 0.6 | % | pts. | | $ | 257.72 | | | 2.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Comparable Systemwide US & Canada Properties |

| | Six Months Ended June 30, 2024 and June 30, 2023 |

| | REVPAR | | Occupancy | | Average Daily Rate |

| Brand | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 |

| JW Marriott | | $ | 245.84 | | | 3.2 | % | | 73.1 | % | | 0.4 | % | pts. | | $ | 336.28 | | | 2.6 | % |

| The Ritz-Carlton | | $ | 347.55 | | | 2.4 | % | | 67.2 | % | | 1.0 | % | pts. | | $ | 516.93 | | | 0.9 | % |

| W Hotels | | $ | 209.99 | | | 0.5 | % | | 64.8 | % | | 1.0 | % | pts. | | $ | 324.30 | | | -1.0 | % |

Composite US & Canada Luxury1 | | $ | 286.72 | | | 1.7 | % | | 70.1 | % | | 0.7 | % | pts. | | $ | 409.26 | | | 0.6 | % |

| Marriott Hotels | | $ | 142.83 | | | 4.2 | % | | 68.2 | % | | 0.7 | % | pts. | | $ | 209.49 | | | 3.0 | % |

| Sheraton | | $ | 126.08 | | | 7.1 | % | | 66.7 | % | | 2.0 | % | pts. | | $ | 188.96 | | | 3.9 | % |

| Westin | | $ | 161.00 | | | 3.4 | % | | 70.2 | % | | 1.0 | % | pts. | | $ | 229.25 | | | 2.0 | % |

Composite US & Canada Premium2 | | $ | 144.83 | | | 4.4 | % | | 68.2 | % | | 1.1 | % | pts. | | $ | 212.36 | | | 2.6 | % |

US & Canada Full-Service3 | | $ | 160.68 | | | 3.8 | % | | 68.4 | % | | 1.1 | % | pts. | | $ | 234.88 | | | 2.2 | % |

| Courtyard | | $ | 111.23 | | | 1.2 | % | | 68.9 | % | | -0.4 | % | pts. | | $ | 161.51 | | | 1.7 | % |

| Residence Inn | | $ | 129.25 | | | 1.9 | % | | 76.1 | % | | -0.2 | % | pts. | | $ | 169.79 | | | 2.1 | % |

| Fairfield by Marriott | | $ | 91.03 | | | 1.0 | % | | 68.5 | % | | -0.5 | % | pts. | | $ | 132.88 | | | 1.7 | % |

Composite US & Canada Select4 | | $ | 110.68 | | | 1.8 | % | | 71.3 | % | | -0.1 | % | pts. | | $ | 155.17 | | | 1.9 | % |

US & Canada - All5 | | $ | 130.96 | | | 2.8 | % | | 70.1 | % | | 0.4 | % | pts. | | $ | 186.70 | | | 2.2 | % |

| | | | | | | | | | | | | |

1 Includes JW Marriott, The Ritz-Carlton, W Hotels, The Luxury Collection, St. Regis, and EDITION. |

2 Includes Marriott Hotels, Sheraton, Westin, Renaissance, Autograph Collection, Delta Hotels by Marriott, and Gaylord Hotels. Systemwide also includes Le Méridien and Tribute Portfolio. |

3 Includes Composite US & Canada Luxury and Composite US & Canada Premium. |

4 Includes Courtyard, Residence Inn, Fairfield by Marriott, SpringHill Suites, TownePlace Suites, Four Points, Aloft, Element, and AC Hotels by Marriott. Systemwide also includes Moxy. |

5 Includes US & Canada Full-Service and Composite US & Canada Select. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MARRIOTT INTERNATIONAL, INC. |

| KEY LODGING STATISTICS |

| In Constant $ |

| | | | | | | | | | | | | |

| Comparable Company-Operated International Properties |

| | Three Months Ended June 30, 2024 and June 30, 2023 |

| | REVPAR | | Occupancy | | Average Daily Rate |

| Region | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 |

| Europe | | $ | 241.85 | | | 6.7 | % | | 75.9 | % | | 0.5 | % | pts. | | $ | 318.49 | | | 6.0 | % |

| Middle East & Africa | | $ | 121.16 | | | 16.8 | % | | 65.1 | % | | 3.5 | % | pts. | | $ | 186.07 | | | 10.6 | % |

