Mountain Crest Acquisition Corp Stockholders Approve Business Combination with Playboy Enterprises, Inc.

February 09 2021 - 2:25PM

Mountain Crest Acquisition Corp (NASDAQ: MCAC) (“Mountain Crest”),

a publicly traded special purpose acquisition company, announced

today that in a special meeting of stockholders on February 9,

2021, its stockholders voted to approve its proposed business

combination (the “business combination”) with Playboy Enterprises,

Inc. (“Playboy”), owner of one of the largest and most recognizable

lifestyle brands in the world.

The business combination is expected to close on

February 10, 2021, subject to the satisfaction of certain customary

closing conditions. As part of the consummation of the business

combination, Mountain Crest will change its name to “PLBY Group,

Inc.” Trading on The Nasdaq Global Market, under the new ticker

symbol “PLBY,” is expected to begin on February 11, 2021.

“We are thrilled by the overwhelming support

from the Mountain Crest stockholders, who we hope are as excited as

we are about Playboy’s return to the U.S. capital markets. This

week we will officially become PLBY Group, Inc., and start trading

under our new ticker, PLBY, marking a momentous occasion for one of

the world’s most iconic brands. We’re thrilled to begin the next

chapter of our company’s growth story and committed to delivering

long-term value for our stockholders,” said Ben Kohn, CEO of

Playboy.

Dr. Suying Liu, Chairman and Chief

Executive Officer of Mountain Crest Acquisition Corp., commented,

“I am grateful for the support of all of our stockholders, and

excited by the opportunity to partner with Ben and the whole

Playboy team on the next stage of growth for this iconic, global

business.”

About PlayboyPlayboy is one of

the largest and most recognizable global lifestyle platforms in the

world, with a strong consumer business focused on four categories

comprising The Pleasure Lifestyle: Sexual Wellness, Style &

Apparel, Gaming & Lifestyle and Beauty & Grooming. Under

its mission of Pleasure for All, the 67-year-old Playboy brand

drives more than $3 billion in global consumer spend and sells

products across 180 countries. Playboy is one of the most iconic

brands in history.

About Mountain Crest Acquisition

CorpMountain Crest Acquisition Corp is a blank check

company formed for the purpose of effecting a merger, share

exchange, asset acquisition, share purchase, reorganization or

similar business combination with one or more businesses. Mountain

Crest Acquisition Corp's efforts to identify a prospective target

business was not limited to a particular industry or geographic

region, although the Company focused on operating businesses in

North America. Visit https://www.mcacquisition.com/.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995.

Mountain Crest’s and Playboy’s actual results may differ from their

expectations, estimates, and projections and, consequently, you

should not rely on these forward-looking statements as predictions

of future events. Words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,”

“will,” “could,” “should,” “believes,” “predicts,” “potential,”

“continue,” and similar expressions (or the negative versions of

such words or expressions) are intended to identify such

forward-looking statements. These forward-looking statements

include, without limitation, Mountain Crest’s and Playboy’s

expectations with respect to future performance and anticipated

financial impacts of the proposed business combination, the

satisfaction of the closing conditions to the proposed business

combination, and the timing of the completion of the proposed

business combination.

These forward-looking statements involve

significant risks and uncertainties that could cause the actual

results to differ materially from those discussed in the

forward-looking statements. Factors that may cause such differences

include, but are not limited to: (1) the occurrence of any event,

change, or other circumstances that could give rise to the

termination of the definitive merger agreement (the “Agreement”) or

could otherwise cause the transaction to fail to close; (2) the

outcome of any legal proceedings that may be instituted against

Mountain Crest and Playboy following the announcement of the

Agreement and the transactions contemplated therein; (3) the

inability to complete the proposed business combination, including

due to failure to obtain approval of the stockholders of Mountain

Crest and certain regulatory approvals, or to satisfy other

conditions to closing in the Agreement; (4) the impact of COVID-19

pandemic on Playboy’s business and/or the ability of the parties to

complete the proposed business combination; (5) the inability to

obtain or maintain the listing of Mountain Crest’s shares of common

stock on Nasdaq following the proposed business combination; (6)

the risk that the proposed business combination disrupts current

plans and operations as a result of the announcement and

consummation of the proposed business combination; (7) the ability

to recognize the anticipated benefits of the proposed business

combination, which may be affected by, among other things,

competition, the ability of Playboy to grow and manage growth

profitably, and retain its key employees; (8) costs related to the

proposed business combination; (9) changes in applicable laws or

regulations; (10) the possibility that Mountain Crest or Playboy

may be adversely affected by other economic, business, and/or

competitive factors; (11) risks relating to the uncertainty of the

projected financial information with respect to Playboy; (12) risks

related to the organic and inorganic growth of Playboy’s business

and the timing of expected business milestones; (13) the amount of

redemption requests made by Mountain Crest’s stockholders; and (14)

other risks and uncertainties indicated from time to time in the

final prospectus of Mountain Crest for its initial public offering

and the definitive proxy statement relating to the proposed

business combination, including those under “Risk Factors” therein,

and in Mountain Crest’s other filings with the SEC. Mountain Crest

cautions that the foregoing list of factors is not exclusive.

Mountain Crest and Playboy caution readers not to place undue

reliance upon any forward-looking statements, which speak only as

of the date made. Mountain Crest and Playboy do not undertake or

accept any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements to reflect

any change in their expectations or any change in events,

conditions, or circumstances on which any such statement is

based.

Contacts:Investors:

PlayboyIR@icrinc.comMedia:

PlayboyPR@icrinc.com

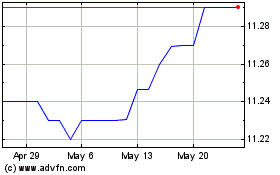

Monterey Capital Acquisi... (NASDAQ:MCAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

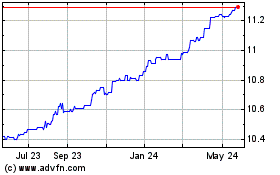

Monterey Capital Acquisi... (NASDAQ:MCAC)

Historical Stock Chart

From Jan 2024 to Jan 2025