| Greater China | | $ | 82.54 | | | -4.6 | % | | 68.9 | % | | 0.9 | % | pts. | | $ | 119.84 | | | -5.9 | % |

| Asia Pacific excluding China | | $ | 110.52 | | | 12.0 | % | | 70.6 | % | | 4.1 | % | pts. | | $ | 156.54 | | | 5.4 | % |

| Caribbean & Latin America | | $ | 171.04 | | | 6.3 | % | | 66.5 | % | | 3.6 | % | pts. | | $ | 257.16 | | | 0.5 | % |

| | | | | | | | | | | | | |

International - All1 | | $ | 121.60 | | | 6.4 | % | | 69.3 | % | | 2.4 | % | pts. | | $ | 175.42 | | | 2.8 | % |

| | | | | | | | | | | | | |

Worldwide2 | | $ | 150.24 | | | 4.9 | % | | 71.1 | % | | 1.7 | % | pts. | | $ | 211.16 | | | 2.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Comparable Systemwide International Properties |

| | Three Months Ended June 30, 2024 and June 30, 2023 |

| | REVPAR | | Occupancy | | Average Daily Rate |

| Region | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 |

| Europe | | $ | 171.89 | | | 6.6 | % | | 75.0 | % | | 2.1 | % | pts. | | $ | 229.13 | | | 3.6 | % |

| Middle East & Africa | | $ | 113.15 | | | 18.1 | % | | 64.9 | % | | 3.8 | % | pts. | | $ | 174.41 | | | 11.2 | % |

| Greater China | | $ | 77.12 | | | -4.2 | % | | 67.9 | % | | 0.7 | % | pts. | | $ | 113.54 | | | -5.1 | % |

| Asia Pacific excluding China | | $ | 113.44 | | | 13.0 | % | | 71.0 | % | | 4.3 | % | pts. | | $ | 159.71 | | | 6.2 | % |

| Caribbean & Latin America | | $ | 149.03 | | | 8.6 | % | | 66.5 | % | | 3.8 | % | pts. | | $ | 224.16 | | | 2.4 | % |

| | | | | | | | | | | | | |

International - All1 | | $ | 121.14 | | | 7.4 | % | | 69.7 | % | | 2.6 | % | pts. | | $ | 173.80 | | | 3.4 | % |

| | | | | | | | | | | | | |

Worldwide2 | | $ | 135.52 | | | 4.9 | % | | 73.1 | % | | 1.6 | % | pts. | | $ | 185.33 | | | 2.6 | % |

| | | | | | | | | | | | | |

1 Includes Europe, Middle East & Africa, Greater China, Asia Pacific excluding China, and Caribbean & Latin America. |

2 Includes US & Canada - All and International - All. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MARRIOTT INTERNATIONAL, INC. |

| KEY LODGING STATISTICS |

| In Constant $ |

| | | | | | | | | | | | | |

| Comparable Company-Operated International Properties |

| | Six Months Ended June 30, 2024 and June 30, 2023 |

| | REVPAR | | Occupancy | | Average Daily Rate |

| Region | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 |

| Europe | | $ | 195.35 | | | 6.0 | % | | 68.8 | % | | 0.8 | % | pts. | | $ | 283.82 | | | 4.7 | % |

| Middle East & Africa | | $ | 133.70 | | | 14.3 | % | | 67.7 | % | | 3.4 | % | pts. | | $ | 197.43 | | | 8.5 | % |

| Greater China | | $ | 83.84 | | | 0.1 | % | | 67.2 | % | | 1.6 | % | pts. | | $ | 124.72 | | | -2.2 | % |

| Asia Pacific excluding China | | $ | 117.65 | | | 14.1 | % | | 71.5 | % | | 4.8 | % | pts. | | $ | 164.59 | | | 6.5 | % |

| Caribbean & Latin America | | $ | 196.16 | | | 8.2 | % | | 67.3 | % | | 2.8 | % | pts. | | $ | 291.59 | | | 3.7 | % |

| | | | | | | | | | | | | |

International - All1 | | $ | 122.39 | | | 8.2 | % | | 68.6 | % | | 2.8 | % | pts. | | $ | 178.27 | | | 3.9 | % |

| | | | | | | | | | | | | |

Worldwide2 | | $ | 146.83 | | | 5.5 | % | | 69.1 | % | | 1.8 | % | pts. | | $ | 212.38 | | | 2.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Comparable Systemwide International Properties |

| | Six Months Ended June 30, 2024 and June 30, 2023 |

| | REVPAR | | Occupancy | | Average Daily Rate |

| Region | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 |

| Europe | | $ | 139.27 | | | 6.6 | % | | 67.1 | % | | 2.7 | % | pts. | | $ | 207.57 | | | 2.4 | % |

| Middle East & Africa | | $ | 123.62 | | | 15.5 | % | | 66.7 | % | | 3.3 | % | pts. | | $ | 185.36 | | | 9.8 | % |

| Greater China | | $ | 78.13 | | | 0.4 | % | | 66.3 | % | | 1.5 | % | pts. | | $ | 117.82 | | | -1.8 | % |

| Asia Pacific excluding China | | $ | 118.61 | | | 14.8 | % | | 71.3 | % | | 4.7 | % | pts. | | $ | 166.35 | | | 7.3 | % |

| Caribbean & Latin America | | $ | 167.20 | | | 10.3 | % | | 68.1 | % | | 3.8 | % | pts. | | $ | 245.56 | | | 4.2 | % |

| | | | | | | | | | | | | |

International - All1 | | $ | 118.42 | | | 9.0 | % | | 67.9 | % | | 3.0 | % | pts. | | $ | 174.42 | | | 4.2 | % |

| | | | | | | | | | | | | |

Worldwide2 | | $ | 126.98 | | | 4.5 | % | | 69.4 | % | | 1.2 | % | pts. | | $ | 182.89 | | | 2.7 | % |

| | | | | | | | | | | | | |

1 Includes Europe, Middle East & Africa, Greater China, Asia Pacific excluding China, and Caribbean & Latin America. |

2 Includes US & Canada - All and International - All. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MARRIOTT INTERNATIONAL, INC. |

| NON-GAAP FINANCIAL MEASURES |

| ADJUSTED EBITDA |

| ($ in millions) |

| | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year 2024 |

| First

Quarter | | Second

Quarter | | | | | | Total |

| Net income, as reported | $ | 564 | | | $ | 772 | | | | | | | $ | 1,336 | |

| Cost reimbursement revenue | (4,433) | | | (4,728) | | | | | | | (9,161) | |

| Reimbursed expenses | 4,501 | | | 4,645 | | | | | | | 9,146 | |

| Interest expense | 163 | | | 173 | | | | | | | 336 | |

| Interest expense from unconsolidated joint ventures | 2 | | | 2 | | | | | | | 4 | |

| Provision for income taxes | 163 | | | 268 | | | | | | | 431 | |

| Depreciation and amortization | 45 | | | 47 | | | | | | | 92 | |

| Contract investment amortization | 23 | | | 27 | | | | | | | 50 | |

| Depreciation and amortization classified in reimbursed expenses | 48 | | | 50 | | | | | | | 98 | |

| Depreciation, amortization, and impairments from unconsolidated joint ventures | 5 | | | 3 | | | | | | | 8 | |

| Stock-based compensation | 53 | | | 57 | | | | | | | 110 | |

| Merger-related charges and other | 8 | | | 8 | | | | | | | 16 | |

| | | | | | | | | |

Adjusted EBITDA† | $ | 1,142 | | | $ | 1,324 | | | | | | | $ | 2,466 | |

| | | | | | | | | |

Change from 2023 Adjusted EBITDA† | 4 | % | | 9 | % | | | | | | 6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year 2023 |

| First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter | | Total |

| Net income, as reported | $ | 757 | | | $ | 726 | | | $ | 752 | | | $ | 848 | | | $ | 3,083 | |

| Cost reimbursement revenue | (4,147) | | | (4,457) | | | (4,391) | | | (4,418) | | | (17,413) | |

| Reimbursed expenses | 4,136 | | | 4,366 | | | 4,238 | | | 4,684 | | | 17,424 | |

| Interest expense | 126 | | | 140 | | | 146 | | | 153 | | | 565 | |

| Interest expense from unconsolidated joint ventures | 1 | | | 1 | | | 3 | | | 1 | | | 6 | |

| Provision (benefit) for income taxes | 87 | | | 238 | | | 237 | | | (267) | | | 295 | |

| Depreciation and amortization | 44 | | | 48 | | | 46 | | | 51 | | | 189 | |

| Contract investment amortization | 21 | | | 22 | | | 23 | | | 22 | | | 88 | |

| Depreciation and amortization classified in reimbursed expenses | 31 | | | 38 | | | 39 | | | 51 | | | 159 | |

| Depreciation, amortization, and impairments from unconsolidated joint ventures | 4 | | | 3 | | | 6 | | | 6 | | | 19 | |

| Stock-based compensation | 37 | | | 56 | | | 54 | | | 58 | | | 205 | |

| Merger-related charges and other | 1 | | | 38 | | | 13 | | | 8 | | | 60 | |

| | | | | | | | | |

| Gain on asset dispositions | — | | | — | | | (24) | | | — | | | (24) | |

Adjusted EBITDA† | $ | 1,098 | | | $ | 1,219 | | | $ | 1,142 | | | $ | 1,197 | | | $ | 4,656 | |

| | | | | | | | | |

† Denotes non-GAAP financial measures. Please see pages A-14 and A-15 for information about our reasons for providing these alternative financial measures and the limitations on their use. |

| | | | | | | | | | | | | | | | | |

MARRIOTT INTERNATIONAL, INC. |

| NON-GAAP FINANCIAL MEASURES |

| ADJUSTED EBITDA FORECAST |

| THIRD QUARTER 2024 |

| ($ in millions) |

| | | | | |

| Range | | |

| Estimated

Third Quarter 2024 | | Third Quarter 2023 |

Net income excluding certain items1 | $ | 643 | | | $ | 661 | | | |

| Interest expense | 175 | | | 175 | | | |

| Interest expense from unconsolidated joint ventures | 2 | | | 2 | | | |

| Provision for income taxes | 223 | | | 230 | | | |

| Depreciation and amortization | 45 | | | 45 | | | |

| Contract investment amortization | 25 | | | 25 | | | |

| Depreciation and amortization classified in reimbursed expenses | 50 | | | 50 | | | |

| Depreciation, amortization, and impairments from unconsolidated joint ventures | 5 | | | 5 | | | |

| Stock-based compensation | 57 | | | 57 | | | |

Adjusted EBITDA† | $ | 1,225 | | | $ | 1,250 | | | $ | 1,142 | |

| | | | | |

Increase over 2023 Adjusted EBITDA† | 7 | % | | 9 | % | | |

| | | | | |

† Denotes non-GAAP financial measures. Please see pages A-14 and A-15 for information about our reasons for providing these alternative financial measures and the limitations on their use. |

| | | | | |

1 Guidance excludes cost reimbursement revenue, reimbursed expenses, and merger-related charges and other expenses, each of which the company cannot forecast with sufficient accuracy and without unreasonable efforts, and which may be significant, except for depreciation and amortization classified in reimbursed expenses, which is included in the caption "Depreciation and amortization classified in reimbursed expenses" above. Guidance does not reflect any asset sales that may occur during the year, which the company cannot forecast with sufficient accuracy and without unreasonable efforts, and which may be significant. |

| | | | | | | | | | | | | | | | | |

MARRIOTT INTERNATIONAL, INC. |

| NON-GAAP FINANCIAL MEASURES |

| ADJUSTED EBITDA FORECAST |

| FULL YEAR 2024 |

| ($ in millions) |

| | | | | |

| Range | | |

| Estimated

Full Year 2024 | | Full Year 2023 |

Net income excluding certain items1 | $ | 2,634 | | | $ | 2,683 | | | |

| Interest expense | 698 | | | 698 | | | |

| Interest expense from unconsolidated joint ventures | 7 | | | 7 | | | |

| Provision for income taxes | 885 | | | 901 | | | |

| Depreciation and amortization | 183 | | | 183 | | | |

| Contract investment amortization | 103 | | | 103 | | | |

| Depreciation and amortization classified in reimbursed expenses | 200 | | | 200 | | | |

| Depreciation, amortization, and impairments from unconsolidated joint ventures | 18 | | | 18 | | | |

| Stock-based compensation | 222 | | | 222 | | | |

| | | | | |

Adjusted EBITDA† | $ | 4,950 | | | $ | 5,015 | | | $ | 4,656 | |

| | | | | |

Increase over 2023 Adjusted EBITDA† | 6 | % | | 8 | % | | |

| | | | | |

† Denotes non-GAAP financial measures. Please see pages A-14 and A-15 for information about our reasons for providing these alternative financial measures and the limitations on their use. |

| | | | | |

1 Guidance excludes cost reimbursement revenue, reimbursed expenses, and merger-related charges and other expenses, each of which the company cannot forecast with sufficient accuracy and without unreasonable efforts, and which may be significant, except for depreciation and amortization classified in reimbursed expenses, which is included in the caption "Depreciation and amortization classified in reimbursed expenses" above. Guidance does not reflect any asset sales that may occur during the year, which the company cannot forecast with sufficient accuracy and without unreasonable efforts, and which may be significant. |

MARRIOTT INTERNATIONAL, INC.

EXPLANATION OF NON-GAAP FINANCIAL AND PERFORMANCE MEASURES

In our press release and schedules, on the related conference call, and in the infographic made available in connection with our press release, we report certain financial measures that are not required by, or presented in accordance with, United States generally accepted accounting principles (“GAAP”). These non-GAAP financial measures are labeled as “adjusted” and/or identified with the symbol “†”. We discuss the manner in which the non-GAAP measures reported in this press release, schedules, and infographic are determined and management’s reasons for reporting these non-GAAP measures below, and the press release schedules reconcile each to the most directly comparable GAAP measures (with respect to the forward-looking non-GAAP measures, to the extent available without unreasonable efforts). Although management evaluates and presents these non-GAAP measures for the reasons described below, please be aware that these non-GAAP measures have limitations and should not be considered in isolation or as a substitute for revenue, operating income, net income, earnings per share, or any other comparable operating measure prescribed by GAAP. In addition, we may calculate and/or present these non-GAAP financial measures differently than measures with the same or similar names that other companies report, and as a result, the non-GAAP measures we report may not be comparable to those reported by others.

Adjusted Operating Income and Adjusted Operating Income Margin. Adjusted operating income and Adjusted operating income margin exclude cost reimbursement revenue, reimbursed expenses, merger-related charges and other expenses, and certain non-cash impairment charges (when applicable). Adjusted operating income margin reflects Adjusted operating income divided by Adjusted total revenues. We believe that these are meaningful metrics because they allow for period-over-period comparisons of our ongoing operations before these items and for the reasons further described below.

Adjusted Net Income and Adjusted Diluted Earnings Per Share. Adjusted net income and Adjusted diluted earnings per share reflect our net income and diluted earnings per share excluding the impact of cost reimbursement revenue, reimbursed expenses, merger-related charges and other expenses, certain non-cash impairment charges (when applicable), and gains and losses on asset dispositions made by us or by our joint venture investees (when applicable). Additionally, Adjusted net income and Adjusted diluted earnings per share exclude the income tax effect of the above adjustments (calculated using an estimated tax rate applicable to each adjustment) and income tax special items, which in 2023 primarily related to the resolution of tax audits. We believe that these measures are meaningful indicators of our performance because they allow for period-over-period comparisons of our ongoing operations before these items and for the reasons further described below.

Adjusted Earnings Before Interest Expense, Taxes, Depreciation and Amortization (“Adjusted EBITDA”). Adjusted EBITDA reflects net income excluding the impact of the following items: cost reimbursement revenue and reimbursed expenses, interest expense, depreciation and amortization, provision (benefit) for income taxes, merger-related charges and other expenses, and stock-based compensation expense for all periods presented. When applicable, Adjusted EBITDA also excludes certain non-cash impairment charges and gains and losses on asset dispositions made by us or by our joint venture investees.

In our presentations of Adjusted operating income and Adjusted operating income margin, Adjusted net income and Adjusted diluted earnings per share, and Adjusted EBITDA, we exclude merger-related charges and other expenses as well as non-cash impairment charges (if above a specified threshold) related to our management and franchise contracts (if the impairment is non-routine), leases, equity investments, and other capitalized assets, which we record in the “Contract investment amortization,” “Depreciation, amortization, and other,” and “Equity in earnings” captions of our Condensed Consolidated Statements of Income (our “Income Statements”), to allow for period-over period comparisons of our ongoing operations before the impact of these items. We exclude cost reimbursement revenue and reimbursed expenses, which relate to property-level and centralized programs and services that we operate for the benefit of our property owners. We do not operate these programs and services to generate a profit over the long term, and accordingly, when we recover the costs that we incur for these programs and services from our property owners, we do not seek a mark-up. For property-level services, our owners typically reimburse us at the same time that we incur expenses. However, for centralized programs and services, our owners may reimburse us before or after we incur expenses, causing timing differences between the costs we incur and the related reimbursement from property owners in our operating and net income. Over the long term, these programs and services are not designed to impact our economics, either positively or negatively. Because we do not retain any such profits or losses over time, we exclude the net impact when evaluating period-over-period changes in our operating results.

We believe that Adjusted EBITDA is a meaningful indicator of our operating performance because it permits period-over-period comparisons of our ongoing operations before these items. Our use of Adjusted EBITDA also facilitates comparison with results from other lodging companies because it excludes certain items that can vary widely across different industries or among companies within the same industry. For example, interest expense can be dependent on a company’s capital structure, debt levels, and credit ratings. Accordingly, the impact of interest expense on earnings can vary significantly among companies. The tax positions of companies can also vary because of their differing abilities to take advantage of tax benefits and because of the tax policies of the jurisdictions in which they operate. As a result, effective tax rates and provisions for income taxes can vary considerably among companies. Our Adjusted EBITDA also excludes depreciation and amortization expense, which we report under “Depreciation, amortization, and other” as well as depreciation and amortization classified in “Contract investment amortization,” “Reimbursed expenses,” and “Equity in earnings” of our Income Statements, because companies utilize productive assets of different ages and use different methods of both acquiring and depreciating productive assets. Depreciation and amortization classified in “Reimbursed expenses” reflects depreciation and amortization of Marriott-owned assets, for which we receive cash from owners to reimburse the company for its investments made for the benefit of the system. These differences can result in considerable variability in the relative costs of productive assets and the depreciation and amortization expense among companies. We exclude stock-based compensation expense in all periods presented to address the considerable variability among companies in recording compensation expense because companies use stock-based payment awards differently, both in the type and quantity of awards granted.

RevPAR. In addition to the foregoing non-GAAP financial measures, we present Revenue per Available Room (“RevPAR”) as a performance measure. We believe RevPAR, which we calculate by dividing property level room revenue by rooms available for the period, is a meaningful

MARRIOTT INTERNATIONAL, INC.

EXPLANATION OF NON-GAAP FINANCIAL AND PERFORMANCE MEASURES

indicator of our performance because it measures the period-over-period change in room revenues. RevPAR may not be comparable to similarly titled measures, such as revenues, and should not be viewed as necessarily correlating with our fee revenue. We also believe occupancy and average daily rate (“ADR”), which are components of calculating RevPAR, are meaningful indicators of our performance. Occupancy, which we calculate by dividing total rooms sold by total rooms available for the period, measures the utilization of a property’s available capacity. ADR, which we calculate by dividing property level room revenue by total rooms sold, measures average room price and is useful in assessing pricing levels. Comparisons to prior periods are on a constant U.S. dollar basis, which we calculate by applying exchange rates for the current period to the prior comparable period. We believe constant dollar analysis provides valuable information regarding our properties’ performance as it removes currency fluctuations from the presentation of such results.

We define our comparable properties as our properties that were open and operating under one of our hotel brands since the beginning of the last full calendar year (since January 1, 2023 for the current period) and have not, in either the current or previous year: (1) undergone significant room or public space renovations or expansions, (2) been converted between company-operated and franchised, or (3) sustained substantial property damage or business interruption. Our comparable properties also exclude MGM Collection with Marriott Bonvoy, Design Hotels, The Ritz-Carlton Yacht Collection, and timeshare properties.

Non-RevPAR Related Franchise Fees. In this press release, we also discuss non-RevPAR related franchise fees, which include co-branded credit card, timeshare and yacht fees, residential branding fees, franchise application and relicensing fees, and certain other non-hotel licensing fees.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |